Deep dive into Inmode: Multi-bagger or value trap?

Introduction

Vanity is definitely my favorite sin.

- Al Pacino, the devil’s advocate

The beauty business has been around for thousands of years and will be around for all time. It’s an answer to a basic human need. The search for self-confidence, or social validation. Written evidence cites medical treatment for facial injuries more than 4,000 years ago. Physicians in ancient India were using skin grafts (skin harvesting and transplantation) for reconstructive work as early as 800 B.C.

Does your skin need tightening or smoothening?

The aesthetic industry can provide you with a myriad of solutions. Today we’re diving deep into Inmode. We’ll analyze the company’s past performance, its competitive advantages, and the industry it is playing in. We’ll also take a look at the impact of the current conflict in Israel.

Who is Inmode?

Inmode is an Israeli company founded in 2008 by Michael Kreinde (CTO) and Moshe Mizrahy (CEO).

Over the past 15 years, they’ve developed and sold platforms with handpieces that allow specific beauty treatments all over the world. Think off:

fat removal

hair removal

skin tightening

body contouring

wrinkle treatment

In the last few years, they’ve expanded into new markets. At the end of 2022, they did a soft launch of a new platform for ocular care to treat:

dry eye

reduce inflammation

smoothening around the eyes

And they’ve started to target the women’s health market, to provide solutions for:

muscle pain relief

strengthening of pelvic muscles (incontinence)

In July of 2023, they acquired the intellectual property assets of Viveve Medical Inc. (a medical technology company focused on women's wellness).

Here’s an example of one of their more popular platforms, the Morpheus, platform and handpiece:

Their goal is to continuously expand their product offering gradually covering more and more markets.

How does Inmode make money?

Platform and consumables

Inmode sells its products directly to physicians or trained medical professionals like plastic surgeons, dermatologists, gynecologists, and dentists.

Dentists? More on that later.

Here’s an overview from their latest investor presentation which displays the number of physicians in the US:

They actively seek to develop new products to enter into new markets. Here’s their current line-up of products (the newest evoke platform for ocular treatment isn’t included).

Here’s an overview of how revenue has evolved based on the 3 platform categories:

It’s the minimally invasive platform like the Morpheus that is increasing revenue share in their line-up while the hands-free platform is decreasing.

To be more precise, they sell platforms and consumables. Consumables are applicators for one-time use. In the annual report, consumables also include extended warranties.

So there is an important difference to notice, a one-time sale of a platform and a recurring revenue from the consumables.

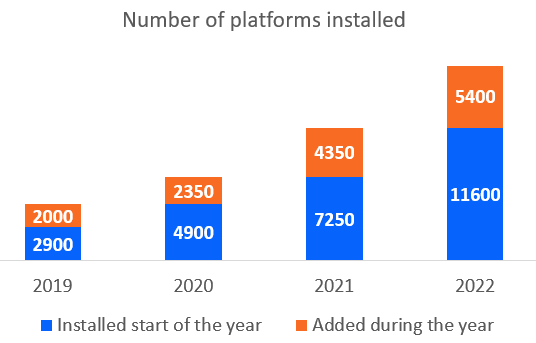

Here’s the evolution of the number of platforms sold over the past years:

The number of newly installed platforms doubled in 2021 and is increasing. A physician pays directly or finances the investment. Usually, it’s a 5-year lease which also gives us an idea about the platform’s lifetime. In one of the latest earnings calls management stated that their support service allows for software and minor upgrades, but after 5 years a physician is better off buying the newest technology. Inmode releases about 2 platforms each year.

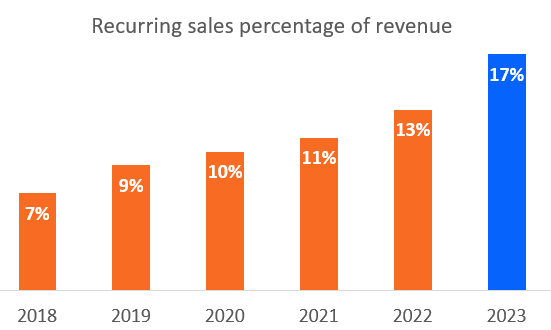

The following figure shows the evolution of the consumables sold or recurring revenue as a percentage of the total revenue:

The recurring revenue is not like a subscription-based model, but it does signal how much the platforms are being used. This recurring revenue lags behind the installed base, so the increase in 2022 and 2023 is due to the big increase in installed platforms in 2021 and 2022. This increase in recurring revenue strengthens Inmode’s business model.

