72 quality companies generated using Buffett’s checklist

A checklist from the master you can download

What does Buffett focus on when reading annual reports?

After reading “Warren Buffett and the Interpretation of Financial Statements” I wanted to dive deeper into his process of picking stocks with a MOAT.

This article contains:

Lessons from his PetroChina investment

How Buffett analyzes financial statements

A “Buffett screener” with a list of 72 companies

And a checklist you can use when sifting through companies.

Let’s go!

The PetroChina investment

As an investor, reading lots of annual reports wires your brain and creates some sort of pattern recognition. After a while, certain companies may jump at you for being very high quality or cheap.

When Buffett bought PetroChina in 2002, it was after reading the annual report and concluding that the business was worth 100 Billion USD. He then looked at the price, which was trading at 35 Billion. Seeing the undervaluation was obvious, they placed their bets and were handsomely rewarded.

It would be misleading to think any investor could read an annual report and come to the same conclusion.

Buffett made a journey before he arrived at the PetroChina report

The oil and gas industry was in his circle of competence

He had read all the annual reports of the other oil majors in the past

He did not look at which price PetroChina was trading, he was unbiased

In other words, he knew how to value an oil company based on his past experience.

It reminds me of this quote where I couldn’t find the origin:

If I do a job in 30 minutes it’s because I spent 10 years learning how to do that in 30 minutes. You owe me for the years, not the minutes.

That’s reassuring!

Every report or book you read, and every loss you make in the markets is a learning moment that compounds. The results may not be visible now, but they will be someday.

And importantly, he wasn’t biased by the share's price. This is much more difficult today in the age of hundreds of software tools to screen for great companies.

If you’ve got a tool that provides financial data without showing prices, please let me know!

What was the trigger for Buffett?

3 things stood out in the report:

Based on what Petrochina had been earning and in comparison to what other major oil companies were earning, it was a very profitable company

Management claimed in the report they would pay out 45% of earnings to shareholders

The company had a moderate amount of leverage

Based on what I could find on this, Buffett did not calculate the intrinsic value of the company, he used relative valuation in his head.

He multiplied the company's current earnings by an appropriate multiple for a quality oil major, thus valuing the company at 100 Billion. He then looked at the price and was surprised it was trading at a third. Being presented with the opportunity to buy a dollar at 35 cents, Berkshire started buying shares. Once the company's value rose to about 100 Billion, they sold.

Although Buffett will cite the theoretical definition of intrinsic value as seen in this video

He’s not using Excel to model a discounted cash flow. We discussed the use or uselessness of discounted cash flow models in the past.

What we can learn from this:

Decades of reading annual reports and studying markets allow you to arrive at a relative valuation fairly quickly

You can benefit from studying entire sectors and the major companies that reside within it

First, look at the company financials and only at the price after you’ve come up with a valuation. This allows for independent thinking and prevents the brain from being influenced by what the market is doing

Buffett assessed the quality of the company very quickly:

What does their current earnings power look like?

Are the earnings translating into cash?

If so, are shareholders getting any?

The answer to all 3 questions was a yes.

Because the price in the market was so low, a good company became a great investment.

To dive deeper, here is a great article on the PetroChina investment:

How Buffett reads financial statements

Before going into how Buffett does this, remember that this is how Buffett selected stocks after he made his journey from a value stock picker to finding high-quality businesses with big moats that can compound for a long time.

He’s looking for signals that could indicate a long-term competitive advantage. But never forget the importance of price. I don’t think he ever paid more than a PE of 15.

Let’s do a quick run-down of the 3 financial statements.

Income Statement

From revenue to operating profits

Gross Margins

➡️The gross margin (gross profit/revenue) needs to be high ideally above 40%.

It could signal pricing power. It provides a cushion for the company when things go sour.

Next, he takes a look at how different operating expenses compare to gross profits between different companies.

He’s looking for companies that are drowning in cash, so the cost structure matters.

SG&A

Selling, General & Admin costs can eat away at profits.

➡️He looks for SG&A/gross profits lower than 30%. The lower the better.

R&D

Phil Fisher loved R&D because it is needed to fuel future growth. But a company that can sustain its future growth with low R&D spending might have something special.

High R&D costs could mean the advantage is temporary, that it is not inevitable, or structural.

➡️Look for R&D/Gross profits < 10%

Depreciation

Depreciation is a cost. You already know he despises EBITDA.

Even worse, the cash was already paid in full at the start of the investment!

Low depreciation costs could mean that it's a capital-light business. And capital-light business might be more profitable.

➡️Look for Depreciation cost/gross profits < 10%

From operating profits to net profits

Interest expenses

You don’t need the balance sheet. The Income statement can give you a signal of financial health.

High MOAT companies can have debt, but their earnings power is so strong if they need to, they can pay it back pretty quickly.

➡️Look for Net interest/Operating profit < 10%

Net Income and EPS

Buffett wants a highly profitable company. He wants the company to have a history of rising profitability, not only on the amount but on the earnings per share.

➡️Look for rising income and EPS

Income Before Tax and Normalization

There are no criteria for this, but I wanted to mention 2 important things:

All investments are relative. Buffett likes the income before tax because if he divides it by the market cap he gets an equity yield. This allows for easy comparison to a bond yield or another company.

When he talks about earnings, he means normalized earnings. We need to remove one-off profits or losses or even look at the cyclical nature of the business. Don’t just look at the P/E on a screen.

The 10-step checklist based on the income statement:

You can download the Excel file here ⬇️

Balance sheet

Let’s look at some important criteria from the balance sheet highlighted in red.

