Half-year review - 11 companies - still investible?

$DNP $ADYEY $TBLD $CXZ $INMD $EPSIL $MSS $KSPI $1448 $LOVE $SMLR

This is my mid-year look back. The goal is to go through the companies I’ve written about and ask the following questions:

WHAT does the company do?

WHY I own it? (or not)

WHEN to own it?

In addition, I’ll add a short paragraph: the latest developments which will get you up to speed with all the companies.

I got the idea to clearly distinguish the why and when from a podcast with

and John Rotonti Jr.. I highly recommend you check out their masterclass in stock picking.After all the analysis, write-ups and sometimes deep dives, I think it’s important to be able to articulate concisely what you own and why you own it.

I try to keep track of the companies I’ve decided not to invest in. You never know if something changes. This way, the knowledge gained in the company doesn’t go to waste.

In the spirit of disclosing my investing strategy (spaghetti with hot sauce):

Spaghetti: Investing in high-quality business on a pullback 🍝

Hot sauce: Invest in quality microcaps mispriced due to unfollowed 🌶️

I’ll flag the different companies with the appropriate emoji if it fits the strategy. You’ll notice that some of them don’t fit in any of them.

All charts below come from www.finchat.io (not an affiliate but I love their product)

The bigger companies I own

Dino Polska (Ticker: DNP)🍝

Short Description(what?)

Dino is a proximity discounter retailer serving rural Poland. It has grown revenue and earnings at a 30% CAGR over the last decade.

Elevator Pitch(why?)

Dino will continue to take share in a fragmented market from the mom-and-pop stores. Due to vertical integration (meat processing plant/builds its own stores), it has a better cost structure than competitors. Dino reinvests almost all its free cash to continue building new stores. At the end of the next decade, the Polish grocery market will be dominated by Biedronka and Dino Polska. The company is run by the founder who owns 51%.

Pricing(when?)

I already have a full position and used pullbacks in 2023 to build it. At the current price, it does not pass my hurdle rate.

Latest developments

The first quarter of the year was slow, but management has claimed that new store openings will be picking up in the second half of 2024 and in the year 2025. Nothing in particular. As I mentioned before, Dino’s earnings calls are kind of boring, but in a good way.

Adyen (Ticker: ADYEN)🍝

It’s been a wild ride looking back over the past year, but the price seems to have stabilized.

Short description (what?)

Adyen is a payments processor and merchant acquiring bank. It helps merchants increase authorization rates which means when someone tries to buy something, there is a higher probability the sale goes through (if refused, the customer might go to another online store). Its focus is to increase net revenue and margins.

Elevator Pitch (why?)

Adyen has a cult-like culture and a long-term view. It is vertically integrated and uses a land and expand strategy to grow its business, meaning it grows by first showing a positive ROI to its clients which convinces the client to give more volume to Adyen. The company is lean compared to competitors, with low SBC, and generates a lot of cash. It behaves countercyclical (it hires when others fire). The founder has skin in the game and still runs the company.

Pricing (when?)

Although Adyen is showing solid growth, it’s too expensive for my taste at a forward FCF Yield of 3%. I wouldn’t mind another drop like in 2023 to be able to add more to my position.

Latest developments

The Q1 investor update was nothing special. Several reports mention Adyen keeps executing, landing new deals, and partnering with new companies.

Here are some tidbits I gathered from X. Make sure to subscribe or follow the

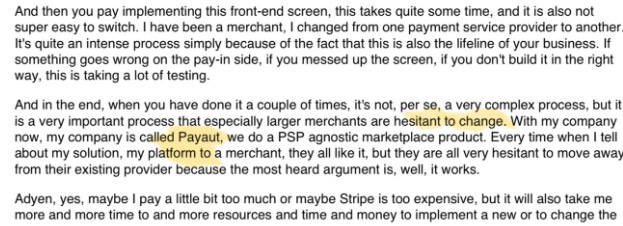

as he tracks Adyen closely.From an expert interview with a former Adyen employee launching his payment processing solution: High switching costs make payment processing stick to the merchants.

