What is a MOAT?

Introduction

We think of every business as an economic castle. And castles are subject to marauders. And in capitalism, with any castle… you have to expect…that millions of people out there…are thinking of ways to take your castle away.

Then the question is, What kind of moat do you have around that castle to protect it?

Warren Buffet, Investor Digest December 2000

Here’s Buffett's 3-step process to look for wide MOAT companies based on his 1995 annual shareholder letter. I’ve copied several quotes because I cannot write them better than Buffet explains them…

"What we're trying to do, is we're trying to find a business with a wide and long-lasting moat around it, protecting a terrific economic castle with an honest lord in charge of the castle."

Step 1: Find a business that has a MOAT

"What we're trying to find is a business that, for one reason or another -- it can be because it's the low-cost producer in some area, it can be because it has a natural franchise because of surface capabilities, it could be because of its position in the consumers' mind, it can be because of a technological advantage, or any kind of reason at all, that it has this moat around it."

Sometimes the MOAT may be obvious, but I think Warren thinks very deeply about this, as evidenced by his remark on the position in the consumer’s mind.

Step 2: What is keeping the MOAT intact?

"But we are trying to figure out what is keeping -- why is that castle still standing? And what's going to keep it standing or cause it not to be standing five, 10, 20 years from now? What are the key factors? And how permanent are they? How much do they depend on the genius of the lord in the castle?"

His goal is to look far into the future. What will change or not change? How can the MOAT be disrupted? Is the MOAT based on the capabilities of the lord, or as Peter Lynch says it:

Buy a good company that even a dummy can run, because at a certain moment in time, a dummy will run it.

Peter Lynch

Step 3: Is the lord going to take it all for himself?

And then if we feel good about the moat, then we try to figure out whether, you know, the lord is going to try to take it all for himself, whether he's likely to do something stupid with the proceeds, et cetera."

In other words, are management shareholders friendly? Do they allocate capital sensibly?

When we go through the step-by-step process later on, we’ll expand on steps 1 and 2 mentioned by Buffet.

One last quote to get it out of our system:

The single most important decision in evaluating a business is pricing power.

Definition

A management team’s primary goal is to allocate capital in such a way as to generate long-term return on investment.

According to Buffet, most managers are bad capital allocators. This is not their fault. Capital allocation is hard. When someone in a company climbs up the corporate ladder, he or she may have a deep knowledge of the processes, the operations, the marketing, etc. But now that person has to play a very different ball game.

There are 2 dimensions to winning the capital allocation game and creating long-term value.

The first one we discussed in a previous article on how to calculate ROIC. It is the ability to earn a return on capital that exceeds the cost of capital. This, in combination with the magnitude of the invested capital, leads to value creation.

The 2nd dimension is how long this can be done. When you manage to build a nice castle (think Nvidia) and you’re creating value, how long will it take for the marauders to take a piece of the pie?

In the end, competition will increase, and the return on invested capital will trend towards the cost of capital. Value creation will fade and eventually lead to value destruction.

A competitive advantage is not a MOAT, it is an advantage that allows a company to earn high returns on capital now. A MOAT is a long-term sustainable competitive advantage.

When investing in a company, understanding its MOAT compared to its competitors, and evaluating how long it can sustain this advantage, will allow you to correctly value the company and compare it to the price the market is offering.

Every company has a business life cycle where it starts, grows, matures and finally declines. The competitive life cycle shows the effects of competition on business returns.

A business needs to be able to:

Create VALUE: economic excess profits

Over a long period of time: DURATION

Economic value means earning returns on invested capital above the cost of capital.

