Till death do us part: A multi-bagger in the funeral industry?

Fu Shou Yuan: A destination analysis

A couple of months ago, my godfather passed away. We lost track of each other the past few years but I have some fond memories of him. His funeral was foreseen at the local funeral provider next to our hometown.

I remember going there more than 30 years ago when I lost my grandfather. I recall an old building, with a window where different tombs and ‘flowers’ were displayed so that the deceased family could choose what they wanted for him.

30 years later, to pay tribute to my godfather and to mourn, we arrived at the same company, but with a completely revamped look.

The team was as professional as it has ever been, it was a funeral service executed to perfection.

A couple of weeks later, marveling at how that company had grown and improved its service, I started thinking if it would be interesting to invest in such a company. After all, the great Peter Lynch made a substantial profit in boring businesses.

The more depressing the business, the better.

Service Corporation International, the largest death care provider in the US was a 20-bagger over the last 15 years. But the ride has been bumpy, with significant downturns in 2000 and 2009.

China has an even, dare I say it, bigger market and loo, and lo and behold, there is a company that caught my attention:

Fu Shou Yuan International (FSU, ticker: 1448): the largest funeral operator in China.

In 1994, it was one of the first death care companies that was created in China (most of them were run by the government).

Can Fu Shou match the past performance of Service Corporation? Let’s find out.

On investing in China

There are 3 things that regulators in China care about:

Is it good for the people?

Is it good for the national interest?

Is it good for GDP?

FSU takes great care to comply, especially with the first 2. It works with the government to increase the standards and professionalism in the death care industry and collaborates in setting afoot better regulations and standards.

But what does the current Chinese stock market appraisal look like?

Below you’ll find the Buffett Indicator that is available on gurufocus.com for China.

Over the past years, it looks at the market capitalization of public companies and divides it by the GDP of the country.

The undervaluation (green) and overvaluation (red) are defined by historical data.

Conclusion: Since 2004, this will be the fourth time the market assesses future growth for China as downward as the market has dipped once again into undervalued territory.

This doesn’t mean there is no risk, but there might be value.

I do believe China does not care much about international investors, but they do care about the people of China, so there are rumors of measures to be taken to try to temper to current downward spiral of the Chinese market and adding 140 billion dollars of liquidity into the market.

How does FSU make money?

Fu Shou Yuan is the largest funeral operator in China. It is active in 30 cities and 20 provinces.

They have 3 business segments :

Burial Services where they sell plots of land and ‘the provision of cemetery maintenance services

Funeral Services: preparation, burial organization, and celebration of funerals

Ancillary Services: in charge of providing garden design services as well as production, sale, and maintenance of cremation machines.

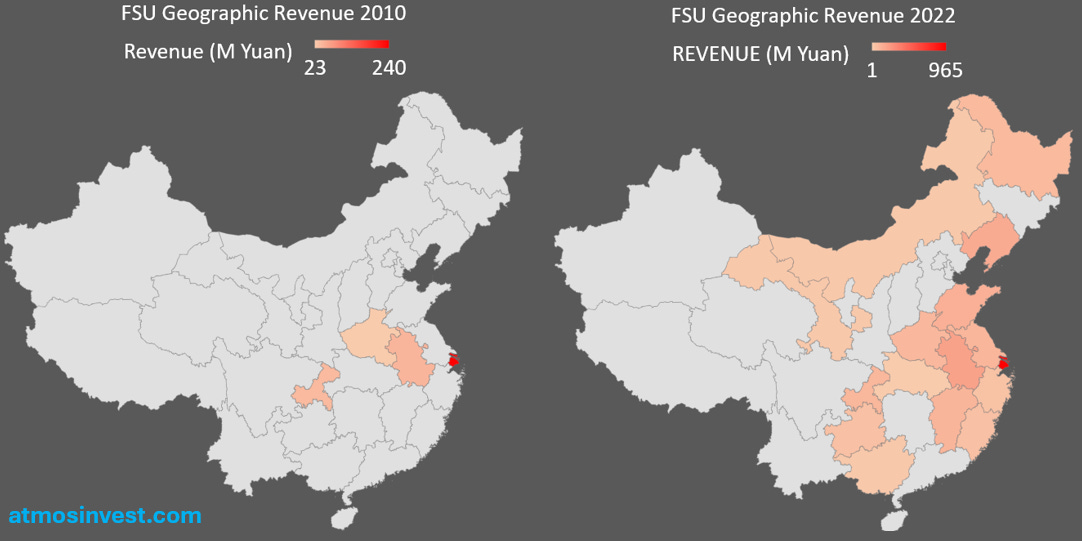

They have grown organically and through acquisitions. Here’s a picture based on revenue from 2010 to the end of 2022.

We can see that the epicenter of the business is still in Shanghai where revenue has grown four-fold in 12 years. In 2010, Shanghai represented almost 70% of revenues, now it is still 50% of overall revenues for the company.

