We continue our investigation of our investible universe (go here to check it out) by using our process. Here’s a thread summarizing our first 5 companies a month ago if you would like to take a quick look:

👇(click the image)

This is the part of our process where our goal is to create a one-pager and find reasons to say NO.

Here is a quick reminder of how the universe was created using the most powerful screener known to man: Uncle Stock

3-Y revenue CAGR of > 10%

Insider ownership > 15%

Institutional ownership < 5%

Excluding industries like finance, commodities

The 5 companies for this month are:

1️⃣Brand 24 (B24.WA) a SAAS business

2️⃣Brave Bison Group (BBSN.L) a digital media company

3️⃣Bumech (BMW.WA) servicing the coal industry

4️⃣Catenae Innovation (CTNEA.L) a digital media company

5️⃣Christie Group (CTG.L) a business services group

The market caps range from 60 million USD to 300k.

No, it’s not a mistake. There’s a company in there with a 300,000 USD market cap 🙂

Let’s go through them quickly…

1️⃣Brand 24

Company Overview

Brand24 provides a software solution where a business can track any mentions of their brand on the internet and within social media platforms. It’s a way for a company to measure the strength of its brand or compare it with competitors. It was founded in 2011 and currently has 27 employees. It first developed its social listening tool for the Polish market and in 2014 released a worldwide version.

You can easily sign up and put in a keyword.

So what did we do?

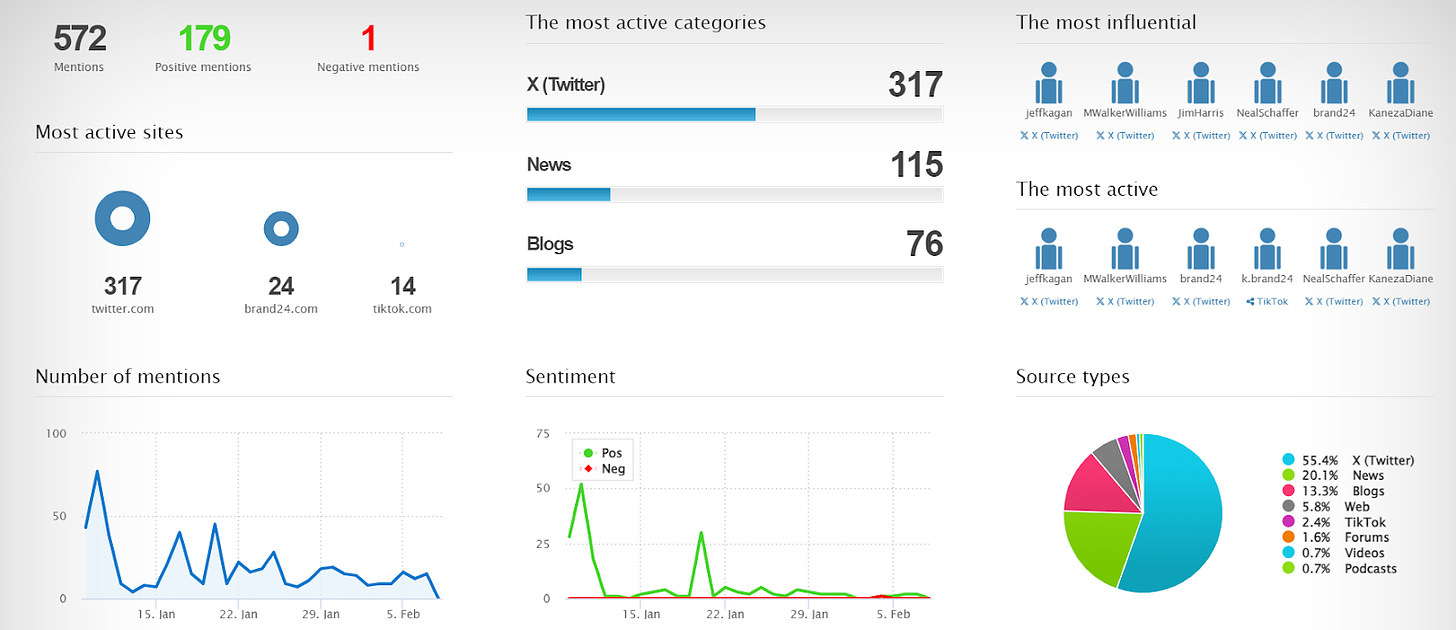

We used their software to look at the brand24 brand strength! The overview below is only for January. It generates reports like this:

It scans the internet and in this case, X (twitter) to look at how many times somebody mentions Brand24 and what kind of reach it gets. It also looks at other similar brands and compares them.

