The ring of power in J.R.R. Tolkien's Lord of the Rings has an inscription on it. It reads the following:

One Ring to rule them all, One Ring to find them, One Ring to bring them all and in the darkness bind them

Kaspi, a fintech business in Kazakhstan, has developed a superapp: Kaspi kz which has been downloaded about 10 million times on Android in a country with 19 million people.

Have they forged the one ring? Can it become the one app in all of Central Asia? Let’s find out.

If you prefer, you can download the 34-page PDF by clicking this button

Who is Kaspi?

Introduction

Kaspi Bank was founded in 2002 as a conventional bank, catering to a mix of corporations and small businesses. At the end of 2006, private equity firm Baring Vostok acquired a majority stake. In 2007, Mikheil Lomtadze became the CEO, completely changing the management team to introduce technology and innovation into the business.

They started hiring people that were tech-savvy and didn’t have banking experience. In a matter of 4 years, the traditional corporate bank shifted to a leading retail bank.

In 2012, Kaspi rolled out its payment business. The e-commerce marketplace followed in 2014. But the real driver for its growth was launched in 2017, their mobile app.

It essentially inverted what Alibaba did in China. From a bank, it went into e-commerce. Although the CEO proudly mentions: “We are not a bank” We are a tech-driven company focused on customer experience.

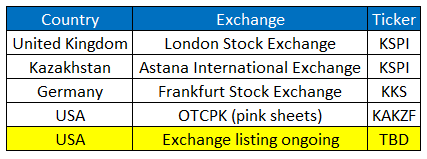

Kaspi KZ, after a failed IPO in 2019, finally went public on the London Stock Exchange in October 2020 at a 6.5 billion dollar price in the market.

You can buy Kaspi on the following exchanges:

It is currently pursuing a ‘proper’ listing in the United States. The latest earnings call stated that the process is moving forward but takes time.

The company is traded currently in the form of Global Depository Receipts (GDR) to list on foreign exchanges. Let’s dive into the business.

How does Kaspi make money?

Where does the revenue come from?

Kaspi can be divided into 3 big business segments:

A payments business

An e-commerce business

A financial services business

The Kaspi super app with 3 business segments

The first 2 are fee-based, where money flows through their system, and Kaspi takes a cut. The last one is a fintech business where they offer services such as wallets and lending.

Kaspi is an asset-light business working together with 3rd party hardware and software companies. It is not completely vertically integrated.

To correlate with other companies you might know, here’s an overview:

Kaspi is gradually moving away from its former bank-only business as can be seen when looking at the percentage of net income by business segment over the past years:

In 2022, only 40% of total net revenue and income came from the Fintech or banking side of the business, and that number will probably decrease looking at the past growth rates:

These CAGRs are massive and show the difference in speed at which the different segments are growing. Payments and Marketplace are now contributing the most to the overall growth of the business. Although not represented in the table, 2020 and the COVID crisis acted as a big accelerator for the overall business and adoption of digital payments.

Overall growth is slowing down but the expected overall growth rate is still around 30% in 2023.

Revenue at the end of 2022 was 56% generated from a fee-based business model. The remaining 44% came from interest in Kaspi’s banking/fintech business.

What are the costs they make?

From revenue to net revenue, the costs that Kaspi has to bear are 3-fold:

Interest expenses which cover the bulk (70%) of the cost of revenue on different accounts and financial instruments

Transaction expenses for enabling and processing payments. We can think of this as the fees paid to payment processors or card networks.

Operating expenses include costs incurred to operate the retail network, 24-hour call support and communication with customers, product packaging and delivery, risk assessment, customer deposit acquisition, etc.

From net revenue to earnings before taxes, we have the following cost breakdown structure:

Technology and product development: Staff and contractor costs related to the research and development of new and existing products and services, development, design, data science and maintenance of our products and services, and infrastructure costs. Infrastructure costs include servers, networking equipment, data center and payment equipment related depreciation, rent, utilities, and other expenses necessary to support our technologies and Platforms. In 2022, this amounted to about 7% of total net revenue.

Sales and Marketing: These costs consist primarily of online and offline advertising expenses, promotion expenses, staff costs, and other expenses that are incurred directly to attract or retain consumers and merchants for the Kaspi Ecosystem. In 2022, this amounted to about 3% of net revenue.

General and Administrative Expenses: These are costs incurred to provide support to the business, including legal, human resources, finance, risk, compliance, executive, professional services fees, office facilities, and other support functions. In 2022, this amounted to about 3% of net revenue.

Provisions

In other words, nothing special from a reporting point of view. However, looking at the cost structure compared to the revenue, Kaspi is a very profitable business. Here’s the EBIT margins over the last couple of years:

For 2023, we only added the first half-year data. But margins are still high but are trending down towards the pre-COVID level.

Let’s dig a little deeper into each business segment

There is a difference in profitability within the segments:

What is noteworthy is the rise in payments which shows the strength of the Kaspi payment ecosystem and the fact that it cannot only compete but outperform Visa within Kazakhstan.

Kaspi Payments

This segment allows consumers to pay for regular household needs, make online or in-store payments, or use the peer-to-peer payment network. Consumers can use Kaspi Pay (Kaspi’s proprietary payment system) or use a Visa or Mastercard issued by Kaspi Bank.

Revenue is generated from:

Transaction fees from merchants and consumers

Annual membership fees from consumers

Interest revenue from cash balances (current accounts)

The bulk, about 77% of net revenue is generated from fees.

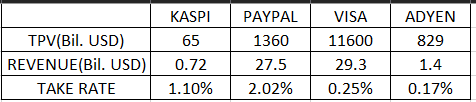

As is usual when comparing payment companies, the Total Payments Volume flows through the system, and based on a fee system, the business has a certain take rate (=revenue/Total Payments Volume)

We’ll first compare Kaspi to typical businesses we know. The numbers shown are based on all these companies' 2022 annual reports.