The colors in the above picture do not clearly show their holdings and locations. Here’s a more detailed overview of their latest corporate presentation:

We can conclude that they are heavily concentrated in the eastern region which is logical as the population density in the east is higher than in the west.

FSU has been hit by COVID since 2020 up until 2022. In the first half of 2023, they have seen record revenue due to deferred demand by COVID. It remains to be seen if that level of revenue will be maintained going forward.

According to the board, their focus is on creating a modern and efficient funeral service company using digital technologies that go beyond mere funerals. Although this may attract a younger generation, the bulk of their revenue still comes from the sales and preparation of burial plots.

Here’s the historical revenue by segment.

In other words, the burial services and sales of plots provide the bulk of the revenue. It is also the most profitable:

Burial Services: 50 to 60% operating margin

Funeral Services: 10 to 15% operating margin

Other: Not profitable, slightly loss-making

Do they have a MOAT?

Let’s go through our checklist and see what it uncovers.

Here are several factors that could give a process advantage:

Complexity: No

Protection: Increased regulations and standards heighten the barrier of entry.

Resource uniqueness: The land mass they have to sell burial plots is valuable due to scarcity

Rate of change in the process cost: They may have a cost advantage towards smaller players but insufficient data to make any conclusions.

When looking at scale advantages, consider these:

Distribution: They are the biggest and most widespread operator in China. However, I would not consider distribution an advantage given the nature of the business.

Purchasing: The company should be able to source raw materials cheaper than smaller competitors.

Research and Development: They go towards more digitization, but I would not consider this R&D. However, some of the products they offer, a smaller competitor cannot offer the same as too costly.

Advertising: They have the best-known brand in the industry

We can then look at the consumer side:

Habit: N/A

Experience: This is important for any death care provider. If you lost a loved one, and everything was taken care of in a professional manner, you will come back to the same operator in the future.

Switching cost and customer lock-in: There is no real lock-in except for those who buy a pre-need contract (discussed below) The only lock-in is for geographical reasons.

Network effects: No

FSU is the biggest private death care service provider in China and they have a large land bank that can be repurposed for burial plots. The construction of an Academy and the inclusion of IT into the business has the goal to become more professional and raise the bar concerning the quality of the service provided. This also means that a privately owned mom-and-pop funeral provider cannot compete due to scale and efficiency. In every 5-year plan, standards and regulations regarding the industry are strengthened by the government which increases the barrier to entry for the entire industry.

Conclusion: I think they have a MOAT in the sense that these competitive advantages will not go away in the future. As they grow in size and continue to acquire smaller competitors, consolidation will occur in the industry which leaves less and less choice for the consumer and could lead to more profits for the company.

What does the market look like?

The trend

I know it’s macabre, but let’s look at the overall trends.

Here is the number of deaths over the last years in China:

It has risen from 8 million to 11 million per year in 20 years, and this number will keep on increasing because of the aging population in China.

The current life expectancy in China is about 78 years old.

In 1971, there were 17 million people aged over 70 in China. This has increased to 100 million in 2020. This increase in the aging population will continue dramatically when we look at the purple area in the below graph.

In other words, the above trend in yearly deaths will continue in the coming decade.

Tradition and background

Funerals, burials, cremation, and rituals, Just as in the West, China is grounded in tradition. However, here’s the Chinese government’s stance on this:

‘The party advocates thick care and thin funerals (houyang bozang). The ideal would be no funerals, no cemeteries, no memorials. When a person dies, their bodies would be donated to medical research or to medical schools as cadavers to be practised on by medical students. Whatever parts were left over when the medical personnel finished would be cremated together. The ashes would be used to make bricks that would then be used for constructing buildings. The families of the deceased would be content with this result as they will have already demonstrated their filial piety by taking excellent care of the deceased when alive.

In other words, if it is up to the government, there wouldn’t be any burials.

In addition to this, there has been a sharp increase in the price of burial plots over the years, even to such an extent that per square meter, some burial plots have become more expensive than residential real estate prices.

On Songhe Cemetary (not owned by Fu Shou), plots have been listed at 342,000 yuan (50,000 USD). This means 5 times as expensive as residential land.

Using the annual reports from Fu Shou Yuan, in the first half of 2023 they sold on average a burial plot for 121,000 yuan or 17,000 USD. (A 15% increase in price compared to 2022).

The response by the government:

In addition to recommending vertical burials and shared family plots, building multi-story columbariums, and limiting urn burial space to just 0.5 meters (about five square feet), the government is offering incentives for those who choose burial at sea, tree burials, or biodegradable urns. Even celestial, or sky, burials (leaving a corpse exposed to the elements on a designated rural mountaintop) are being promoted. In 2015, the government held a “cremation competition,” pitting the country’s top 50 crematory workers against one another to demonstrate their technical skills.

Good to know from a risk point of view.

The market

The goal here is to get a ballpark answer to the following questions:

How big is the market?

Is it growing?