Cash

Buffett wants companies drowning in cash. So if cash and cash equivalents has been increasing over the last years, it’s a good sign the company is doing something right.

➡️Look for a steady rise in cash and cash equivalents

Inventory

In the case of a company that holds inventory, a steady increase of inventory over the last years signals the company is selling more and more products. This is a good sign.

Net receivables

The best companies have a cash conversion cycle that is negative. In other words they get paid in cash first and only have to pay their own suppliers later.

We dove deep into the cash conversion cycle in a previous article.

➡️Buffett looks for net receivables/sales that are lower than competitors

Long term debt

Debt on itself is not an issue. Strong companies usually have a low debt level. But even if they have debt, look at the earnings power compared to the debt.

➡️Buffett looks for a long-term debt-to-earnings power ratio below 4 (if profits are cash, they can pay back debt in 4 years)

Debt to equity

➡️Is debt to equity consistently low, preferably below 80%?

Retained earnings

This is one number that gives you information about the history of the company. How much earnings have been retained within the company in the past?

➡️Buffett looks for companies with a history of increasing retained earnings

Treasury shares

When a company buys back shares, it is registered as treasury shares. This reduced the amount of shares outstanding of the company.

➡️Buffett looks for companies with increasing treasury shares.

Return on Equity

Has Return on Equity been stable or grown over the past decade? ROE is a measure of efficiency, although it might not be the best measure:

ROE can be a trap, it might be better to look at ROIC. You can click the picture.

Cash Flow Statement

Profits are an opinion, cash is a fact

Alfred Rappaport

CAPEX

Capital investment is needed to maintain and grow a business in the future. But here are big differences in industries.

➡️Because Buffett is looking for a capital-light business, he wants CAPEX/Net Income to be below 25%.

Buybacks

We already covered this through the balance sheet, but the cash flow statement will also show the repurchase amount of shares (if any).

The 10-step checklist based on the balance sheet and cash flow statement

If this resonates with you, you can also check out Compounding Quality to find companies with high MOATs that can keep on winning:

The Buffett Screener: 72 quality companies?

The entire goal of building this checklist was to find criteria to put into a stock screener.

We’ll use the most powerful stock screener known to man: www.unclestock.com

Unclestock provides a lot of the criteria right out of the box. For some of them, we have to choose a different one to find the best companies.

Here’s a screenshot when introducing all these criteria into Unclestock:

For the Income Statement:

Notice that we’ve used 5 or 10-year averages when possible.

The interest coverage ratio is the inverse of what Buffett mentioned, so it needs to be higher than 10.

Let’s just run the screener and see what happens

The screener displays 439 companies out of 60,000 companies worldwide. Let’s continue and add the criteria from the balance sheet and cash flow statement:

So let’s see what happens

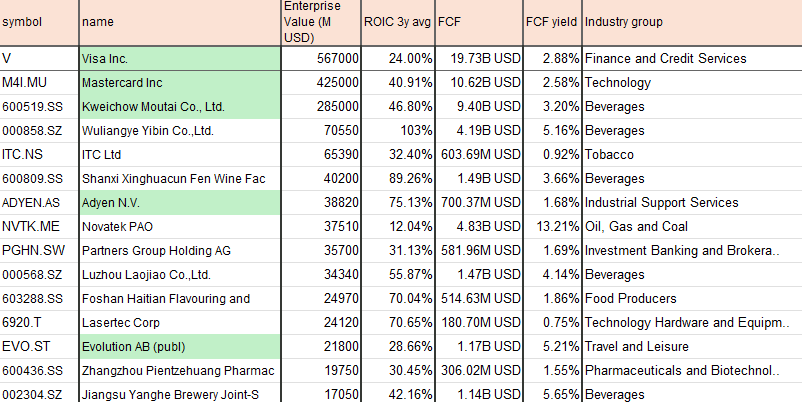

We get 72 companies, in the entire world!

Let’s take a look at some characteristics:

The chart was corrected as the country data was off. Thanks to

for spotting it!Only 4 from the US (Visa and Mastercard) and a whole bunch from China and India.

When looking at these companies by type of industry

Knowing Buffett and what he holds and has held, Investment banking, and beverages coming on top is not that surprising.

And before diving into the top 15, let us take a look at the size of the companies by enterprise value.

I would have guessed the companies to be on the larger size, but a quarter of them are micro caps.

Let’s look at the top 15 by enterprise value:

I’ve highlighted the ones in green that I know.

Now to finish, let’s add Buffett’s last criteria to these 72 companies, the ones that are doing buybacks over the last 5 years.

We get a list of 27 companies. Here are the top 10 by market cap

Download the list here ⬇️

Conclusion

The world of high-quality companies becomes small quickly when piling up these criteria. Some companies in the list are curious, and off the beaten path, in countries I have never invested in. But it might be worth taking a closer look.

Knowing Buffett’s portfolio, the screener delivers capital light to highly profitable companies like brokerage firms and beverage distributors.

We did not cover all the lessons within Buffett’s financial statement. I recommend you give the book a read.

I hope this article was useful.

And as always,

May the markets be with you!

Kevin

Thanks for this great article! I enjoyed reading it a lot.

After downloading your list of 72 companies I was wondering, though, if the data is really reliable: At first glance I noticed that the country of some companies is wrong: The Singapore Exchange Ltd is obviously not located in Germany (and this is just one of many mistakes). Did your stock screener provide that, or did that happen during preparation of the data?

Wow Kevin great artickle! well done!