We covered a full destination analysis of where we think Dino Polska is headed in the future.

Here’s a quick recap:

Dino Polska is the fastest-growing grocery retailer in Poland (30% sales CAGR)

It is the 4th biggest grocery retailer in terms of sales

It has a very specific strategic positioning, like Southwest Airlines -> its focus is on rural Poland, building small stores that only need 2500 people to be economically viable.

Consequence: it mostly competes with mom-and-pop grocery stores which get competed away (80%) In certain areas, it has to compete with the likes of Biedronka (20%)

It is vertically integrated:

Own meat production with fresh meat counters. The meat production factory has no other customers. This reduces for example costs of waste.

The land and stores are owned, not leased. A specific construction company, owned by Dino’s owner, builds the stores. This company has no other customers. This will lead to cost advantages in the long term.

Consequence: This leads to a very high degree of standardization and predictability when opening new stores. They haven’t had to close stores in the past (which is uncommon in the retail industry).

When thinking about standardization, again we refer to the example of Southwest Airlines or Ryanair in Europe: Only short routes, 1 type of plane which simplifies spare parts and maintenance. All this standardization leads to strict schedules and a high degree of predictability

Capital allocation is simple: No dividends, no buybacks or share issuance, no (meaningful) acquisitions. They reinvest their free cash flow in growth to open new stores and additionally have decreased their debt exposure over the last 2 years

There is no CEO, Dino is operated by an experienced management team, and their owner and chairman. The company is led by an owner-operator (51% ownership)

Their store land ownership (no leases) will allow them in the future to provide other services to their customers (like gas stations) or through solar PV installations, reducing their energy cost

Destination analysis

I believe Dino will continue to execute its growth strategy, building new stores every year with a focus on rural Poland. In the end, in urban surroundings, the grocery retail market will be dominated by Biedronka. In the rural areas, Dino will dominate. Overall, Dino will become the second-largest grocery retailer by sales behind Biedronka. The future grocery market will be dominated by the 4 biggest players:

with the other companies behind them.

The consequence of reduced competition in rural Poland and standardization will lead to higher net margins for Dino compared to the other retailers.

Now let’s look at the latest earnings call and see if the thesis still holds…

Insights from the latest earnings release

Dino’s growth

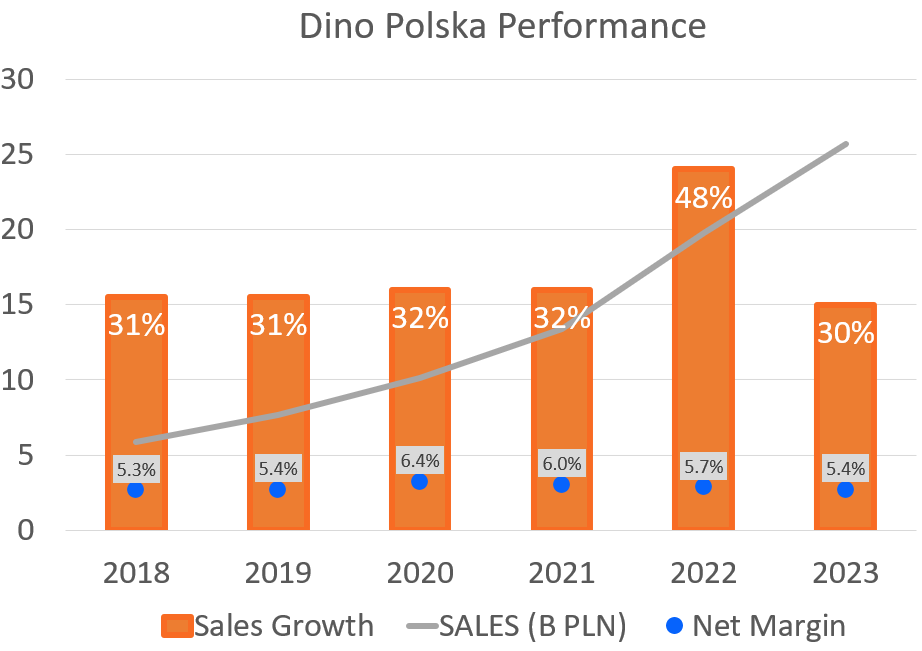

Here’s a quick overview of Dino’s 2023 performance:

