We continue our investigation of our investable universe (go here to check it out) by using our process.

This is the part of our process where our goal is to create a one-pager and find reasons to say NO.

Last month, we went a little deeper into Brand24:

Here’s the thread that summarizes it.

A quick reminder of how the universe was created using the most powerful screener known to man: Uncle Stock

3-Y revenue CAGR of > 10%

Insider ownership > 15%

Institutional ownership < 5%

Excluding industries like finance, commodities

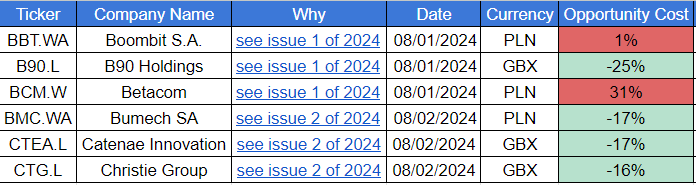

What does the opportunity cost look like for the companies we’ve said NO to?

Especially Betacom has seen a 30% increase over the last 2 months. Bear in mind that these are very small companies. We’ll see at the end of the year if some of the opportunity cost was meaningful. (the cost does not include currency risk at this time). It is too early to tell.

The 5 companies for this week are:

1️⃣DP Eurasia (DPEU.L) Domino’s Pizza in Eurasia

2️⃣Esotiq and Henderson (EAH.W) a Polish fashion producer

3️⃣Elkop (EKP.W) a Polish real estate business

4️⃣Energoaparatura SA (ENP.W) a specialized engineering company

5️⃣Ensurge Micropower (0JI9.L) a battery manufacturer

1️⃣DP Eurasia

Company Overview

DP Eurasia NV is a Netherlands-based company, which operates as a franchisee in Turkey, Russia, Azerbaijan, and Georgia of Domino’s Pizza. The Company offers pizza delivery and takeaway/eat-in facilities at its more than 570 stores which include corporate stores and franchised stores. Stores in Russia are no longer part of the company.

This one piqued my interest when I first got to the list of 64 companies.

Domino’s has been one of the fastest-growing franchises in the West. Can it work in the East?

Sadly, the company has been delisted since last week.

Here’s what happened

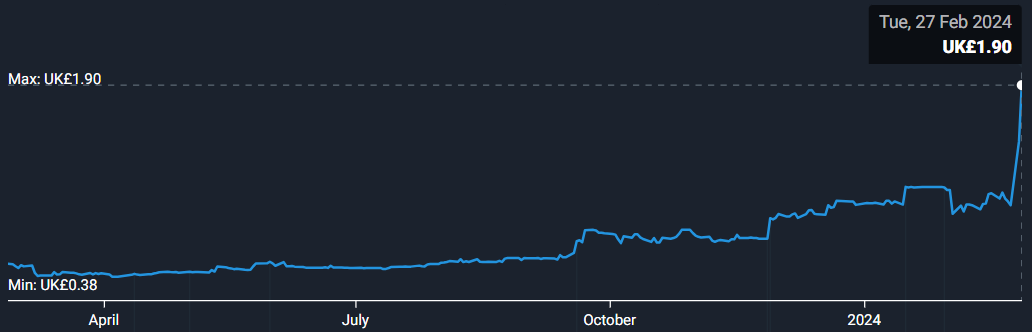

Nov 28th, 2023: Jubilan makes a first offer to acquire remaining shares at 85 pence

Dec 19th, 2023: Offer is raised to 95 pence

Feb 20th, 2024: Declaration of delisting following final 110 pence per share offer

And here’s how the price evolved over the past year.

Because the company has been delisted, the only thing we can do is ask ourselves the question: IF we had seen the company a year earlier, would we have put it on the potential deep dive list?