The reason we do this comparison is to verify how much Kaspi is taking in the value chain of payment processing. The precise values of the calculated take rates are not important, it is the order of magnitude that matters.

Kaspi is essentially doing what PayPal tried to do in the past. Paypal tried to compete with Visa to get people to fund their wallets with their Credit cards which means that once the wallet is filled, future transactions will go through Paypal and Visa no longer gets a cut. Visa then used its position of market dominance and Paypal quickly abandoned the fight.

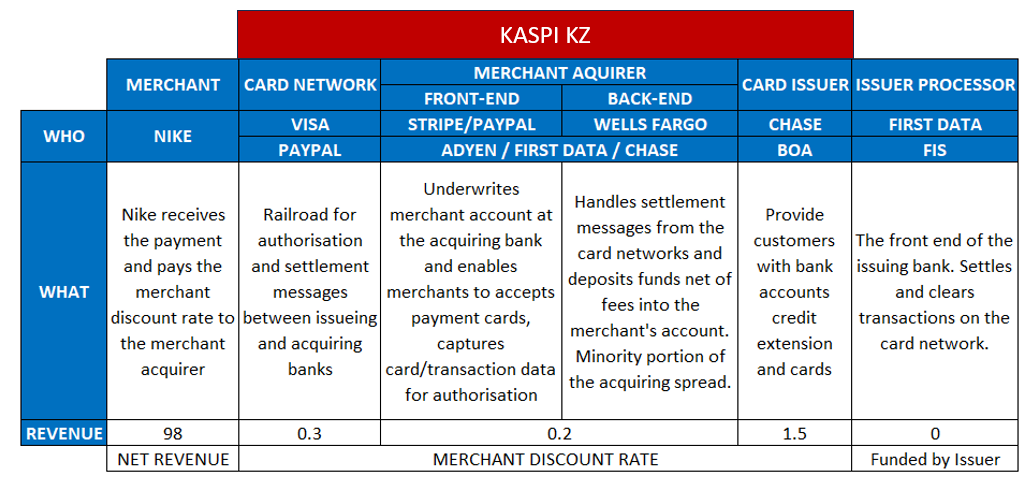

Remember the value chain in payment processing which we discussed in a previous article on Adyen.

When people are paying with Kaspi Pay, Kaspi is essentially bypassing the card network, issuing their card as if they are a bank, and providing payment processing services to the merchants as an Adyen.

So visually, the value chain and who captures what becomes this:

Now we didn’t find detailed data to confirm that Kaspi is handling every part of this process in detail. But based on their take rate, they seem to be operating as a Paypal/Braintree/Issuing bank combination, all in one single company. But based on the data there are 3 possibilities:

Kaspi Pay: They have a take rate on the entire value chain like in the above example

Visa: They issue a Visa card, and have a lower take rate (Visa takes its cut)

Mix: They operate like a card issuer and only take the cut of the card issuer (the biggest one)

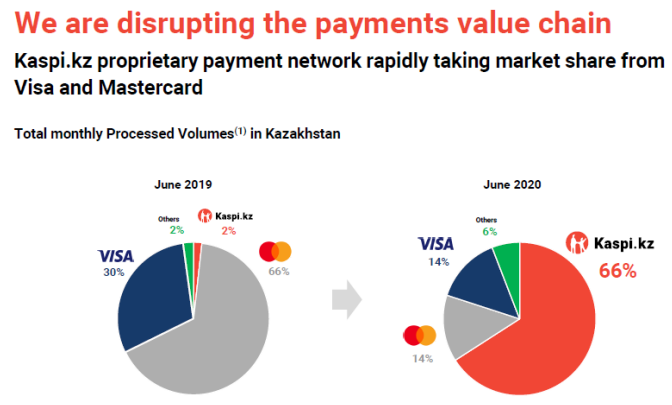

What does this mean when looking at market dominance in Kazakhstan?

It means from a payments standpoint, a monopolistic position and a displacement of a company like Visa.

Here’s some data from their IPO prospectus:

The National Bank of Kazakhstan supplies data on payment volume. Although it does not provide data specifically for Kaspi, it provides data for local payment systems and international payment systems like Visa or MasterCard.

Here’s the data for the last couple of years:

This graph shows the increase in digital payments volume in (Billion Tenge) over the last 5 years. In other words, this is a mind-blowing 77% CAGR over this period. Kaspi and other local players have been riding a wave toward digitization. The speed of growth is slowing, the growth rate from 2022 to 2023 sits at 32%. Notice that Visa has grown faster in the last 2 years than the local payment systems. Lastly, Kaspi has been one of many beneficiaries of this wave, competitors like Halyk Bank have also grown significantly, but not as much as Kaspi over the last years. As the CEO of Halyk Bank mentioned in an interview, we had a great year, with a Return On Equity of 40%, but there is one that did even better…

Conclusion: Kaspi’s payments business has become a dominant part of how consumers use payments in Kazakhstan. Based on company reports and data from the national bank, Kaspi holds about a 70% market share within Kazakhstan on digital payments.

Kaspi Marketplace

The 2 sided marketplace is a sort of Ebay-like business model where they collect fees from sellers. It enables consumers to buy a broad selection of products and services from a variety of merchants. Fulfillment options include in-store pick-up, delivery by merchant, and delivery powered by Kaspi.

There are several interesting parameters to track:

Number of merchants: This will influence the offering and variety of products available

Number of consumers

GMV (Gross Merchandise Value): The total value of goods and services sold across the Marketplace Platform during a certain period

GMV/active consumer: The average ‘basket’ size

Take rate: Revenue/GMV

When we look at the growth for these criteria:

We can see that growth in GMV is slowing down a bit, GMV/consumer keeps increasing and most importantly, the number of merchants keeps on increasing substantially which is important as revenue is made by seller fees.