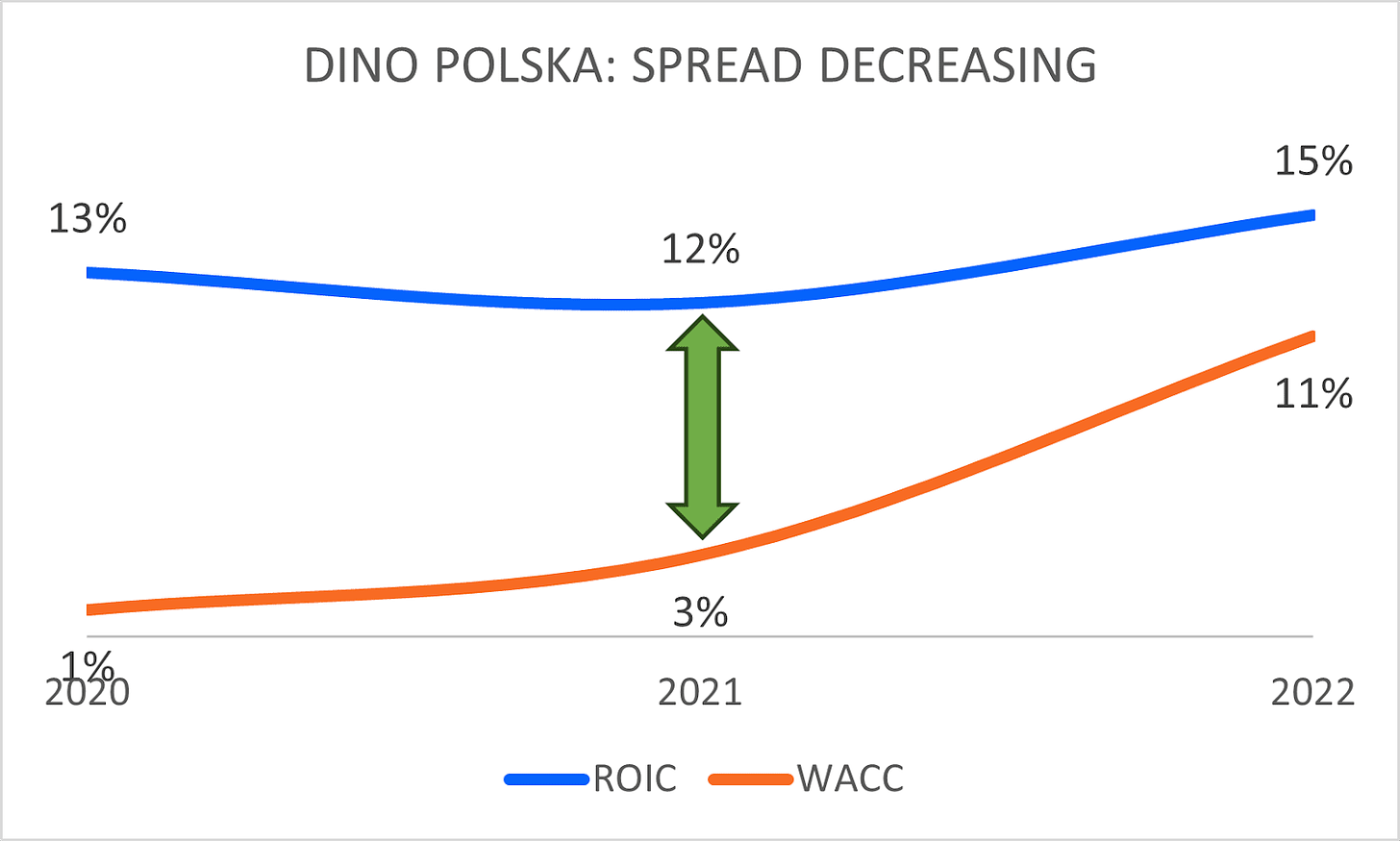

Here’s the ROIC versus WACC for DINO Polska:

The economic value is then calculated as:

TOTAL VALUE = (ROIC-WACC) x Invested Capital x DURATION

DURATION is the time at which the company can continue to create value in the market.

If a company can create value over long periods of time, then it may have a MOAT. Calculating historical value creation is the first step to see if a company is surrounded by a MOAT. If value creation is positive, then a search for why this is can begin.

The competitive life cycle in 4 phases:

During a period of high innovation, the return on invested capital increases rapidly. Once it surpasses the discount rate, value is created. These are young companies before they go public

Marauders attack the castle. Returns start to fade. Value is still being created, but margins are taken away.

Companies now reach a balance in the market. The castle’s MOAT has narrowed. On average, the companies earn the cost of capital.

Competition and technological innovation by new entrants drive returns below the cost of capital. A restructuring of the company might be needed. Value is destroyed in the market.

At some point in time, reversion to the mean will occur. When, depends on the size of the MOAT. The wider the MOAT, the longer this reversion will be prevented. Because compounding takes time, wide MOAT companies allow long-term compounding.

