A strange thing happened.

While researching the E for Endurance in our S.P.E.C.I.A.L. ranking system, I tried to find the questions or checklist I would build to measure how a company could stand the test of time.

I stumbled upon this video which shows an interview with Jensen Huang, the CEO of Nvidia.

The ability to stand back up in the face of adversity, to build resilience, is a great lesson. It’s exactly what I’m looking for as a trait in a company.

Nothing lasts forever.

Even the oldest company in the world, Kongo Gumi, a Japanese construction company, established in 578 A.D. (no, there is no 1 missing at the beginning) was acquired in 2006. For 1400 years, they specialized in building Buddhist temples.

In 2026, Apple will turn 50. Will it reach 100? I have no idea. The consumer tech business is much more disruptive than the temple building industry.

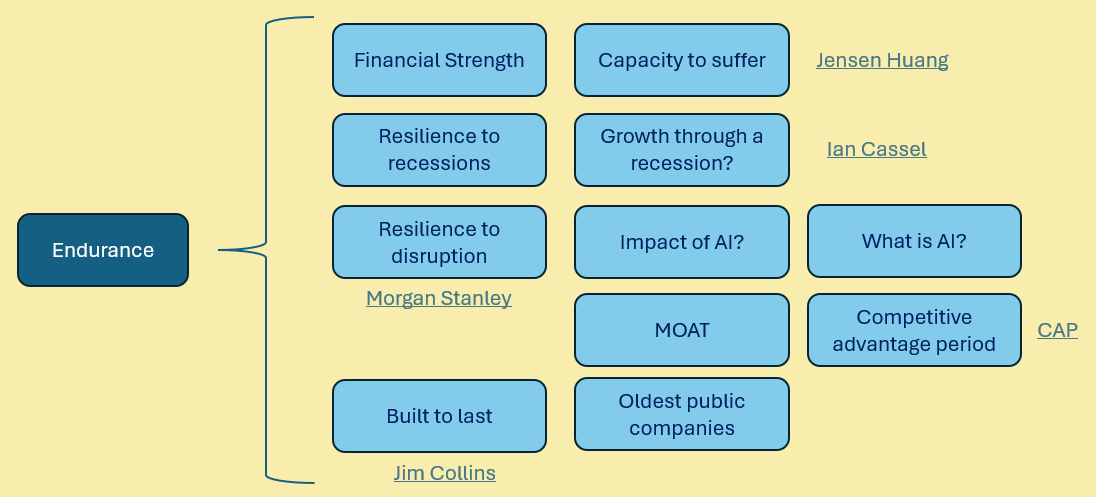

Here’s what our mind map on company endurance looks like:

We can distinguish 5 major sources of endurance:

Financial strength is a no-brainer to add to the checklist

Resilience and growth through a recession go one step further

The impact of disruption, in particular in the age of AI might be worth pondering over

Endurance is linked to competitive strengths, MOATS, and competitive advantage periods

And lastly, we have Built To Last by Jim Collins where we might find some important lessons

Let’s build the checklist and look at some companies along the way.

Financial Strength

This is the easiest part of the checklist.

If a company has a war chest in cash, strong cash flows, and low debt, it should have some capacity to suffer.

That’s exactly what’s happening with a company like Inmode. No debt, half of their market cap in cash. Net profit margins above 30%. High free cash flow to earnings ratio.

BUT.

Growth is slowing down, a bad history of capital allocation, and the market is punishing the company for it. Time will tell how this will play out. You can find our deep dive through the link below.

Even if the company plows through this downturn, you as an investor also need the capacity to suffer. But that’s food for another article.

To be more precise, here are the 5 questions we’ve added to the Endurance checklist. Some are similar to the Buffett checklist we previously discussed.

Is the Debt to Equity ratio below 30%?

Are current assets 1.5 times current liabilities?

Is cash on the balance sheet increasing over time?

Is Total Debt less than 3 times operating cash flow?

Is Total Debt less than 10 times the free cash flow?

What would you add or remove when looking at the financials?

Inmode passes all these, and so do Connexion Mobility and Adyen.

What can I say?

I like companies with low debt levels.

Resilience

Resilience is a lot harder to quantify. It’s the ability to get back up after a setback. They say you can only really know a company has a MOAT if it has been attacked and if its defenses have been tested.

In this great podcast on the traits of multi-baggers, Ian Cassel talks about a company being able to grow through a recession. It does not mean the company will not take a hit, but it does mean that growth continues (even if it's at a lower clip). So we’ve added the following question to the checklist:

Is the business defensive and independent of market conditions, can it grow through a recession?