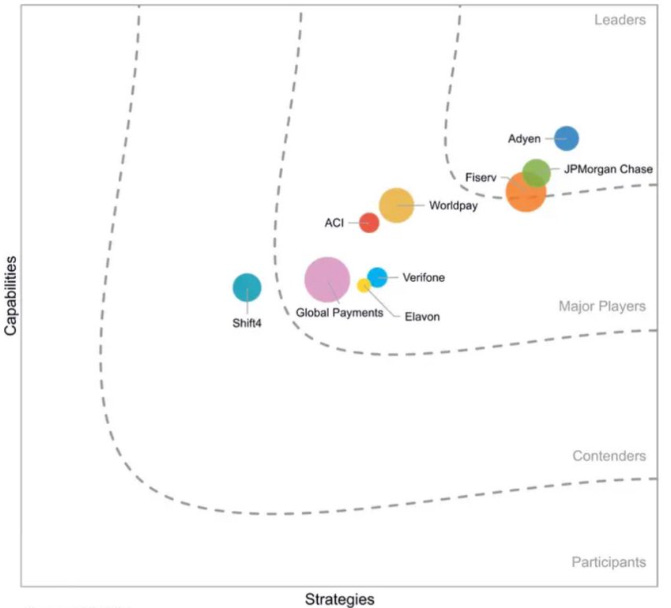

IDC published a market research report on Retail Omni-Channel payment platform software where Adyen was recognized as the leader in the space.

And a last one, Adyen has partnered with xnPOS to cater to Hotels with their payment processing software:

The smaller companies I own

Inmode (Ticker: INMD)

Short description(what?)

Inmode manufactures and sells aesthetic medical devices to physicians. It is called the skin tightening company although it is now venturing into other health-related domains like ophthalmology and women’s health. Their flagship product is the Morpheus8 minimally invasive device.

Elevator pitch(why?)

Inmode is too cheap compared to its cash-generating capabilities. Although growth has stalled, it keeps expanding its product line. Their no-growth forward FCF Yield sits at 13%. The combination of no or very slow growth combined with a yearly buyback plan (10% announced in 2024) can yield good shareholder returns.

Pricing(when?)

If you believe in the thesis, the best time is now.

Red Flags

I track Inmode closely with a thesis tracker. I’m betting on a no-growth scenario, so red flags would be:

A decline of more than 10% in sales for 2024

Not executing the buyback plan

In 2025, if buybacks are executed in 2024, not accounting for a new buyback plan in 2025

Latest developments

After the deep dive, I mentioned I had sent some questions to investor relations.

Sadly I did not receive a response. The only way I can think of to get some answers is to try to get in touch with a fund that has a larger holding, and maybe ask them to add my questions to theirs if they plan to contact investor relations.

If you know of a fund with a sizable position, please let me know in the comments!

Here are some notes from the Jefferies Global HealthCare conference on June 5th where Inmode was interviewed:

This year marks the first year of the replacement cycle as leases for their first customers come to an end. But in 2024, marketing and sales will focus on new sales, so we shouldn’t expect much from replacements in 2024

2nd-generation devices are coming into the market.

The interest rate headwinds continue:

Psychological: A physician waits another year so they can pay less if there is a rate cut

Underwriting: Lease agencies used to just do a credit check, now they ask for full financial statements over the last 2 years. It takes more time. The more time a deal takes, the higher the probability the deal doesn’t close

With 1 lease agency, Inmode uses its balance sheet to share the risk. 6% for Inmode and 94% for the agency. The lease agency then agrees to speed up the underwriting process

Capital allocation: Priority remains M&A but it’s difficult to find a company that could be accretive to Inmode’s EPS. They will execute the buyback program this year. For 2025, all options are on the table, M&A and buybacks, dividends, or a combination of these.

May take:

Management finally acknowledges that rates will stay higher for longer

This is the first time buybacks/dividends or a combination thereof have been mentioned since I started following the company.

They claim guidance hasn’t changed despite the headwinds. If they succeed, then there will be no growth in revenue. 2025 will be a crucial year. The replacement cycle will determine if Inmode can grow once more

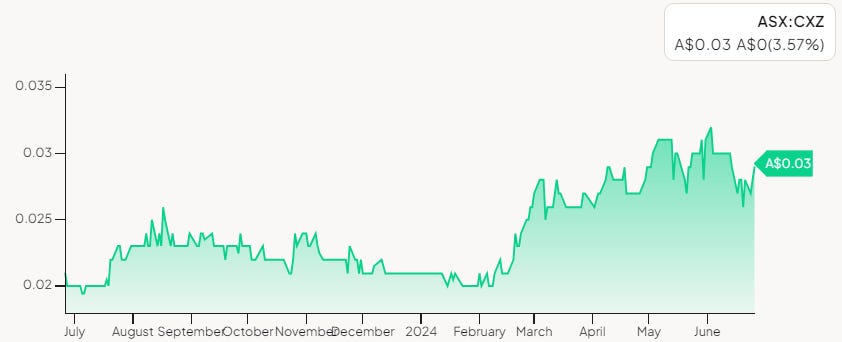

Connexion Mobility 🌶️(Ticker: CXZ)

Short Description(what?)