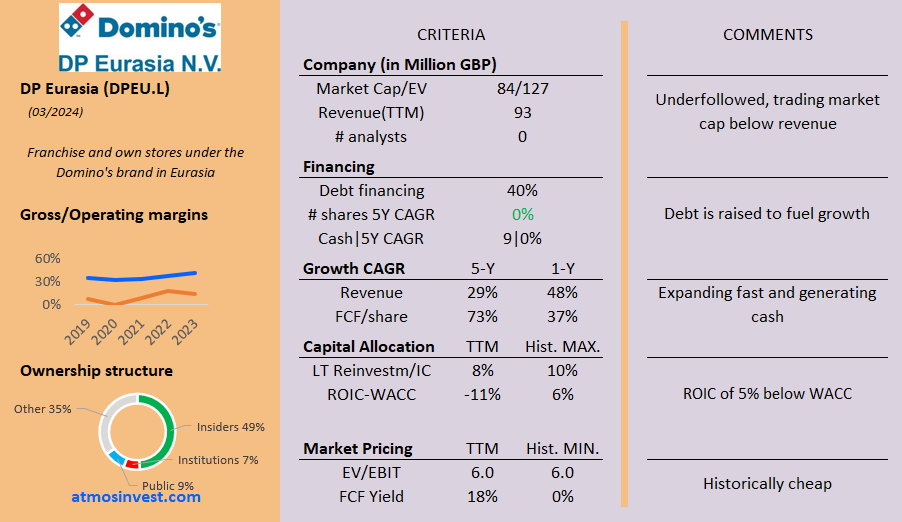

Here’s what the one-pager would have looked like at the end of 2022:

This is a high-growth company generating lots of cash and trading pretty cheaply.

It's always dangerous to judge with hindsight bias, but it looked interesting. I would have to dig a little deeper into why a high cash flow but low net income. And was the debt load ok?

I think this is a positive find. It shows that there are opportunities in the smaller underfollowed space. I couldn’t find any write-ups on this company. I had never heard about the Domino’s of Eurasia.

Up to the next company…

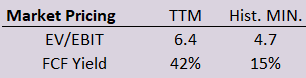

2️⃣Esotiq and Henderson

Company Overview

Esotiq and Henderson is a Polish underwear producer and retailer. It started in 1998, with the launch of its male underwear brand, Henderson. A few years later the Esotiq brand for women’s underwear followed suit. In 2005, they opened their first store.

It has been listed on the Warsaw Stock Exchange since 2011. It has since ventured into cosmetics.

They have franchise stores and own stores, in Poland and abroad.

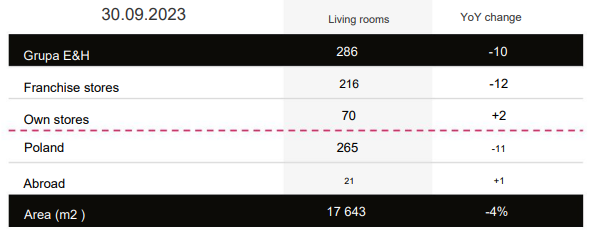

Here’s what it looks like based on the most recent Q3 2023 update:

Several franchise stores were closed, but still they managed to generate record sales, through their stores, online, and wholesale.

You can download their latest Q3 presentation and report in English by clicking the button below.

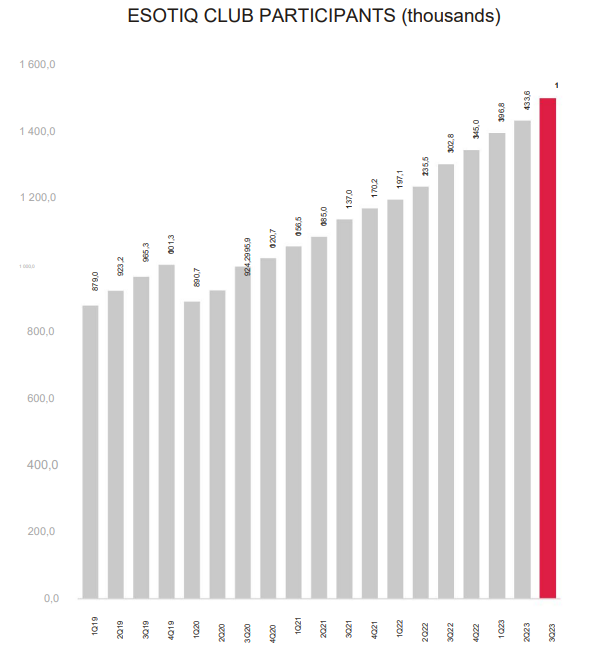

Their loyalty membership program keeps on increasing:

Past Performance

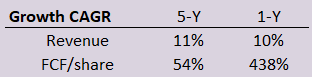

The company is showing steady growth at a 10% CAGR, so it sits in the mature growth phase of its life cycle.