Dino has again had a strong year in sales, with about 30% growth. The net margin is decreasing a bit. Management has claimed to want to increase long-term EBITDA margins but hasn’t stated in detail how they plan to achieve this.

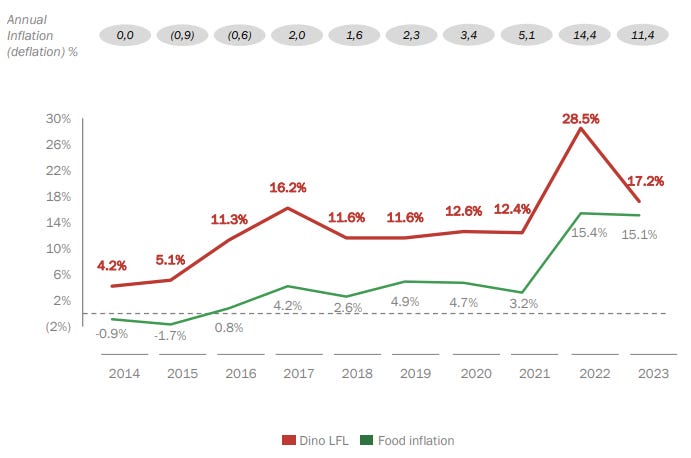

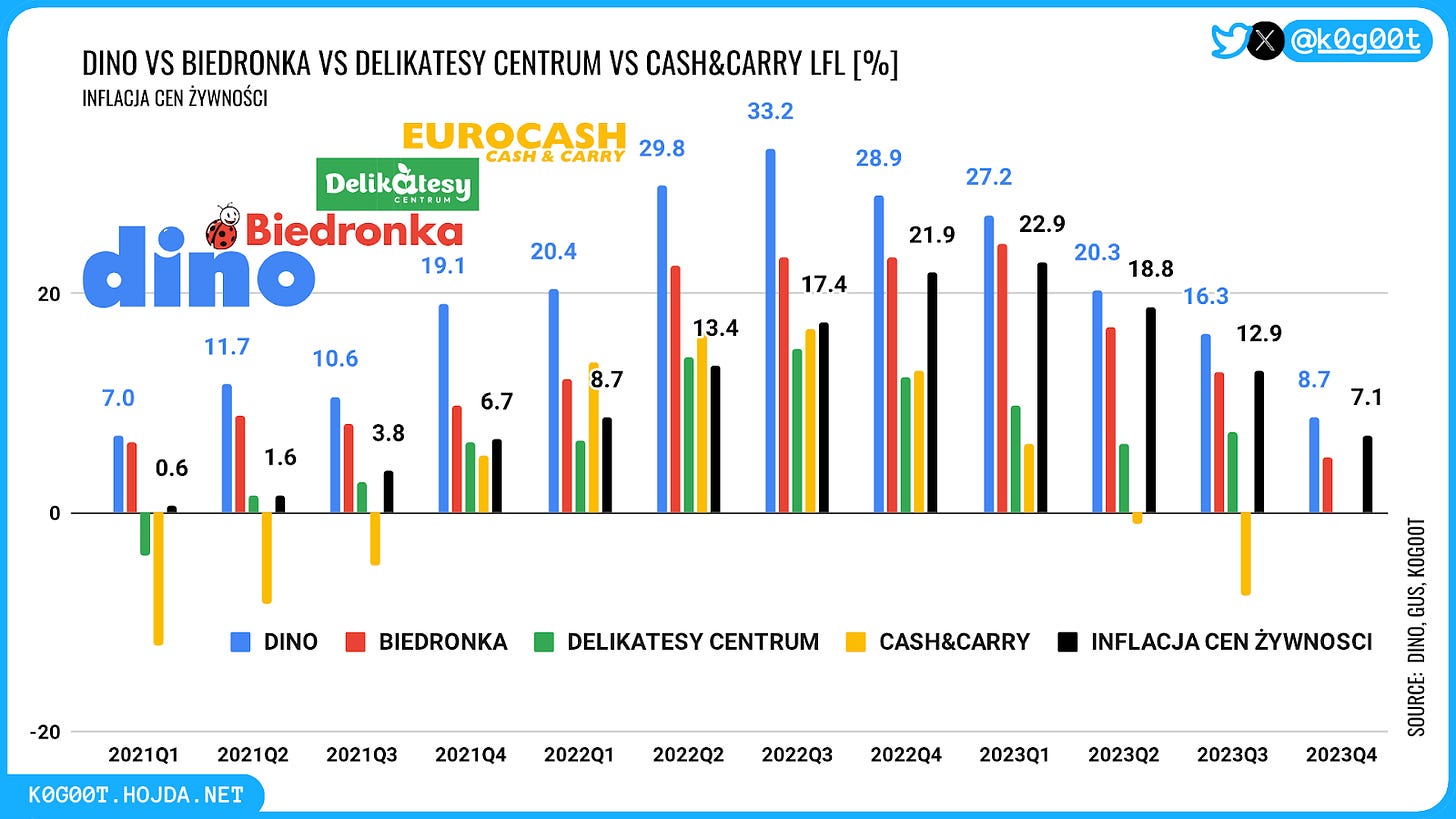

We must be careful when comparing it to 2022. From 2021 until 2023, Poland has experienced an inflation peak. Here’s the life for like sales compared to inflation:

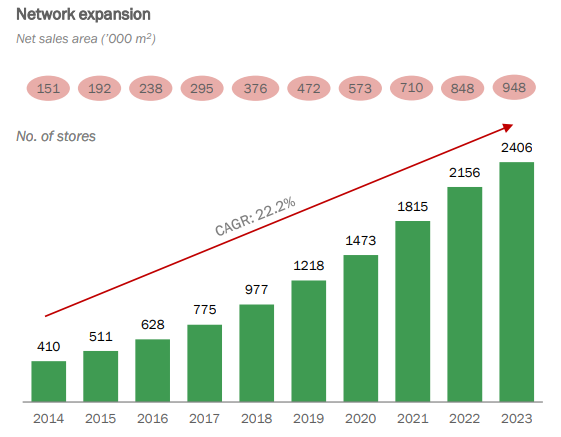

The number of stores has increased by 250 to 2406.

Which is slower than in the past, but this was a deliberate management decision based on uncertainty in the economy and Ukraine.

The construction of four new distribution centers has started. As a reminder, 1 distribution center can serve up to 350 stores.

The first one will be opened in Q2 and the others will follow in the following months.

The meat processing plant is being expanded to be able to serve more stores.

An important factor to look at is Like For Like sales:

What you want to see is a big gap between like-for-like sales growth and inflation. The difference in 2023 was the smallest since 2014. There are articles concerning price wars between Dino and other retailers which leads to margin reduction.

Current food inflation in Poland has dropped to 4.4%. I expect that the future outlook will be similar to the period from 2018 to 2020. These last 2 years were unusual.

A short Intermezzo on like-for-like sales:

With like-for-like sales, we measure the performance of existing store sales while ignoring the impact of opening additional stores. It allows us to look at organic growth excluding the store expansion.

Dino, because of its rapid expansion, can show higher LFL sales growth as opposed to more mature companies. A store needs time to achieve maturity. If a new retailer has like-for-like sales growth similar to an established player, then there might be something wrong.

