This is part of a series where we break down the investment strategies of successful investors in order to see if we can improve our own process.

Who is Paul Andreola?

Paul Andreola is a small-cap and micro-cap investor and board member focusing on Canadian companies. He hunts for multi-baggers (and 100-baggers) and has a track record of finding them over his 25-year career. He runs a website called https://smallcapdiscoveries.com/ where you can subscribe to his newsletter.

Before entering the investment world, he studied construction management and was a carpenter. Afterwards, he became a broker then switched towards investment banking. This gives him a unique perspective: Business operator/owner, broker and banker.

Besides his newsletter, he invests and sits on the board of companies like Total Telecom (Ticker: TSXV:TTZ) and acts as an independent director at Atlas Engineered Products (TSX.V: AEP).

Paul has a very unique investment strategy. Let’s see what we can learn:

Lesson 1: Where does he hunt?

Paul is a niche hunter. He purposely chose his investment universe to be small: micro-cap and small cap Canadian companies. By limiting his universe, he can go deep and become the most knowledgeable person in that universe. In general, he’ll only look at companies with a market cap below 50 million USD. Companies that are too reliant on commodities are also excluded from the universe. (which excludes several Canadian companies)

This approach allows him to study the little nuances, the mispricings in his universe.

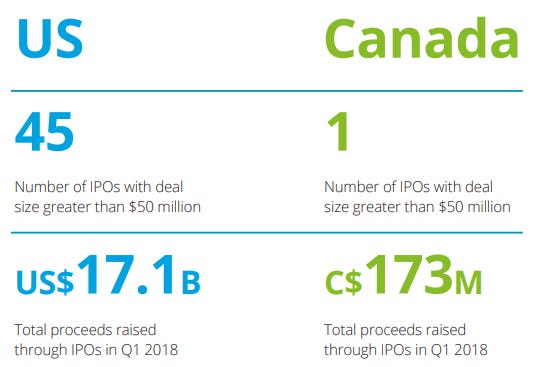

Using a screener to take a closer look at the amount of possibilities, here are the numbers to get an idea of how big the universe is.

Reason for his choices

First the market cap. Small-cap stocks undergo a cycle of discovery. Below 50 million in market cap, institutions are not interested. Generally, they have too much capital to deploy so they look for bigger companies. Also, small caps can be illiquid, which could also refrain them from investing here. More on the discovery cycle later in this article.

But why Canada?

The Canadian stock market is very different from the US. In the US, there is a well-developed venture capital market. In other words, companies that start and grow are funded by venture or private equity before going public. Once they do go public, they are usually bigger in size. In Canada, because there is a less developed venture market, companies may seek to finance their operations by going public when they are a lot smaller. The below data point confirms that.

In other words, in the US, venture and private equity capture alpha before a company goes public. In Canada, you have the possibility to capture alpha on smaller public companies before they become big. Other markets that come to mind are the AIM market in the UK, where there are less restrictions for companies to go public, or maybe the Polish Market.

Conclusion: At the moment, my current investable universe is:

Small to mid cap

No commodities, financials or utilities

Worldwide

In other words, my universe is big. This makes me think if I shouldn’t focus more on a specific geography but taking into account that the market needs to allow companies to IPO at an early stage (as opposed to the United States where the venture capital market is very developed).

How big is your universe? Do you think about making it smaller?

Lesson 2: Do the work: An informational edge?

When we discussed our 100-bagger checklist, we talked about getting an edge in investing. There were 3 factors:

Having information that no one else has.

Having a process that is superior

The most important one, gaining an edge by having the right temperament.

In Canada, companies that list have to apply and upload their documents through the SEDAR system. SEDAR is the equivalent of EDGAR in the US. It’s an old archaic system. Once information is provided into the SEDAR system, financial websites will retrieve the data from SEDAR to allow you to screen for these companies.

