Polen Capital’s Focused Growth Fund has compounded and delivered net returns of 14% yearly over a span of 35 years.

Let’s say you’ve followed Charlie Munger’s advice, and scraped together 100k.

The first $100,000 is a bitch, but you gotta do it. I don’t care what you have to do – if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000.

- Charlie Munger

Here’s what compounding at 14% annually looks like:

Not too shabby, but it is the way Polen Capital achieved this feat that is of interest.

In previous articles, I mentioned that I mainly use a 2-sided approach into creating a reactor portfolio:

The moderator: Investing in quality compounders which in the short term suffer a price decline

The core: Investing in quality small cap stocks which are more volatile and are mispriced due to being underfollowed

You can also translate this 2-fold strategy as follows:

Go fish where the big fish are: These fish are big, they are beautiful, but you’re not the only one fishing for them…

Go fish where there are few fishermen: These fish are still growing, they are smaller, but very few are fishing in this pond…

We previously wrote about Paul Andreola’s discovery cycle, which explains the reasoning why it can be interesting to look where few others are.

Polen Capital has mastered the first approach: investing in quality compounders, so it’s worth digging deeper into the details of how they did it, and are still doing it.

History

Polen Capital was founded by David Polen in 1979. As a stock broker, David had lived through the 1987 crash (Black Monday) and wanted to figure out a way to build a portfolio that could endure, where you could just sit it out. He honed in on a focused growth strategy and later took on Dan Davidawitz as co-portfolio manager of the fund. The focused growth strategy continues and has been performing well over the last 35 years.

What is quality?

The problem with quality is it comes in all forms and sizes. Everyone has their own definition of what quality is.

Here are the 5 guardrails that Polen uses to filter what they want a quality company to be:

1️⃣ Cash rich balance sheet (debt is max 3 times free cash flow)

It starts with the balance sheet. They prefer their companies to be net cash positive and debt free. This allows for optionality and a cash cushion in bad times.

2️⃣ Excess free cash flow every year

The companies have to show a consistent ability to generate free cash over multiple years.

3️⃣ Sustainable return on capital > 20%

They have to be efficient. Since returns will come from compounding, a high return on capital is needed. Few companies will manage returns over 20% over multiple years.

4️⃣ Stable to increasing profit margins

The business is getting better with age, like a fine wine.

5️⃣ At least 5-9% organic revenue growth

They want pure organic growth and will filter out revenue related to acquisitions.

This is applied to the large cap universe. So the companies that they invest in, you know them. Here’s the Top 10 from their focused growth prospectus:

By using these guardrails, their investable universe shrinks to about 350 companies. Then further research on for example competitive advantages will cut the universe in half once more to about 160 companies.

This also shows the power of this strategy. If your investable universe is only 160 companies, it becomes really easy to say NO to other opportunities. You can focus all your precious time on getting to know these companies inside and out.

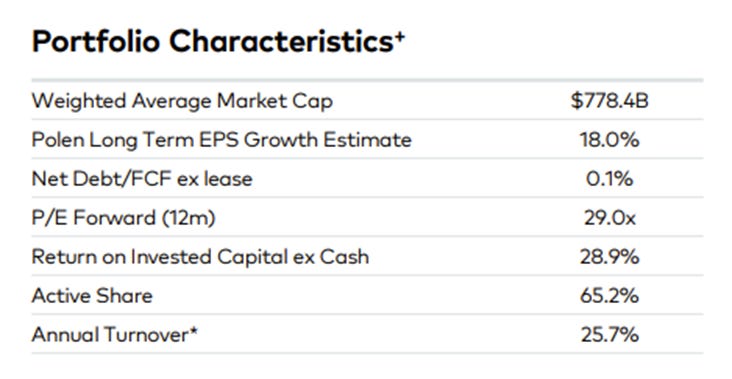

The end result of having these guardrails shows in the combined statistics of their portfolio:

With a high ROIC, no debt and a low portfolio annual turnover.

The strategy

The strategy is simple in theory but hard to execute in practice. At least that’s my view.

But remember what the master said:

“Investors should remember that their scorecard is not computed using Olympic-diving methods: Degree of difficulty does not count” – Warren Buffett

Or as the founder of Polen Capital emphasized:

“We want it to be crayon simple”- David Polen

By focusing on creating a portfolio of 20 to 25 very high quality and known companies, which will usually trade at premium multiples in the market, portfolio returns are fully derived from the compounding effect. Their average holding period is about 5 years. They have a team of 11 to analyze a universe of about 160 companies. As an example of the depth of their research, 2 analysts worked on Adobe for 15 months to get to know the company in detail.

Instead of going wide, they go deep

One of their main goals is to assess the size of the MOAT of the different companies (See our previous post on how to analyze a MOAT here or download a checklist in the tools section).

This is crucial as returns are made thanks to high returns on invested capital over long durations (competitive advantage period). The goal is to find companies that can withstand the reversion to the mean. If these companies can continue to earn high returns on capital, and avoid multiple compression in the market it will lead to a great return for the investor.

Why was the company performing in the past?

