Lots of quotes and statements by Buffett are often misinterpreted.

This article by

is a great read and emphasizes that.The young Buffett invested in Generals & Workouts

Generals: Nothing special, but plainly undervalued, net-nets,...

Workouts: Special situations, mergers, arbitrages, spin-offs,...

On a CAGR basis, these were his best years. From 1957 to 1968 the Buffett Partnership averaged 31.6% (25.3% for limited partners).

The older Buffett, now that he had too big of a capital base to invest and in partnership with Charlie Munger, invested in Quality Companies, in inevitables. He tried to find business with a long competitive advantage period.

Quality at a fair price. Just to emphasize this, he almost never paid more than 15 P/E for a company.

But P/E’s of 20 to 30 are now common. I did it too when purchasing Dino Polska (DNP) at a P/E of 24. And I might be wrong about that (I’m writing a bear case on the company to try to kill that idea). Not that it’s not a good business, but the long-term performance might turn out worse than we expect.

And Buffett on numerous occasions was an active investor. In certain cases, he kept buying until he got a majority of the shares. Then he was able to leverage the board into distributing the value of the company to its shareholders.

You can learn more about it in a previous article, or just read this incredible book: The deals of Warren Buffet: The first 100M.

So as a private investor we should be careful and try to uncover the real lessons from Buffett’s investment approach.

Buffet has been investing for 7 decades.

What has changed over all this time?

More and more industries have intangible assets

More market participants, more efficiency in the markets

The increase of passive investing, where companies are bought disregarding valuation work

A bombardment and ease of access to information (an investor in the 50’s had to do the hard work, life Buffett going through a 1000-page Moody’s manuals)

Excessive profits, some of the most profitable companies in the history of mankind exist today thus having higher prices in the market.

Increased winner-takes-all economies where certain companies grow into Trillions USD of market cap (due to network effects and global reach)

So, can we still apply what Buffett did in the past taking into account this change in context?

Accounting still hasn’t got a great solution to value intangible assets, but a mental model like the competitive advantage period can help tie strategy to accounting

Although the market overall has become more efficient, there are still moments of inefficiency and local geographical pockets of inefficiency if one bothers to look

Information is now widely available. So where is the edge for an investor? You could say the only edge an investor has now is taking a long-term view and his temperament

My takeaway is this:

Investing in high-quality compounders is still possible, but people are paying a pretty hefty price. Doing the work now, and then lurk and wait to jump in is key. This strategy might take a lot of time. It requires enormous patience.

Action: Make a list of high-quality companies you’d love to own, but are too expensive. Then wait, and wait some more. You could call this your “buy on a crash”-list

Microcaps in illiquid and lesser-known markets still provide the best informational edge if one is prepared to do the work (like going A to Z through the filings) and not relying on a screener or other software tools. You’ll be looking for changes. You’d be surprised to find information the market just hasn’t reacted to yet. But, these situations are rare. You might go through a hundred filings, and find nothing. This is treasure hunting “pur sang”.

Action: Do an A to Z analysis of company filings in a certain country and try to find information on the future development of a business that the market is not noticing. (you’ll may find opportunities just like Buffett did with his PetroChina investment)