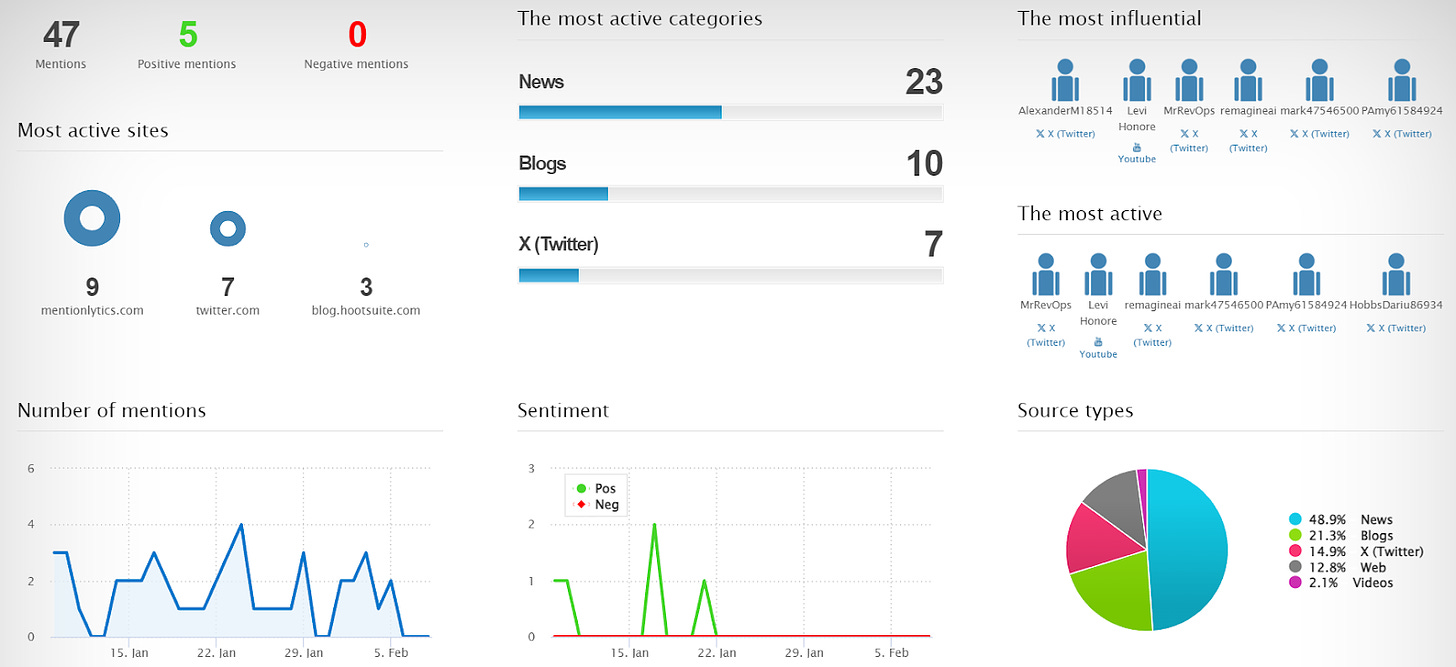

And we can then compare it to a similar company like Mentionlytics.com

In this case, Brand24 scores a lot better. Prices for their service range from 80 USD/month for individuals to 400 USD/month for enterprise clients.

But our quick and dirty is not meant to do a competitive analysis. What we can say, however, is that this is a competitive industry. The software that is needed to scrape the internet and social media platforms may be replicated by different players. When the company started, it could be that they had a local advantage within Poland, but now, they are competing with the rest of the world.

Past Performance

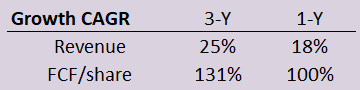

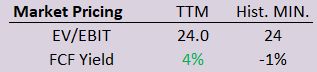

Brand24 has been growing fast since 2020. Here’s an overview of their revenue and free cash flow growth:

FCF increase is mainly due to their fast growth in operational cash flow.