The marketplace take rate has stabilized at 8.2% over the last 2 years (which is lower than for example eBay, but Kaspi’s marketplace is not a pure e-commerce play)

Now from a business perspective, the marketplace itself can be divided into different segments which on a GMV distribution, looks like this:

The 4 segments are:

e-commerce as an eBay

m-commerce which allows customers to browse through a selection of wares from the merchants and then come pick it up inside the store (and buy through Kaspi pay)

Travel: Customers can purchase flight and rail tickets. Fully integrated with Kaspi Payments and Buy Now Pay Later

e-Grocery which was launched at the end of 2021 in collaboration with the largest food retailer in Kazakhstan: Magnum. This part is at the moment still small, but the grocery market size is big. In 2022, e-Grocery was only available in the city of Almati but will be rolled out across the country. Although the absolute number in GMV is still small, it has increased 8-fold in 1 year. Based on the last quarterly results in 2023, it is now available in 2 cities and has again tripled the total number of GMV.

The marketplace segment keeps on growing in will gradually overcome the fintech segment in bottom-line income.

Kaspi Fintech (Bank)

This segment enables consumers to manage their personal finances online and access consumer finance and deposit products and services. These products are seamlessly integrated with the other two segments. In other words, a customer can buy a product on the marketplace, select the way he/she wants to finance it (fintech), and then use Kaspi Pay as a payment method (Payments).

Revenue is generated by interest (70%), fee revenue, and membership fees from consumers who are members of the Kaspi Red Shopping Club.

The main products within this segment are:

Buy now pay later (BNPL) for customers on the marketplace

Business finance: Merchants can access Kaspi’s working capital finance products and based on several criteria, borrow a certain amount

Kaspi deposits

An important parameter used here is the TFV or Total Finance Value which is the total value of loans to consumers issued within the Fintech Platform.

51% of this TFV value comes from BNPL short-term loans and 12% from business finance products.

As the CEO mentions, we are no bank, and he is partially right since the fintech or banking part of the business is gradually reducing while the marketplace and payments business is growing faster.

When looking at the fintech data, currently the bank has:

2,639 billion KZT in loans

3,151 billion KZT in savings deposits

In September 2022, Kaspi Bank’s credit rating was increased by S&P Global from BB- to BB-rating. A BB rating means that a moderate degree of fundamental financial strength exists, which would have to be eroded before the financial institution would have to rely on extraordinary support to avoid default

The super app business model

What can it do that my banking app cannot do?

Here’s what my personal banking app can do:

Wires, mobile payment, credit card information, etc

Parking/Transportation tickets/Shared mobility subscription/Services at the airport

Purchase value for carrier smartphone

Digital vault / Safe for government documents

Different payment services like Paypal etc..

Tickets to the movies or amusement parks

I have to be honest, I have never used any of these services. I only use my banking app for banking and will use dedicated apps for all the rest. This is an example of how our apps in the Western world have evolved. From a dedicated large number of apps to banks now trying to add more ‘services’ to their apps.

A super app is something different, it aims to be an ecosystem, wherein a user spends a lot of time and does not use dedicated apps for certain specific means. It’s the ecosystem within the operating system that is Android or iOS.

I think Andreesen Horrowitz can describe it best:

In brief, a super app is an application that builds upon its core functionality to mix and mash a bunch of seemingly unrelated services — but ones the user would need or want to do anyway — into one place. Imagine a single app that allows you to shop for groceries, pay your rent, review work documents, refill prescriptions, book a trip, and chat with friends, interest groups, and businesses — that’s a super app. Sounds more like your entire iPhone than one app, right? That’s because it essentially is. True super apps are more akin to an operating system than any Western app, with the bonus ability to share fun selfies with your friends.

That is exactly what Kaspi is aiming for, and it seems they are succeeding.

They have built a 2-sided super app, one for the merchant, the other for the consumer:

Where the previous 3 business segments are fully integrated.

Note: Notice that the super app has a button: Government Services. Kaspi has actively worked together with the government to allow for example tax reporting or other services. This makes a lot of services easier for the citizens of Kazakhstan and again contributes to the quasi-monopoly Kaspi has.

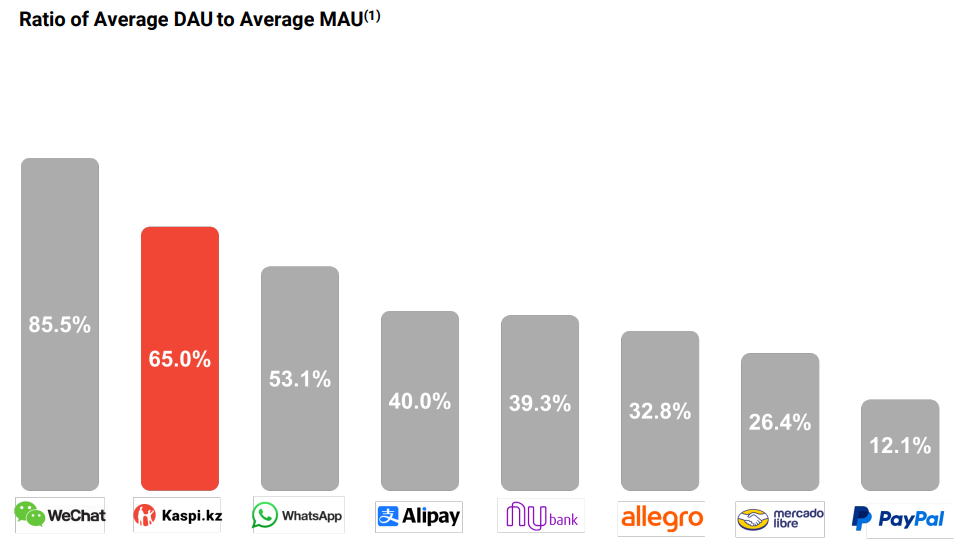

What’s important for the usage of an app is the following KPIs:

DAU = The daily number of users with at least one discrete session (visit) over 10 seconds on the Mobile App; average DAU is a simple average of DAU for any given period

MAU = The monthly number of users with at least one discrete session (visit) over 10 seconds on the Mobile App in the last calendar month of each respective period; average MAU is a simple average of MAU for any given quarter

In other words, the ratio says something about the proportion of monthly active users who engage with your product in a single-day window

It is an indicator of active engagement. As the previous comparison shows, engagement with the Kaspi app is high. Imagine you have an app on your phone, and you’re using it more frequently than WhatsApp.