Will they be able to sustain it into the future?

Are there trends, is the market growing?

But these companies always trade at high multiples, and price always matters. So what to do?

Their edge lies in taking a long-term view and using spurts of irrational behavior in the market to get into or add to a position.

Risk management

Risk management is embedded in their strategy. By only picking the best companies in the world with fortress balance sheets, you avoid a lot of risk with risk being the permanent loss of capital, not volatility.

The companies are by nature resilient. There is no need to worry about these companies being able to self-finance through a period of economic or financial stress.

Valuation approach

Because the focused growth fund looks at high quality compounders, most of the time, these will be trading at a premium in the market, but not always. The trick is to know these companies and wait for a good entry price. The goal is to pay a fair price, a dollar for a dollar.

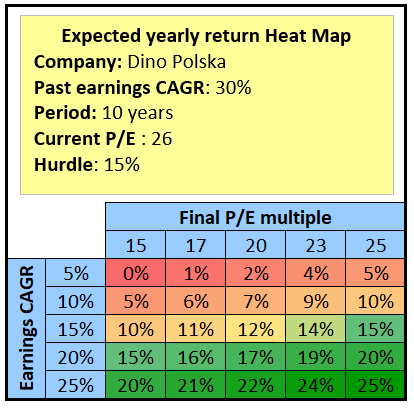

The price is determined by their hurdle rate, which is a 15% earnings CAGR. They do not model multiple expansion, because these are high quality companies they use a heat map to model multiple compression over a 5-year period. I do not know the exact model that is used within Polen Capital, but you can develop a similar heat map based on the expected return model.

In the long run, an investor’s expected return is equal to the sum of:

FCF/share growth

Dividend yield + buyback yield

Multiple expansion/contraction

We can then make a heat map based on model. For demonstration purposes, we’ll use Dino Polska as an example as there are no dividends or buybacks. To simplify, we plot earnings per share growth on one axis and the final multiple after 10 years on the other axis.

Based on the in-depth analysis and the heat map, their goal is to analyze different scenarios and see what is plausible. The most important question will be: why? Will the competitive advantages be able to sustain this growth or limit a multiple contraction?

Some examples

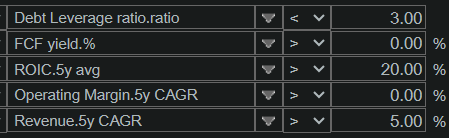

Let us use a screener with the five guardrails to get an idea of the companies that are in them. We use the most powerful screener known to man: unclestock.com

Here are the criteria we used. These are the criteria the screener allows us to select I feel are the closest to get to the 5 guardrails:

And here are the results:

Worldwide: 1420 companies of all market cap sizes fit the criteria

Large cap (> 10 Billion) : 190 companies the likes of Alphabet, Microsoft and Apple

Small caps (<250M): 426 companies

Here are 3 examples of companies that popped up in the top 10 of the small Cap high quality screen:

Semler scientific (US: Ticker SMLR)

Eneraqua technologies PLC (UK: Ticker ETP.L)

Titanium Oyj (Finland: Ticker: TITAN.HE)

If we would ignore company size, would a company like Dino be part of their investable universe?

Let’s take a look at the 5 guardrails:

220M PLN in cash and debt leverage below 3 ☑️

Dino reinvest all free cash ☑️

10Y average ROIC of 19% and ROE of 30% ☑️

EBIT and net margins stable the last 5 years ☑️

10Y sales CAGR at 30+ ☑️

I do think Dino would be in the quality universe. Polen would then do an extensive analysis of the company in particular to see how big the size of the MOAT is.

Conclusion

There is a lot to like of what Polen Capital is doing:

Quality first, always

The focus on a very strict investable universe

The due diligence and depth of research, go deep not wide

The discipline that is needed to execute this strategy, the patience

It’s a simple strategy but hard to execute. It requires discipline and patience. Or as mentioned in one of the interviews:

It’s glacial. It’s like watching paint dry. We love it

To emphasize this, in their 35-year history, they just bought their 132th company.

This is probably the most important lesson of all. Finding an investing strategy that fits your personality. A strategy that you love.

There’s a lot I did not talk about in this article. Their phenomenal culture, how the team works and how they are organized. If you want to delve deeper, I suggest diving into the further reading section below.

As with the investable universe we created based on Paul Andreola’s strategy, I might create one based on a quality approach, but not limited to large caps of course!

Thank you for reading and as always…

May the markets be with you!

Kevin

Further reading

I discovered Polen Capital through my favorite podcast, the JRo Show, hosted by John Rotonti. Check it out if you’re into refining your process. You can find the transcript in our library.

Here’s another podcast interview with Dan and Jerry from Polen Capital at the Value Investing with legends podcast by the Columbia Business school:

And here you can find an article discussing Polen Capital by @mastersinvest:

Polen Capital also regularly writes white papers which are interesting to read. You can check them out on their website.

This is awesome Kevin. Very few people do understand that if you can manage to keep emotions out of it, beating the market can be as simple as that.

Great read Kevin, thanks for sharing