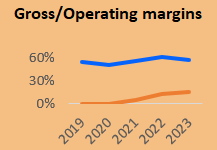

Gross margins are good, what you would expect for a Saas Company:

Operating margins have started to become positive over the last 3 years.

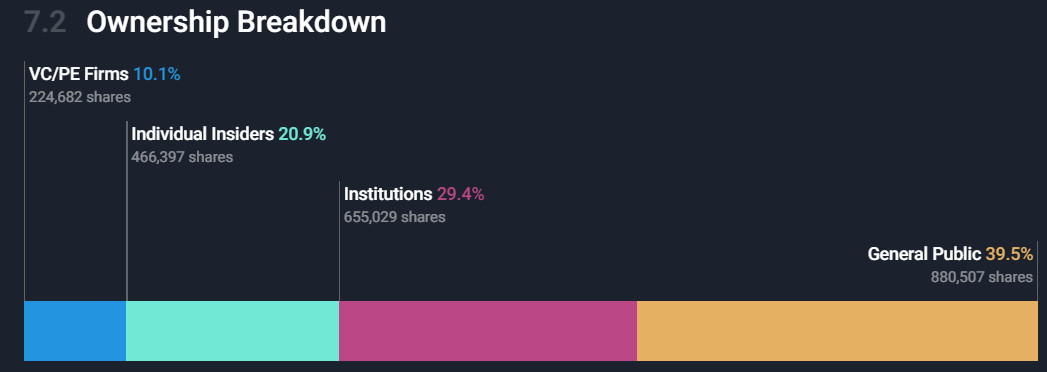

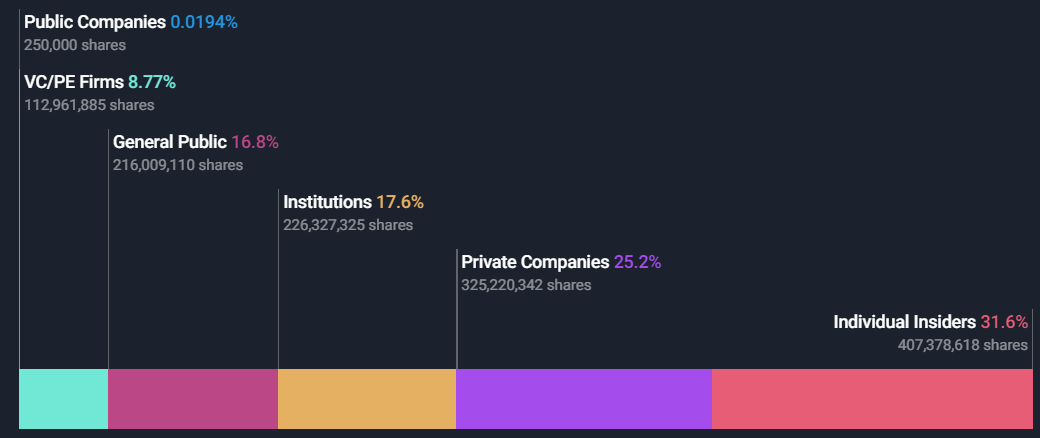

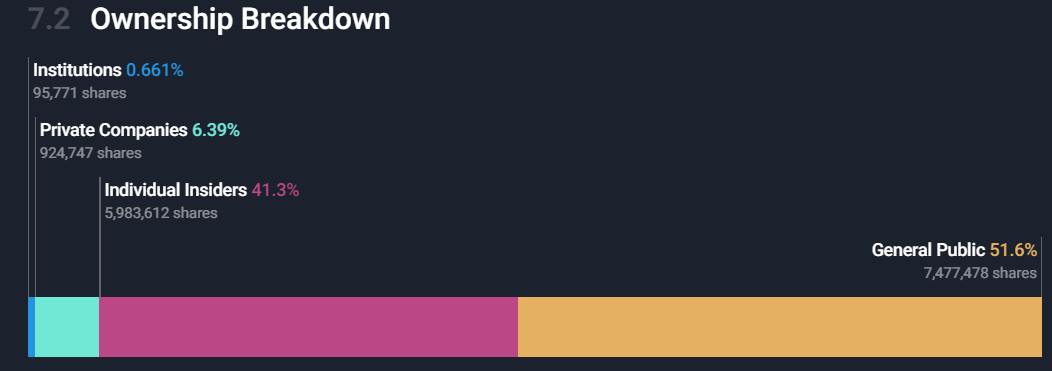

Ownership Structure

Here’s the current ownership breakdown from Simply Wall Street:

The CEO holds about 10% of the company valued at 9M PLN. I couldn’t find any information on the CEO or management team’s salary. You can find their annual report translated into English here.