Diving into Kazakhstan

A short history

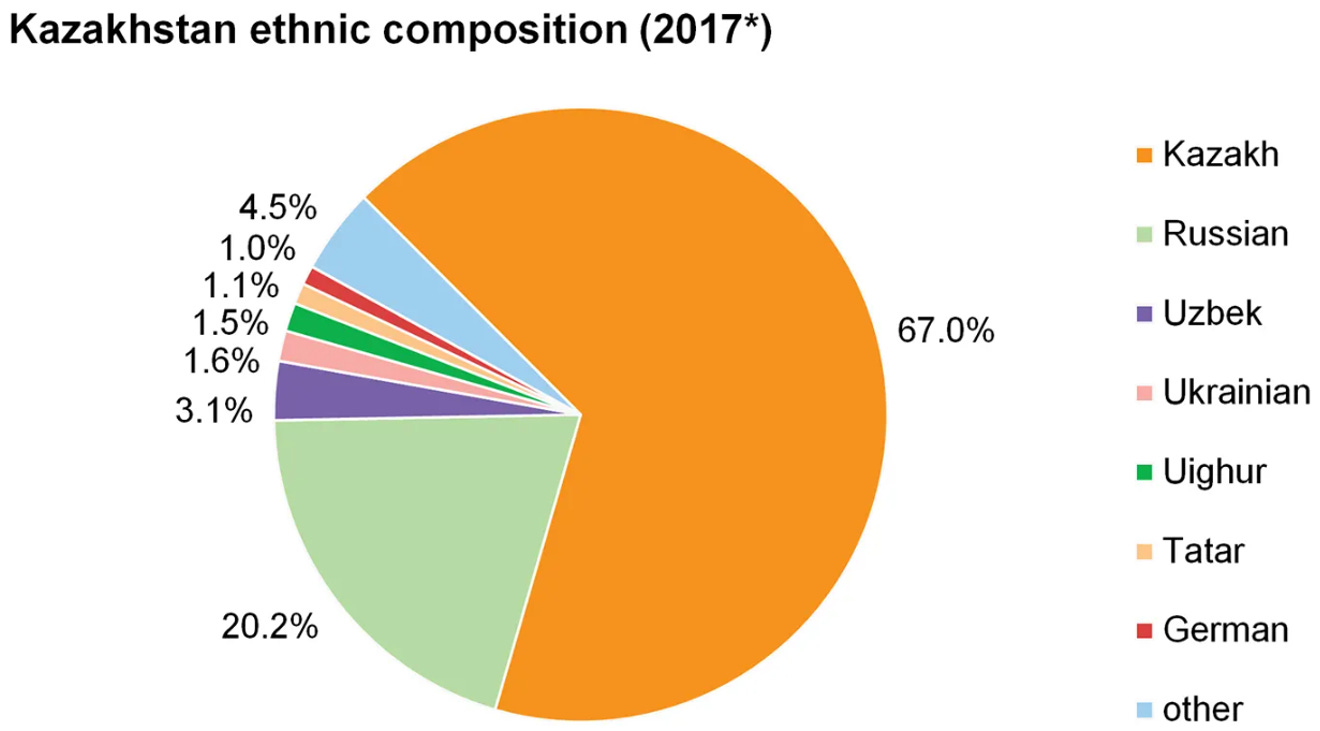

Kazakhstan means ‘Land of the Wanderers’. This speaks to the nation’s ancient history as nomads and the deep-rooted spirit of independence in Kazakh culture. Over the centuries, it has been inhabited by nomadic tribes. Kazakhstan is home to a whopping 120 ethnicities. Here’s a distribution from 2017:

The official languages are Kazakh and Russian. 95% of the population speaks Russian fluently.

In 1920; Kazakhstan became an autonomous republic within Russia and in 1936 within the Soviet Union. Kazakhstan was the last of the Soviet Republics to declare independence in 1991. This explains why Russian is the main language.

Kazakhstan lies in central Asia and it’s a big country, really big.

Just to get an idea, of how big it is, you can fit, Germany, France, and Spain in it, and still, there’s room to spare:

We’ll discuss the neighboring countries when looking at possible international expansion.

Governance

From the official website:

The Republic of Kazakhstan is a unitary state with a presidential system of government. Under the Constitution, Kazakhstan is a democratic, secular, legal, and social state that recognizes the man, his life, rights, and freedoms as the supreme values of the country.

It is not for me to judge these claims, but the parliament and president, in 2019, have been elected with a more than 80% approval rate. A democratic country in the West does not have such high rates.

We will shortly discuss what happened in January 2022 as it explains what happened to the pricing of Kaspi in the markets.

In January of 2022, there were several unrests and mass protests. This was the result of a sudden increase in the price of liquefied petroleum gas. This increase was the result of a lifting of the price cap by the government at the start of the year. Although the protests started peacefully, they spread around the country becoming more violent. The government stepped in and according to Wikipedia, 200+ and 10k civilians were arrested. The price cap lift was the instigator of a more widespread dissent towards the rising inequality in wealth in the country.

The government has promised reforms since the January tragedy.

So what happened at Kaspi? During the 2 weeks of unrest, parts of the business were still operating. The price in the market however took a severe hit.

It is impossible to predict what will happen in the future. The only way for such an event to reoccur is to reduce inequality and provide at least the chance of prosperity for all.