But because the SEDAR system is archaic, sometimes companies fall through the cracks. In other words, some information is uploaded but displayed in a strange way through the system which makes it difficult for the screener to correctly retrieve the information. The only way then to uncover these gems is to manually go through the annual reports. This can provide an informational edge which is rare these days. Most investors don’t go through each annual report on a regular basis. It takes time.

Once a year, Paul will go through all annual reports from A to Z of his investable universe with his partner. They each do it and then confront notes. It takes him about a week to go through everything.

Conclusion: Up until now, most of my investment ideas come from other investors. I’ve used screeners from time to time, but didn’t find it super useful. My plan for 2024 is to make a list of companies based on certain criteria, and then do an A to Z approach to go through them during the year.

Does your process allow you to gain some sort of informational edge?

Lesson 3: Underfollowed = loved

On price and information discovery:

That is one of the mysteries of this business, it is a mystery to me as well as to everybody else. We know from experience that eventually the market catches up with value. it realizes it in one way or another.

Benjamin Graham

One of the things that gets Paul most excited is when calling the company or the investor relations of the company, that the person on the other side has no idea what he’s talking about. In other words, the company is too busy executing on its operations and sales. It didn't have time to set up an investor relations desk. This means by definition, the company is underfollowed.

Companies that are not tracked by analysts, do not have any articles written on them, are not discussed in any forums, these are the companies that peak Paul’s interest.

They might set at the beginning of a discovery cycle. What does this discovery cycle look like?

Lesson 4: The discovery cycle

In a 2016 Youtube Video, Paul and his partner explain how the discovery cycle works. Here’s a summary.

Imagine a business that is growing and fundamentals are gradually improving. The business will now get discovered over time. The discovery cycle can be divided into 5 phases:

The pre-discovery phase

The catalyst phase

The retail phase

The institutional phase

The full discovered phase

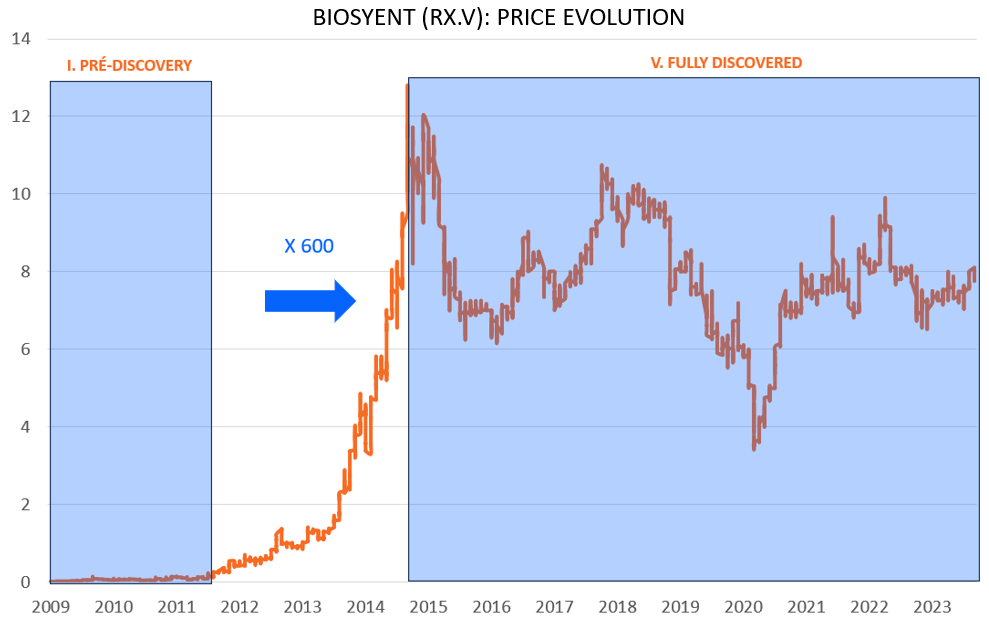

To go into more detail, the price evolution of a company called BioSyent Inc. is used. Here’s a short description of what this company does:

Listed on the TSX Venture Exchange (TSXV: RX), BioSyent is a profitable growth oriented specialty pharmaceutical company focused on in-licensing or acquiring innovative pharmaceutical products that have been successfully developed, are proven safe and effective, and have track records of improving the lives of patients. BioSyent supports the healthcare professionals that treat these patients by marketing its products through its community, hospital, and international business units.