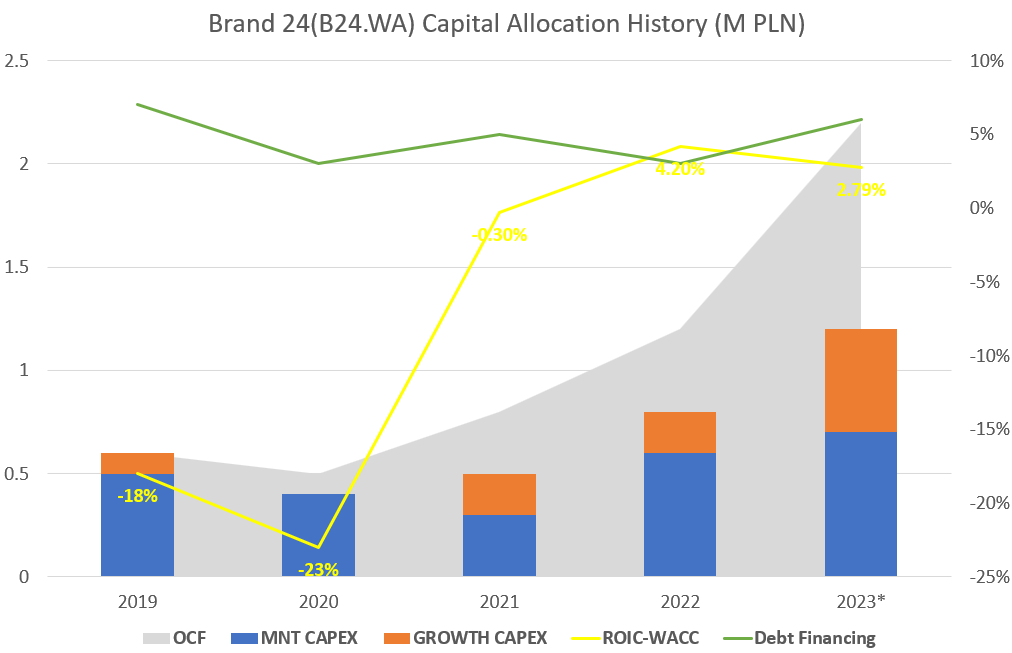

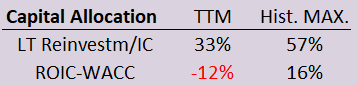

Capital Allocation

Let’s take a closer look. Here’s the 5-year history of their capital allocation strategy:

The analysis:

Nice increase in operating cash flow, the business is growing

No dividends: Lots of small Polish companies pay dividends once they generate cash

Cash generation increased in 2023 so they invested more in growth

Since 2022, ROIC has grown beyond its WACC. The company is finally generating economic profit

Debt financing is very low and has been reduced in the past

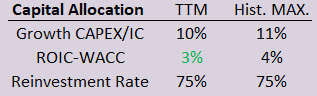

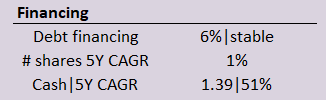

Here’s a quick overview of their growth and reinvestment rate.

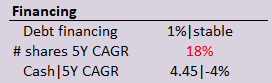

Financing

The company has very low debt. Its share count has slightly increased over the 5-years at a 1% CAGR. Cash position has increased dramatically.

The company is in a sound financial position. Growth is funded by the business.

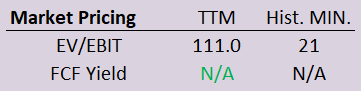

Pricing

It’s not priced cheaply in the market, but growth has been high. It does however show a decent FCF yield thanks to increased cash inflow.

Conclusion

Here’s the complete one-pager:

It seems that since 2020, the company has hit some sort of inflection point, becoming profitable and creating economic profit. The question is, did they ride the accelerated digitization wave of COVID or are they doing something truly unique?

In other words, will it last? And what explains the increased cash flow over the last 2 years?

Decision: It will be added to the potential deep dive list to figure out WHY it started growing over the last 3 years.

