Maison Solutions Inc. - a road to multi-bagger delights?

One of my goals this year was to read through an IPO prospectus and value a company before it became public. Screening the upcoming IPOs on investing.com, my eye fell on Maison Solutions Inc., a fast-growing specialty grocery retailer offering traditional Asian food and merchandise to modern US consumers.

Sounds great! Let’s dig in.

The Company

Maison has 3 supermarkets and a 10% equity ownership in a 4th. They are a retailer founded in 2019 and focuses on the Asian-American consumer with typical fresh specialty products. In my own local Asian supermarket, they even have frozen durians!

For the uninitiated, no this is not a made-up fruit from some Star Wars movie, although they could use it as a prop. It’s a very special fruit from Southeast Asia with a peculiar smell. I’m not saying more, you’ll have to discover it for yourself.

On vacation, I love walking around in foreign supermarkets. When it comes to investing, I had to think about Chris Mayer's 100-bagger book. You can spend hours analyzing, buying, and selling trading like there’s no tomorrow. Or you could just as well have bought Walmart and held onto it for a couple of decades. Of course, that’s easier said than done, but safe to say, I’ll always be attracted to a great retailer. (I’m looking at you Dino Polska, but you’re just too expensive).

Anyway, here are some key takeaways regarding Maison Solutions Inc.:

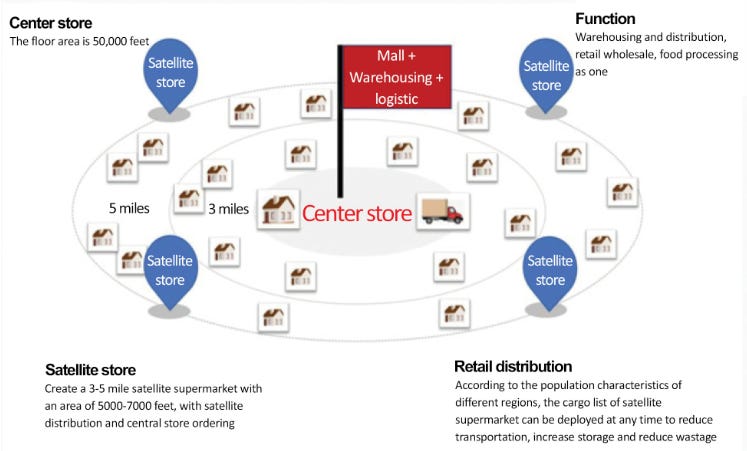

They operate 4 center stores. A center store services its area but also has a warehouse that can be used to offer distribution to smaller satellite stores. They currently have a 10% equity ownership in 1 satellite store

The management team is experienced and has a deep cultural understanding of the needs of their customers

The products they offer, meats, seafood, and other groceries that are staples of Asian cuisine are not commonly found in a mainstream supermarket

An in-house logistics team and strong relationships with local and regional farms allow them to offer high-quality perishables at a competitive price

They offer on-line and off-line shopping to their customers. They use a third-party mobile app Freshdeals24 and an applet in WeChat for either home delivery or in-store pickups

They are working closely with JD.com to go further into the digital transformation of their stores with updated apps and interconnected data between all the stores (again, reinforcing the operational excellence strategy of their business model)

They have a 10% equity ownership stake in an Asian food import business (the Dai Cheng Trading Co.)

Some images to get a general idea about what it all looks like:

Look closely at the right-hand picture in the below right-hand corner. This is like a sort of colorful pudding made from fruit. My wife is addicted to these.

And the location of the current stores

The trading/import business is located on the left and the 4 center stores and 1 satellite store are on the right

The IPO

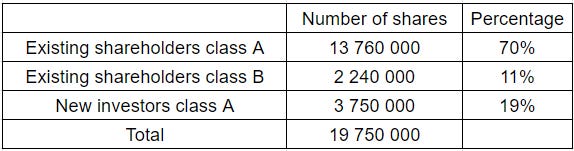

Maison wants to raise capital to fund its expansion. They will be listed on the Nasdaq Stock Exchange under the <MSS> ticker. Here’s what the shareholder’s count looks like:

On a not-unimportant side note :

3 000 000 class A shares are reserved for future rewards under a Stock Incentive Plan

Class A shares could be issuable upon the exercise of outstanding warrants

If issuance occurs because of these reasons, investors will be further diluted.

Class A shares have 1 vote per share. Class B shares have 10 votes per share.