The pricing of Kaspi in the market is slowly recovering:

And has reached the level it had in the middle of the unrest.

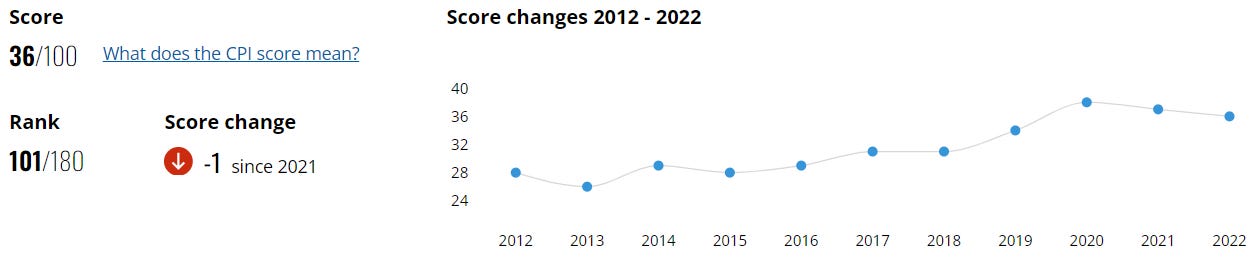

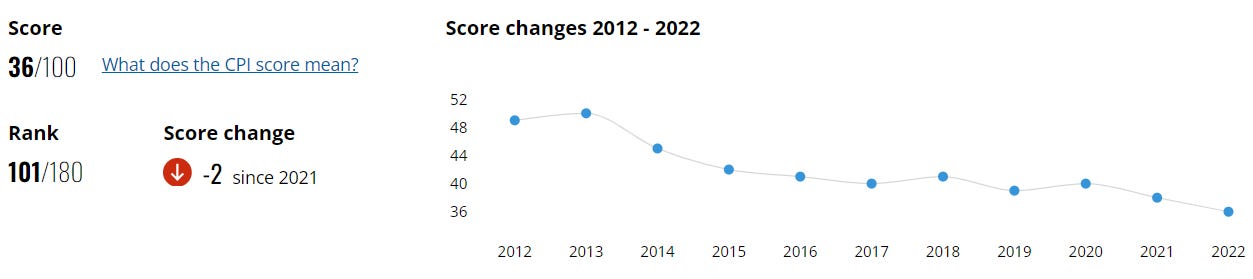

One way to gain additional insights into the government body is through the corruption perception index. It’s important to first understand how this index is constructed. The index is constructed by Transparency International. Its index allows it to rank different countries.

For Kazakhstan, the index is improving:

But relative to other countries, it still scores less.

Just to put this into perspective, here’s the evolution of the index for Turkey

Turkey has the same index, but the trend is completely different. Corruption by government officials is increasing instead of decreasing.

Just to be clear, although several Western countries have a higher rating, it does not mean there is NO corruption in these countries. The goal here is to get a picture of the risk you are exposed to as an investor. It is not for me to judge the different countries' governing bodies.

Currency Risk

The national currency of Kazakhstan is the Kazakhstani Tenge (KZT). Here you can see the evolution over the past year of the KZT versus the USD.

10 years ago, 1 USD got you 150 KZT. Now, 1 USD yields 460 KZT. The currency has steadily weakened over the last years with a significant step that can be observed in 2015. Previous to 2015, to government was holding the value of the tenge up, which was costly. The national bank finally allowed the tenge to float which led to a significant currency devaluation. From 2018 until now, the currency compared to the dollar has lost about 4.4% of value annually at a geometric rate.

In May 2015, the government launched a large-scale institutional reform program – “One Hundred Concrete Steps, a Modern State for All” – which encompasses reforms in public administration, the regulatory framework, public financial management and accountability, the management of state-owned enterprises, and various sector-specific reforms.

The goal is to reduce dependency on its economic drivers like oil and minerals to grow the economy in the future in a more stable manner.

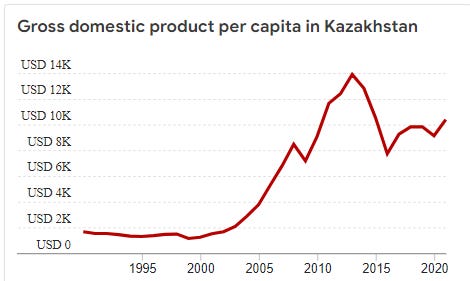

Although the currency has continued devaluating at a slower pace, GDP/Capita is increasing.

We can see the impact of the economic recession until the bottom in 2015 when the country is now trying to recover.

Or if we look at GPP/capita corrected for purchasing power parity they would be about 50% of the level of a country like Germany as illustrated by the following figure:

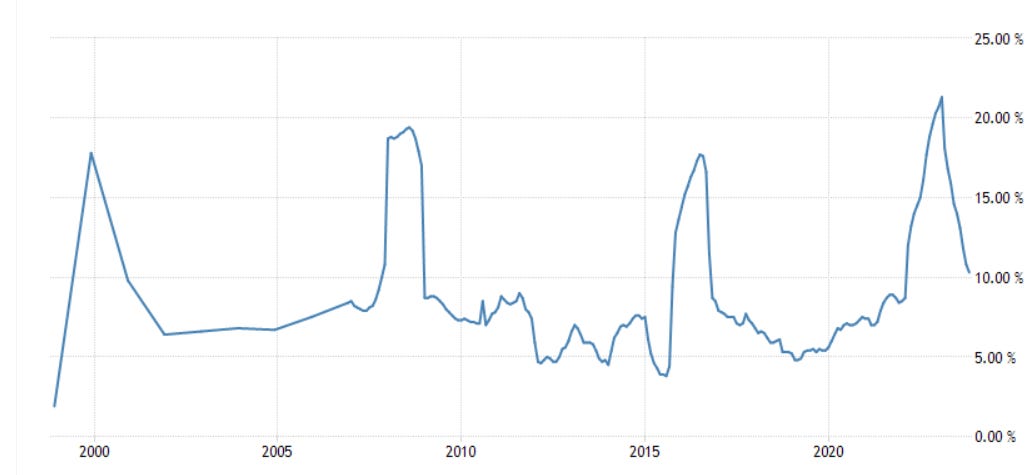

Inflation

Current inflation in Kazakhstan is high.

