Before we start off this update, I’m working on a ranking system which should allow me to rank all my positions in my portfolio. By example, If you have 10 positions, the goal is to rank them from 1 to 10. If a better opportunity should come up with a higher rank, theoretically, number 10 should be switched out.

Do you use some sort of ranking system and if yes, how do you proceed?

This week we had the earnings calls for several companies. Let’s go through the current development with Adyen. I plan to do multiple updates on other companies discussed in the past in the near future, but because there are only 168 hours in a week, which one would you prefer the most?

If you want me to provide an update on another company, please leave a comment:

What is happening at Adyen?

If you haven’t read our destination analysis, you can find it here:

Prior to November 2023, based on the past performance of the business, the quality of the leadership, and the business as a whole, we figured the market was overreacting in the short term and figured the dip was a great buying opportunity to get into a high-quality company.

This fits into our strategy to identify high-quality companies and wait for opportunities to hop in.

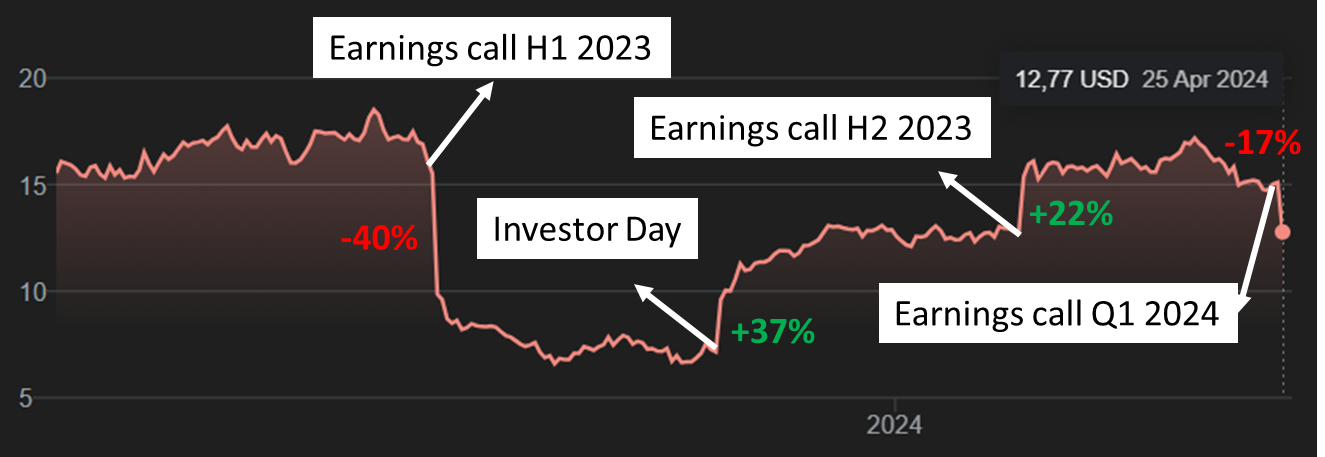

But Adyen’s stocks has experienced a true roller coaster in a short amount of time.

From the H1 2023 earnings call up until the H2 earnings call, only 175 days have passed.

Adyen’s business cannot change much in only 175 days. So the factors that explain such volatile behavior are first, a high price in the market.

Let’s take a look at the historical PE ratio:

These are pretty mind-boggling PE ratios. The lowest PE Adyen had was 34.7.

A pure value investor might get a headache seeing a chart like this.

If we zoom out a little, Adyen has never traded at ‘low’ PEs in the market:

In other words, the dip last year was the lowest PE in Adyen’s trading history!

When a stock is priced that high, small sentiment changes can lead to bigger swings.

Remember that multiple assumptions are embedded in a PE ratio.