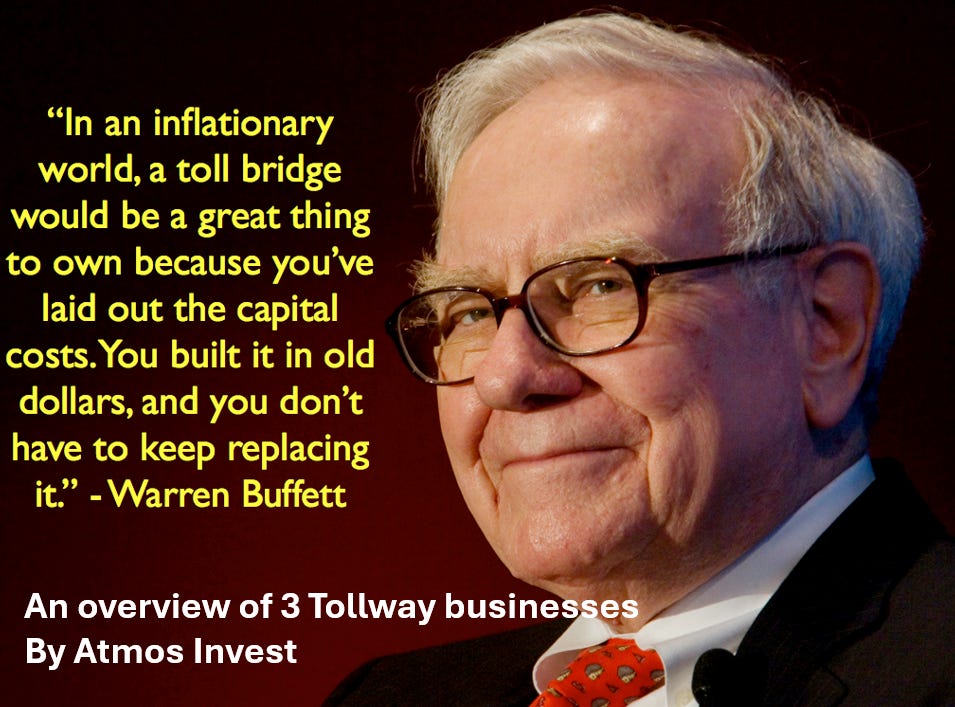

Today, I wanted to create a list of a specific company Buffett mentioned in the past.

The Tollway companies.

Buffett loves the toll bridges type business. How could you not? They have particular characteristics:

Pricing power

Sort of a monopoly position

Predictable recurring cash flows

The main capex is done, and the infrastructure is there

The ongoing transformation of business from the tangible to the intangibles has created digital tollways.

A 30% fee for Apple’s app store ✅

A 30% fee for publishing a game on Valve’s Steam ✅

But these digital tollways are food for another article as I went down the rabbit hole researching these Toll Bridges.

Physical Tollway companies

Atlas Arteria Limited (ALX)

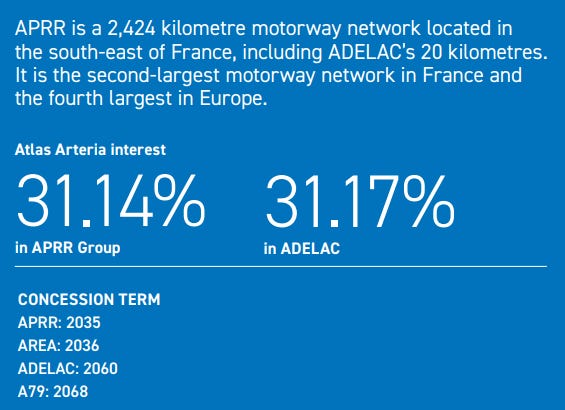

By accident, I’ve been focused on the Australian markets lately, like my write-up on Connexion Mobility. So it came as a surprise to find a company trading on the ASX which holds a 30%+ interest in APRR, one of France biggest operators of motorways and a 13% interest in a toll road investor partnership for the Dulles Greenway toll road located in Virginia, the United States.

As you would expect from these kinds of companies, the goal is cash generation and paying out dividends to the shareholders.

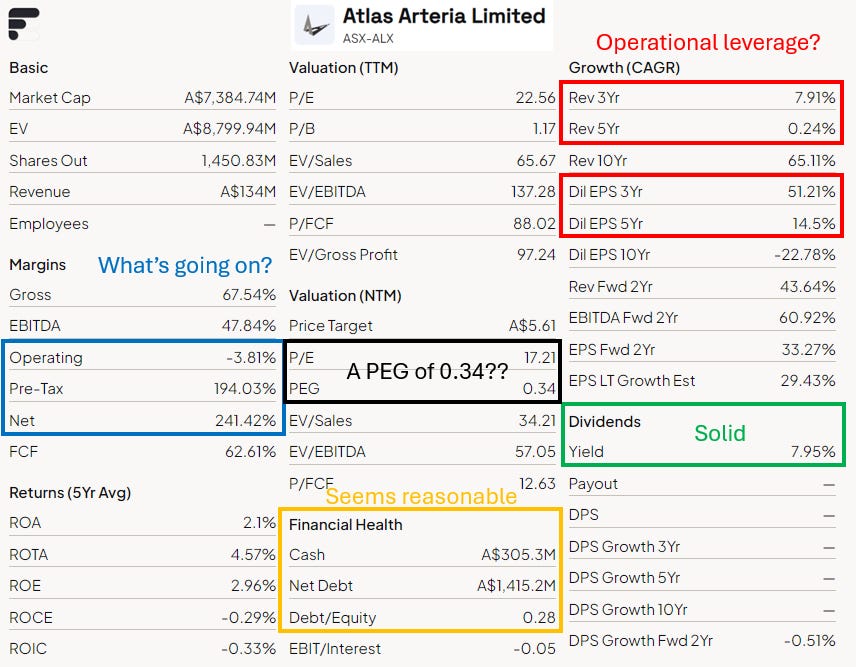

The company is showing some operational leverage at a first glance as EPS is increasing more quickly than revenue over the last 5 years. Its current dividend yield sits at almost 8%. Gross margins are high. But then, just as I thought I understood the business, they have negative operating income, and a 241% net margin. A PEG of 0.3?