Here’s a look at the absolute amount of consumables sold:

It gives us an idea about the number of procedures being done each year. Because more and more consumables are purchased after the platform is installed, if we divide the number of consumables sold during a year by the number of installed platforms at the start of the year, we get some sort of utilization rate of the platforms.

We could conclude that more and more platforms are sold, and from 2019 to 2021, the number of consumables increased rapidly, but the utilization rate is now stable. Of course, this is a crude estimate because consumables are also sold at the moment the platform is sold and we do not take into account an increase in consumables spending month by month.

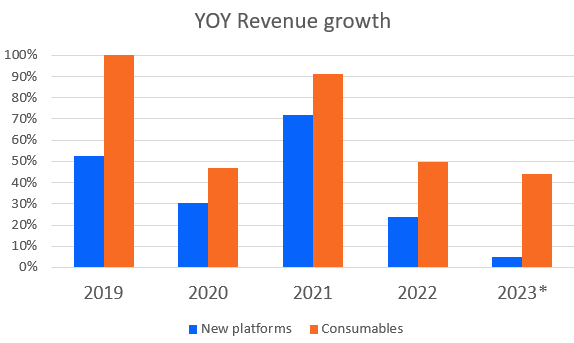

To conclude, let’s look at the growth rate for revenue by platforms installed and revenue from consumables:

The numbers for 2023 have been adapted for the latest guidance. Revenue growth is slowing down from the new platforms but slowing down a lot less for the consumables. Rising interest rates and the slowdown in the economy will have an impact on new platforms sold, but the consumables act as a certain cushion to prevent a complete stop of the overall growth.

The conclusion is that we also see a slowdown which signals that the number of procedures performed per platform might be saturating. Why this occurs is more important. Is it because there isn’t sufficient demand or is it because demand is there and physicians need to expand and buy more platforms?

Management believes it’s the latter.

Finally, when looking at all the revenues:

Because we know the platform revenue and we know the number of newly installed platforms, on average, one platform sells for about 70,000 USD. Prices will of course vary by type of platform and by the sales region. Reports on the internet in the US talk about 100,000 to 150,000 USD for a full option platform sale.

Business model

Inmode outsources most of the manufacturing. Parts and unfinished products arrive at their plant for final assembly and quality control before shipping to the customer. Inmode has long-term contracts with their supplier/manufacturers Medinor, Flex and Resonetics:

All three companies are located in the North of Israel close to one another within a 30-minute drive.

They have their own sales representatives and sales teams for most countries but not all. Some countries are served by a third party. Here’s what it looks like

In total, they sell to 92 countries. The focus of direct sales is not to increase sales volume but to capture more margin and to get direct feedback from physicians.

Inmode’s business is not cyclical in the traditional sense but it is seasonal with usually strong quarters before the summer and at the end of the year. Their strongest quarter is at the end of the year, because physicians usually start their fiscal year in January, and more purchases are made at the end of the year before starting the new fiscal year. Current rising rates and economic slowdown will slow down growth.

Past performance

Inmode’s past performance has been stellar. Here are the annual growth rates for different financial criteria:

The company has grown all metrics rapidly over the last 5 years, but growth is slowing down. The reason for the perceived no growth in earnings and cash flows in 2022 is due to taxes. From 2012 until 2022, Inmode was exempt from certain income taxes. In 2022, they had to perform a one-time payment covering the last 10 years. This amounted to an additional cash outflow of 26.3 million USD which impacted the bottom line. Based on Q2 of 2023 management guidance for the coming fiscal year, revenue should grow by about 19% and EPS by about 17%. In the future, they will be taxed at about a rate of 7.5 to 10%.

The above table also shows the close growth rate between earnings and cash flows. Inmode has very high-quality earnings. Their gross margin is high at about 84% and stable throughout the years.

Inmode has a strong balance sheet with no debt and sits on a big pile of cash of 629M USD (latest Q2 2023 numbers). This cash was generated from a growing free cash flow stream year by year. Operational cash flow is very close to free cash flow as Inmode spends almost nothing on CAPEX. They invest about 3% of revenue in R&D each year.