This is not the case for Dino.

Here the LFL overview of Dino versus its competitors:

Management has stated during the earnings call to increase EBITDA margin going forward.

Reasons for drop in Q4 compared to Q4 of 2022: Price sensitivity and people in Q4 of 2022 were hoarding and stock up.

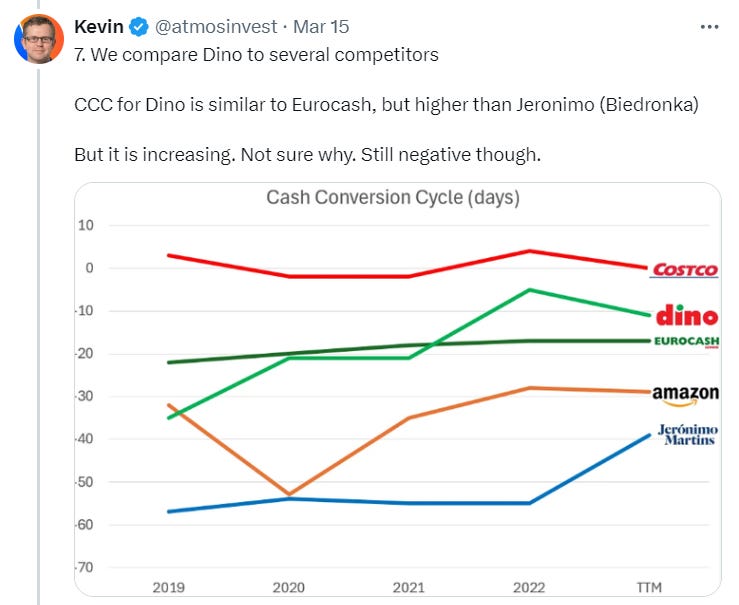

Cash Conversion Cycle

Previously, we discussed the Cash Conversion Cycle. There was one question lingering:

Dino’s cash conversion cycle was negative as is the case with most bigger retailers. But it was becoming less negative:

Go the the full thread:

The issue was addressed during the earnings call.

The payables rotation is much shorter than it was in the past. This explains the increase in CCC. The payables rotation has changed in the past to maintain good relations with their suppliers. The level at the moment (about 50 days) is comfortable for their suppliers. They do not intend to change anything from now on. In other words, we can expect the cash conversion cycle to be more or less stable going into the future.

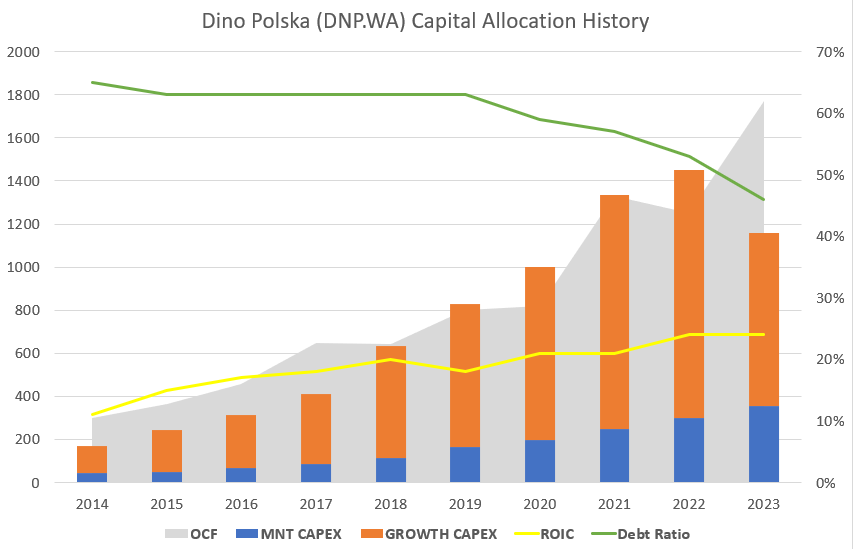

Capital allocation

Here’s the view of Dino’s capital allocation history based on the latest 2023 data:

We can see that:

The debt load has been reduced

ROIC is increasing and floats above 20%

Operational cash flow continues to climb relating to Dino’s top-line growth and margins

This is the first year they are generating free cash flow due to a decision by management to decrease the speed of new stores opening

There’s nothing else to add.