If, after thorough analysis, you find a company that has a MOAT, but you think the company will be able to repel marauders for a longer time than what the market is thinking, then you may have an opportunity.

Before diving into a more detailed process to find MOATS, do they really matter?

Why MOATS matter

Heather Brilliant wrote a book for Morningstar with this title.

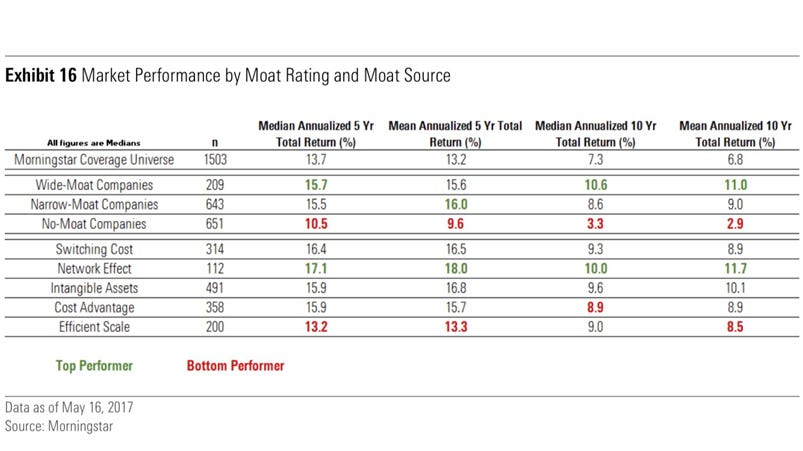

Morningstar defines 5 main categories, which they use to identify MOATS in their database.

Switching costs: pricing power by locking in customers into a unique ecosystem

Network effect: the value of the service increases with more users

Intangible assets: brand recognition, patents, regulatory licenses

Cost advantage: producing at lower cost through technology or scale

Efficient scale: markets limited in size to deter entry of new competitors

They have assigned a wide, narrow, and no-MOAT to about 1500 companies.

A wide MOAT means it is capable of fighting marauders (and dragons) for a least 20 years