In addition, their annual report talks about inflation hedged investments, as they have the pricing power to follow inflation if needed (exactly what you would think of when looking at a tollway company). Because of the recent decline in share price related to new taxation in France on a concession which might impact a contract they have with APRR, the board has approved a buyback program. I must admit, I like this company already. They could just keep on providing a dividend to shareholders, but they seem to acknowledge that a buyback could bring in more value.

So let’s dig a little deeper

The income statement is somewhat distorted.

Revenues are recognized for a part of their business where they own 100%. The ownership they have in companies like APRR is accounted as Income on Equity investment which explains the net margin surpassing 100%. One important factor, these concessions they have with APRR and the French state are limited in time, with the most important one ending in 2035.

Let’s take a quick look at the cash coming in from their stakeholders compared to the cash they are paying out to shareholders:

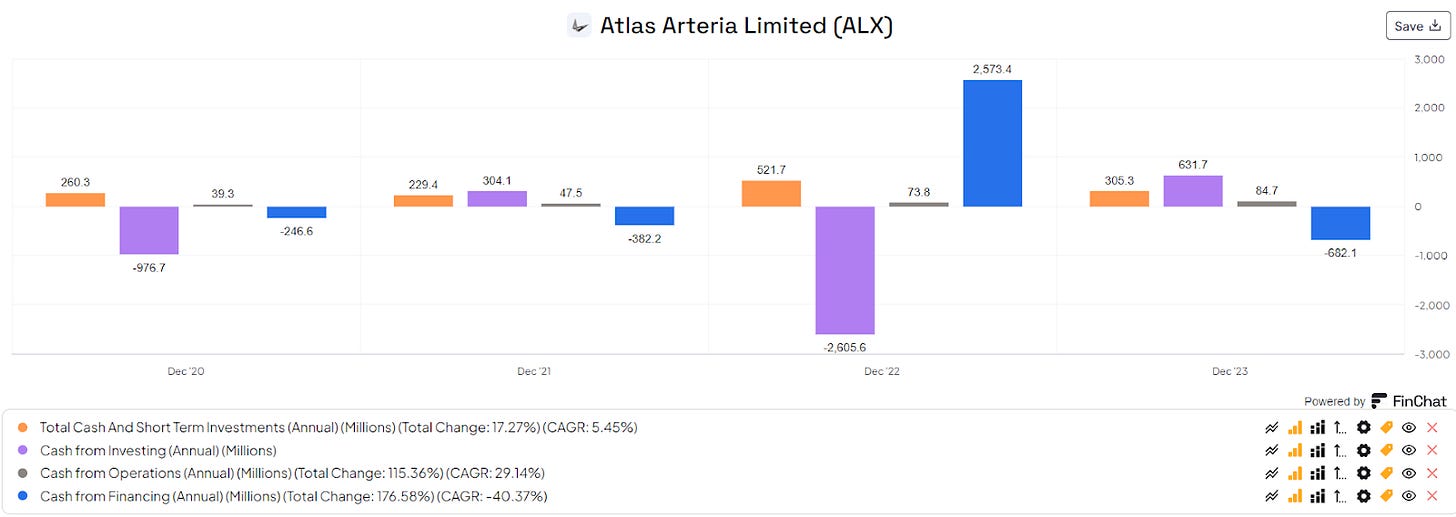

You can see the investing activities drop 2020 and 2022 where they expanded their business. 2023 is a pretty good measure as it shows what the cash earnings power of the company is based on current property and stakes. They did take on debt in 2022 to finance the acquisition. The cash from operations is low because the accounting where most of the cash comes through equity holdings.

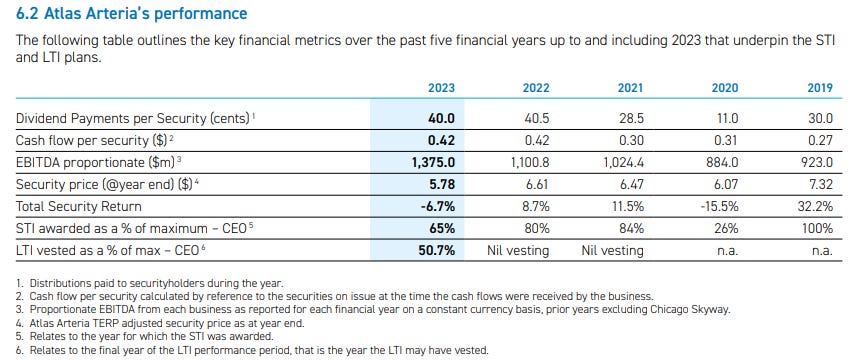

Short-term and long-term incentives are listed in the annual reports where the long-term incentives are linked to a Total Shareholder Return hurdle rate relative to other companies in the industry.