We like what Dino is doing and expect that growth capex will increase in 2024 and 2025 based on what management has claimed during the earnings call. Since operational cash flow will also continue to increase, we expect free cash flow to be generated from now on.

Based on past management decisions, we shouldn’t expect any dividends or buybacks. They will continue to look for ways to reinvest their excess cash and may use some of it to reduce even more debt.

Dino is projecting about 1.5 to 1.6 billion PLN for the development of new stores. There will be additional capex for the meat plant and distribution centers.

Additional news

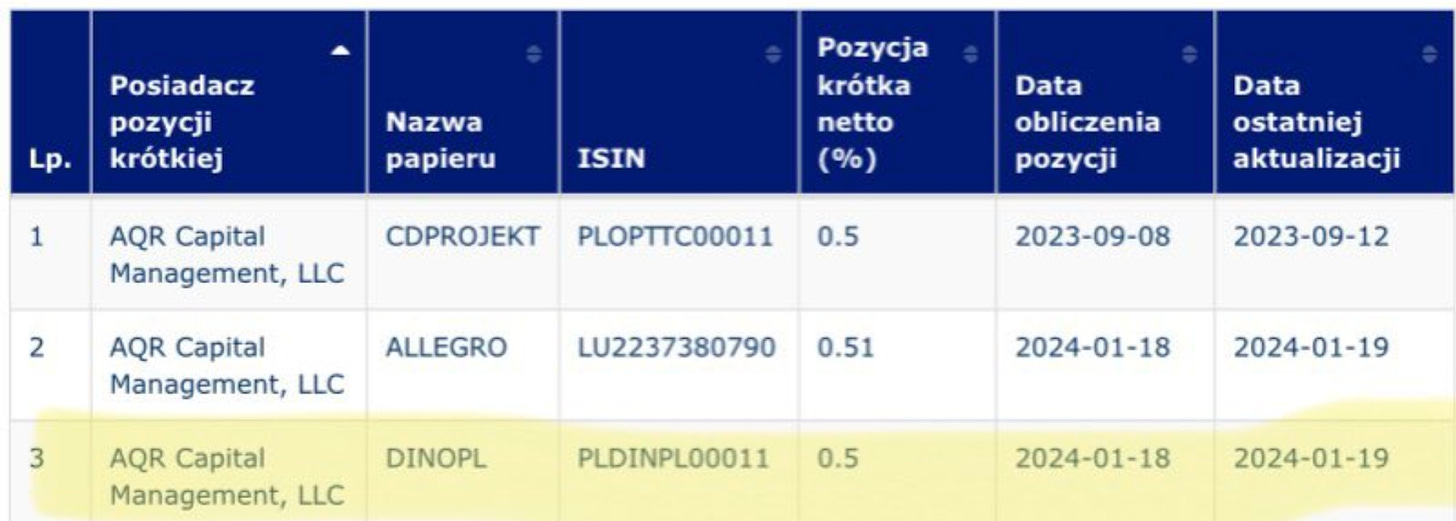

Short Position

The AQR fund has taken a small short position in Dino. Here’s the data:

AQR is a quant-driven fund. In other words, these are short positions taken in the function of the strategy and factors the fund uses. This is not a short position taken based on fundamental analysis.

Dipping a toe into e-commerce

In 2023, previous Dino wanted to acquire a 75% stake in eZebra, a Polish online retailer.

The goal was to establish knowledge and skills in the e-commerce market.