From the start of the cycle, the pre-discovery phase towards the beginning of the fully discovered phase, Biosyent was a 600-bagger:

Phase 1: Pre-discovery

The pre-discovery process: As Richard Branson said, how do you become a millionaire? You start out as a billionaire, and you buy an airline.

You start out as a small cap, for some reason it makes some mistakes, and it becomes a micro-cap and is left for dead by investors.

Imagine a private company raising capital through an IPO. The company isn’t profitable yet. It raises capital based on a promise, a story. In the following years, it takes time for the fundamentals to improve. Profits stay out. The hype around the IPO is long forgotten. The company is now unknown. But the business keeps on running.

This may not be the time to go in as an investor. This period might take some time (4 years in the case for Biosyent). However, it’s important to do the work, and track companies in this phase, waiting for something to change.

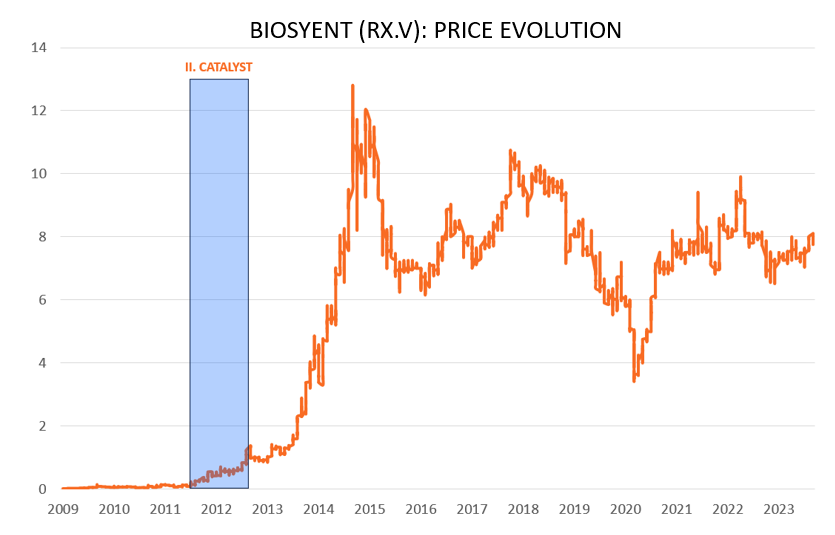

Phase 2: The catalyst

Something changes. A quarter or 2 consecutive quarters of profitability. A large deal or contract is won by the company. Gradually some articles appear on the internet. This is the catalyst, the signal. Now it may be time to take a position in the company. Here’s how Paul looks at this in more detail:

He first looks at sales growth. Are they growing fast? (25%/year) These companies are not necessarily profitable. Another criteria will be to look at dilution. Ok, the company is growing fast, but how much financing does it need to grow? If the company is constantly issuing shares to fuel its growth, it’s not a prime candidate.

A third criteria is the inflection towards profitability. You can have a fast growing company, modest dilution but unprofitable at the moment. Once it has 2 quarters of profitability, he will assess if this is real profitability based on the operations of the business (and not some sort of accounting trick). Then this could be an inflection point to start taking a position in the business.