Because all class B shares are owned by Mr. Xu, he will retain majority control of the company after the IPO.

The new class A shares are offered at 4 USD per share. This would mean 15 million dollars in proceeds but the IPO costs and other expenses related to the offering would lead to a net cash increase of 13.36 million.

Mr Xu, the CEO and owner, holds all existing shares. In other words, of the total number of shares outstanding after the offer, 81% is held by Mr. Xu, and the rest can be traded freely in the markets (float of 19%).

Use of proceeds

Their main goal is to create a network of center and satellite stores as shown in the figure below.

In fact, the company’s strategy is operational excellence and ease of access. Spreading stores around an area like that is a clustering strategy. Basic Fit uses the same strategy by flooding an area with multiple locations.

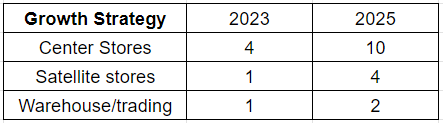

So the exact use of proceeds is as follows:

Finalize the remaining 90% acquisition of the satellite store they already operate

Finalize the remaining 90% equity acquisition of the Dai Cheng trading company

Both these are owned by the owner’s wife by the way.

This will cost them a total of 4.4 million USD because they’ll use the cash to pay off the loans on these businesses.

This leaves them with about 12 million in cash to

Open new center stores, including a flagship store in Rowland Heights, California

Acquire a center store in Northern California

Establish a new warehouse on the East Coast to provide for the stores

Acquire 5 new center stores on the East Coast

Open 2 to 3 new satellite stores in Chino Hills and Rowland Heights

Repaying the 390k loan in default

R&D and upgrade of ERP and POS systems with the help of JD.COM

Other upgrades and revisions to existing stores

This means

So if we consider future center stores and satellite stores of similar size, it would mean more than doubling in size as a company in 2 years.

Bear in mind that 12 million seems a low number for 16 new stores, but they never own the sites. Everything is leased.

Incentives

There is significant skin in the game for the main owner. For the other employees, a specific set of targets is set for each store. Weekly performance reports are reviewed and monthly cash bonuses are awarded to each store up to 1% of gross revenue. (which at the moment would be about 500k MAX spread over 258 employees or about 2000 USD per employee over a year)

A stock option incentive plan is reserved as mentioned before.

Financial situation

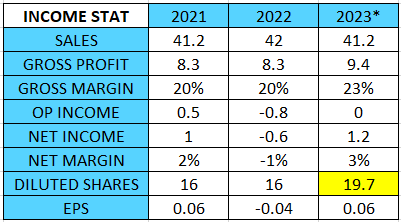

The prospectus only provides financial data from 2 full fiscal years 2021 and 2022 and a 9 month fiscal year 2023. This means that the sales number for the entire fiscal year of 2023 is probably higher. If you would extrapolate those 3 months in sales, then you would look at a 10% CAGR in sales growth over the last 3 years.

Net margins are slim, as you would expect from a retailer. They managed a net income in 2021 and in the last fiscal year with an EPS of 0.06. Again you could extrapolate the EPS, but for conservative reasons, we are leaving it as is.

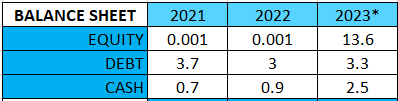

I was surprised to see the balance sheet because this is the first company that I've encountered that is completely financed by debt. The prospectus also mentions one of their debt liabilities is currently in default. It amounts to about 390k in outstanding debt. The company has 2.5 million USD in cash and a loan in default of 390k.

I don’t understand.

Moving on.

I put in the equity value for 2023 based on the offered price of 4 USD in order to balance the two sides of the balance sheet. Suddenly, it looks more like a balance sheet I’m used to.

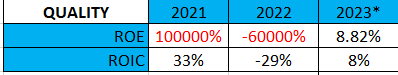

Now normally, when I try to assess the quality of the company, I look at the ROE or ROIC value, but as you would suspect, it gets weird

It’s difficult to assess their capital allocation prowess because of the lack of historical data and how young the company is. In addition, they do not have a lot of possibilities or choices. They want to grow so they take ownership of existing stores and expand, in the hopes of running the store more efficiently and making it more profitable, etc.

They explicitly state that there will be no dividends in the foreseeable future. This, of course, is a good thing.