Connexion develops the software to run the courtesy loaner program at General Motors. If your car is serviced, the software allows the franchised dealer to quickly find you a replacement car. The software will track telemetry to recoup fuel costs for the dealership.

Elevator Pitch(why?)

The CTP software is only the start. The company is developing more software applications so that franchised dealerships can make more money. One of these is the development of a marketplace where Connexion will provide its own apps and 3rd-party apps that dealers can use. The company has a strong balance sheet and uses some of its cash to buy back shares. The CEO holds an important part of the company.

Pricing(when?)

I consider the current price attractive. If the company can land other clients beyond General Motors or successfully launch the marketplace, I expect a rerating of the price in the market. If the company delivers on its strategy, I will probably add to my position.

Latest developments

You can consult my write-up. I’ve sent some questions to investor relations but have received no feedback. I’ll try to use other channels to see if I can get a response to my questions

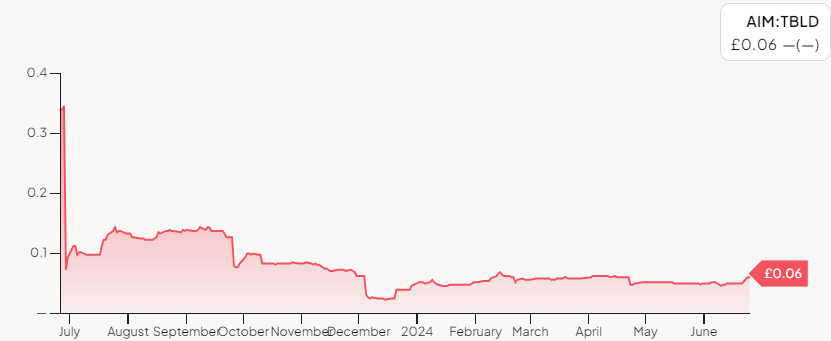

Tinybuild (Ticker: TBLD)🌶️

Short description(what?)

Tinybuild is a premium game developer and publisher. Since its IPO in 2021, it has grown through acquisitions by equity financing. Its goal is to create games and IPs that can be developed into animation series and other media. They publish on all platforms.

Elevator Pitch(why?)

Tinybuild uses a decentralized organization with different studios to publish and develop its games. Since its IPO, it has been dropped in a perfect storm, with a gaming market slowdown, some games that flopped when released, and a complete halt of development revenue (for example: Game Pass that gives cash upfront to develop games for their platform). The IPO proceeds have been used to fuel a strong development pipeline. Some of these games are set to release at the end of 2024. They have currently gathered more than 3 Million wishlists for their games on Steam which shows progress. The founder still runs the company and now owns more than 50% of the company after having injected 10M USD into the company due to liquidity problems (skin in the game).

Pricing(when?)

The value of this pipeline exceeds the current value of the company. The investment stands or falls with the release schedule at the end of this year. If you believe Tinybuild can turn the ship around, now might be a good time to get in.

Latest developments

TBLD just released their latest trading update.

It was pretty vague:

Sales have appreciated more than anticipated in the first months of the year

Next game releases are scheduled for the end of the year

Cash position is in the mid to high single digits

An IP divestment to Atari in June

I like transparency and being blunt when it comes to management communicating performance to the markets. A cash position in the mid to high single digits (probably the most important metric given the past liquidity problems and equity raise) is not very specific. It does not boost confidence in the company, as the only reason I can think of to choose this vagueness is if they fear a precise number might make the market react downwards. If the price drops, it’ll cost more if they need an additional equity raise. (I’m speculating of course)

This company is not out of the woods yet. It needs to develop true cash-generating power. This means having some titles that bring in much more cash in a sustained way so they can build a cash buffer and avoid future liquidity problems.

There are the first signs of progress as on Steam, they have gathered more than 3 Million wishlists for their upcoming games which is the main reason I’m still holding on.

Show me your sustained free cash flow-generating capabilities!