It is generating solid free cash flow and growing. It continues to expand by opening new stores.

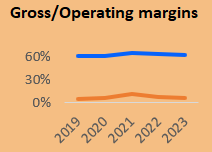

Gross margins are increasing above 60%. Operating margins hover between 6 and 7%

Ownership Structure

17% of the shares are still held by insiders. There is some institutional ownership which means it slipped through the cracks of your screener.

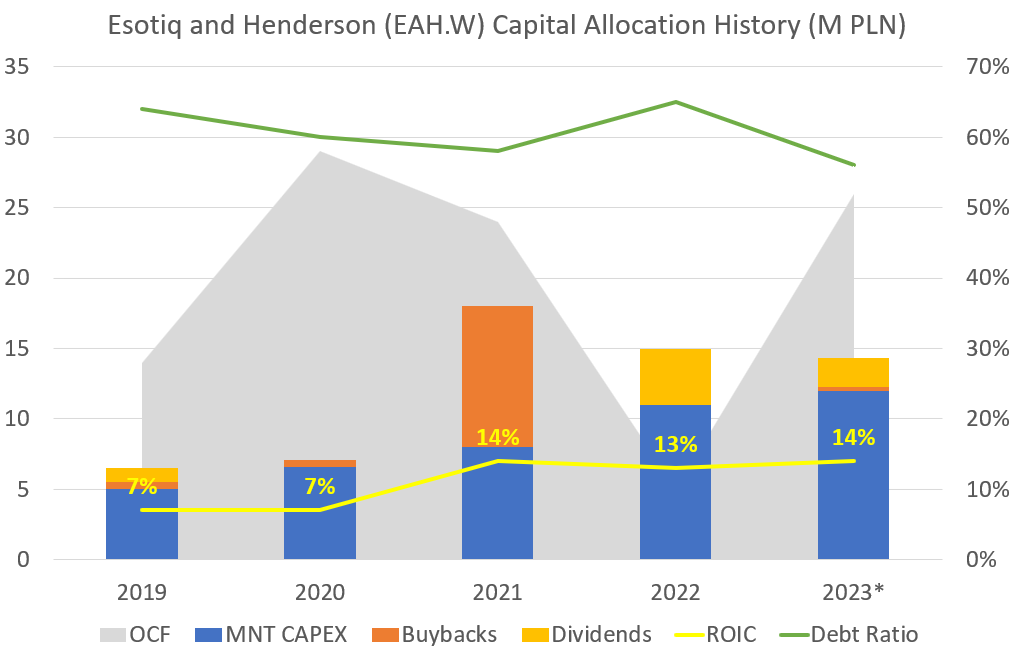

Capital Allocation

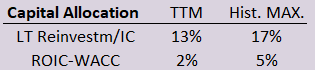

The company grows by opening new stores and focusing on online sales. They continue to reinvest.

They manage to achieve an economic spread of about 2% and they have been doing this for the past decade.

Here’s an overview of their capital allocation history for the last 5 years:

Increasing maintenance CAPEX related to increased store growth

Regular dividend payments since 2018, but put on hold during COVID

Some buybacks in particular in 2021

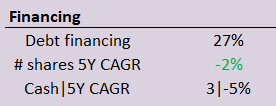

Financing

Part of the growth is financed through debt, but debt levels are acceptable and have been managed correctly throughout the decade.

Pricing

Pricing has increased since their lower multiple at the end of 2022 but is still below their 8-year mean EV/EBIT of 8.

FCF yield has been consistently positive since 2020.

Conclusion

Here’s the complete one-ager:

I will add the company to the potential deep dive list for the following reasons:

The company is easy to understand

Growth is modest at 10% but steady

Margins are increasing and cash generation is increasing

Couldn’t find any write-ups on the company. If you have any information:

3️⃣Elkop

Company Overview

Elkop is a Poland-based company engaged primarily in the real estate business.

The Company’s main activity consists of offering real estate for various purposes for rent. Its focus is on finding and buying property, which has office space, opportunities to trade, or is of industrial value.

Elkop operates mainly in Polish cities, with a focus on cities such as Plock, Chorzow, Elblag, and Poznan. It started 70 years ago and IPO’d in 2013.

Its real estate is focused on warehouses and office space.