This could be a great defensive investment if you like taking a little bit more risk than a fixed income bond, but with inflation protection. Although the company has debt, it has great cash flow generating capabilities. They had about 700M in cash which they used 100M to pay down part of debt and 580M was distributed as a dividend compared to a long-term debt of 1.5B.

Now for a tollway company, the past performance for shareholders has been quite impressive. I would have expected a share price going sideways or slowly rising and lofty cash distributions towards shareholders. But in the case of Atlas, imagine you bought 10,000 shares at the end of 2014, your capital would have risen 5-fold and you would have received 20,000 AUD in dividends over that period.

That sure passes my 15% hurdle rate. Not too shabby!

But will the past be repeated? I’ll need to dig deeper into the company to better assess the future. The beauty of these kinds of companies, is notwithstanding future equity stakes in other tollways, you have a pretty good idea of future cash flows based on what they have now and the duration of current concessions.

There’s a lot of predictability. But alas, you pay for predictability in the markets.

Let’s look at another one

Transurban Group (Ticker: TCL)

This time it’s an Australian company operating and managing Australian toll road networks (mostly)

It operates 21 toll roads in Sydney, Melbourne, and Brisbane in Australia; the Greater Washington area, the United States; and Montreal, North America.

This one is a lot bigger, at 38 Billion AUD market cap and 1900 employees.

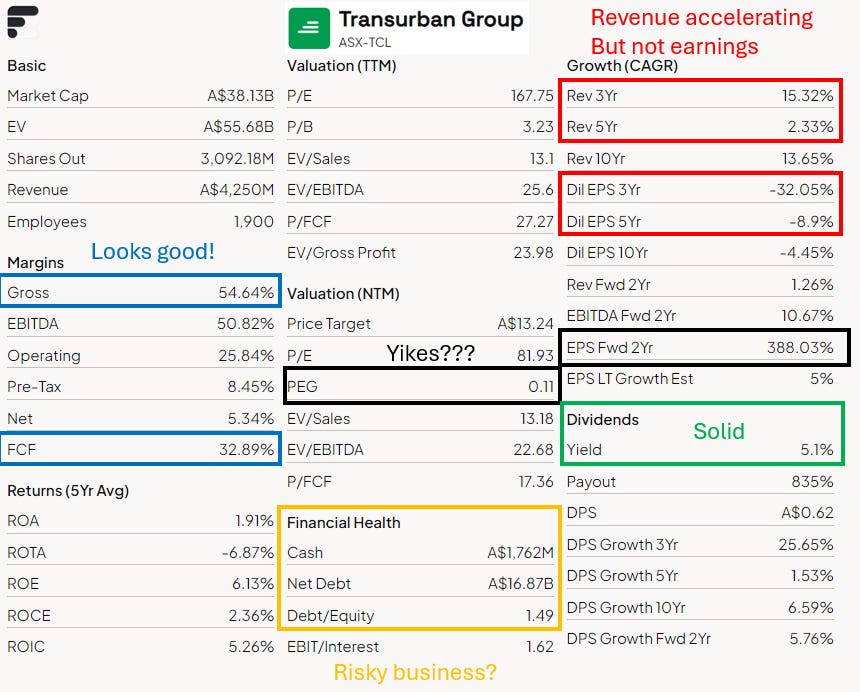

The financial statements look completely different. Revenue is accelerating, great free cash flow margin at 33%. But the company has a lot more debt, we’ll need to so how much cash it generates to see if this is a problem. And Finchat estimate the PEG at 0.1 because of a forward EPS growth rate of 388% .

They have a similar structure when it comes to their income statement, but their operating profits are reduced due to losses on their equity investments (stakes in other roads) and their debt payments.