Here’s the inflation rate in Kazakhstan since 2000:

When zooming in on the last 5 years:

Inflation increased rapidly in 2022 and is steadily decreasing in 2023. This is mainly related to increased government spending during crises (COVID) but also non-crisis years (as in most Western Countries)

The base rate at the Central Bank of Kazakhstan is now 15.75% (due to a recent 0.25% reduction) intending to keep inflation at a 5% level.

This of course impacts the results for Kaspi. For example, the marketplace GMV will increase by increased volume and increased prices which are partially related to inflation. We need to take this into account when assessing future growth prospects for the company, especially when looking at the performance of the year 2022 and this year.

Past performance

Income statement and profitability

We already discussed in large part the business model and the performance results. Let us take a look at Top and Bottom line: Net revenue growth and growth in earnings per share:

Now the 1 year CAGR is calculated on 2023 guidance.

Although the company is still growing strong, it is slowing down, at least from an EPS point of view.

Balance sheet

When looking at the balance sheet, and as we previously discussed on the fintech part of the business, we expect a certain amount of debt. Here’s a quick overview in billion KZT

Where 93% of the liabilities are booked as the customer accounts, and a large part of the assets are loans.

A quick peek at the ratios at Gurufocus gives us the following financial strength:

The column comparison with the industry is the comparison towards the software industry. We will dive deeper into the capital allocation strategy and ROIC in the next chapter.

Cash flows and capital allocation strategy

Without any doubt, Kaspi is a cash-generating machine, with a high level of profit margin and earnings quality. But what are they doing with all that cash?

If we take the cash flow statement from Yahoo Finance, we get a quick overview of what has happened over the last years:

The banking part, especially the lending, provides a disturbance in the past operating cash flow. We can see operating cash flow growing except for a significant drop in 2021. The reason: A lot of cash has been used as lendings. This will eventually trickle back in the form of principal and interest payments (except at a certain rate of delinquency).

Let’s dive into the possible capital allocation decisions.

CAPEX

Overall CAPEX spending as compared to net revenue is low. It is within a 3-5% band with the highest capex by net revenue spending in 2022 at 4.7%.

Most of this is used to develop new features for the business. There are some acquisitions which will be discussed in the next paragraph.

This is an asset-light business, aimed at providing software and banking solutions.

Acquisitions

In the past, some acquisitions have been made:

In 2020, Digital Classifieds in Azerbaijan

The activities of the Digital Classifieds company are aimed at elaborating, maintaining, and developing of 4 own online services, which all together create a platform for users to sell or purchase cars, real estate, and any other products, as well as employment in the local market: turbo.az, bina.az, tap.az and boss.az.

In 2021 Ukrainian BTA Bank purely to obtain a banking license

In 2021 Portmone Group (A payment processing company in Ukraine, 3 months before the start of the war)

“With its payments licenses and substantial merchant and bank relationships, the acquisition of Portmone will allow Kaspi.kz to enter the Ukrainian market. The combination of high cash usage, high smartphone penetration, and a population of 42 million, means Ukraine offers a substantial, multi-year digital growth opportunity. We believe Kaspi.kz, with its high-quality mobile products and Super App strategy can make a difference to the everyday lives of Ukrainian consumers and merchants.”

In 2023 acquisition of 51% in Kolesa a platform, that operates in Uzbekistan. (it has a marketplace for second-hand cars) and is similar to the company that was taken over in Uzbekistan in 2020

In 2023 acquisition of 90% of Magnum E-commerce to continue expanding the e-grocery capabilities

From an acquisition standpoint, Kaspi is slowly but gradually developing its capabilities abroad.

Management is focused on giving the returns back to their shareholders through dividends and buybacks while at the same time, repaying some of their debt.

Their expansion into surrounding countries is done by making ‘small’ and thoughtful acquisitions into other marketplaces (Uzbekistan, Azerbaijan) or Payments (Ukraine).

This can be seen as a good thing, but other players are stirring within those countries. Return on invested capital is high as evidenced in % by the below numbers:

However, the reinvestment rate is low because most of the cash generation is distributed. Could they not be more aggressive towards international expansion? Would this not allow for long-term shareholders' returns by a higher reinvestment rate?

In the chapter on international expansion, we’ll take a look at the state of the surrounding countries which might explain why Kaspi is slowly expanding.

Management and incentives

From the annual reports and the IPO prospectus, we can distill the following ownership structure:

Where the chairman of the board, the CEO, and management hold about half of the company. Baring Vostok a PE fund owns almost 29%.

Here’s a simplified table for the ownership categories:

The fact that there is high insider ownership can be positive. The increase of insider ownership by the general management of the firm allows for an alignment in incentives.

Destination analysis

International Expansion

In the chapter on capital allocation, we’ve already seen that Kaspi is gradually making acquisitions in neighboring countries. Let us take a look at some data metrics to compare the surrounding countries to Kazakhstan.

GDP/Capita

Here you can see the GDP/Capita for the surrounding countries:

Kazakhstan and Turkmenistan are both at roughly the same level and set to increase in the coming years. Small countries like Tajikistan and the Kyrgyz Republic have a GDP/Capita that is 10 times lower with low prospective future growth rates. In other words, on a GDP/capita basis, Turkmenistan and Azerbaijan make the most sense for international expansion in the near term. For reference, the GDP/Capita of Kazakhstan is about 25% that of Germany.