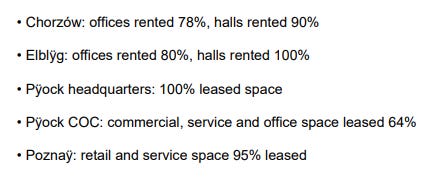

Here is an overview of where the real estate is located:

Past Performance

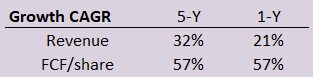

Growth has been impressive over the last 5 years:

ELKOP SE owns real estate with a total value of PLN 129M PLN office space, production and warehouse halls and land with a total area of over 93,000 m².

Here is what the occupancy rate looks like for each property:

Ownership Structure

51% of shares are owned by insiders.

Capital Allocation

Capex is mainly spent to maintain the properties. There hasn’t been any spending to increase or buy new properties over the last year.

Although ROIC vs WACC is negative, I’ll need to dig deeper and do my own calculations.

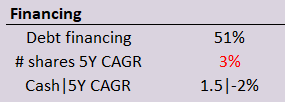

Financing

Debt financing was 77% in 2019 and has steadily decreased towards 51%.

The share count has increased at a 3% rate over the last 5 years and more than 4% over the last 10 years.

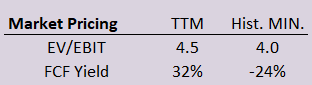

Pricing

This business is trading at historically cheap levels when looking at EV/EBIT or EV/FCF.

Conclusion

Complete one-pager:

The past 5 years of this company seem solid.

There has been an increasing number of shares, but the growth has been a lot faster, so that doesn’t bother me.

What also attracts me is that no dividend has been paid over the last 5 years, which for a Polish company is very unusual.

I like unusual.

The most important question that needs answering is where did all that growth come from, and how will they sustain this into the future?

The problem is, that I’ve never invested in a real estate company, and at this time, I consider it to be outside my circle of competence.

It goes to the NO list.

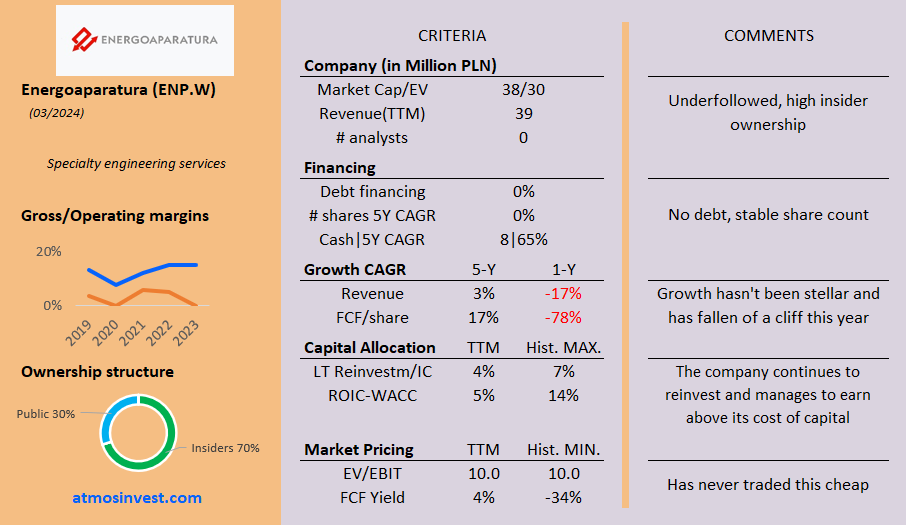

4️⃣Energoaparatura

Company Overview

Energoaparatura SA is a Poland-based company engaged in specialty engineering, building, and architectonic services. Energoaparatura SA undertakes projects in such fields as instrumentation and control, electric works, as well as building installations.

Here’s what the one-pager looks like:

I’ll keep this brief, in summary:

The company has stable gross margins except for COVID years

It has high insider ownership

No debt, strong balance sheet

Growth is decreasing

Capital allocation is ok

It seems cheap but we would need to dig deeper to reveal if this is true or not

It’s going to the NO-list because of sales (or lack of growth).

All value starts with sales growth. Before COVID, their 5-year CAGR was a negative 22%. They took a massive hit during COVID-19 and have since recovered, but I can’t see how they will achieve a higher than 10% growth rate in the coming years.