When we go back to Inmode, it is currently undergoing a recession in the medical devices market. Their competitors also decline in growth. Only in the local Korean and Asian market growth continues at a great pace.

Will Inmode shows resilience? We’ll have to wait and see. Growth has stalled so currently it does not pass this question.

Disruption

Even if an industry as a whole is doing great, a company can be disrupted through innovation. It’s another form of resilience.

Here’s the question for the checklist:

Is the business resilient in the face of new innovations?

Let’s take a look at the buzz surrounding AI, and how it could disrupt our businesses.

I came across a report by Morgan Stanley where they assessed their portfolio to see if AI is a tailwind or headwind looking into the future. It’s an interesting test.

But first, we need to understand what AI is and go beyond the hype.

A short AI IntermezzoThere have been some platform shifts with serious impacts on the nature of the economy and certain sectors and businesses.

The dawn of the Internet with winners like Google Search

The shift to mobile with winners like Apple’s iPhone

From local to the cloud with winners like Amazon’s AWS

Several experts are now claiming we are experiencing the fourth shift, the rise of AI.

In the short term, this has generated several winners, those like Nivida or other companies that service AI data centers. The pick and shovel companies.

Here are some examples of Pick and Shovel companies that appeared in my idea funnel over the last weeks:

Total Site Solutions (TSSI) (source Pernas Research with a write-up on data centers and a great article by

Alarum Technologies (ALAR) - data web scraping and a great analysis by

These have of course all ramped up significantly over the past year. (Note: I haven’t done any work on these companies)

If you’re interested in diving deeper, here’s a great article by

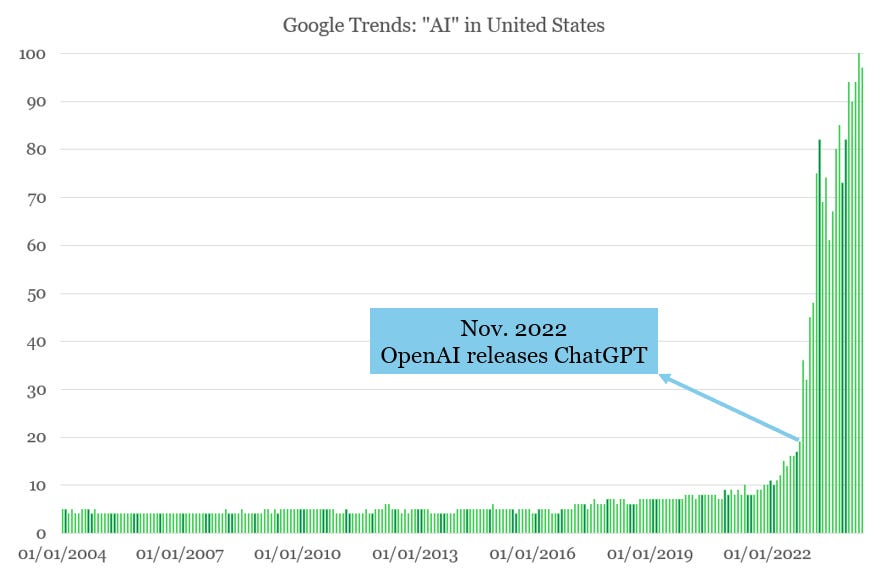

on Capex spending by some of the Mag6 which of course directly benefits Nvidia.Although OpenAI has paved the way for generative AI with ChatGPT, it seems too early to tell if they will be the winner.

ChatGPT is useful for certain tasks, and their direct translation demo brings us 1 step closer to the universal translator used in Star Trek.

But there is no winner yet when it comes to the end-user experience.

The goal here is not to go look for the potential winners or losers. The aim is to see if the companies we own will benefit from AI, could potentially be disrupted by AI, or neither.

Can they endure?

Before we go through the list of companies, let’s deconstruct AI, because it captures a lot of things.

The term Artificial Intelligence dates back to 1955. There are four main topics within the artificial intelligence domain.

Machine Learning

Machine learning goes back to 1949, with the first paper on neural networks. Machine learning is an application that includes algorithms that parse data, learn from that data, and then apply what they’ve learned to make informed decisions. YouTube, X, Spotify, and Facebook all use machine learning to recommend what it thinks is what you’re looking for in your feed.

Natural Language Processing (NLP)

NLP goes back to the early 1900’s when languages were for the first time presented as systems. NLP helps computers understand, interpret, and utilize human languages. It breaks down language into short words, and periods (tokens) and attempts to understand their relationship.