In what market are they playing?

Market size

Here’s what certain research agencies have published regarding market outlooks.

The global aesthetic device market was valued at 17 billion USD in 2021 to reach 44 billion in 2029 (13% CAGR)

The global radiofrequency aesthetic device market was valued at 1.3 billion USD in 2022 to reach 3.7 billion in 2031 (12% CAGR)

Inmode had 454 million USD in sales in 2022, and their most popular product is their radiofrequency morpheus platform. We do not have any information on sales by platform, so it’s difficult to estimate the size of the market they are occupying. Based on their total sales number in 2021 and taking into account the entire global aesthetic market, they would have had a market share of 2.7%.

My conclusion for all of this is, it is a growing market. Despite competition, the total pie will grow in the future. How much? Hard to say, I wouldn’t focus too much on the CAGR rates that are published.

The recent popularity of weight loss drugs such as Ozempic or Wegovy has also been beneficial for companies like Inmode as quick weight loss leads to loose skin, which an Inmode platform can solve.

The main players

This market is very fragmented with a lot of players. The more we dive deeper, the more players come up. Here’s an overview of the most important ones and a performance comparison with Inmode.

Notice that Inmode is one of the newer companies. When it was founded in 2008, it was a new entrant into a fragmented market with several incumbents from the 1990s. Some of these companies are public, most are private (we only showed the bigger players who are private). When the P/E ratio indicates N/A, it means it is not turning a profit. For a private company, we do not have the data.

What stands out is that in 15 years, Inmode has grown to be one of the biggest players in the industry. It is by far the most profitable company in the space, it has the highest gross margins and in the past 3 years can show the highest sales CAGR.

Based on pricing multiples compared to others, it seems cheap, but looking at the underlying financial drivers, we’re comparing apples to oranges.

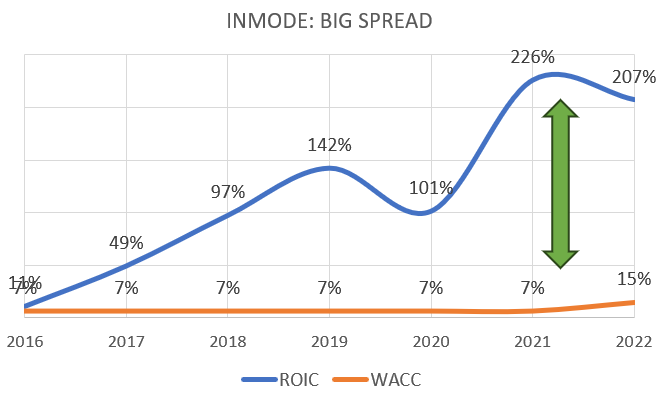

Finally, let’s take a look at the amount of value created in the market. We do this by comparing past return on invested capital and 5-year rolling return on incremental invested capital:

Half of the companies on the list are not profitable. The other half has returned above the cost of capital, like Endymed, Ya-Man, and Lutronic. But Inmode hovers far above all of them…

When looking at the 5-year rolling ROIIC:

Again, Inmode soars above the other players. We must be aware, that although this sample shows Inmode’s dominance, it is still but a sample. And as always, past performance may not help us that much in forecasting the future.

Here’s a distribution based on the medical devices industry:

In other words, for the entire industry, based on ROIC, Inmode is with the best in class.

As Mauboussin says, there are great businesses in value-destroying industries and bad businesses in value-creating industries.

Overall, this industry sits in the middle, with a bit more overall value destruction. Inmode is the outlier within the industry.

When doing the MOAT analysis, we’ll turn back to some of Inmode’s competitors.

How have they allocated capital?

Let’s first look at where we think the company is in its business life cycle.

It has taken Inmode 15 years from startup to where they are now, which is in the mature growth stage. We’ve seen high growth in the past, but growth is slowing down, Inmode still has high earnings. What’s special about the company however is it managed to generate free cash flow fairly quickly in their life cycle. The tricky part is of course to forecast what the future looks like.

Mature growth is about increasing revenue and increasing market share. The business is still on the offensive. The mature stable stage is more about defensive positioning. How to defend to stretch the mature stable stage as long as possible.