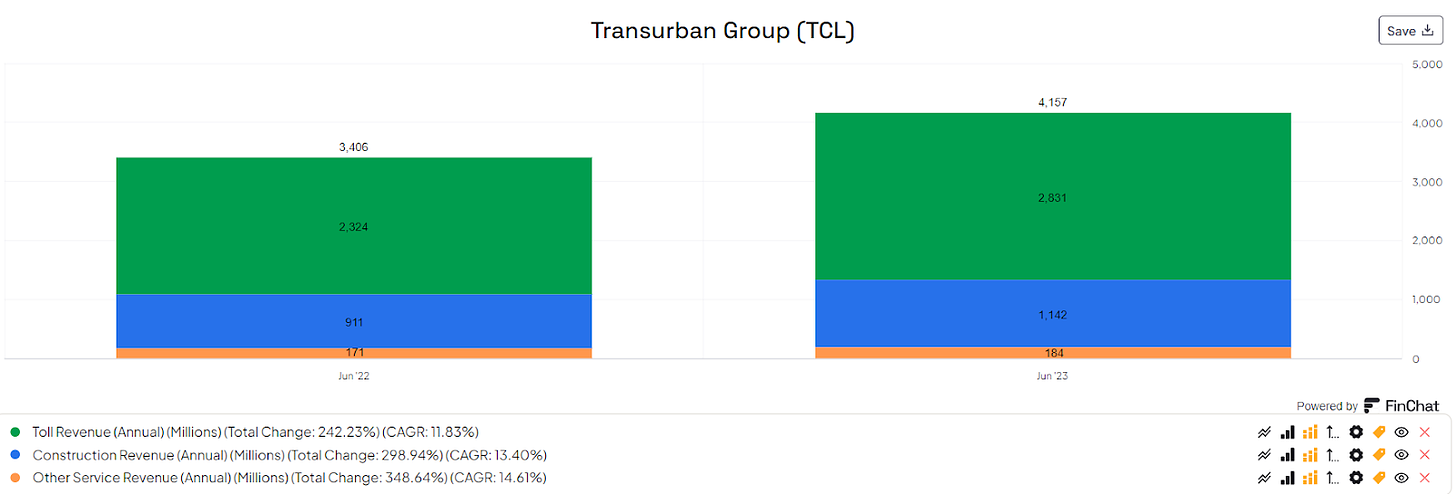

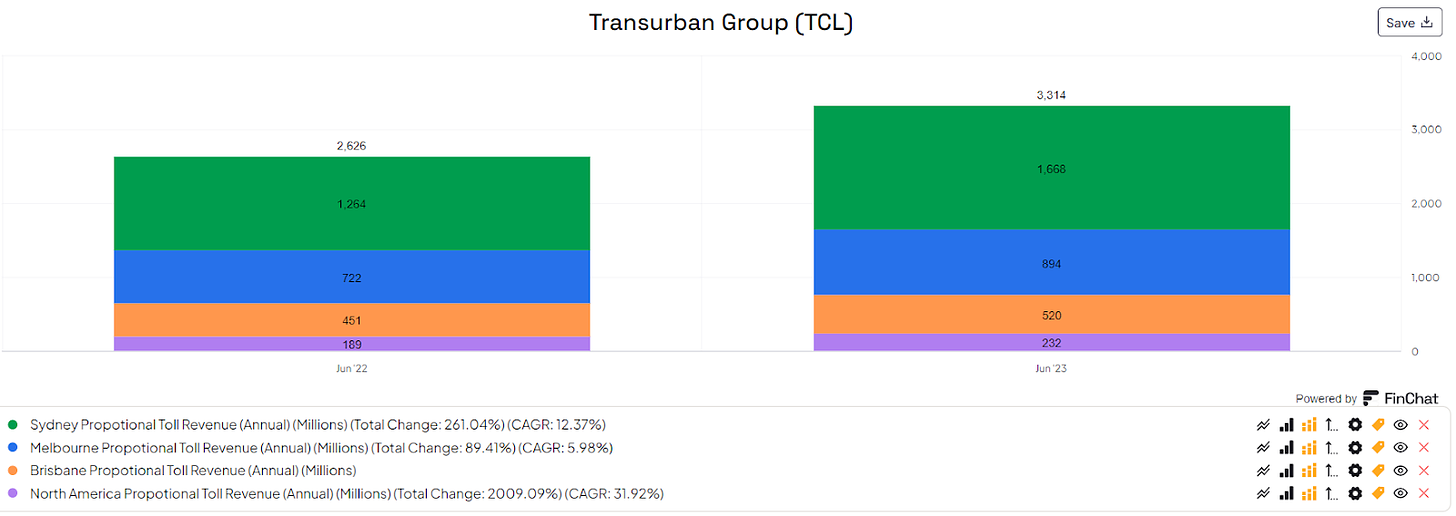

What’s nice with Finchat is it sometimes offers additional segment breakdowns so I do not have to go into the annual reports. Here’s where the revenues come from:

With the majority coming from toll, but also part of their construction business, which is of course lower margin.