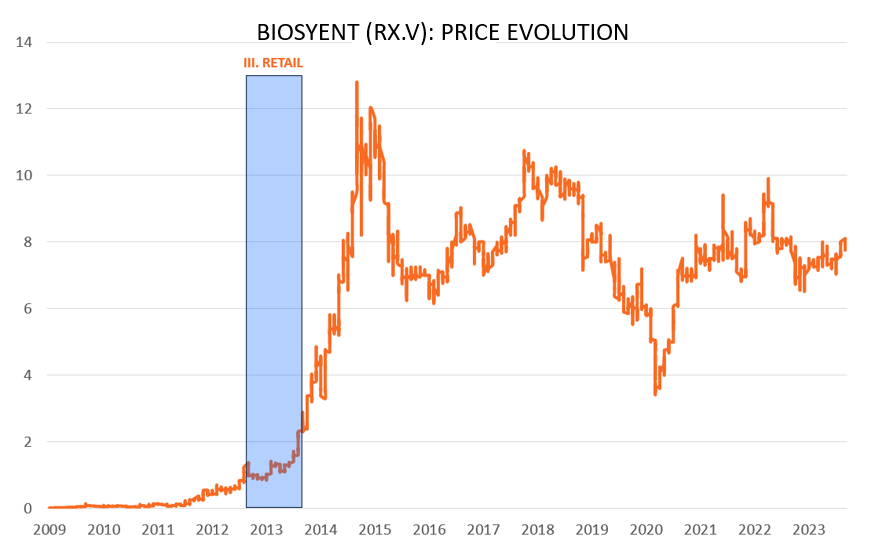

Phase 3 : Retail

Retail investors start to take notice. The company is still small, even if someone in an institution got notice of the company they cannot buy it. More and more information is spread about the company. The price starts to move.

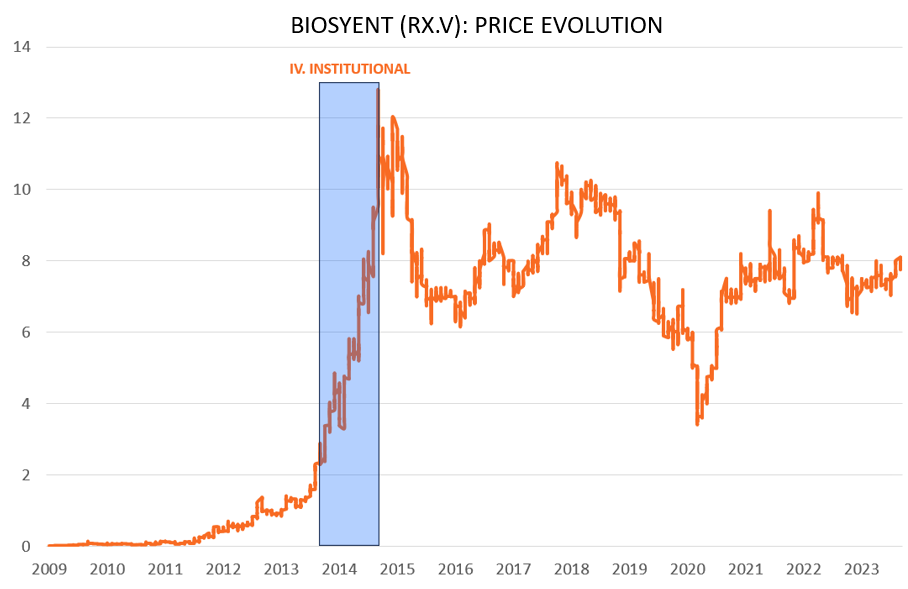

Phase 4: Institutional

Certain hedge funds that do not have buying restrictions start to get in. Capital starts to flow. The stock is now a must-have. Price discovery occurs quickly. This phase is accompanied by a rapid multiple expansion. In Canada, most institutions do not touch a company below 50 million.

Note: The first professional analyst coverage was when the price hit 6-7 dollars.

Phase 5: Fully Discovered

The company and its stock is now fully discovered. In the example, the P/E ratio for the company expanded from 4 to about 50. But as can be seen from the last 8 years, the stock has not been able to gain a new all time high. In the fully discovered phase, price will now move on the news and quarterly reporting. There is no longer a gain to be made based on discovery, the fundamentals will now dictate where the price is going in the long run.

For Biosyent, although revenues have kept growing since 2015, its return on invested capital has decreased since 2015, which might partially explain the price movement.