To get a better sense of how long this mature phase could be, we’ll need to take a look at

Growth in the overall market (which seems OK)

The magnitude of the competitive advantages (MOAT)

The sustainability of these competitive advantages (MOAT)

We’ll go deeper into these later on. Let’s go through our capital allocation checklist.

All revenue growth has been organic. There have been no acquisitions in the past (except for the IP they acquired). Cash has been building up thanks to good business performance. There aren’t a lot of opportunities to reinvest.

Let’s first check if Inmode passes the Buffet one-dollar test and what kind of reinvestment rate they can achieve:

It passes the one-dollar test with flying colors. Their ROIC is high because the business is asset-light. They do not need a lot of invested capital and because they earn good returns, ROIC is high. Value is created. The cost of capital is the cost of equity because of the absence of debt.

A quick comparison to Cutera, a competitor:

Which has destroyed a lot of value over the last years.

How has the reinvestment rate for Inmode evolved over the years?:

Although ROIC has been high in the past, their reinvestment rate is slowing down. This shows again that they do not have or do not see sufficient opportunities to continue to reinvest their capital (which is apparent by the increasing cash pile). You want a business that has a high spread and high reinvestment rates so that it can keep compounding.

The company does not pay any dividends and only did buybacks in 2021 and 2022. However, the amount of buybacks was limited, enough to offset dilution created by their employee incentive plans.

In the annual report of 2022, it is stated that the board had acknowledged a share buyback program for 3 million shares.

At the drafting of the annual report, they had bought back a total of 2.5 million shares at an average price of 37.2 dollars.

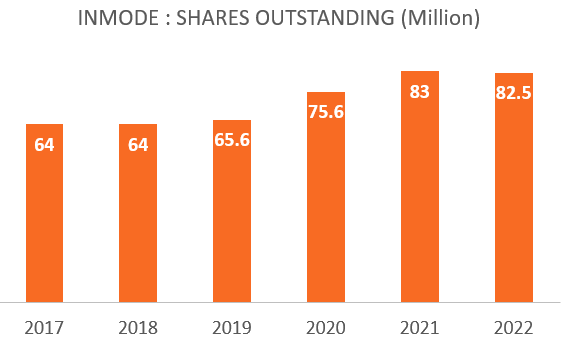

Here’s a view of the total number of shares outstanding:

This means in 2022, the net buyback percentage was 0.5% Which of course in some ways is a good sign because it shows a turning point, but on the other hand, if they plan to buy back 0.5% every year, it is better than nothing, but it won’t move the needle.

Management has stated several times during earning calls that they are actively looking for acquisition targets. They specifically mention that acquisition has to be accretive, meaning it needs to strengthen the overall business. This is of course very good, but on the other hand, because gross margins are so high for Inmode (the highest in the industry), it will be a challenge to find a business that strengthens Inmode.

Conclusion when looking at capital allocation.

The only way to provide more value per share moving forward is:

Start buying back shares now that price per share is low

Do acquisitions, but we do not see this happening because Inmode is very profitable, and acquisitions could lead to fewer profits (except for acquisitions of IP and patents)

Reinvest in growth, but this is difficult as they have a very asset-light business and do not need more investing in R&D. Growth comes from the marketing and sales, although these are not considered as CAPEX spending, we believe this is where their focus needs to be.

They could also decide to pay dividends, but I’m personally not a fan of cash payouts.

Does Inmode have a MOAT?

Every company has a competitive life cycle. Due to competition, the return on invested capital will decrease, and in the end, the company will earn the cost of capital. Here’s where we think Inmode is in its competitive life cycle:

It has passed the high innovation period and sits somewhere at the beginning of fading returns. The big question is of course, when and for how long do we think returns will start to fade? We discuss this in the chapter on risk analysis and valuation.

When we split ROIC into NOPAT/SALES and SALES/INVESTED CAPITAL for Inmode we get this:

Which when plotting the values on this simple competitive advantages diagram leaves us with the following:

So both consumer and production advantages may apply. Let’s see.

