To celebrate the new TV show “Fallout” on Prime Video, I created a thread where I joined my passion for the Fallout franchise with investing in the stock market.

You can check it out below if you’re interested.

Here’s a glimpse:

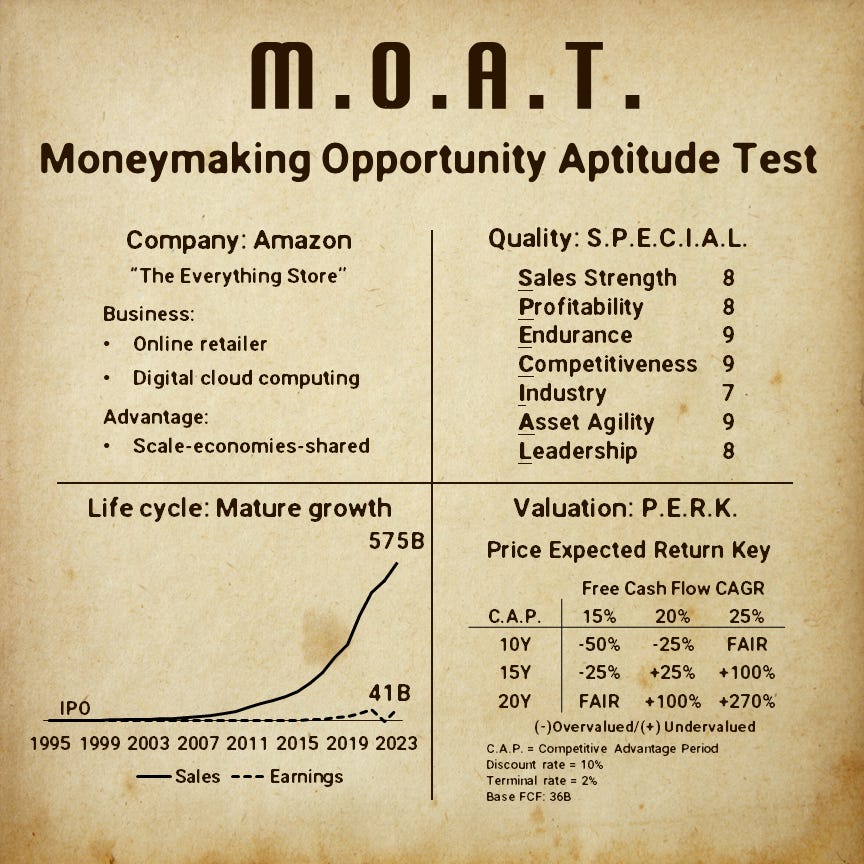

What makes a company S.P.E.C.I.A.L.?

You’ll have to read the full thread through the below button:

All fun aside, I am developing my ranking system to assess how SPECIAL or how high the quality of a company is. More on that in a future article.

We continue our investigation of our investable universe (go here to check it out) by using our process.

This is the part of our process where our goal is to create a one-pager and find reasons to say NO.

Here is a quick reminder of how the universe was created using the most powerful screener known to man: Uncle Stock

3-Y revenue CAGR of > 10%

Insider ownership > 15%

Institutional ownership < 5%

Excluding industries like finance, commodities

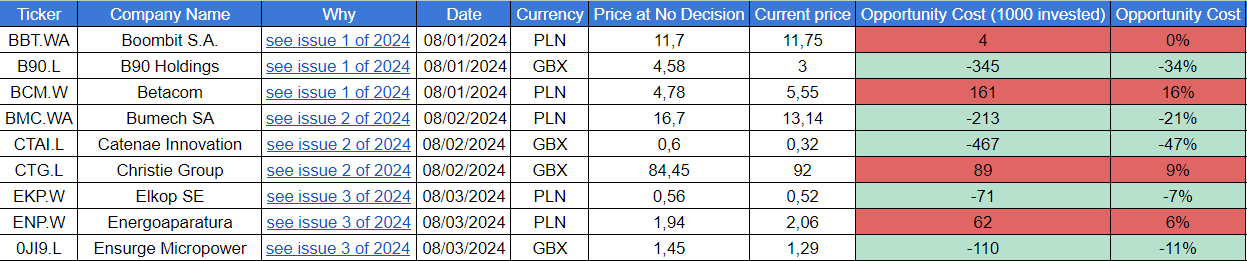

What does the opportunity cost look like for the companies we’ve said no to?