A narrow MOAT means it is capable of repelling rivals for 10 years

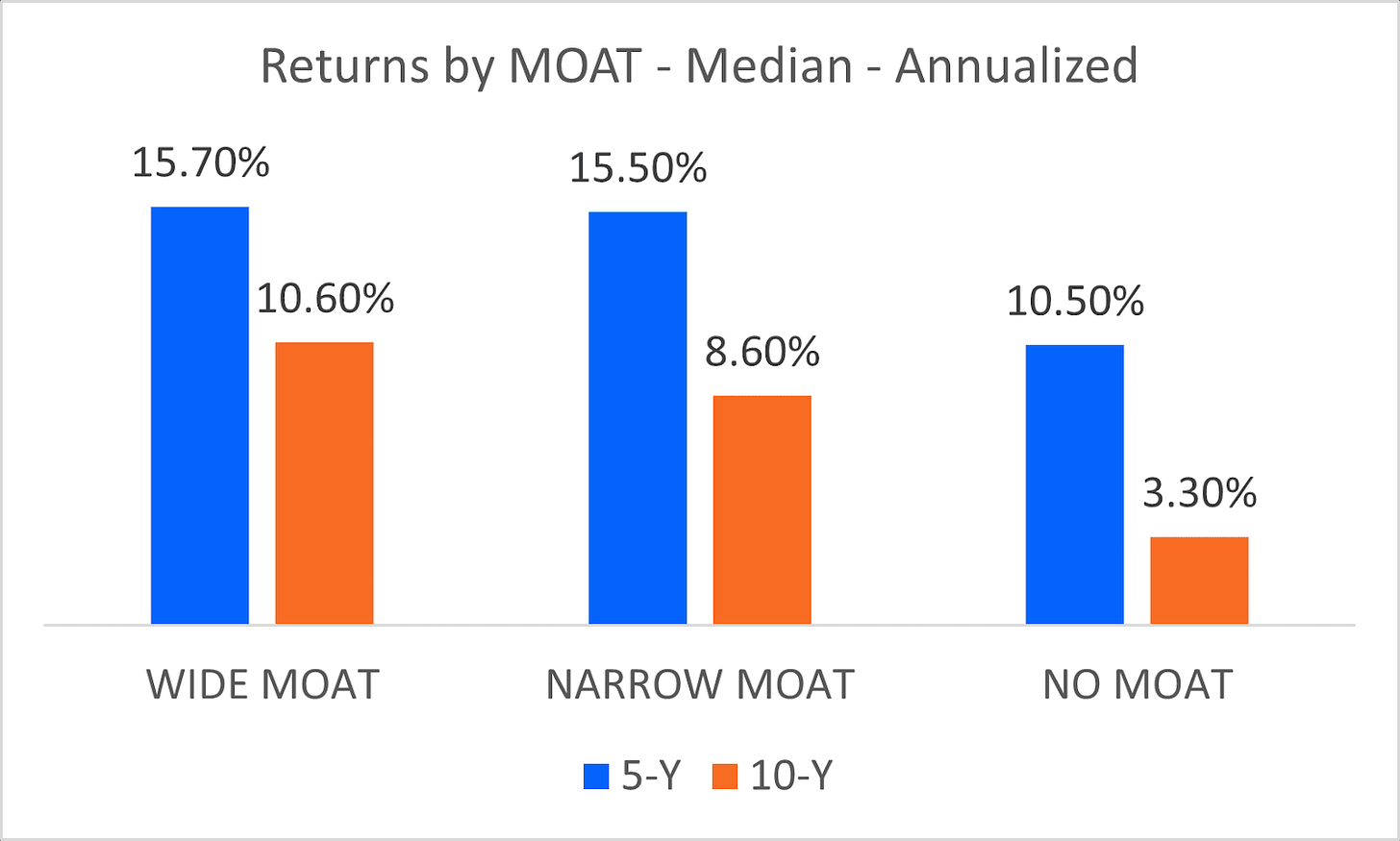

What are the results on a total return over the period 2010 to 2017:

When we look at MOAT and no MOAT results:

Their conclusions were:

Companies with a MOAT outperform no MOAT companies over a 5 and 10-year period

Network effect had the highest contribution in that time frame

13% of the coverage universe has a wide MOAT

A couple of examples of wide, narrow, and no MOAT companies according to Morningstar

MOATS seem to matter. Let’s see how we can find them.

Find a MOAT, step by step

Everything in business and investing is relative. In other words, does a specific company have a MOAT versus its competitors? What does the industry look like? Are there high or low barriers to entry?

All these questions will allow us to zoom in more clearly on if and why a business has a MOAT.

One of the best articles written on this subject is by Michael Mauboussin: “Measuring the MOAT”. The process detailed below is an adaptation of what Michael proposes in his article.

There are 2 things that influence the size of a MOAT for a company:

Company-specific competitive advantages

The type of industry it is in and how companies interact

The Company

Each company uses a strategy to do business and compete with others. Strategy is about strategic positioning, in other words, how is the company doing things differently? Maybe it chooses to only compete and focus on one part of the market etc…

I really like the picture used by Vaneck to illustrate this:

What is the company doing differently than the others?

Imagine the value created by a company as a value chain (Michael Porter)

If you’re researching a company, what does its value chain look like? What is it doing differently than its competitors? What are the cost drivers? Compare it to the general value chain of the industry.

There are 2 sources of added value for a company:

Production advantages

Consumer advantages

We can use certain financial numbers to give us an idea of where to look.

By splitting the ROIC and using sales we get the following:

ROIC = NOPAT/IC = NOPAT/SALES X SALES/IC

with NOPAT Net Operating Profits after Tax and IC Invested Capital.

You can dive deeper into this here.

If NOPAT/SALES is high, the company has a high margin, this could indicate a consumer advantage.

If SALES/IC is high, this means a high asset turnover, which could indicate a production advantage.

A retailer typically has a low margin but a high asset turnover. A luxury brand typically has higher margins but low turnover.

Overview of production advantages

A production advantage means that the company is able to outperform its competitors on the cost side.