Here’s a full equity research article if you want to dive deeper:

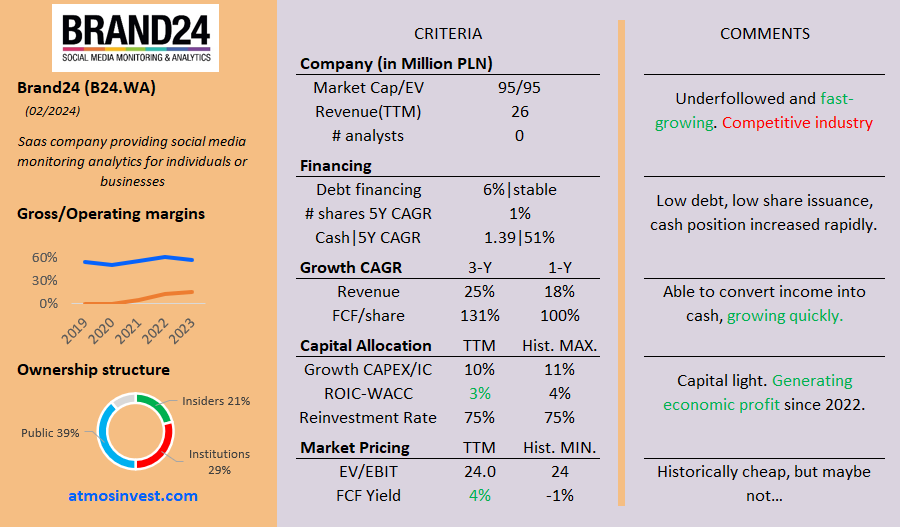

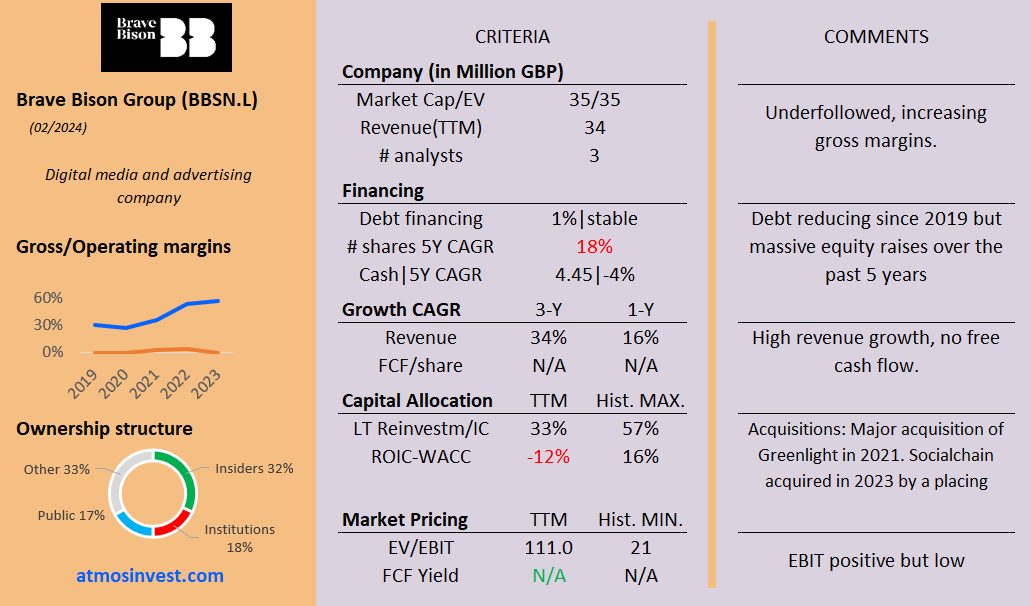

2️⃣Brave Bison Group

Company Overview

Brave Bison is an advertising, media, and technology company, and when you visit its website, it absolutely screams at you:

They have 4 business divisions:

Brave Bison performance

Brave Bison Commerce

Social Chain

Brave Bison media

The following overview explains what each business unit does:

In 2023, it acquired an ailing agency (Socialchain) and has already managed to restructure and integrate some of its business.