Click here to go to the file

Red means the stock has gone up. Green means it has gone down.

At the moment, it seems we’ve made the right call, but it is too early to tell. It’ll take a year or 2 to get a first idea of what the possible opportunity cost was. We’ll continue tracking it to verify if our screening process is solid.

The 5 companies for this week are:

1️⃣Gelion PLC A battery manufacturing company in the UK (GELN.L)

2️⃣Gfinity An esports company in the UK (GFIN.L)

3️⃣Global Ports Holding An independent cruise port operator (GPH.L)

4️⃣Grammer AG A German manufacturer of interior components for the automobile sector (0OQX.L)

5️⃣Grodno Spolka Akcyjna A Polish distributor of electrical and lighting fixtures (GRN.W)

Let’s dig in!

1️⃣Gelion PLC

Company Overview

Gelion plc is a renewable-energy storage innovator. It conducts research and development in battery systems and associated industrial design and manufacturing. It is engaged in the development of two battery chemistries-Lithium-Sulfur (Li-S) and Zinc hybrid cell technologies.

The company was founded in 2015 as a spin-off of the University of Sydney and has been listed on the London Stock Exchange since 2021.

The company is debt-free but continues to raise money through equity to fund its research in developing a new generation of battery solutions.

They had about 2 Million GBP in revenue for the year 2022, but as expected, do not make any profits.

An important indicator with such a company is the Month Before Cash Runs out which sits at 30 months at this time. So the company is sufficiently financed.

Conclusion

I’m going to have to pass on this one very quickly. This would be in my too-hard pile.

The company has no proven record of business performance. We would have to dig deep into the technology, the state of the battery market, and a competitive overview.

Although there have been positive developments in the past, they are still trying to commercialize their products.

Decision: PASS ➡️To the NO-list

2️⃣Gfinity

Company Overview

Gfinity plc is a technology and media company in the video gaming industry. The Company specializes in building digital highly engaged communities for gamers, both for its brands and on behalf of others. The Company operates through two groups:

Gfinity Digital Media Group: The digital home for gamer lifestyles. Its network of Gfinity-owned and operated websites drives up to 15 million visitors per month. It creates monetization opportunities through advertising, brand partnerships, and e-commerce activities. It includes related social platforms.

Jointly owned properties include long-term commercial partnerships with organizations that have a strategic need to connect with gamers. This includes the Global Racing Series, in conjunction with Abu Dhabi Motorsports Management, in which the Company offers services, including broadcast production.

Quick analysis

Revenue has decreased at a 15% CAGR over the last 5 years. They are in the process of divesting parts of their business. Their goal is to rebuild a digital media network with about 12 websites. The aim is to get to a profitable business by drastically cutting its operating costs, but revenues keep on declining. They have no debt.

Conclusion

Again, this is a quick pass. Revenues are the oxygen for any company. There has to be growth and I do not invest in turnarounds. The only exception is if a business is downsizing one part of its business and seeing rapid growth in a new product or service line.

This is not the case for this company.

Decision: PASS ➡️To the NO-list

3️⃣Global Ports Holding

Company Overview

Global Ports Holding PLC is a United Kingdom-based independent cruise port operator. It operates over 27 cruise ports in 14 countries. It also provides a range of primary port services for cruise lines, passengers, and crew.

Quick analysis

Revenue has been steadily increasing. But no economic value is being created as ROIC (1.5%) < WACC. The company also has a lot of debt. The debt to FCF ratio, in other words, the time it would take to pay off all debt is 200 (which is massive).

In addition, compared to 2022, the CEO compensation has gone from 500k to 1.3M. Yes, the business is improving after COVID in 2020, but I wonder what the incentives are…

Conclusion

This is not the kind of company we are looking for. Not enough quality related to the above reasons.

Decision: PASS ➡️To the NO-list

4️⃣Grammer AG

Company Overview

GRAMMER is a Germany-based company that is active in the automobile and auto parts sector. The Company develops and manufactures components and systems for automobile interiors, as well as driver and passenger seats. It is organized into two business segments:

The Automotive segment supplies headrests, armrests, and center consoles

The Seating Systems segment provides driver seats for trucks and off-road vehicles, including tractors and agricultural machinery, construction machinery, and forklifts, as well as driver and passenger seating solutions for trains, coaches, and inter-urban buses.