There can be two reasons:

Because of process

Because of scale

Here are several factors that could give a process advantage:

Complexity: If it has taken years of R&D to create a product, and that process is complex, it will be difficult for competitors to replicate it

Protection: Patents that can protect certain advantages, but only for a certain period of time

Resource uniqueness: If the process used a resource that is unique and hard to come by and the company managed to take on long-term contracts on it

Rate of change in the process cost: If through technological advancement, the production cost is lowered. There is however a trade-off between easier entry for a new entrant versus the learning curve needed

Indivisibility: What is the minimum fixed cost that you always need to pay?

When looking at scale advantages, consider these:

Distribution: Large-scale distribution capabilities are rare. Create a geographical map of sales. Is there clustering somewhere? It may reveal a distribution advantage in that region (for example: Tesla does things differently. They distribute directly to customers without going through car dealerships)

Purchasing: Scale leads to more power for suppliers. Does the company have increasing purchasing power with increasing scale? (example: Home Depot, Walmart)

Research and Development: R&D can lead to unseen new product development. Does it have an R&D process where new spillover products are developed? Is there an optionality to the company? (for example Pfizer and their accidental discovery of Viagra)

Advertising: If the way advertising is done is by a fixed cost per consumer, then scale will create an advantage

Overview of consumer advantages

A consumer advantage means that the company is able to outperform its competitors on the benefits side.

Here are several examples of consumer advantages:

Habit and high horizontal differentiation. The product is preferred versus other products, especially when used habitually (Coca-Cola)

Experience: You need to try the product first before making a decision to buy. These products are often technically complex (Apple iPhone)

Switching cost and customer lock-in: Even if another product is better, high switching costs may prevent the customer from changing. (Typical examples are large software packages in business like Enterprise Resource planning software. )

Network effects: There is a positive feedback loop. With increasing users, the product itself gets better for that user. (Facebook app)

The Industry

An industry analysis can give you more insight into how all players interact or compete. How profitable is the industry as a whole? Here are some key takeaways:

Industries as a whole can create value, be value-neutral, or destroy value. But even the best industries have companies that destroy value and the worst industries have companies that create value. In other words:

The industry does not equal destiny

However, in a ‘good’ industry, there are more companies that are creating value.

How big is the impact of industry and how big is the impact of firm-specific factors when discussing MOATS?

The industry you’re in has a big impact on high performance

Firm-specific factors are drivers of low performance

The economic cycle does not have a big impact

In other words, if the business is competing in a ‘good’ industry, it has a higher chance of performing. Low performance is related to the companies (resources or strategic positioning) themselves and the bad decisions they make.

Industry does matter. Michael Mauboussin proposes to do an extensive industry analysis, but for this, you would need data that is not readily available to everyone. (data on entire industries, even for companies that are not publicly traded). We’ll refrain ourselves to some important insights and what you can do when analyzing an industry:

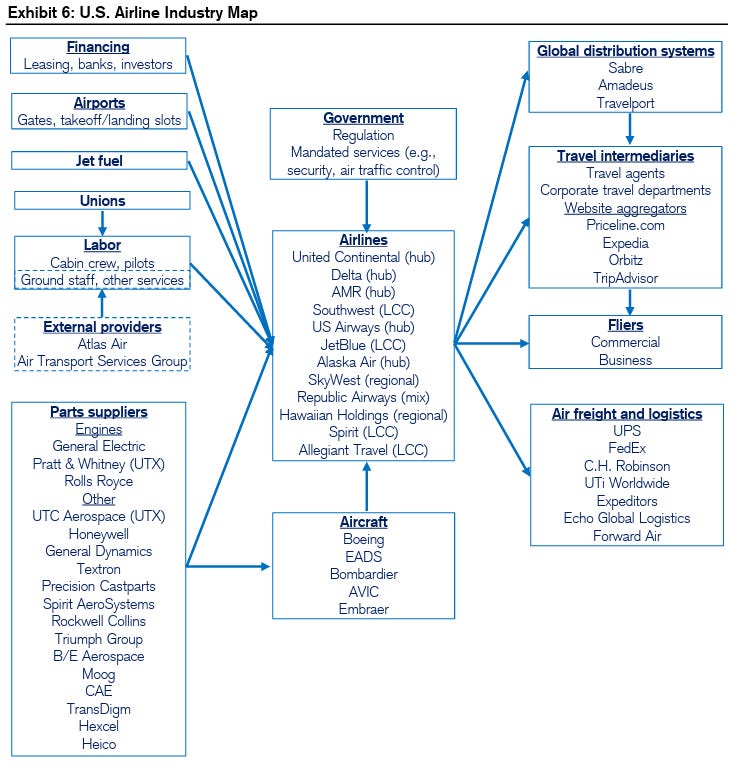

An industry map

Creating an industry map will allow you to have a general overview of the industry. The detail in this map is of your choosing, but in general, at the minimum, have a player for each role in the economic cycle, like suppliers or other services your company needs to function.