Predictive Analytics

Based on historical data, combining statistical modeling, data mining, and machine learning, predictions can be made for the future. A typical use case is within banks and insurance, where this kind of analysis is used to assess the risk of a person or policy.

Generative AI

The idea is to use AI to generate new content in the form of text, images, or even audio and video. The idea dates back to 1960 when the very first chatbots were introduced.

So this has all been in development for many years, and then this happened:

ChatGPT is the first chatbot that showed the power of generative AI. 2 developments in the AI landscape made this possible:

The transformers

I wish it were transforming robots but alas. Here’s a great description:

Transformers are a type of machine learning that made it possible for researchers to train ever-larger models without having to label all of the data in advance. New models could thus be trained on billions of pages of text, resulting in answers with more depth. In addition, transformers unlocked a new notion called attention that enabled models to track the connections between words across pages, chapters, and books rather than just in individual sentences.

A large language model

I found this great simple explanation on the net:

In simpler terms, an LLM is a computer program that has been fed enough examples to be able to recognize and interpret human language or other types of complex data. Many LLMs are trained on data that has been gathered from the Internet — thousands or millions of gigabytes' worth of text. However, the quality of the samples impacts how well LLMs will learn natural language, so an LLM's programmers may use a more curated data set.

LLMs use a type of machine learning called deep learning in order to understand how characters, words, and sentences function together. Deep learning involves the probabilistic analysis of unstructured data, which eventually enables the deep learning model to recognize distinctions between pieces of content without human intervention.

LLMs are then further trained via tuning: they are fine-tuned or prompt-tuned to the particular task that the programmer wants them to do, such as interpreting questions and generating responses, or translating text from one language to another.

End of AI IntermezzoSo now that we understand AI a little bit better (we only scratched the surface but hey) let’s go back to our endurance checklist.

Will AI make our companies stronger or weaker?

There are 3 possibilities:

AI acts as a tailwind

AI acts as a headwind

Neutral - AI will not drastically propel or dispel your company

How can it be a tailwind?

The company has unique data that it will be able to monetize (think Reddit)

The company uses processes that can be made more efficient in the future with AI (do more with the same workforce). But most likely, competitors in the same industry will also be able to do this, so a company will have to do it as a defensive measure (think software development companies)

The value of the product or service the company is selling will increase by implementing for example generative AI (think Microsoft or Adobe)

How can it be a headwind?

A company’s business model is made obsolete by other companies using new AI developments

A company within your industry has some unique data that allows it to massively improve its offering (a combination of 1 and 3 in the previous discussion)

Startups use generative AI to develop software which will increase existing software vendor's churn

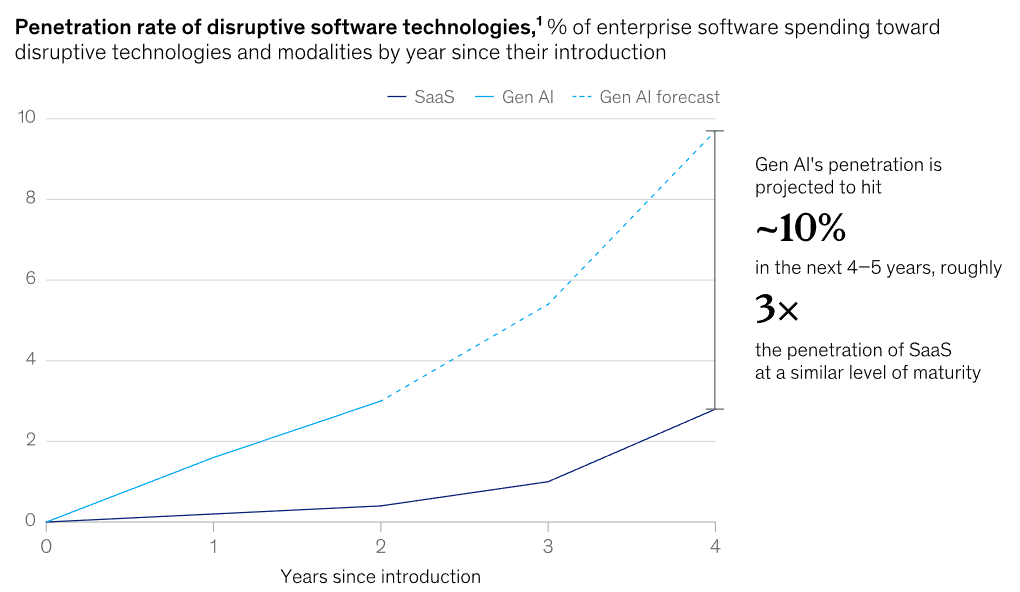

According to Mckinsey, the adoption of generative AI is moving a lot faster compared to the previous switch towards Software as a Service:

Let’s look at some of the companies in our portfolio and see if AI will be a tailwind, a headwind or be pretty neutral.