I won’t delve deeper as the General Meeting is scheduled for today. James at www.firmreturns.com follows the company in detail. Check him out for future updates.

Given the release schedule, we’ll have to wait until April 2025 to see the result of the pipeline coming online.

Those I do not own

Maison Solutions (Ticker: MSS) 🌶️

Description(what?)

A niche grocery retailer focused on Asian produce in the state of California. It went public in October of 2023 to raise capital and expand its business operations (it had 4 stores at the time). They also offered online shopping.

Why don’t I own it?

I’ll just add the conclusion I had at that time:

Latest developments

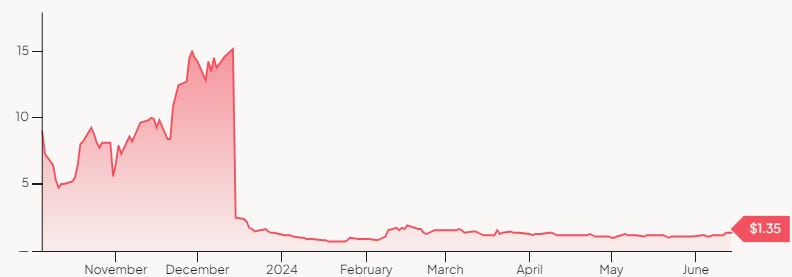

Let’s look at the stock price chart for the first couple of months:

I was baffled by the price action on this company. Although the IPO prospectus talked about some business transactions with family members within the company, my main reason not to pursue the investment was that it was just too expensive.

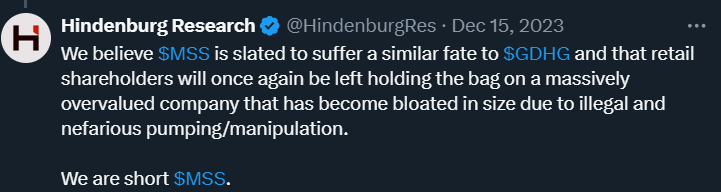

Then this happened:

And you probably know where the name Hindenburg comes from. Here is the impact of their social media posts:

Sadly, a full short report is not available.

And what happened at Maison Solutions?

They keep on executing on their strategic plan:

April 2024: Acquisition of Lee Lee Oriental Supermarket

End of 2024: They plan to acquire one of the most advanced Asian grocery stores in California

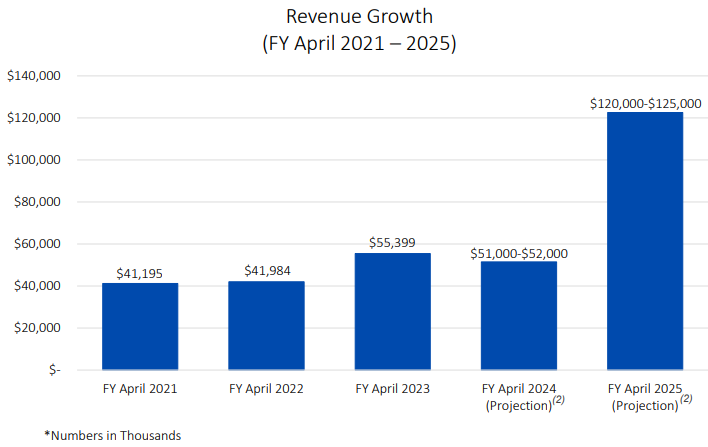

With their current revenue projection being:

A big research agency shorted the company, the price declined to 1/4 of the IPO price, and underneath, the company kept on executing its business strategy.