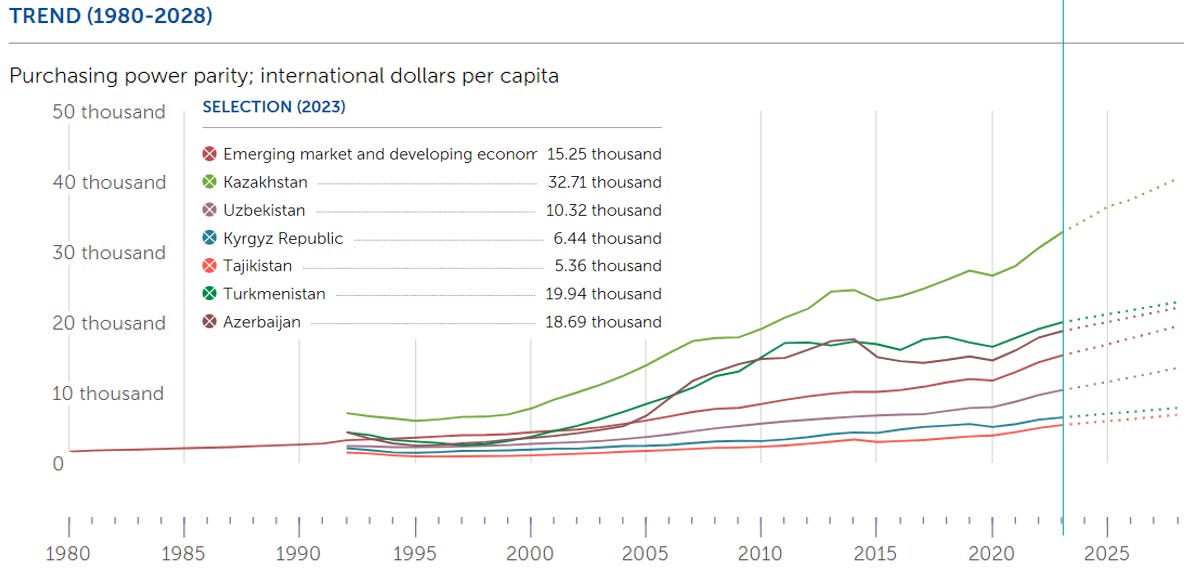

GDP/Capita (PPP)

When correcting for purchasing power, the data supplies the following trends:

Now, Kazakhstan is clearly in the lead, and set to keep growing in the next 5 years. Turkmenistan, Azerbaijan, and Uzbekistan are the runner-ups.

When comparing to Germany while including the PPP, Kazakhstan has a GDP/Capita of about 50% of Germany.

Population

One reason to also consider Uzbekistan; is its growing population:

In general, the population in central Asia has been on the rise as opposed to for example the decline in Europe. For Kaspi, from a population point of view, Uzbekistan is an interesting market.

Overview

When directly comparing several countries to assess the attractiveness of the market:

Conclusion:

Kazakhstan is on another level regarding digital payments. The other countries still have a way to go in comparison. We also mentioned the percentage of the population that speaks Russian as it allows for an easier expansion of the business. However, the acquisition strategy of local marketplaces disregards the language barrier.

The % of people older than 15 with bank account numbers date from 2021 except for Azerbaijan (2017). It is therefore possible that they are probably farther ahead at the moment when regarding this number.

All in all, there is opportunity in the surrounding countries, but they are moving ahead at a slower pace.

Can Kaspi return a 100x?

What would happen if Kaspi could recreate what it did in Kazakhstan, but in Azerbaijan, Uzbekistan, and Turkmenistan?

From a pure population point of view, the target market increases from 19 million to 70 million. But from a GDP/capita view, as we’ve seen before, there is still a long way to go in these countries when looking at economic growth and adoption of digital payments.

Kaspi currently has a market cap of 18 billion USD, which is by far the biggest company by market cap in Kazakhstan. The top 4 looks like this:

Kaspi 18 Billion USD

National Atomic Company 8.2 Billion USD

Freedom Holdings 4.7 Billion USD

Halyk Savings Bank 3.9 Billion USD

Halyk Savings Bank is a direct competitor of Kaspi. They also have a ‘super app’ and a marketplace but are far less dominant in the country.

To become a 1.8 trillion company, it would need to not only develop its market within Kazakhstan but expand into the surrounding countries. This does not seem possible. The rapid evolution within Kazakhstan was due to a convolution of elements arriving at the same time:

Government reform in 2015

Alignment with the government to go for digital adoption + contracts for digital taxes etc.

Covid in 2020 which boosted digital adoption

Not only are the cultures and languages in these countries different (which always makes expansion more difficult), but there are local players/banks in those countries already developing similar services like smartphone payment through QR codes, etc.

Becoming a trillion-dollar company means wide international sales and expansion even beyond Central Asia. That seems too far-fetched, even for a company as strong as Kaspi.

Can Kaspi return a 10x?

What does Kaspi need to do to become a 180 Billion dollar company which is roughly 1/3rd the size of Visa which operates worldwide?

What can be done within Kazakhstan?

Further digital adoption of payments

Further economic growth and thus spending

Further development of new services that integrate within the super app

But this alone will not propel them to such a valuation. It will need to go beyond the borders of Kazakhstan and as discussed before, several challenges have to be overcome.

Although Kaspi does a lot of things and is more profitable than even a company like Visa, it will be difficult to get the same worldwide reach. But, what is unique about the company, is its integration of new services inside the super app.

Let us take e-grocery as an example, where Kaspi has only just begun scratching the surface.

According to Statista, the grocery delivery market in Kazakhstan is expected to grow rapidly:

The numbers displayed here, are the aforementioned GMV numbers. When we convert this from USD into KZT, you get a total market of about 750 Billion KZT in 2028. Remember current GMV for Kaspi is about 12 Billion. Of course, Kaspi will not capture the entire market, but because of its partnership with the biggest retailer, its acquisition of said e-commerce capabilities, and the number of people already using the app daily, the opportunity for Kaspi is there. As a reminder, the current total GMV for Kaspi Marketplace in 2022 was 2800 Billion KZT.