And when looking at it from a regional point of view, we see that most of revenue comes from Australia:

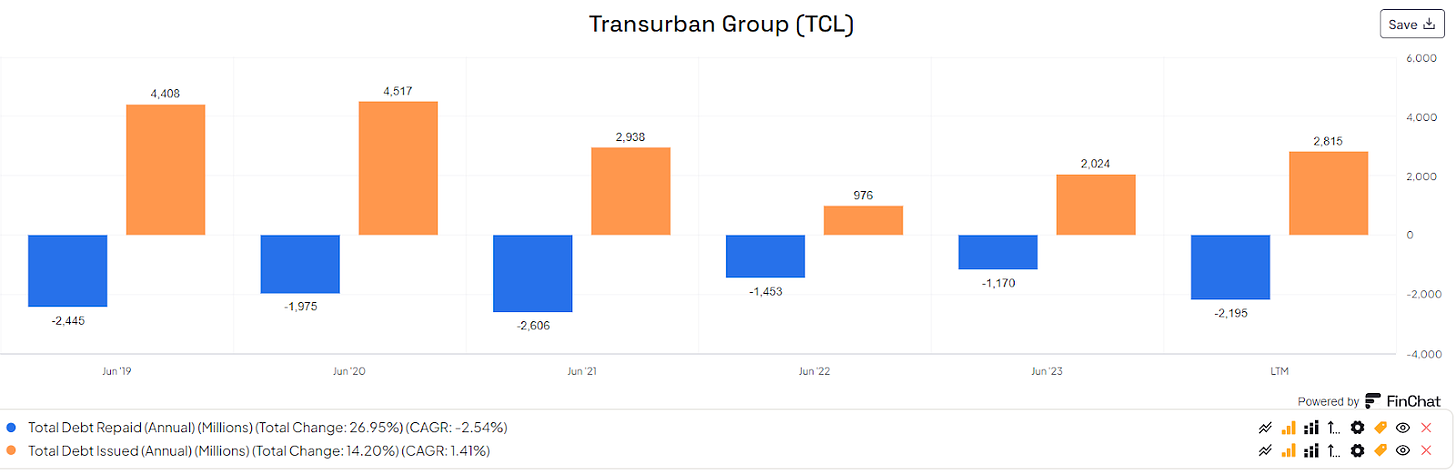

When it comes to debt, the company is constantly issuing and paying down debt:

But on a net basis, long term debt is more or less stable hovering around 16-18 Billion.

Is this a problem?

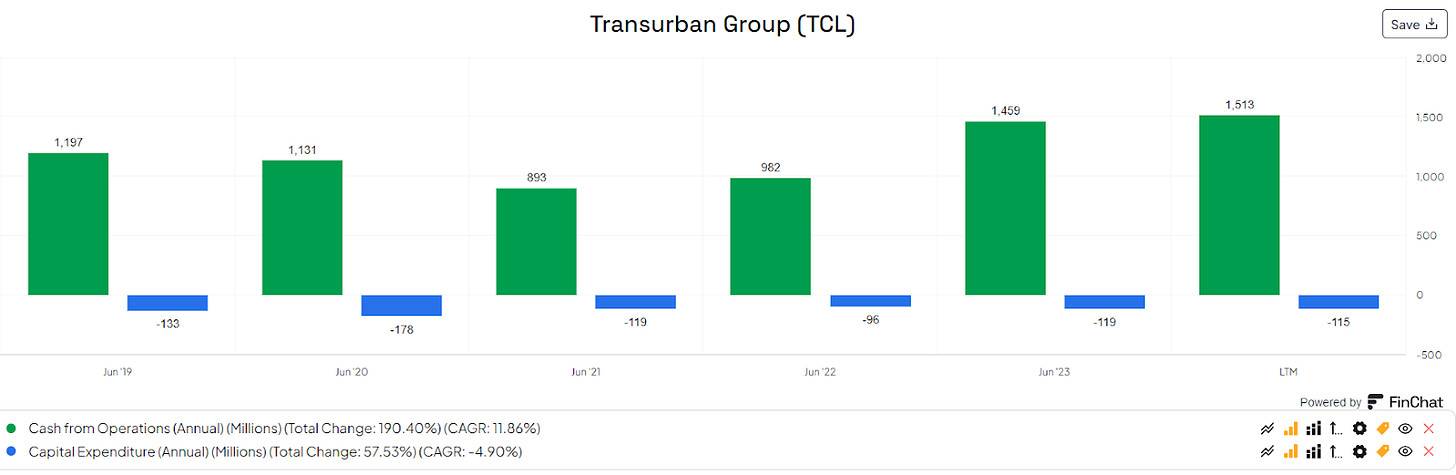

Cash from operations is good, and capex are low:

So we’ll have to dig into the terms of the debt, but 16 Billion and 1.5B in cash coming in each year, that’s too much for me.