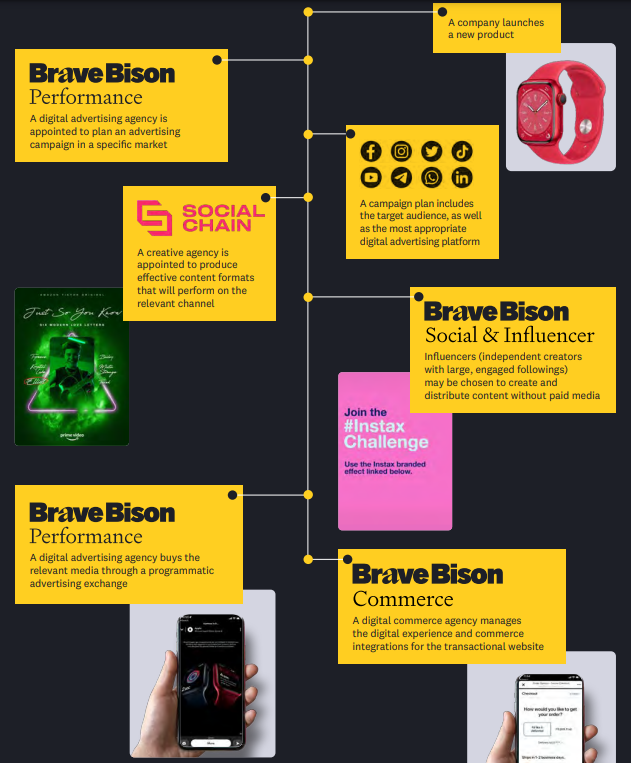

Past Performance

The company is growing in revenue over the last couple of years:

It is not generating free cash flow. Cash comes in through equity raises and operations and is spent on growth and maintenance.

Gross margins are increasing. Operating margins remain low.

The company shows adjusted EBITDA numbers, but I choose to ignore these.

Ownership Structure

The executive chairman and the chief growth officer both hold about 20% of the company based on the 2022 annual report. They have a salary of 104,000 GBP which is low compared to their holdings in the company.

Institutional ownership is higher than expected (it seemed to have slipped through the criteria of our investible universe).

Lord Michael Ashcroft (Billionaire) continues to increase his stake in the company (from 18 to 20%).

Capital Allocation

The company grows mainly through acquisitions and partly by organic growth of the business.

The current trailing ROIC versus WACC is negative. We’ll need to look at the annual report for 2023 to see if this is confirmed. Long Term reinvestment as mentioned is dominated by Capex costs.

Financing

already mentioned in the last issue, that there is a lot of dilution going on in this group.The company has practically no debt but continues to raise equity to finance its growth. Growth is obtained through acquisitions. It has a pretty stable cash position.

Growth through continued equity raises is not a problem in itself, as long as growth and cash flow can keep increasing at a higher rate.

Pricing

It looks expensive in the market because of the small EBIT generation. We’ll have to take it with a grain of salt. We need more time to asses this.

Conclusion

Here’s the complete one-ager:

Decision: I will add the company to the potential deep dive list for the following reasons:

I want to take a deeper look at what is making gross margins increase. Has their acquisitions been accretive?

What is needed in the future? Will they continue their growth strategy?

You can find a complete overview of the company here (paid)

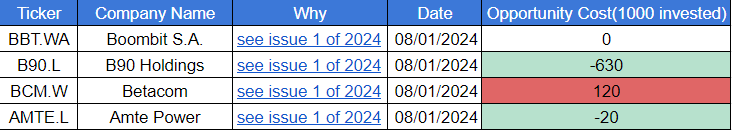

Intermezzo: I think I made a mistake last week. I posted this 👇 on X (you can click the image if you want to take a quick look at the entire thread)

Don’t buy without a why, but I feel it’s important to also track why you decide NOT to buy.

My NO-list (download it) tracks the opportunity costs. It’s still early days. We’ll see what it will look like in a couple of years. Green means the price has decreased since my decisions, red means the price has increased.

Anyway, back to the other companies…

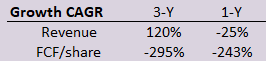

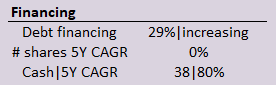

3️⃣Bumech

Company Overview

The company was founded in 2007 and manufactures and maintains machines in the mining industry:

Especially in the coal industry.

Past Performance

They have had a peak in performance in the last 3 years:

Going from 80 million PLN in revenue in 2020 to 1 billion at the end of 2022…

When looking at their statements, it appears that this increase in revenue is related to a sharp increase in the demand for coal after the COVID pandemic AND the start of the war, which also increased the demand for coal. Revenue is now decreasing and earnings are also decreasing.