5️⃣Ensurge Micropower

Company Overview

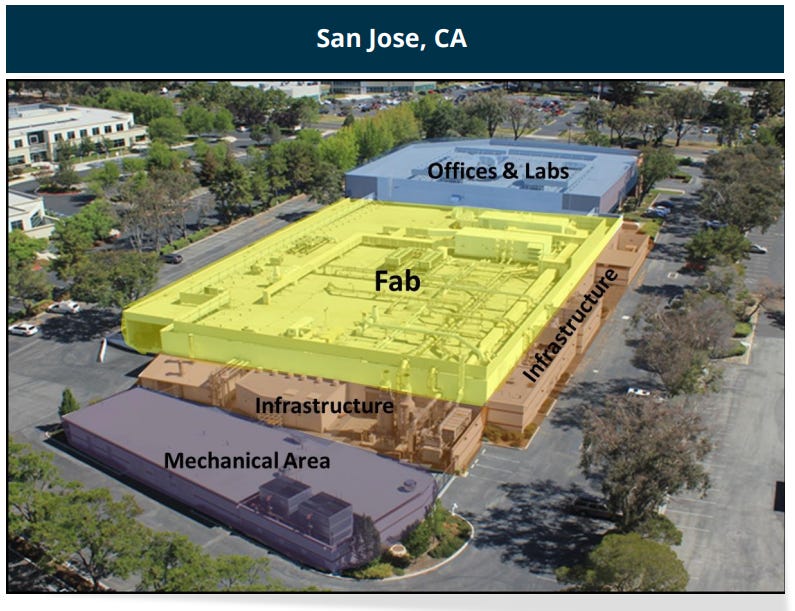

Ensurge is a company that aims to develop a solid-state lithium micro-battery and is based in Norway.

With a production facility in San José California:

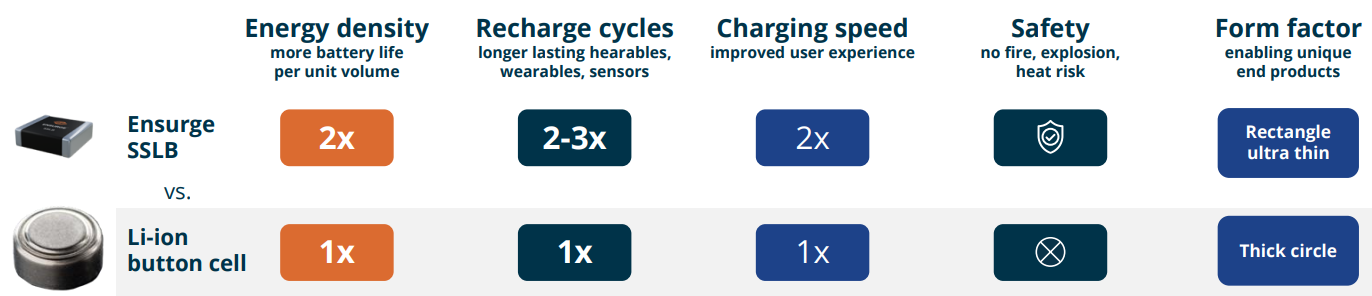

And in one image, why they claim their battery is better than a normal Lithium battery at this time:

I couldn’t find any information on a cost comparison.

And here is the one-pager for Ensurge:

Summary

This is a company still in the start-up phase of its life cycle. I’ve added the month before cash runs out rate to the one-pager and it currently sits at about 3 months.

The company is seeking funding to cover the year 2024. Its revenue is not meaningful.

Although I sometimes invest in early private start-up companies, this one is way out of my league.

A solid understanding of the solid-state battery market and how far Ensurge has come is needed before even considering this company.

It goes to the NO-list

Conclusion

That’s it for this week. We’ve added one company to our potential deep dive list.

Here’s what our potential deep dive list looks like after going through our investible universe:

Our waiting cost has been negligible up until now. Once the list becomes somewhat longer, we’ll need to go through the companies in a second run and pick one.

Thanks for reading, and may the markets be with you, always

Kevin

Awesome article Kevin. What are your thoughts on the wider Polish stock market? Some very solid individual stocks there no doubt

Hey Kevin. You are more than welcome to take a look at Betacom SA on my blog here:

https://activebalance.substack.com/p/growing-cheap-and-neglected