The Company operates approximately 40 product and distribution sites in Europe, North America, Latin America, Asia and Africa.

This is one of the reasons why I like doing an A to Z analysis:

The company has its origins over 100 years ago as a saddlery in Amberg, Germany (about 200 km from Munich). Later, in 1954, Willibald’s grandson started the Grammer company that produced seats for tractors.

The stock is of course traded on the German stock exchanges.

In 2023, it had about 14,000 employees and generated 2.3 billion euros in revenue.

They have come a long way from saddles and carriages:

Quick analysis

Let’s look at the one-pager and see what it tells us:

Margins have been declining but analysts are predicting an uptick in the coming years. The biggest problem is that the business has declined from a balance sheet point of view. The equity raise on itself was not enough, add to that the increase in debt levels to continue finance their growth.

On a positive note, revenue has resumed growth and is growing faster than in the past. Based on past metrics, it's not cheap in the market at an EV/EBIT of 15. But if the analysts are right, forward P/E sits at about 4.6 (from Simply Wall Street) which is more in the ballpark of what I would expect for this kind of company.

Conclusion

Based on the above analysis I’ll pass. Remember this company serves the automobile industry. This industry has its cycles, so the company will follow the ebb and flow of the market.

The main reason is that the balance sheet is not strong enough for my taste.

Decision: PASS ➡️To the NO-list

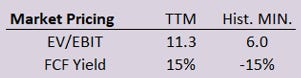

5️⃣Grodno Spolka Akcyjna

Company Overview

Grodno SA is a leading distributor of electrical and lighting products operating on the Polish market for 31 years. It is actively developing the green energy segment in terms of photovoltaics, heat pumps, and electric vehicle charging stations.

The company also provides services in the field of audits and electrical and lighting projects, implementation and modernization of electrical and energy installations, and programming of building automation. It is also a supplier of complex solutions for industry

It sells products in the wholesale and retail trade. The Company operates through a main office and a network of 36 local branches based in Poland. The Company also offers lighting and electrical installation design, technical consultancy, lighting maintenance, transportation, and disposal of used lamps.

Past Performance

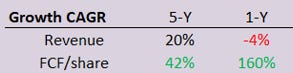

Grodno has shown some pretty impressive growth over the last 5 years, but growth has stalled in 2023.

But, as we’ll see in the capital allocation section, they’re FCF has increased, not only because of a rise in Operating Cash Flow, but also because there were no growth investments in the business over the last 2 years.

Margins are under pressure and are trending slightly down.

Ownership Structure

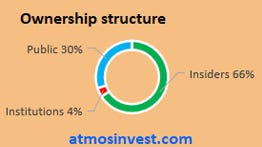

66% of the shares are still held by insiders. There is some institutional ownership at 4% which is low.

Capital Allocation

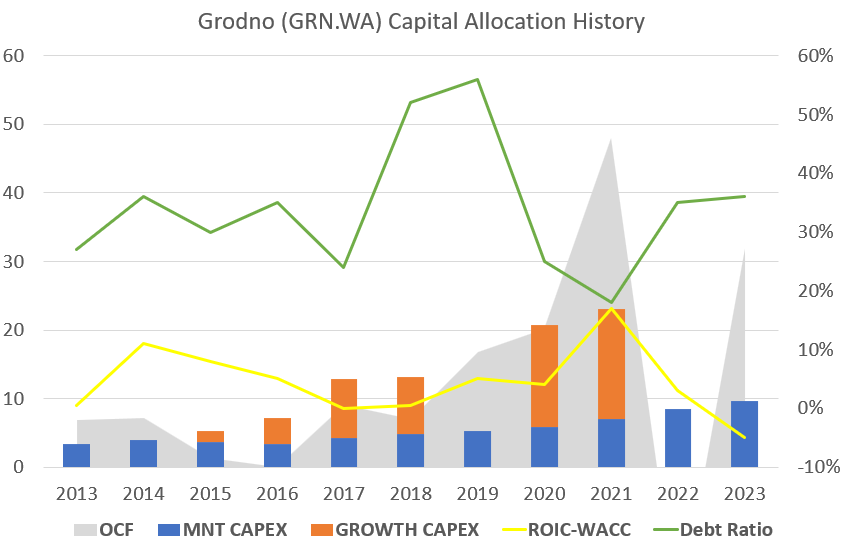

Here’s an overview of their capital allocation for the last 5 years:

They did some investing in the past, especially in 2020 and 2021 to grow their business.