Production advantages

Complexity: Inmode invests about 3% of revenue each year in R&D. There is some complexity involved, in the production of their platforms and handpieces. Inmode develops the technical specifications and does the final assembly and quality control. Most of the manufacturing is outsourced. Their most important technological development was the RFAL or radio-frequency assisted liposuction (implemented in their Tite platforms) with additional microneedling (Morpheus handpieces). Here’s a short overview of what it looks like:

Protection: Inmode has several patents filed to protect its IP. In particular their radio-frequency technology. They have issued several patents over the years:

Distribution: In total, they serve 92 countries. They will try to sell directly if possible to get more margin and feedback from the customer. Otherwise, they work with 3rd party distributors

Purchasing scale: Because of their high growth, they have achieved more scale, but based on the frameworks and turn-key production they have signed at a fixed cost with their suppliers, it’s not clear if the scale is a benefit since this isn’t a mass production product.

Marketing: Inmode uses a multimodal approach from billboards to social media and influencers like Kim Kardashian and Eva Longoria. They will look at what works best and double down on it when they launch a new product.

Conclusion: What does Inmode do differently than its competitors? Other players as Cutera, Apyx Medical, etc, also spend on R&D, file patents, and use influencers as marketing. The 2 main domains where Inmode is more dominant and different are:

Manufacturing: Inmode has the highest gross margin in the industry. They manage to significantly reduce their cost of goods sold when compared to the others. The outsourcing of manufacturing to a reliable partner makes a big difference. Can others copy this? For incumbents, this would not be that easy, as you need to find a good partner and would have to modify your entire internal structure.

Distribution: Inmode has succeeded in surpassing certain competitors regarding distribution. They now serve 92 countries versus 83 for their closest competitor (Cutera). Almost half of their workforce are sales reps. This is not to be underestimated. Each new launch needs to go through clinical trials, and regulatory approvals (FDA) before finally the sale can begin to the customer.

Let’s look at the cost structure when comparing Inmode and Cutera to get a better view of the differences:

You can see there is a big difference in the cost structure. R&D and G&A for Inmode are much smaller than Cutera’s. Cutera is trying to ramp up its sales and marketing but in absolute value is lagging behind Inmode.

Solta Medical was a company that achieved the second-highest gross margins of more than 70% but is now part of the Bausch Health group. The press states that it continues to be deleveraged inside the group structure. I would have liked to have added them to the comparison, but the data is not publicly available.

Consumer advantages

Switching costs: When a physician invests between 70,000 and 150,000 dollars in a platform, he will not change in the next years. A typical lease contract being 5 years, you can consider a 5-year lock-in. But once the period comes to an end, there will be fierce competition and a physician can pick from several players. I therefore do not consider this a competitive advantage

Network effect: Non-existent

Conclusion

I think Inmode has a narrow MOAT, meaning there is a sustainable competitive advantage, that may last for a decade, but not longer. It will be very difficult for others to reach the gross margins that Inmode generates. Inmode has wisely invested heavily on the sales front when compared to competitors. If they want to keep the lead, they will have to continue these investments and if it makes sense, go more and more direct to capture more dollars.

On the product side, despite patents, R&D, etc, the product they sell is not like Tesla. It does not sell itself. They are not a product leader (in fact every player in this industry claims it has the best product). Inmode excels in operational excellence and marketing & sales. That’s where their strength lies.

The end consumer, the patient, does not care about the technology that is used. They care about the result. This result is the combination of a product and the skill of the person using that product. Every player in the field will claim they have the best devices. A physician wants 2 things:

Clinical studies that show that the product works

A business case to show them that it will generate revenue and income

I think Inmode excels at the latter.

Incentive structure

Insider ownership

Here’s an overview of how insider ownership has evolved:

As an investor, you of course want to see insider ownership remaining high. The 2 founders sold a lot of their shares in 2021. On the other hand, I also sold my shares at the time.

Why?

Because of the excessive overvaluation of the stock.

The difference of course is, that we are investors and not founders. When a founder sells because he believes the price is higher than what his own company is worth, if he truly believes for the long term, then he has to buy back shares when prices are below intrinsic value (or just do nothing).

Although it seems that their ownership percentage did increase a little in 2022, I haven’t found any statements of additional buybacks.

On the other hand, there’s a notice on EDGAR that Mr. Kreindel (CTO), on the 31st of July 2023 has sold an additional 150,000 shares. Now we must put this into perspective, this equates to 0.04% of the shares he owns. But he sells 2 months prior to a reduced forward outlook guidance. Honestly, I’m going to ignore this information.