Will they die through AI?

Dino Polska

Dino is a Polish proximity retailer. Retailers have data on customer behavior which they use for targeted marketing. AI might be used in the future to enhance the processing of this data, but competitors will do the same. Dino at the moment does not have an online presence. They are developing their capabilities in this domain by acquiring an online pharmacy retailer (eZebra).

I believe Dino does not risk disruption from AI nor will it benefit massively from it.

Conclusion: Neutral

Adyen

Adyen is a payment processor and merchant acquiring bank. It uses a vertically integrated tech and software stack to help merchants increase authorization rates and make more money.

In the payments processing industry, different forms of AI can increase efficiency, and increase the service towards the customer. Adyen using a multi-modal payment platform means it can provide data to the merchant independently of how the customer makes a purchase. AI might help the merchant gain more insights into customer behavior.

Conclusion: AI could be a tailwind for Adyen given its unique positioning and the vast amounts of data it provides to its customers. Because they are vertically integrated, the integration of AI could lead to more benefits as opposed to competitors.

TinyBuild

Tinybuild is a decentralized game developer and publisher. They aim to create IPs and develop them into games and other media publications (for example TV series).

Generative AI will impact the gaming industry in the way that games are developed. It will accelerate and facilitate the coding and graphical design. This could be seen as a tailwind for the entire industry. This could also increase competition if it becomes easier to create games and bring them to market. But the current tech still has a long way to go, so this is not an immediate concern. The real value remains in the Intellectual Property.

Conclusion: Neutral

Connexion Mobility

Connexion Mobility develops software for franchised dealerships. They currently provide a software service for loaner vehicles.

As a sidenote, they just completed another 2% buyback of their shares.

Similar to Tinybuild, since they are a software developer, they should be able to develop more with the same amount of developers when AI assistants like Copilot become more powerful. This does not increase the competitive advantage since their competitors can do the same.

Looking at the product or service they are developing, I do not believe current LLMs will increase the user experience.

Long-term, automated vehicles might change how car dealerships do business or might render the current iteration of loaner software obsolete. This is difficult to estimate at this time.

Conclusion: Neutral

So the question for our checklist becomes:

8. Will AI act as a tailwind, headwind, or remain neutral toward the future business prospects of the company?

MOATS

Endurance is linked to the strength of a MOAT. The stronger the MOAT, the longer the company can fend off competition, keep earning returns above the cost of capital, and lengthen its competitive advantage period.

We’re not going to go deeper into this at this time as our SPECIAL system has a specific C for Competitiveness where this is analyzed in detail.

You can however check out our MOAT checklist we developed in the past.

Built to Last

Jim Collins wrote a great book called Built to Last. In this study, he looked for companies that stood the test of time and compared them to certain competitors who didn’t. Here are some of the insights he gained:

Clock building, not time telling: Great organizations don’t tell time, they build clocks. Look for companies that are building something for the future, instead of responding to what the market wants in the short term.

Visionary companies that go beyond profits: There is something higher, a purpose ingrained that goes farther than just making money.

Big Hairy Audacious Goals (BHAG): These are outrageous but clear goals that seem almost impossible but bring about motivation on all levels within the company.

Cultlike cultures: A tight-knit group of people working towards a common goal. They hold a certain ideology and we can even speak about some sort of indoctrination when working there.

Trial and error: Try small things, accept mistakes, repeat. Innovating and doing this differently by creating a culture of risk-taking.

When looking back at all these statements, it seems Tesla fits the bill. Will Tesla endure?

What do you think?

We’re not going to add questions from Built to Last to the Endurance Checklist as they all pertain to management and work culture. We’ll save some of them for the L for Leadership checklist.

Bonus questions

We now have 8 questions in our Endurance checklist and I’d like to add 2 more. Both are inspired by the book: Quality First by Redeye Investment Management (if you’re into quality investing then I can highly recommend this book).