Here’s an industry map Michael made for the airline industry.

An industry map is useful because of a ripple effect. Shocks to one firm ripple through to other partner firms (through supply or demand).

Is the industry stable according to market share?

Stable industries allow for more sustainable value creation. How steady are the market shares for the different players? Look at market shares on different 5-year periods.

Beverage market: Stable

Smartphones: Unstable

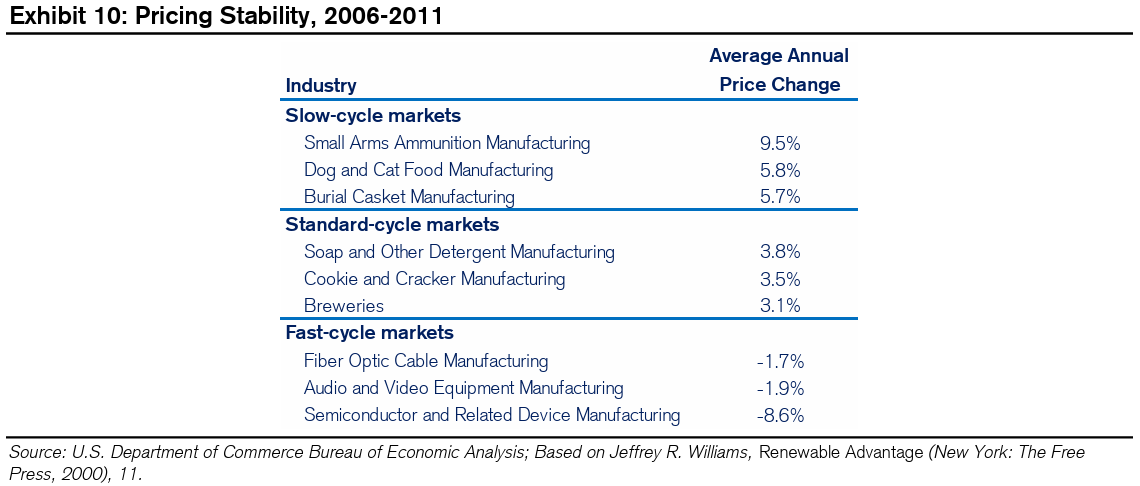

What is the trend in prices in the industry?

Is it possible to raise prices without losing business? Slow-cycle markets are usually able to increase prices more easily. It is challenging to create sustainable value in fast-cycle markets:

What are the barriers to entry?

An industry with high rates of entry and exit means there are low barriers. The ability to make profits is lower because of high competition.

The construction industry has low barriers to entry

The manufacturing industry has high barriers to entry, and manufacturing is hard, just ask Elon

What is the supplier’s power?

Can the industry pass on price increases? If a supplier is more concentrated than the industry it is selling to, it has more power. If the industry is only a small percentage of their sales volume, then again they have power.

The buyer’s power will is similar to the later discussion on firm-specific analysis.

What is the amount of rivalry within the industry?

Coordination between companies improves profits for everyone

Fewer firms make it easier to coordinate

The Herfindahl-Hirschman index allows a measure of the concentration of the number of companies in an industry. In general, an index above 1800 signals reduced rivalry between companies.

Concentrated industries typically earn above-average profits.

Examples are Visa and Mastercard with an effective duopoly. They reinforce each other's profits because of the absence of intense rivalry.

Is the market growing?

If the market is not expanding, the companies within it will be playing a zero-sum game. If the market is expanding, there is the possibility of getting a piece of a bigger pie.

Look for markets that are expanding.

Beware of fake MOATS

This is what you get when you look for fake MOATS on the internet. A “castle” in Miami Florida with an artificial MOAT:

Pat Dorsey talks about this in the little book that builds wealth. Here are examples of fake MOATS.