Employee Incentive Plan

In 2018, Inmode introduced an employee incentive plan that rewards employees with options and RSUs.

The annual report of 2022 states there are 7.5 million unissued shares and that every year, the number of shares available for distribution increases by about 800,000 (it’s validated during the general shareholder’s meeting).

I do not have a problem with this per se because this also means if the company is doing well, the employees will do well.

The question is, how are these shares offered? What are the goals or KPIs used? I haven’t been able to find any specific information on this. I do not think it is value per share, because if it was, management’s capital allocation decisions would have been different in the past. This will be included in my list of questions for investor relations. I’ll update this analysis accordingly.

Work Culture

I haven’t found any information specifically related to how the company is structured.

When looking at Glassdoor reviews, there are only 89 of them. This is the result:

Glassdoor uses several criteria, but they all trend the same:

When reading the reviews, it is mostly focused on the sales reps. They talk about making good money, but it is a grind. Long days, long hours. This is not for everyone.

My take on this is they have invested and are pressurizing sales heavily. Their product is not like Tesla's, it does not sell itself. There is a lot of competition. A strong sales team is needed to get results.

Sites like Glassdoor are useful, but only if you compare them to other competitors to see what the entire industry is like.

Here’s the overview of competitor Cutera:

Which if you read the reviews is very similar.

And here’s Lutronic (A Korean competitor)

Lutronic sets a different tone than its competitors. But in the reviews, several people mention, “copycat devices” or “late to the market”. In other words, it’s a great place to work, but those who like working there, say that the company is not executing as it should.

And the last one: BLT Industries, which is privately owned, so we cannot invest in it, but because of its size, its worth taking a look:

The overall trend is much better however, in the reviews you’ll have the same comments about no work/life balance, lots of pressure on the sales teams, etc…

General conclusion:

The entire industry is very competitive with lots of pressure on the sales teams. They have difficulty creating products that stand out.

Market expectations

How is the market pricing Inmode at the moment?

We use an inverse DCF to get an idea about what the current price means. Here are the different inputs used:

A base year 1 free cash flow of 180M USD (= 2022)

The cost of capital = cost of equity = the discount rate = 10%

The exit multiple in a mature market equals the commodity multiple. Since earnings and cash are close for Inmode, we assume a P/FCF commodity exit multiple of 10

Inmode currently is trading at about 22 dollars which is about 1.24 billion dollars in enterprise value because of their cash pile.

To arrive at a valuation of 1.24 billion dollars, would mean a declining-growth scenario for Inmode. In other words, it means the market expects FCF to decline at a rate of 7% for the next decade.

In the model, 30% of the pricing comes from the terminal value, and 70% from the future cash flows before the exit. You can download the Excel here.

What does a no-growth scenario mean?

To generate 180 million FCF in 2022, Inmode has sold 5400 new platforms. A no-growth scenario means Inmode needs to sell 54,000 platforms in the next 10 years. In reality, the number is less, because the more the installed base increases, the more revenue can be attributed to consumables.

If we look at the US, the US accounts for 66% of current revenues or about 11,000 platforms installed. At the moment, they have focused on plastic surgeons and aesthetic medical professionals. According to their presentation, there are about 17,000 of them in the US. This would mean that on the aesthetic side, there already is a certain amount of saturation in that market (bearing in mind that some physicians with clinics buy more than one platform). Their strategy to expand towards other medical disciplines seems logical to avoid this saturation. Of course, there is recycling going on, every 5 years they will try to sell their latest upgraded technology to the same physicians.

The market knows that growth is slowing and expects it to slow even further.

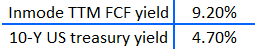

In the case of a no-growth scenario, we can compare Inmode’s FCF yield to the US 10-year treasury yield.

What are the analysts saying?

Most analysts are putting out a buy rating:

Data from 13/10/2023, but may change based on the latest Q3 2023 guidance

The average consensus price is 54 USD which would mean an almost 100% upside from current levels. (but analysts will now review their models based on the latest guidance from management)

Based on the previous pricing in the market, what are the analysts predicting for future growth if we keep the same input variables?

The consensus is a 20% revenue growth in 2024 and a 10% growth in 2025. (or if you use the model I explained earlier, a 10% FCF growth rate for the coming 10 years).

Risk analysis and valuation: Is Inmode a multi-bagger?