9. Is the business relatively immune to regulatory risk?

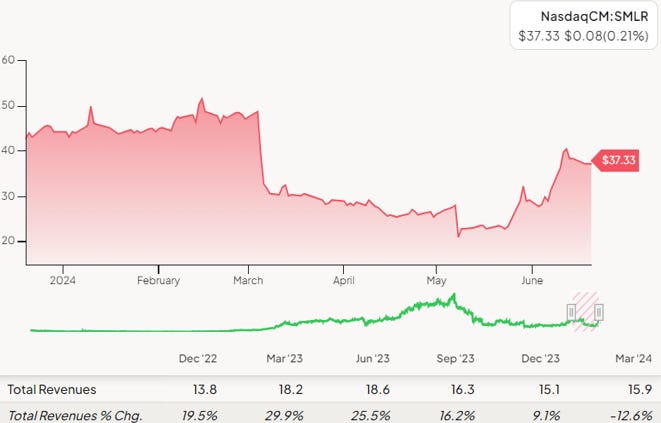

Remember our write-up on Semler Scientific? Semler had incredible past financials. However, a regulatory change in health insurance hit the business hard, and revenue is declining.

It then released a statement it was going to buy Bitcoin, and the stock ripped. It tells you something about the state of the markets.

In the final question we want to look at risk related to single major partners, which if they would change the partnership would significantly damage the business performance.

10. Is the business dependent on any major partners?

Connexion Moblity has 1 customer who is also a major partner: General Motors. So Connexion does not pass this question.

Final Checklist

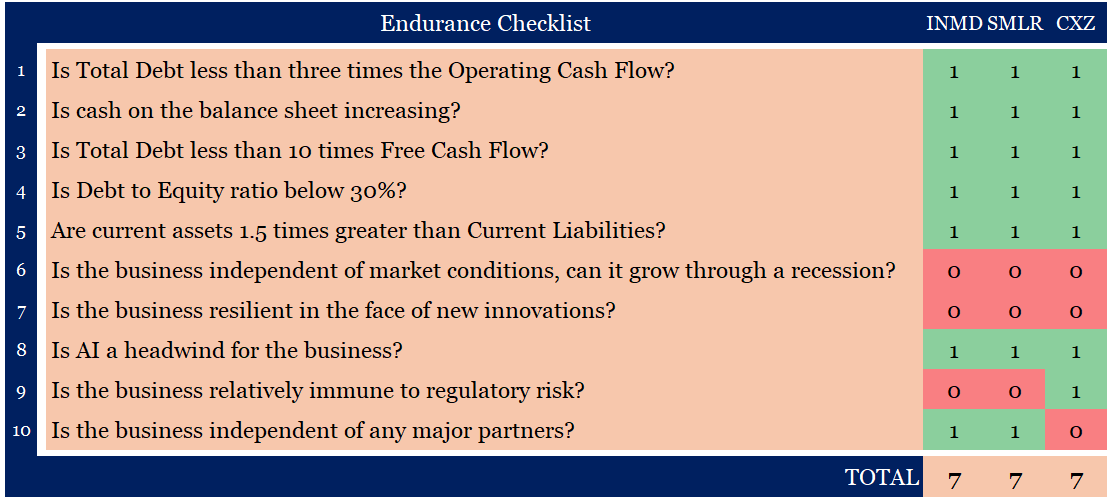

Here’s the final checklist applied to 3 companies we’ve previously discussed:

You can download the checklist below

What about your portfolio?

Do you think your companies will endure?

Will they grow or die by the rise of artificial intelligence?

May the markets be with you, always!

Kevin

Great list of questions Kevin. I would perhaps suggest adding two more dealing with the food chain of the company itself. Customers and suppliers are critical, and they are not static. For instance, a management shakeup in a major competitor might now make that competitor that much more competitive/aggressive. Changes in their systems for product/service offerings might also test resilience. Equally this applies to customers, particularly major customers.

Maybe you have this covered in question 10.

I own 3,500 shares (cost basis $26) of Tesla and am currently reading Security Analysis by Ben Graham/ Dodd. There is just so much about investing that is unknowable. Today we have so much more data, research just a click away. Yet even with this we can't really know the future. I know Tesla doesn't check all the boxes for typical value investors or growth investors either. But Musk is such an unusual character that I can't bet against him. It is like betting against Tom Brady. He is 3 touchdowns behind late in the 3rd quarter, but more often than not he finds a way to win!!! So I will buy more shares should a recession manifest itself. Whatever it is, I can be sure Musk will have an answer for it. This isn't very scientific or rational, but I have to call them as I see them. I read both the biographies on Musk and I can assure you they won't be making many more like him any time soon. He, like Brady, is not money motivated. They both just have to win, and prepare like no one else to do that. I wouldn't bet the farm on Tesla either, but I am confident that they have a long way to go and that volatility will be with the stock for at least another 10 years. Great article.