I mentioned in the destination analysis that because Dino’s focus is on convenience (your neighborhood store 5 minutes away), they should not fear any significant disruption from e-commerce in the short term when it comes to grocery sales.

To close the deal, Dino needed the consent of the Office of Competition and the consent of the founder’s lending bank.

On the 19th of December, both conditions were met. However, on the 21st of November 2023, the first civil division of the district of court in Lublin granted a temporary injunction which led to a delay in finalizing the agreement.

Dino’s investor relations have confirmed that at this moment, the deal is still suspended, but they have taken legal action and are confident that the transaction will take place in 2024.

The acquisition cost Dino 61 million PLN.

Pricing in the market

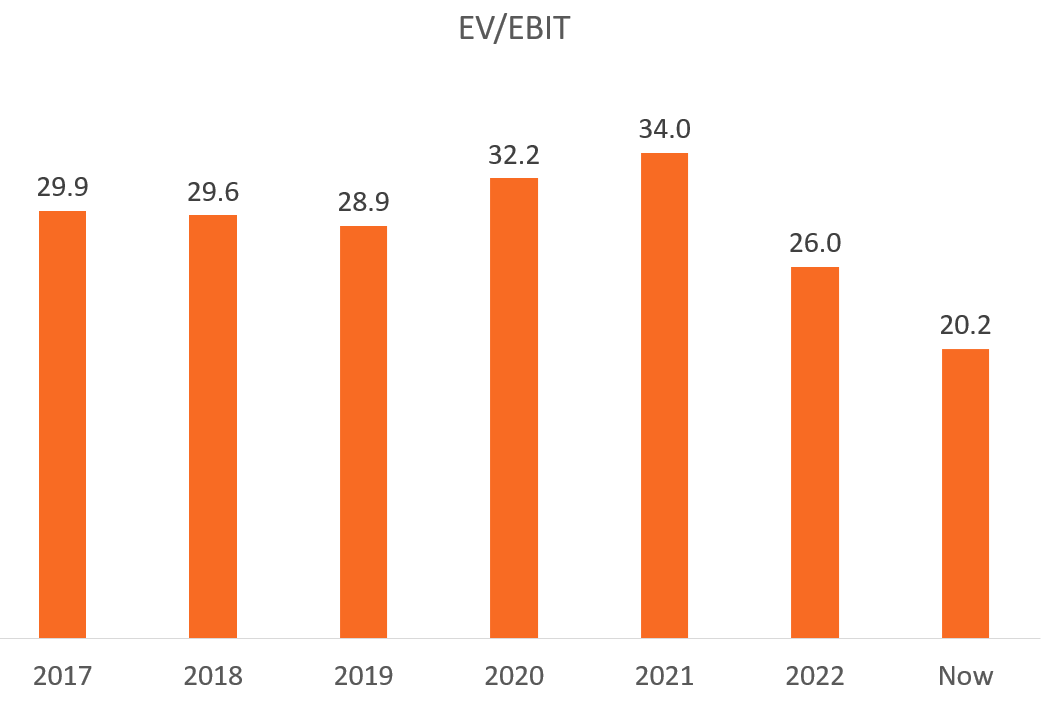

Let’s take a look at past pricing data. We take enterprise value (EV) over operating income (EBIT):

Why the sudden decrease when we look at this ratio?

Dino has decreased their debt load during 2023 which together with the drop in market cap leads to a lower EV. Net debt is now at the same level it was in 2020. Compared to 2020, operating income has continuously increased. The result: a historically low price in the market based on past data.

But the past is not the future.

The forward P/E for Dino is 21 at the moment (data from simply Wall Street). This again is historically low.

Finally, we’ll look at a reverse DCF to look at what growth rate the current price in the market implies.

Assumptions:

Next year FCF = 1.4 billion: This is calculated based on Dino opening 250 stores (same as in 2023)(conservative)

Discount rate of 10%

10-year DCF period

Terminal value: EV/FCF = 20 (which implies multiple compression compared to now)

Based on this data, this implies a growth rate of 10% on FCF over the next decade.