Other factors that explain such behavior:

The actual business results(there is still growth but not as massive as before)

Communication which influences perception: Adyen has always been a company that does things differently. Although it went public in 2019, it did not need the funding. It has always been a bit peculiar when it came to communicating with their investor base. This was redeemed during their investor day in 2023 which by the way was in stark contrast to the one Paypal held. Since then they decided to inform investors on a quarterly basis. But these quarterly business updates are pretty scarce on information

For Adyen, since it is a capital-light business, most of the costs are related to staff. An increased staff is an increase in OPEX and hits the bottom line. After slowing down their counter-cyclical hiring spree in 2023, they have added an additional 27 staff to the team, and plan to recruit about 100 people in 2024.

What did we learn from the Q1 earnings call this week?

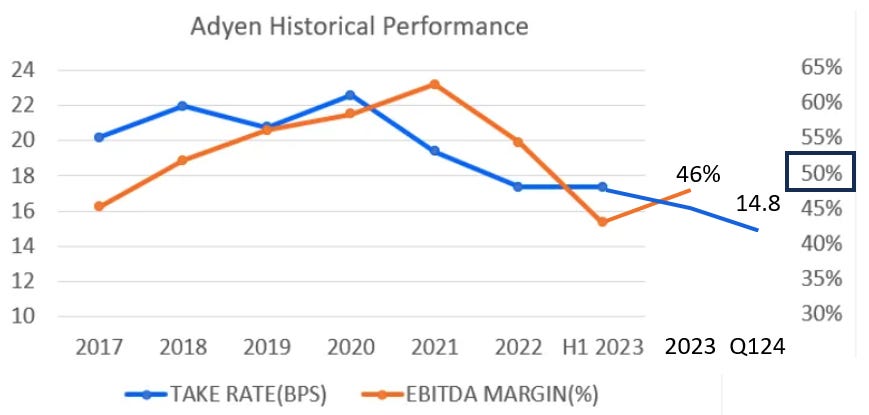

Not that much honestly, but the stock fell by 17% after the update. Let’s look at some previous metrics and update them.

Past growth

On the Total Processed Volume, we can see a strengthening in the second half of 2023 and a big increase in Q1 of 2024. 80% of this comes from their existing base or as they call it their land and expand strategy. You land the customer and the customer, seeing the value that Adyen can offer opens up to let Adyen handle more and more payment volume.

Their net revenue has increased at the lower end of their long-term guidance. During the earnings call, most analysts ask about the take rate or the decline in take rate. Adyen responds that they do not manage their contracts based on a take rate. They have objectives focused on absolute net revenue values and thus they have 2 goals:

Reach a certain absolute value in net revenue

Become more efficient and increase EBITDA margin

Long-term guidance

During the Investor Day, Adyen changed their long-term guidance:

The new long-term guidance has become a medium-term guidance. During the earnings call, they reiterated that medium-term guidance remains unchanged, however, in the short term, guidance will be more towards 20% growth as opposed to 29% for net revenue.

Valuation

In our previous destination analysis, at a price of 10 USD, I considered the price to be fair for a high quality company. At the current price 12.7 USD, since the outlook has not changed, the company is a bit overvalued.

Conclusion

6 months is too short to assess an investment. We’ll need to see what Adyen will do in the coming years.

Adyen seems to be performing as promised as explained during the Investor Day with a higher growth in total processed volume but which does not immediately translate into the same growth in net revenue (take rate decreasing). If the decline in take rate is compensated buy a higher increased in Total Processed Volume, than this is not an immediate problem, however, take rate should be an indication of their pricing strategy.

Adyen explained that an increase in volume for certain customers is accompanied by a decrease in fee structure which explains the decline in take rate. We’ll need to keep tracking this. The major risk for a company like Adyen in a highly competitive payments market is their product or offering becoming a commodity. Once that happens, for the customers, price is all that matters and a race to the bottom will have started.

I do not believe this is the case at this time. I will hold my position and will not add nor trim or sell.

A ranked list of stocks is a great idea. Not many writers would have the courage to do that.

D'Iteren