Ownership Structure

38% of the shares are owned by the chairman of the board. We would like to see more people on the management team have some part in the company.

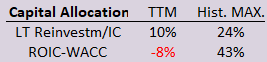

Capital Allocation

There is a continued reinvestment into the company based on the capex structure, but the economic profit is too dependent on outside factors. Without the exceptional demand that was generated after COVID and due to the war, I’m not sure this company would be generating an ROIC higher than its WACC.

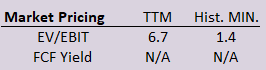

Financing

Debt financing has increased but levels are ok. The share count hasn’t budged over the last few years. Cash position has increased thanks to the windfall related to covid and the war.

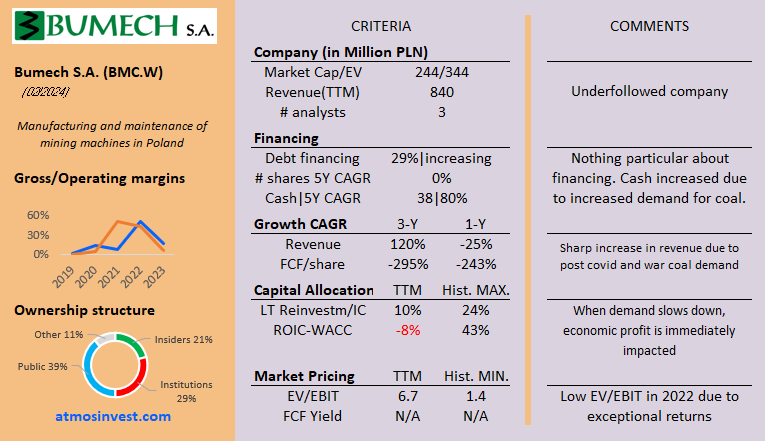

Pricing

It’s not trading cheap on historical levels, because due to the high operating earnings in 2022, the company was actually trading at a historical low.

Conclusion

Complete one-pager:

Decision: I will pass on this company as it is too dependent on a commodities cycle.

The sharp increase in sales and earnings has been due to external effects and not solely to the prowess of the company. Therefore, it is impossible to predict what the future revenue and earnings will look like.

4️⃣Catenae Innovation

Company Overview

This is a company that made revenue during COVID by providing a mobile application that contains an encrypted digital wallet as proof of a person’s COVID-19 status. It states that it provides financial technology and media publishing solutions in the UK.

It made 15,000 GBP revenue in 2020 and 30,000 in 2021. Share count has doubled in 2021. I’m not sure why this company is still public with a market cap of 300k.

I’ll pass. Let’s move on to the last company.

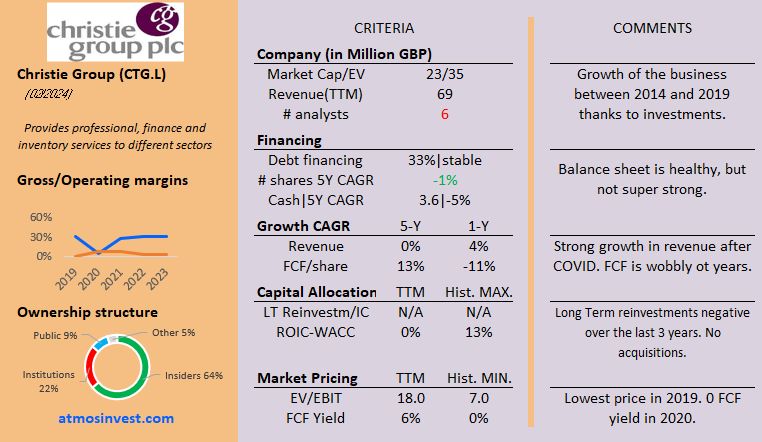

5️⃣Christie Group

Company Overview

Christie Group is a professional services company that serves businesses in the following sectors: Hospitality, leisure, healthcare, medical, childcare, education, and retail.