I think Dino can do better and consider Dino to be undervalued.

Conclusion

Based on all the new information, our thesis remains valid. But I am acutely aware of the endowment effect, so please, leave a comment to push back on this analysis.

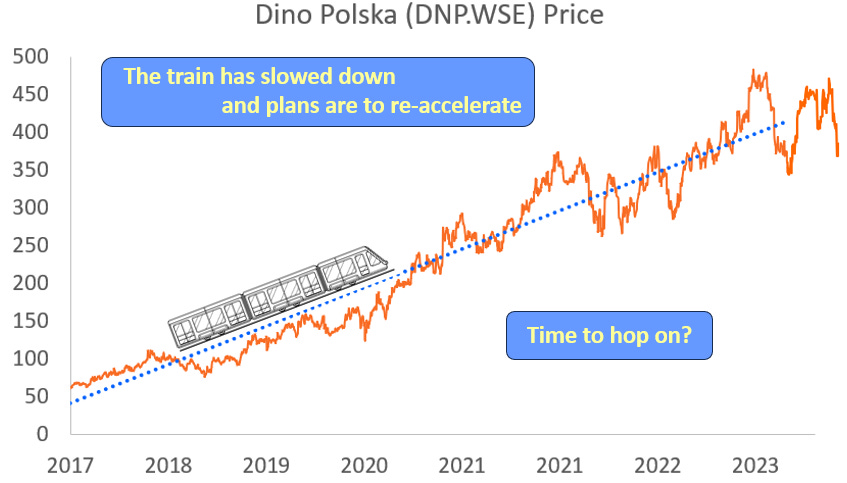

Short-term sales reduction and fewer store openings were conscious management decisions related to the uncertain macroeconomic environment and the war in Ukraine.

Management has claimed, now that inflation has dwindled, to increase the number of stores to open in 2024 with a possible higher number of store openings in 2025.

There is nothing flashy about Dino’s annual report, earnings call, or company presentation. It’s pretty boring but this is what we want.

Remember bias number °2, human's love for stories in our latest article.

There is no form when you investigate Dino. Management isn’t trying to sell you anything. You come along for the ride, or you do not. They are 100% focused on the business, not on the stock price.

Dino will continue to execute and grow its store network and will maintain its competitive advantages in rural Poland. Sales for 2024 will be strong thanks to the spring coil effect of the past new store openings (344 store openings in 2022 that will achieve maturity in 2024-2025).

I have used the recent pullback in price to increase my position in Dino Polska as my read is that the driver of the train, due to possible obstacles ahead, momentarily reduced its speed, but looking ahead, they are going to push the pedal to the metal and accelerate once more.

It’s full steam ahead.

May the markets be with you, always!

Kevin

Additional coverage on Dino

A recent article by Fundasay also considered this a good moment to add to his position:

Full deep dive by Compounding Quality. I recommend subscribing to his premium newsletter if investing in quality companies resonates with your investment philosophy. (this article is available for members only)

Also, check out this interesting analysis of retailers published by Edelweiss which I also referenced in the article.

As a reminder, I use a 2-fold investing strategy:

Invest in high-quality companies that usually trade at high multiples. Profit from pullbacks in the market to buy at a right price

Invest in small quality companies that are underfollowed in the market. Profit from mispricing due to reduced size, illiquidity, and being too small for institutions to take notice. Inspired by Paul Andreola’s discovery cycle.

Dino sits in the first part of our strategy.

Also 20x terminal value is just delusional. Dino would be growing just a MSD or LSD

Take a look at how many store space Biedronka has, whether Dino is able to get more store space than biedronka, the current rate of store openings, LFL sales that are similar to competitors if you adjusted for new stores.

Management needs to be skilled (at capital allocation outside of store openings) and smart to compound at a decent rate.