The discovery cycle is interesting because it is a process in addition to the business fundamentals, it is a cause for mispricing in the market. In other words, it starts with the business fundamentals, but looking for underfollowed stocks can lead to finding mispricings in the market.

Lesson 5: Portfolio and risk management

Paul typically holds 8-10 main positions in his portfolio. A position on a cost basis usually starts small. If the company confirms and executes his investment thesis, he will add to the position up to 10-15%. He says: “They have to earn their way in”.

Then there are two important strategies to consider:

Fire losers fast: If a company starts to break away from the investment thesis, the faster you lose it the better

Let your winners grow: If a company keeps growing and becomes a big portion of your investment portfolio, don’t be too quick to trim or sell

Picking which companies to buy is not on an absolute basis, it’s based on a ranking. Say that he finds 5 to 6 good ideas, and they all experienced some sort of a catalyst, then the best idea will get a bigger position, but the goal is to put all the best players on the ice.

On the risk of microcap and illiquidity: You need to have a high margin of safety. Because small caps can be illiquid, start with a small position, and add to it when the company is executing well.

Lesson 6: When to sell?

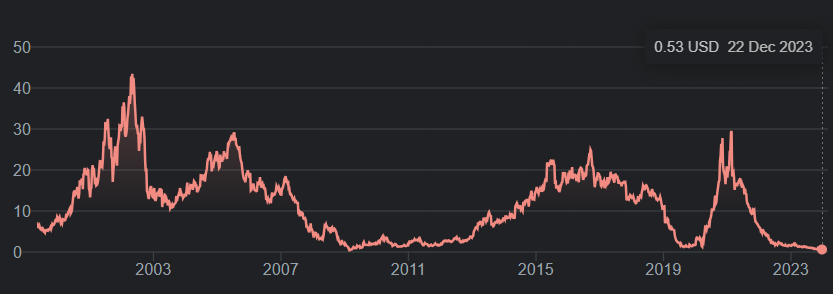

His biggest mistake, as is usually the case in an investing career, is not to have bought the wrong company, but to have sold the right company too soon.

This happened in the past with a company called Bowflex. At a certain moment, Paul had a 10-bagger in his hands. He sold. In the following years, the company again increased 10 to 20 fold. In other words, he missed a 100+-bagger. He sold because it appreciated 10-fold in 18 months.

Keep your Wayne Gretzky in your lineup as long as possible

Paul Andreola

Also be mindful of Buffet’s phrase:

Our favorite holding period is forever.

Here’s the stock price over the years for Bowflex:

Keep looking at those fundamentals. Bowflex was a multi-bagger at a certain point in time. Not anymore…

There are only 3 ‘good’ reasons to sell:

Because the company is no longer executing in accordance with your investment thesis (your why)

Because the company is extremely overvalued (but one still has to be careful with this argument)

Because you are fully invested and found something you think is better

The best reason is still number 1, because you disregard pricing in the market, and are only looking at business performance.

Lesson 7: The 52-week high

Paul’s investing strategy was influenced by the following books:

One of the things he took away from the first book was to look at 52-week highs. The reasoning is as follows. The market is volatile. If you look at the historical pricing of a 100-bagger, at numerous occasions, it will have reached a 52-week high in its history. In other words, it can give you an indication on how to buy the stock (for example during a downtrend after it has reached a 52-week high).

This means, if you have conviction, that it might be better to average up instead of averaging down.

Conclusion

Hunting for micro and small caps can be very profitable thanks to the discovery cycle, but it is not without risk. I learned a lot from Paul, him being so transparent and sharing his process.

If you want to dive even deeper, here are some excellent resources for you to discover:

Paul’s newsletter https://smallcapdiscoveries.com/

Interview with Kyle Grieve @ Millennial Investing

Video interview with Robert Kraft @ Plant Microcap

May the markets be with you, always and Happy Holidays!

Kevin

Kevin, this is awesome! I haven't heard of Paul before, but definitely going to be following him. Excellent write-up, I'll throw this in next week's newsletter if it's alright with you! Cheers