Great products can create short-term results like a new model of a car, but it does not have the sustainable edge a patent can give a business.

A strong market share is good at a certain moment in time. But the market share in itself is not a MOAT. How and why did the company gain so much market share of the years?

Great execution is good but does not necessarily constitute a sustainable advantage unless we’re talking about a patented process or high complexity that cannot be copied

Great management of course is not sustainable. Management can change.

On management, a statistical study on the impact of management performed by Micheal Raynor and Mumtaz Ahmed led to the following conclusions:

Focus on better before cheaper

Focus on revenue instead of cost

The last fake MOAT is the branding. A Brand on itself is not a MOAT.

There is no empirical evidence to prove that a brand is a MOAT. You need more than just a brand.

There are 2 types of MOATS

In the previous discussion, we looked at how to identify why certain companies are creating long-term value in order to estimate if it will continue far into the future. But one can divide wide moat companies even further into 2 buckets:

the legacy moat companies

the reinvestment moat companies.

The difference between the 2 is the reinvestment rate.

ROIC = NOPAT / Invested Capital

RiR = (Net Capex + Change in net working capital)/NOPAT

The reinvestment rate displays a percentage of how much of your profits can be used in capex and net working capital.

A legacy moat company has a wide moat, but no longer has the ability the reinvest at high rates. In other words, yes they are earning a high return on invested capital, but it increases their cash pile, and they do not see a lot of new opportunities within their business to reinvest and truly compound their high ROIC. A typical example of this would be Inmode. Maybe Inmode has a MOAT, but it is a legacy MOAT.

A company with a reinvestment MOAT not only earns a high return on capital but is able to consistently reinvest these returns at high rates. An example of this would be DINO Polska.

DINO is not building cash on its balance sheet, it continues to reinvest, and open new stores because each new store will add to the compounding effect. Therefore, DINO has a reinvestment MOAT and Inmode may have a legacy MOAT.

Usually, companies with a reinvestment MOAT are expensive in the markets. This has been the case for Dino Polska, but remember, if a company can compound at rates of 20% or higher, a fair price and time are all you need to get a great return.

Here’s the reinvestment rate for DINO Polska and Inmode Ltd.:

Dino is able to reinvest beyond its profits by using its change in working capital.

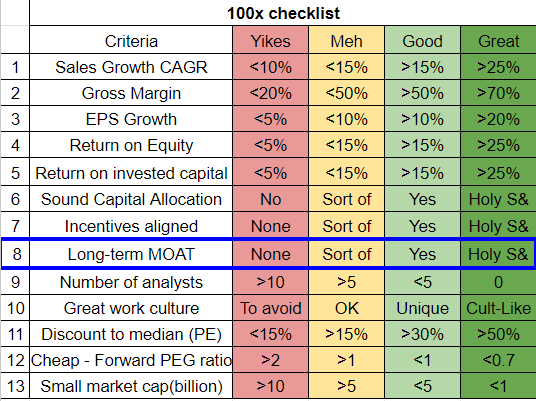

Impact on the 100-bagger checklist

In our first article, I introduced the 100x checklist. Now we have a way to verify the MOAT of a company.

How to finally choose between the 4 categories for the MOAT of a company?

None: They may be earning an ROIC higher than the cost of capital in the past, but it is unclear why. The company is not doing anything different than its competitors. In the worst case, they earn below their cost of capital

Sort of: The companies have some competitive advantages, but they will only be sustainable in the short term. In other words, it is a narrow MOAT that may last for the coming years, but not beyond a 5-year period.

Yes: The company has a MOAT that should be able to sustain them for the next decade. They have monopolistic tendencies. It is a legacy MOAT meaning, the MOAT is there, but they are unable to reinvest at a high rate.

Holy S&: The company has a strong MOAT and it is hard to see how anyone will be able to compete. They have a monopolistic or oligopolistic position in the market or heading there. They are able to reinvest at a high rate. This is called a reinvestment MOAT, the best MOAT there is.

Most companies have no MOAT or Sort of have a MOAT. Some companies have a legacy MOAT. Very few companies have a reinvestment MOAT.

Download the MOAT analysis checklist here

If you have any questions or comments please do not hesitate.

As always, may the markets be with you.

The best article i have read on Moat