Before diving into the company, I have compiled a list of questions I will send to Inmode Investor Relations at the end of next week. If you would like to add a question to the list, please comment below or send me an e-mail.

A lot has happened since our latest update:

Inmode has decided to buy back 10% of the shares (finally)

Shareholders voted to stop the term of the current CEO

The market remains challenging while revenues drop

Discover our updated Deep Dive below or download the pdf

I’ve tried to improve the content and the layout of the document. Let me know what you think!

In the deep dive, we go into:

Detailed analysis of sales, platforms vs consumables, utilization rate

A competitive analysis

A MOAT analysis

A capital allocation analysis

Work culture, customer reviews etc.

Not in the mood for that amount of reading? 😀

You can find the summarized state of affairs below 👇

Original thesis oktober 2023

The main thesis in Oktober was that the market was pricing in a decline in growth, and I bet that the speed of that decline was exaggerated.

The market was partially, right, the business did decline, and guidance for the year was modified twice in 2023.

On top of that, the first quarter of 2024 proved an even bigger decrease in revenues when comparing Year over Year.

And yet, there still might be an opportunity despite this.

Thesis tracker

Let us take a look at our tracker:

You can find the sheet for the thesis tracker here.

1. Revenue growth

Our thesis does not completely hold, because the decline in Q1 2024 compared to 2023 was 16%. They also revised their guidance for the year 2024. They expect revenue to be between 485 and 495M USD. (compared to 492M USD in 2023).

They expect no growth top line, while the market has priced Inmode as a company in decline.

If revenue keeps on declining and a new revision downwards is published, then we could see a NOK in this paragraph

2. Gross Margin

The gross margin was a bit lower in Q1 of 2024, but too early to draw any conclusions.

3. Capital Allocation

Although the board has approved a buyback program for the year, we first want to see the actual buybacks happening before changing the status of this criterium.

4. Competitors revenue

You can find a detailed competitive analysis in the deep dive, but here is the summary:

Most competitors are in revenue decline

The leader BTL Industries (a private company) is not

Future potential competitors from Korea are performing well (solid revenue growth). In particular, Classys, has claimed to aim for the US market in 2026 which could mean increased competition for Inmode.

So OK at this time, but we need to monitor going forward.

5. ROIC vs WACC

ROIC still very high for Inmode, the highest in the market. But no specific data for Q1 2024.

6. Distribution strategy

Inmode has made some improvements. They now serve 96 countries instead of 93. And in 2 countries, they have established their own direct sales team, and will no longer go through the distributor (higher margins). So on track.

7. The integrity of the business

This is the main problem. In addition to the negative reports on alleged injuries or bad sales practices published on the capital forum, a class action lawsuit was initiated in April of this year. This is not uncommon in the business world, but it tarnishes once more the reputation of Inmode.

8. EPS Growth

Despite the slowdown growth, EPS still grew 20% in 2023. It however declined in Q1 of 2024 compared to last year, hence the score we gave.

Additional information

During the shareholder meeting, shareholders did not approve the continuation for 3 years of the current CEO and Chairman of the Board. The current CEO has steered Inmode over the last 2 decades. They will have to find a new one.

Inmode has installed 80% of their platforms in the last 5 years. These have an economic lifetime of 5 years (but the real lifetime may be longer). However, this provides an opportunity for renewal of the current installed base in the coming 5 years. It may be easier to sell to an existing customer than to find a new one.

The conflict in Israël

During the end-of-year earnings call, management mentioned that part of the personnel was called away into the Israëli Defense Force. They have had to search for interim staff or work in a double shift system to keep production going.

The company, at this time, was not negatively impacted.

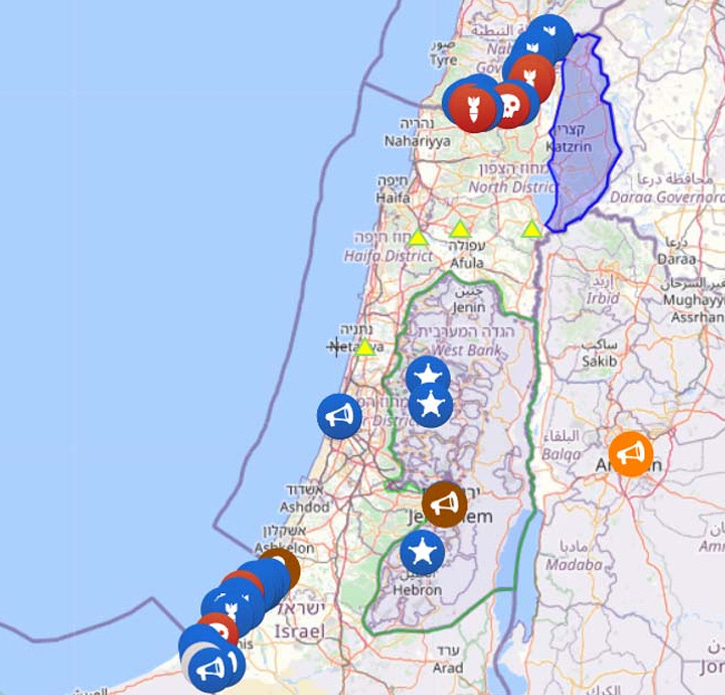

Below, you can find a map that is updated live based on the current news on the conflict. Inmode’s HQ and partners are highlighted by a yellow triangle:

There have been no hostilities around Inmode’s sites.