They have 2 business segments:

Professional and Financial services: valuation, buying, selling, financing, insurance

Stock and inventory systems and services: stock control, inventory management services and provides software and systems to the leisure and hospitality sectors

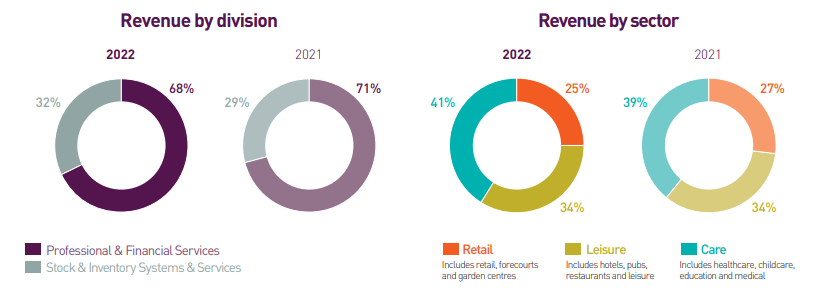

Here’s a quick overview of where revenues are coming from (2022 annual report)

Past Performance

The company has been hit by COVID when looking at past revenues. For 2022, they managed to increase revenue above 2019 levels for the financial services segment.

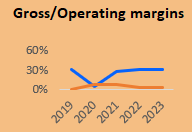

You can see this when looking at the gross margins:

While operating margins remain slim.

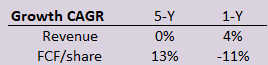

Revenue is flat in the sense that it has now recovered from the loss of business in 2020-2021.

Ownership Structure

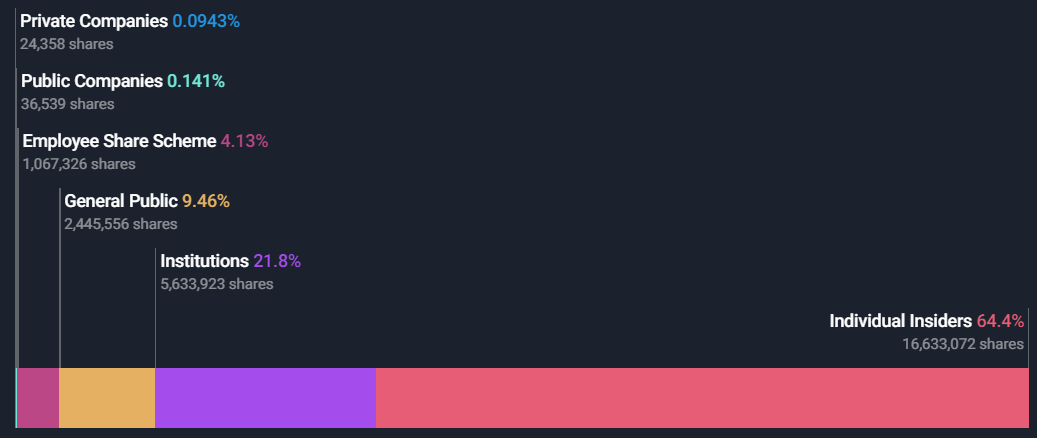

CEO makes 339,000 GBP per year and owns 0.3% of the company. The former chairman holds 20% of the shares.

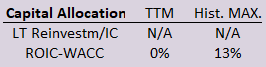

Capital Allocation

Looking at the cash flow statement, it’s not clear how they invest in growth. Being a services business, it’s logical that very few capex and mostly opex are booked. Growth is related to an increase in employees and sales/employees.

Economic profit was good in the past, but at the moment they are operating close to their WACC.

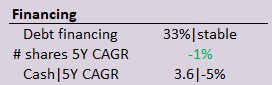

Financing

About 1 third of assets are financed by debt. Debt levels have been stable over the past years. There is a slight decrease in shares, but it’s small. Cash position is stable but has decreased over 5 years.

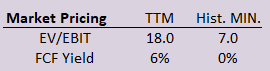

Pricing

It’s not trading cheaply based on historical data when looking at enterprise value on EBIT. However, FCF yield seems ok.

Conclusion

Here’s the full one-pager:

Decision: I’ll pass on this company for the following reasons:

This is a competitive industry and I’m not sure how they will be able to generate economic profit in the future

A small company should be increasing its revenue at a high rate. The company has recovered but is not able to keep up the pace looking at past 1Y growth.

If you want to check up on the company or want to dive into other small caps, check out

Summary

I’m getting the feeling we’re not saying NO as much as we would want to.

The NO-list now holds 7 companies

The potential deep dive list holds 4 companies

In the end, I’ll probably start cutting in the potential deep dive list.

Before finishing up, here’s a last question if I may:

Thanks for reading, and as always, may the markets be with you!

Kevin

Love these quick breakdowns Kevin.

Some super interesting businesses here

Would love to see more of this too!