In this risk analysis, we are looking for asymmetry. These can be determined by looking at the extremes:

worst case scenarios

a downside scenario (downside risk)

the theoretical best upside scenario (how big is the upside potential?)

This is necessary before we would decide to place any bets in the market.

Worst case scenario

I see 2 worst-case scenarios:

Several stories of disfigurement after treatment using Inmode’s platforms could lead to reputational and irreversible damage to the company. It is important management does not overextend its pressure on marketing and sales. They should only sell to physicians with the necessary skills

The current conflict in Israel leads to an all-out war with neighboring countries with a total loss of production capabilities (sales are mostly located around the world). I think the probability of this happening is low (nobody benefits) although it has increased since the start of the recent conflict.

Downside scenario

The downside scenario that we would consider is that Inmode’s growth decreases and in 3 years completely comes to a halt. From then on, a decline in revenue sets in for the coming years. Because Inmode’s gross margin has been stable throughout its growth phase, we consider that despite the decline in sales, the gross margin will be maintained as they can scale down COGS with scaled-down production but the operating profit will reduce as the company will try to compensate for this decline by increased investing in marketing and sales, but to no avail.

Parameters considered:

Decline as of 2024 of revenue by 5% each year

Net income has been 33% percent of revenue and will decrease to 25%

In 2033 Inmode would have a revenue of 527M USD and net income of 130M with their outstanding shares the same as now AND a Commodity P/E multiple of 10.

This is worse than what the market is currently pricing.

This would mean a 50% decline from the current situation over the next decade.

Note: Since the 20% drop in price on 12/10/2023, market expectations are now even below this downside scenario, which means the current downside risk has been reduced.

Value trap?

Inmode could be a value trap. If management keeps piling up the cash, and growth keeps slowing down, it could become a stock that will trade sideways for numerous years.

Upside scenario

Can Inmode one day sell 100 times what they are selling now?

Their projected revenue for 2023 is 530M USD. This would mean a revenue of 53B USD. At a 20% CAGR (their current growth rate) they would achieve this revenue amount 25 years from now. If we assume the global aesthetic market from 2029 keeps growing but at a lower pace (consider 7%), the market in 25 years would be 159B USD. Inmode would then own 33% of the entire market.

This is not possible. Inmode will never sell 100x of what it is selling now.

Can Inmode one day sell 10 times what they are selling now?

This would mean a 5.3B USD in annual revenue. They would reach it in 13 years and have a 7.5% market share of the global aesthetics market. (they currently hold 2.2%) This seems possible, but is it feasible?

For simplicity, let us take 70,000 USD per platform with a 3% inflation rate for the coming 13 years. We’ll take an increase in consumable consumption from 16% now up to 30% and stable from then on. How many platforms will Inmode need to sell?

Over the course of 13 years, they would need to sell 260,000 platforms, which equates to about 20,000 each year. Up until now, they have sold 17,000 platforms. Management has stated that they see ‘a few 100,000 platforms’ as a long-term possibility in the market.

This seems not feasible based on the current analysis. I think the upper limit is 4 to 5X based on the needed EPS growth rate and P/E multiple. If the P/E multiple increases to 15 and EPS growth is stable at a 15% CAGR.

Conclusion

Can Inmode be a 100-bagger? No

Can Inmode be a 10-bagger? No

Can Inmode be a 4 or 5-bagger? Possibly

I consider Inmode to be an asymmetric bet, where the downside risk has been reduced by the current price drop and the upside potential is still available.

What do the customers say?

When you dig around on the internet, you’ll find some bad stories. But my gut says that these are isolated cases.

Why?

Because there are more than 20,000 platforms in the world right now, if there were serious problems with these, these stories would not be so isolated. In addition, you find bad stories for competitors too.

There is one dermatologist who has a popular YouTube channel (Dr. Dray). She has a video where she talks about RF minimally invasive treatment and in particular the Morpheus8.

Her conclusion is the following: The device in itself works. But more importantly, the person who is using the device, the MD or aesthetic medical professional, that person is key to the end result. There are several settings on the platform you need to adjust and these settings are different from patient to patient and problem to problem. Her opinion is that a skilled person will be able to get results with the Morpheus platform.