Conclusion

I will hold my position, for the time being. But as you can see in the tracker, more yellow and red are starting to appear, and the tension is rising.

Although the company’s growth has stalled, it is the current valuation that still makes it attractive.

The decrease in market cap since October 2023 and the increase in cash because of the high cash-generation capabilities of the company, have made the valuation more attractive. More downside risk seems to be priced in.

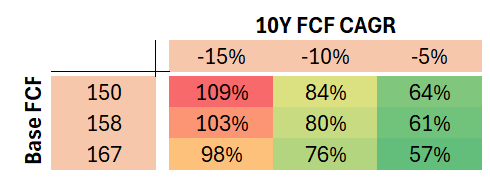

Based on this reverse DCF which looks at 9 different scenarios:

The current price in the market implies a 15% yearly decline in FCF over the coming decade.

If guidance for 2024 can be achieved and margins remain the same, you are looking at a 50 to 100% upside.

Time will tell.

In the medical devices space:

Classys is the best company at the moment

Inmode is the better investment

The buyback program and the fact they will need a new CEO is a plus.

What I would like to see in the future:

Insider buying. Management became rich in 2021 when the valuation was sky-high. If they truly believe in the company, an increased insider ownership would give a clear signal to shareholders. Of course, they already receive equity through the shareholder’s incentive program, but a buy on the open market would be a strong signal.

Revenue and margins need to stabilize. In a high interest-rate environment, it’s normal for physicians to postpone buying new equipment or have more trouble in financing the purchase. But at a certain moment, a new steady state of sales needs to be found. If not, then there is more going on than just high rates.

Radical candor by management. I’ve read the past earnings calls, and when questions are a bit more challenging, there is never a candid response like Yes, that was a mistake. We should not have done that. We’ll do better in the future.

Bonus: A profitable acquisition, but honestly, I’ve lost hope on that topic. Their main goal should be to stabilize or find growth once more and continue with a solid buyback program to create shareholder value.

How could the thesis break?

Additional surprises and revisions in guidance. This would mean revenue keeps dropping faster than expected (faster than management itself expected). We would need to reevaluate our valuation scenarios. If the resulting valuation would move us closer to fair value, then there is no longer a margin of safety.

Additional lawsuits or lawsuits with important monetary consequences

As mentioned in our latest article, I’m switching more and more to ranking and comparing different investments. Once I’m fully invested and if I find something better than Inmode, even if the thesis is not broken, it could be a reason to sell Inmode. More on that in a future article.

I hope you liked this article and as always,

May the markets be with you!

Kevin

As mentioned at the start of this article, if you would like to add a question, please leave a comment or send me an e-mail. I will compile the questions and send them to Investor Relations

Questions for Investor Relations

These will be sent to Inmode on Friday next week.

During the past 2 earnings calls, management mentioned they are not reducing their R&D or sales staff investments. They want to be ready for when interest rates drop and the market picks up again.

Question: How will Inmode prepare itself when rates stay higher longer and financing rates for physicians will remain at a high level (up to 15%) for several years to come?

Korean companies like Classys are showing revenue and earnings growth in Asia for a similar product lineup. Classys has stated they plan to enter the United States in 2026. Classys has high margins (close to those of Inmode) but more importantly a lower cost structure than Inmode.

Question: How will Inmode prepare itself when competitors arrive and possibly undercut Inmode’s offering by reducing price? Given the high interest rates, physicians might be more sensitive to price.

Management has stated to believe in the future prospects of Inmode. However, after their massive insider selling in 2021, they have not bought back any shares in Inmode.

Question: If management believes in the future of Inmode, why are they not increasing their ownership now that the price of the shares is low?

During the last shareholder vote, the proposal to extend for another 3 years the current CEO and Chairman of the board was not approved.

Question: Will Inmode look for a new CEO from inside the company or is it looking for an outsider? What is the timeline?

The company uses an employee incentive program to award shares.

Question: What are the specific performance objectives that need to be met to be met to be rewarded by equity compensation?

Since a platform has an economic lifetime of 5 years, those that were sold prior to 2019 are coming up for renewal. At the start of 2019, Inmode had 2900 platforms installed.

Question: On the current installed base, how many of these come from physicians who have upgraded their platform (second buy)?

Note that the board reinstated the CEO after he was voted out.

Kevin, thanks for following InMode.