No investments were made in the last 2 years.

Debt levels have increased but are similar to historical levels. More importantly, for the first time, their economic spread or ROIC versus WACC has plummeted below 0.

Financing

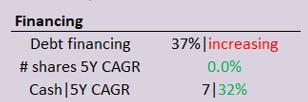

Part of the growth is financed through debt, but debt levels are acceptable and have been managed correctly throughout the decade. Their cash position has increased over the last 5 years.

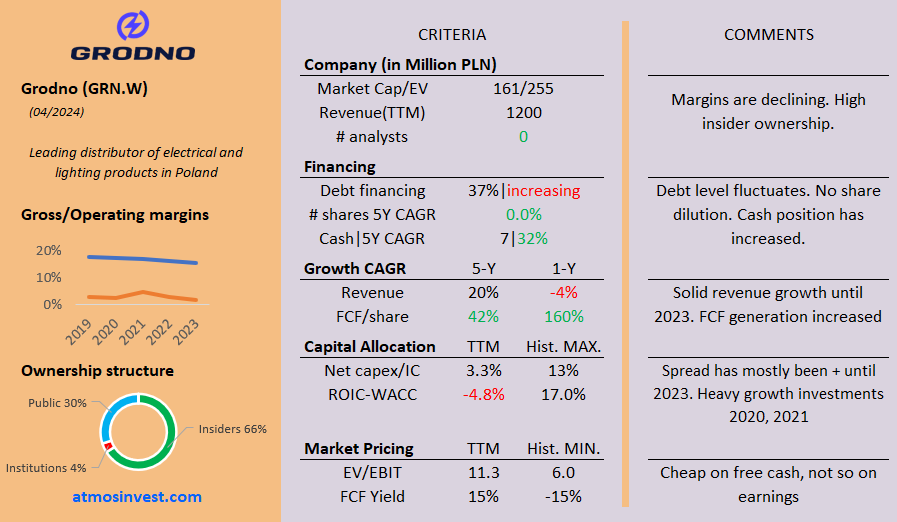

Pricing

The company looks attractive on an FCF yield. But remember the discussion on capital allocation.

If they want to continue to grow in the future, they will have to invest once more. This will lead to a lower FCF and a lower yield. The current past yield does not reflect the true price in the market.

Conclusion

Here’s the complete one-pager:

Again, I’ll have to pass on this company. I do not like the downtrend in ROIC and the FCF will come down because of future needs for investments. The company is a distributor, and I can’t see any obvious competitive advantages.

Decision: PASS ➡️To the NO-list

Further reading

I found some articles that could help you dig a little deeper into this company:

General Conclusion

So 5 companies and no clear winners.

You could say to yourself: What a waste of time. But that’s not true. Once you start doing this, you’ll notice that you go through them faster and faster. This allows you to turn over more rocks faster which is important in small and microcap land.

In the end, I always look for quality first:

The quality gives you a degree of probability for the future

The valuation gives you an idea of a possible expected return

It’s the combination of both that determines the investment case.

Consider the following example.

You have 5 companies and each company receives a quality score. The higher the score, the more likely it will endure and beat its competitors. Next, you have the expected yearly return (EYR).

Out of these 5, which one would you choose

If quality equals probability, theoretically, you should pick number 5. But I believe there is a threshold of quality, a lower limit. After all, company n°5 has multiple scenarios that will lead to a complete loss of principal.

It’s not that hard to find high-quality companies in the market, but expected returns are usually lower.

This is what I’m working on. A system based on a SPECIAL score and an expected return which will allow us to:

Rank all the companies in our portfolio

Since I’m fully invested -> if I find a company better than the lowest rank -> Sell the worst and add the newest

That’s it for this week.

So our potential deep dive list has not changed. Here’s what it looks like, with its included waiting cost.

Our waiting cost has been negligible up until now. Once the list becomes somewhat longer, we’ll need to go through the companies in a second run and pick one.

Thanks for reading, and share your thoughts in the comments!

May the markets be with you, always

Kevin

Esports is a very interesting sector. No idea how fundamentally strong it will be, but it's one of those that grabs my attention...