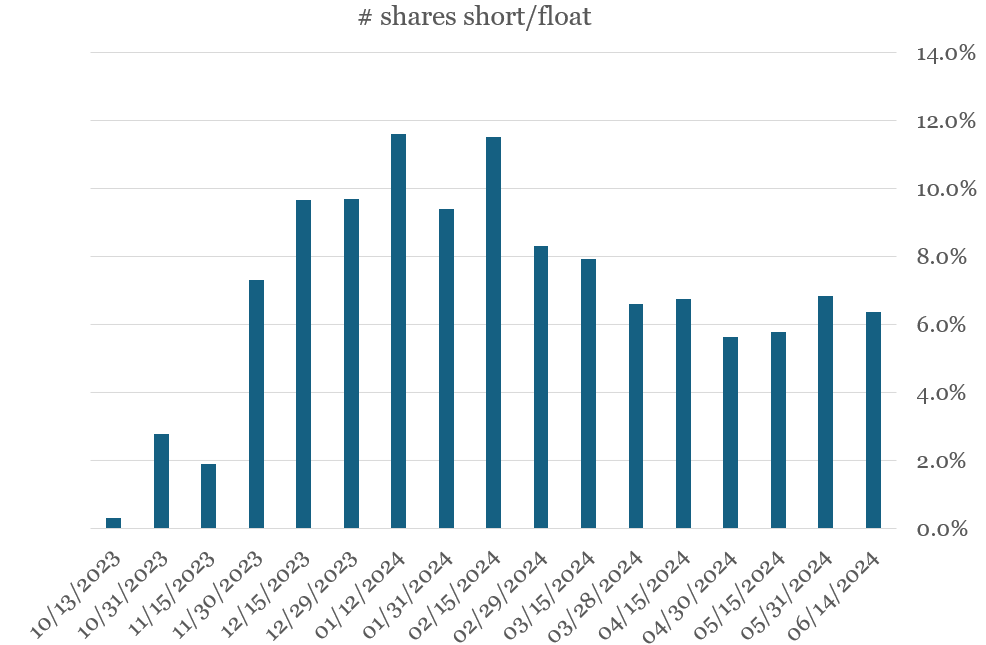

Here the amount of short interest on the stock:

Call me intrigued. I plan to follow up with the company and maybe do a little write-up in the future.

Be fearful when others are greedy and be greedy only when others are fearful

Warren Buffett

Kaspi 🍝(KSPI)

Short Description(what?)

In Kazakhstan, Kaspi has developed a super-app. This mobile app provides banking services, a marketplace, and payment processing in the background. It is one of the few companies that can bypass the networks of Visa and Mastercard in Kazakhstan. Within Kazakhstan, it has developed a sort of monopoly.

Why don’t I own it?

There were 2 reasons. First, the uncertainty related to the country's risk. Although it is more stable now, there was some instability in the past. Secondly, other companies like Halyk Bank performed even better as an investment.

Latest developments

The stock did well over the past months. Here are some updates on company performance:

KSPI now has 15 million users with a total population of 20M in Kazakhstan

They are now looking to expand abroad (for example to Uzbekistan)

The latest earnings update was solid

If you want to dig deeper into possible international expansion and the opportunity, I wrote about this specifically.

Fu Shou Yuan (Ticker: 1448)

Short Description(what?)

Fu Shou Yuan is the largest death care provider in China. It owns lots of burial plots which have increased significantly in value over the last years.

Why don’t I own it?

Performance has been rocky over the last year and expansion is slow. I was also informed it had a twin brother. Anxian Yuan China holdings (Ticker:992). Check out this article, but I’ve never dug deeper.

Latest developments

Revenue has been declining the last 2 quarters YOY. Management claims that they had unusually high revenue the year before because of the lifting of COVID restrictions. They hold a pretty big cash position, and although they pay out a dividend, it feels they should do more for the shareholder.

Lovesac (Ticker: LOVE)

Short Description(what?)

Lovesac operates in the furniture retail market and delivers modular durable couches in the seats and sofas category. It has been growing fast (in a slow-growing market) over the past years. It offers a premium product in the higher price category.

Why don’t I own it?

I couldn’t get past the ‘one trick pony’ aspect of the company. I had a hard time imagining where future product development might go.

Latest developments

Lovesec published its results in Q1 2024 and stated its guidance for the year. It expects at least the same revenue or slightly higher in 2024 (700 to 700M USD) and a diluted EPS between 1.1 and 1.6 (compared to 1.4). So no growth or slight growth in 2024 compared to 2023.

Semler Scientific 🍝(Ticker: SMLR)

Short Description(what?)

Semler Scientific (Ticker: SMLR) develops and sells the QuantaFlo device to health insurance companies like the UnitedHealth Group (Ticker: UNH). Quantaflo provides an easier way to detect PAD (Peripheral Arterial Disease) in an early stage (before more severe symptoms start to show). It's beneficial for the patient and for the insurance company as it lowers risk (and costs)

Why don’t I own it?

Semler only has one service they sell, the Quantoflo. In addition, regulations regarding Medicare in the US changed, and the use of Quantalfo is no longer reimbursed when treating ‘low-risk’ patients. This will impact the top and bottom lines in the future.