Let’s leave Australia and go to Dubai

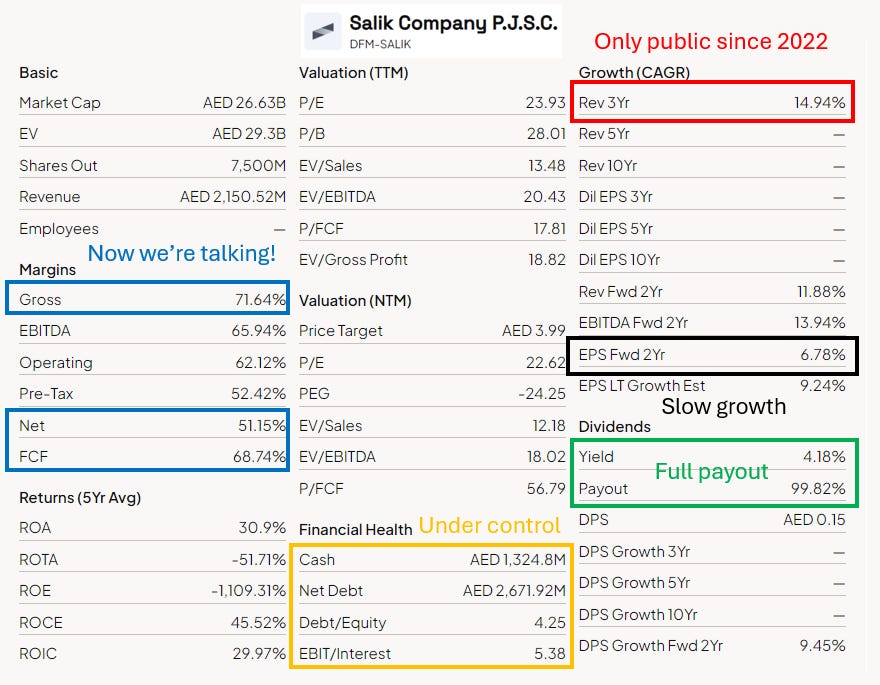

Salik Company (Ticker: SALIK)

Here’s a brief description on what the company does:

Salik, meaning “open” or “clear” in Arabic, is Dubai’s exclusive toll gate operator and currently operates eight automatic toll gates utilizing Radio Frequency Identification (RFID) technology throughout Dubai. Salik’s toll gates are located at strategic junctures throughout Dubai, especially on Sheikh Zayed Road which is considered Dubai’s main road. Under a 49-year concession agreement (ending in 2071) with the RTA, Salik holds the exclusive right to operate current and future toll gates across the Emirate of Dubai.

Salik can also engage in new business activities within and outside Dubai as per Salik’s decree of establishment.

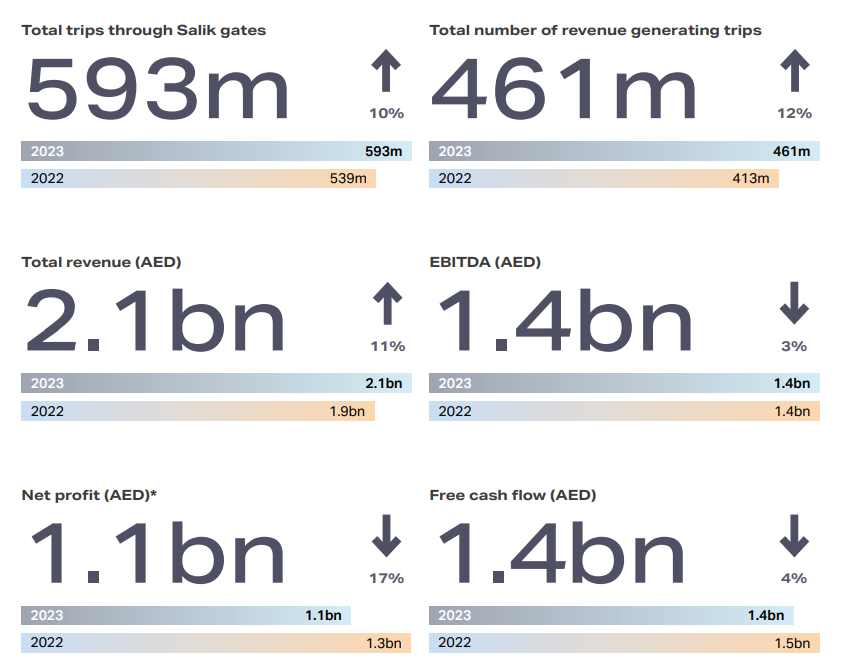

Salik is a lot more straightforward compared to the previous 2 companies:

CAPEX is very low

Dividends paid: 1 Billion

Long-term debt: Stable at 4 Billion

Stable operating cash flow of 1.4 Billion

Net Income was lower in 2023 due to interest payments (no payments before)

So the investment case becomes pretty simple:

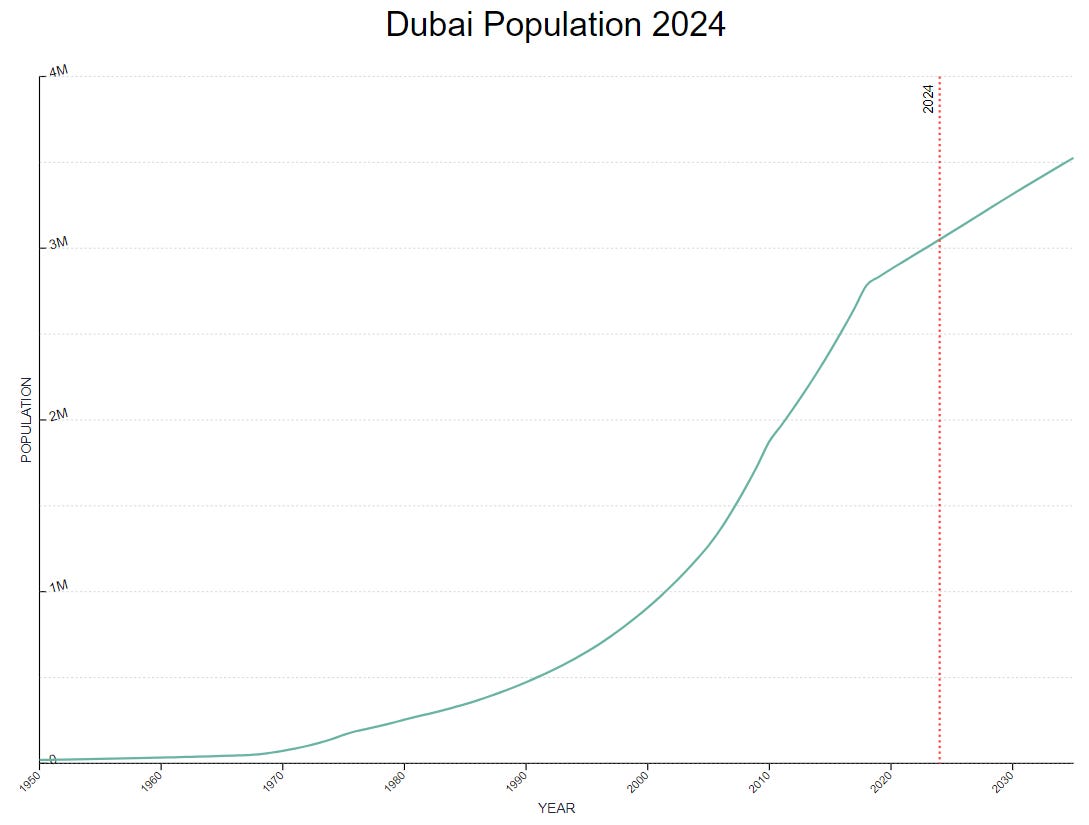

What kind of growth can we expect in Dubai? How will the number of trips change in the future?

Well this is the past growth of the local population, increasing at 1.5%/year.

But of course a lot of those trips are not just by the local population but also the tourists.

Here’s the evolution of the number of tourists that have visited Dubai:

You had about a 7 to 10% rise before COVID. This means the forward 2-year revenue growth rate provided by Finchat seems reasonable.

So it seems Salik could keep on doing what it’s doing, payout out all cash in dividends and probably growing top and bottom line at a 10% clip.

Conclusion

I don’t know about you, but I like these kind of businesses and I understand why Buffett did to. As long as there is traffic, these businesses will make money. And by their nature, they do not have a lot of competition.

Do you own any of these tollway companies?

As always, have a great week-end and

May the markets be with you!

Kevin

Great article, I always enjoy reading up on companies I never knew existed.

Interesting. I don't know that I understand the business well enough to be confident investing in them. Certainly worth looking into further. One business that Mohnish Pabrai invested in Turkey called Tav Havalimanlari Holdings TAVHL.IS . is on my buy list. It is an airport service business. They own the rights to several airports in the Turkey, and several other "Stan" countries . So they have a monopoly on all the duty free goods people buy and transport. Also fueling the planes, and other services at the airports. They have long term leases and exclusive rights to the airports they service. Mohnish sees it as a heads I win, tails I don't lose much or make much investment. He bought them just a few years ago and has made money on them so far. Each plane taking off and landing provides quite a cash flow.