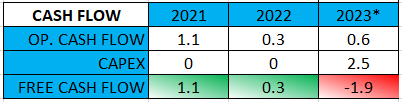

Looking at the cash flows

They do generate free cash flow but this will not be the case in the future because of their expansion plans.

The market

Food retail is a very competitive market, even in a niche. The market for Asian produce is currently very fragmented with a lot of smaller stores. However, the Asian American population is increasing and so is their purchasing power.

In general you have:

The big retailer who has scale and better financing, but with some niche produce available

The small mom-and-pop store have an intimate relationship with their customer, but lack scale and financing

Online grocery stores such as Weee! (Say Wee is the largest online Asian and Hispanic online food retailer in the US)

Other more direct competitors are:

H Mart (A korean chain with 66 locations in 12 states in the US, 17 in California)

99 Ranch Market (Which has 58 stores most of them located in California)

Conclusion: This segment of the food retail market may be growing, but there is significant competition in the space which will erode margins.

A rough valuation

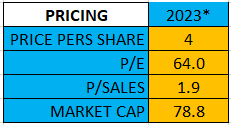

Let us call it pricing because I’m not going to do a detailed DCF. An EPS of 0.06 and a price in the market of 4 dollars leads to a PE ratio of 64. The company is listed as an emerging growth company, but a lot of growth will be needed to justify such a price. Maison’s intent is to grow 100% in 2 years, but that will probably not result in an EPS growth of the same rate. Even if you would consider an EPS growth rate of 50%, your PEG ratio would come down to 1.3. I’m curious to see how the markets will react, but I expect the price to fall after opening on the 1st of September (I’m writing this on the evening of the 31st of August)

The light side of this investment

I think there will be demand for their produce in a growing market

They want to run an operational excellence business model, expand to several stores, interconnect them with data, and run them as efficiently as possible

The vertical integration of a part of the import of specialty products

Everything is geared towards running a tight ship

Besides inventory, they have an asset-light business

The dark side of this investment

I like insider ownership, but 81% is very high

The owner has majority control, your voting rights are worthless as an investor

19% float is low - probably not the most liquid market after IPO

4 USD per share is expensive

The prospectus specifically states that deals were made (Mr. Xu acquiring his wife’s supermarket and distribution center) and that such deals may continue in the future

All stores are leased, I was hoping that the land of some stores was owned. So leases make up the bulk of their liabilities

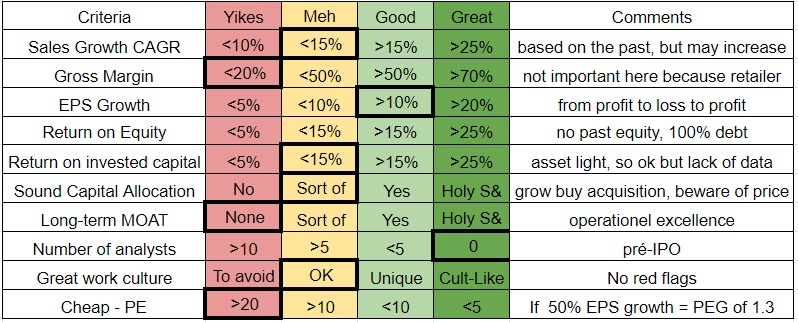

Quick and dirty - Multibagger checklist

This is a checklist I created based on the 100-bagger book by Christopher Mayer. As you’ll see, when I complete the checklist, I try to do a rough evaluation. For example, EPS went from 0.06 to -0.04 to come back to 0.06 at the end of the 2023 fiscal year. Mathematically, you then consider a 10% CAGR but because of the recovery in 2022, I rate it higher.

Overall, it’s a normal company in a growing market facing a lot of competition.

Conclusion

I was hoping to stumble upon the next Dino Polska made in the US. But alas, this is not the case. Although it could be that their business will grow as the years go on, there are too many red flags for me to consider an investment. In my view, the company is not worth 4 USD per share. Even if they can create an EPS growth rate of 50%, this would bring their PEG ratio down to 1.3. (The current PEG ratio for Dino Polska is 1.2, so I would buy Dino instead). I cannot seem to find unique traits in their business model or some sort of specific competitive edge.

But, a well-managed retailer, with a specific offer that services a rising demand in Asian-American needs, could be a big winner.

I hope you enjoyed this little overview of Maison’s IPO prospectus. It was an interesting read with a couple of surprises along the way.

As always, may the markets be with you!

If you like this stuff, we would be honored if you would join us.