Latest developments

The impact of the change in regulation was felt in Q1 of 2024 with a decline of 13% in sales (the first time since several years of growth). Semler has sent out a press release stating that they are using a part of their cash position to buy Bitcoin (think Microstrategy). The share price jumped on the news.

Epsilon Net 🍝(Ticker: EPSIL)

Short Description(what?)

Epsilon Net started with accounting software and is now a leading software and software solutions provider to businesses in Greece.

Why don’t I own it?

I would have loved to own it, but was too late. A week after completing my write-up, there was a takeover bid to get the company private. The bid price was 12 EUR and the market reacted.

Latest developments

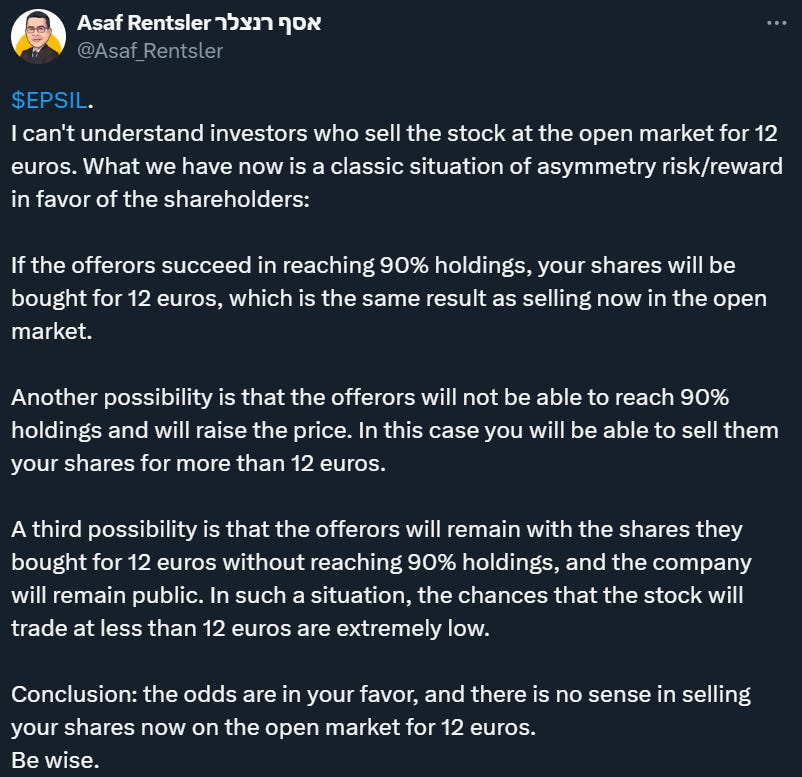

Q1 numbers were solid. Since the takeover bid, the stock’s price has been fixed at around 12 EUR in the market. I especially liked this analysis on X:

In other words, you could be better off buying the stock at 12 and see what happens.

I do think the company is worth more seeing at the rate it grows.

What do you think?

Conclusion

I hope this half-year review brought you some value. It’s always useful to look back at the companies and write down in a couple of sentences why you own them.

If you have a question on any of the companies, please email or DM me.

What am I currently looking at?

Paypal 🍝 My niece called me to open an account and I immediately had to think of Peter Lynch. On the same day, I received a great article on PayPal by

It’s like the universe is trying to tell me something, or not?Intelligent Monitoring Group 🌶️ : An Australian microcap security services roll-up driven by an activist investor who owns over 50% of the company. You can read the write-up by

which I greatly admire.Gaming Innovation Group 🌶️: A spinoff situation. If Charlie Munger and Joel Greenblatt say that spinoffs are a fertile hunting ground for great investments, who am I to argue? The best article I found on this is from

.

What is missing from this review? Any suggestions for other interesting companies?

Please comment below.

And as always,

May the markets be with you!

Kevin

Love seeing people hold themselves accountable! I agree with the others that this is a good framework. I like that you’ve checked in on the companies you passed on as well. Also appreciate the PayPal shoutout! 😁

interesting post but a lot of stocks you never mentioned! looking forward to learn them better via a deep dive? I own Dino, Adyen and some call options in Inmode. stock has a bad reputation due to fraud: I think after q2 it will improve. I read somewhere that the company has cash reserves of > 45% of its market cap and it continues to be profitable. Excluding the cash reserves, the stock is trading at a P/E ratio of below 5. I think also it is a highly attractive buy.