Here’s where the aforementioned dentists come in. There are reports of aggressive sales tactics of Inmode salespersons who sell their devices to dentists. After all, the value proposition for the customer is they have a platform that they can use to generate more revenue for their own business. I cannot confirm whether this is true or not. And I do not mean to disrespect dentists. But if you are looking for a beauty treatment to tighten your skin or remove hair, are you going to go see a dentist?

I think not. Moving on.

I’ve read several testimonies of customers. There is a website called Realself where people can post reviews. Here are some scores for the Inmode device:

What is interesting is not necessarily the reviews on themselves. Most reviews are in the 60-70% neighborhood. What pops out is the number of reviews. When looking at certain devices from competitors like Cutera, the number of reviews is much lower. This means Morpheus and Bodytite platforms are more popular. This may be through the use of popular influencers to market their brand, like Kim Kardashian, Eva Longoria,...

Impact of the current conflict?

Does the current war in Israel influence Inmode’s business? I believe the impact should be minimal.

Inmode released a short statement on the 9th of October that there will be no production disruptions expected from the conflict.

Production facilities are located in the north of Israel, and reports say that for the moment there is no unrest in the north. They claim they have enough stock for the next 3 quarters.

If the situation becomes more dire, I don’t think that shipping products out of the country will be a problem

Most of their business is conducted in USD. A short-time drop in Valuta exchanges will not play a major role in their business

Inmode’s next quarterly earnings call is scheduled for the 26th of October. We’ll see if they can provide additional information and I’ll post an update to inform you all.

Summary

The good

Vanity is a basic need. It has been present throughout history. It will not go away in the future.

Inmode has seen high growth in the past, but growth is slowing down. Revenue will grow 20% year over year in 2023

Inmode has a simple business model and it is strengthening by an increasing part of its revenue coming from consumable sales (recurring revenue)

They are competing in a growing market and are by far the most profitable company we’ve found

Inmode has a narrow MOAT, meaning it has a competitive advantage for the next decade, but not beyond. This advantage stems from outsourcing production and highly skilled sales teams.

The market is pricing in a declining growth scenario, meaning the market considers free cash flow to decrease by 7% for the next decade

It’s boring, but in a good way. When you read through past annual reports, earnings calls, etc. the numbers change, but all the rest is always the same, like a metronome.

There is an asymmetry here. A probability of a 50% loss versus a potential 4x upside. But this potential upside is heavily related to the following paragraph. The probability feels more likely towards the upside.

The latest price drop on 12/10/2023 has reduced the downside risk and seems an overreaction of the market

The bad

They haven’t been particularly shareholder-friendly up until now. Buybacks have been performed in 2021 and 2022 but they have only managed to offset the share-based compensation plan

Management has significantly reduced insider ownership during 2021

The company ‘seems’ cheap, but with growth slowing down and rates going up, it’s normal that multiples have contracted. If management cannot create value per share in the future, the stock could become a value trap.

The Ugly

The ugly? This is a beauty devices company! No, we haven’t noticed any big red flags.

Possible catalysts

Management is actively looking for acquisition, but because of Inmode's high gross margin, it will be difficult to find accretive targets. Even in a no-growth scenario, their cash position will reach 1 billion USD in a couple of years. An important buyback program can serve as a catalyst

Management buying back into the company at current prices would be a strong signal of confidence in the long-term future of the company

The increase in the use of Ozempic and related drugs can actually be a tailwind for Inmode (and it’s competitor’s)

Although the company does not provide numbers, more than 90% of revenue comes from aesthetic platforms. Growth in their new markets: womens-wellness and ocular treatment platforms can help sustain overall growth

General overview looking at the 100x checklist:

Looking at the checklist overview, our bet is that the market is overreacting AND management improves capital allocation.

This is not a wonderful company at a fair price. It lacks a wide MOAT and stellar capital allocation strategy.

This is a good company at a cheap price. It is very profitable, a future slowdown will occur, but not as much as the market is pricing in right now.

Disclosure: I have taken a small position and will track fundamental performance for the coming 5 years. I’ve added to that position because of the 20% drop in price yesterday. This is not a company to forget and never sell. Management decisions and performance need to be tracked in order to see if our thesis holds. If catalysts are not shown in the following years, it might be a reason to sell. How I track and what my exit strategy is will be published after the next earnings call on November 2nd.

Thanks for reading this analysis, and as always,

May the market be with you