In other words, a 180 billion USD company will take time, but is not impossible.

How is the market pricing Kaspi?

A company growing EPS at 40% CAGR and only trading at a low double-digit PE multiple might seem strange. If this company were based in the US, the multiple would more likely be around 30. The US has a stronger currency, lower inflation, a more stable government structure, and much higher economic growth.

The risk you take as a foreign investor has to be reflected in the multiple it is trading at. The question then becomes, is the current multiple fair, or is there still a discount present?

We can get a sense of this when looking at market expectations. An inverse DCF model with free cash flows doesn’t seem too useful, as because of the banking and BNPL lending, you don’t have a stable increase in free cash flows. What we do have is a more or less stable rise in earnings power.

One way to look at this is to try to asses the earnings power growth rate corrected for the additional risks we take. If we consider inflation to stabilize at 5% and currency devaluation continuing at a rate of about 4% we can forecast future growth taking into account at the end of 5 years a conservative commodity PE-multiple of 12. Meaning, that we count on earnings power growth and not on multiple expansions in the next 5 years.

EPS has grown at 23 % in 2023. Inflation in 2023 was on average 12%. If the central bank can maintain inflation at 5% in the future, we can subtract the difference, 7% from the 2023 growth rate. If we then reduce by another 4% to convert from KZT to USD, we get the EPS growth rate in dollars.

This would mean a share price of about 150 USD per share in 5 years or other words a 12% CAGR equivalent to the EPS growth rate.

This is an estimate supposing that this year's EPS growth rate can be maintained in the coming 5 years. Depending on your hurdle rate and risk tolerance, you’ll need to decide if this is something for you.

Will a direct listing in the US drive a multiple expansion?

It could provide more visibility to the company but the stock is already tradeable on the London stock exchange. The risk you take as an investor does not change one bit when buying a GDR on the New York Stock Exchange. An increase in multiple might be possible if as a consequence more institutional money starts flowing in. I remain conservative and will ignore this as a possible catalyst for multiple expansions.

Proper multiple expansion can occur when:

Kaspi keeps growing

Kaspi can get a proper foothold in other countries

Kazakhstan keeps developing and strengthening its currency

Inflation can stabilize

Perceived country risk decreases

If these factors occur, I can see a multiple expansion maybe towards a P/E of 20 but not towards a P/E of 35 like the likes of an Adyen.

Conclusion

Will Kaspi become the Wechat of Central Asia?

Maybe, but the road will be challenging. Their past hypergrowth can be explained by being at the center of:

Having the government as an ally at the right time

COVID wish has accelerated digitization in Kazakhstan

Shifting from a traditional bank to a tech company

What we have here at the moment is a monopolistic company within Kazachstan that is surfing on an increased wave of digitization and cashless payments, supported by the government and with positive trends towards the future.

Growth will most likely slow down (as it has slowed this year) but the company is still growing fast on all metrics.

You could imagine a company like this rerating in the future, but at the moment, we would only consider the compounding by the earnings per share.

The market is applying a discount based on the previously discussed country risks. It may look cheap, and we believe that there is a nice return to be had, but the low value of the P/E ratio does correctly include risks that should not be overlooked.

Inflation remains high at the moment and thus inflates parts of the revenue growth. The local currency that is losing strength towards the dollar must be considered when investing.

The surrounding countries are less affluent than Kazakhstan, but they are growing. Kaspi is prudently setting steps into Azerbaijan, Ukraine, and Uzbekistan. Similar to Dino Polska, the main focus in the short term will be Kazakhstan with gradual tentative steps into surrounding countries.

Finally, Kaspi is generating lots of cash and returns that cash to its shareholders in the form of dividends and share buybacks. Smaller acquisitions are made to pave the way for the future. Although they have a high return on invested capital, they are unable to reinvest at a high rate.

Pros

The super app: The fact that their app has so many active users allows them to gradually add new services and immediately see rapid growth in these segments, with the e-Grocery service as a prime example

Kaspi is a very profitable business with a dominant almost monopolistic market position in Kazakhstan

Kaspi’s growth is slowing but still considerable

There is high insider ownership with buy-in from the management team

New products within the super app are growing fast which is a testament to the power of the business model. Organic growth is still possible within Kazakhstan

Cons

Capital allocation: We like companies that can reinvest capital at a high rate, this is not the case for Kaspi. Most of the profits are returned through dividends and buybacks. This could be considered a pro but depends on your investment strategy.

Political risk, if the events of January 2022 were to reproduce, this would hurt the investment performance. The situation is now stable, but reforms must lead to a reduction of inequality in wealth to avoid repetition

High inflation has to be taken into account when assessing future growth prospects, especially for the payments and marketplace segments

Currency risk: The Tenge versus the dollar continues to lose strength, which must be taken into account as a foreign investor

International expansion will be challenging. Kaspi will most likely not have a similar trajectory as Kazakhstan as competition within these countries is not sitting idle. Economic prospects and projections vary from country to country.

100-bagger checklist

Disclosure: I do not hold any shares of Kaspi KZ at this time and will not enter into a position within the next 7 days to avoid any commitment bias.

May the markets be with you, always!

Please consider sharing if you like what you’ve read!

Further reading

This article was mainly written based on the prospectus and annual reports. For further reading, these are the articles I would recommend:

The Generalist Substack

One of the best articles from someone who lives in Kazakhstan

Aika’s newsletter

A great twitter thread on Kaspi

I think you may have made a mistake in the "Can Kaspi return a 10x" section. You give Kaspi's GMV as KZT 12 billion, and conclude that Kaspi could therefore become a 10x, since the e-grocery market is projected to reach 750 billion. Small problem, Kaspi's GMV is not 12 billion but 12 trillion KZT.

What a deep dive about this hidden gem! Will have to read it again and again. Thanks!