Is it fragmented, who are the players?

The Chinese death care market at the moment is about 100 billion Yuan in size. This means, that FSU has about a 2-3% market share.

The IMF projects a 4% growth CAGR for Chinese GDP in the coming years and an 8% growth CAGR within the Chinese death care market.

I usually try not to hold too much credit to the absolute numbers, but we could conclude that:

The market will grow at least at the same pace as the country's GDP

From a montaka.com research report:

As such an important part of Chinese culture, the market is highly fragmented and dominated by local government welfare services to ensure accessibility for lower-income families. However, the private industry emerged in the 1980s to take advantage of shifting regulations and has grown at up to 30% per year by offering high-quality, personalized services to China’s expanding urban middle class.

And some interesting information on the scarcity of land:

With such little urban space, the government has stopped granting certificates to develop new cemetery land. For instance, in Shanghai, no new land has been approved for over 10 years, and no new certificates for 20. This means the incumbent players in the private market have full control of the scarce supply of burial plots and, with that, their rapidly growing price.

In other words, the market remains fragmented, with Fu Shou Yuan the only company that has operations in multiple provinces in China.

Peer comparison

There are very few publicly traded funeral companies in the world. Here are 5 of them, if we order them by market cap (in USD for easy comparison):

US: Service Corp International (SCI) (Market Cap = 10B)

China: Fu Shou Yuan International (1448) (Market Cap = 1.4B)

Canada: Park Lawn Corp (PLC) (Market Cap = 0.5B)

US: Carriage Services (CSV) (Market Cap = 0.4B)

Japan: San Holdings (9628) (Market Cap = 0.2B)

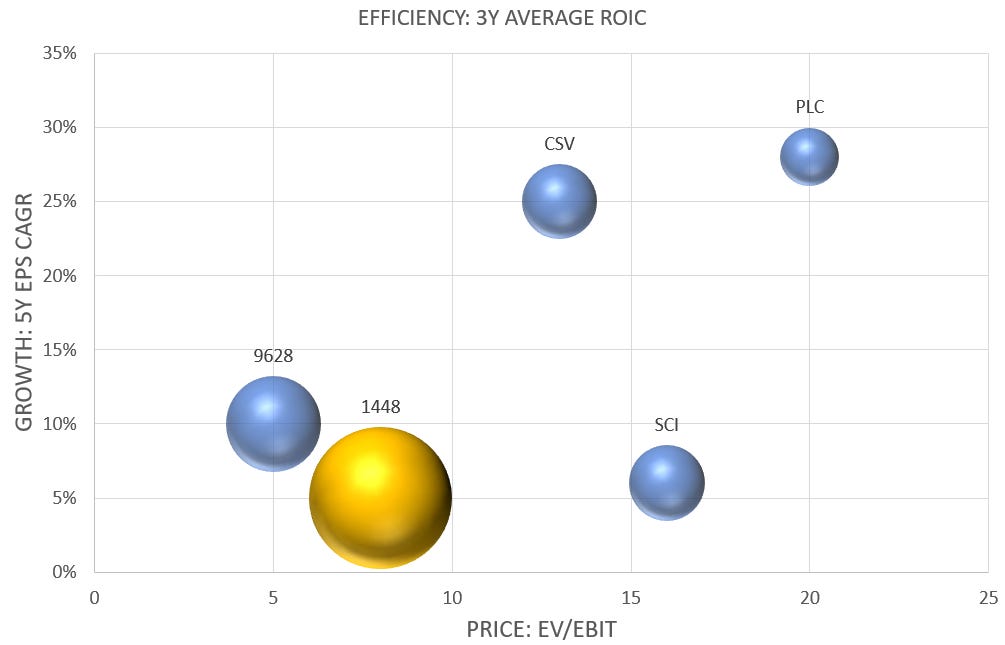

We can then compare them directly on 3 dimensions:

PRICE: EV/EBIT

GROWTH: PAST 5-YEAR EPS CAGR

EFFICIENCY: 3-YEAR AVERAGE ROIC

Here are the results:

San Holdings and Fu Shou are priced lower but have seen less EPS growth over the past 5 years when compared to Carriage Service or Park Lawn Services. Fu Shou is the most efficient on an ROIC measure. The fact that the first 2 operate in Asia and the others in North America also plays a role in the multiples that are awarded. EPS growth for Fu Shou is 14% but in the last 3 years, they have seen their growth plummet.

Insider Ownership

Here’s what Simply Wall Street tells us:

But in reality, those private companies should be added to the insider ownership. In total, you have about 46% of insider ownership. It was 62% in 2018 so it has been reduced.

As will be discussed in the Capital Allocation Strategy, there is an employee shareholder program that can be used to grant options or shares. See the below discussion.

There was some sort of dark secret that was rumored during the IPO concerning funny business going on with some of the owners. You can check it out for further, but in the last 10 years, I found no negative news on the company.

Capital allocation strategy

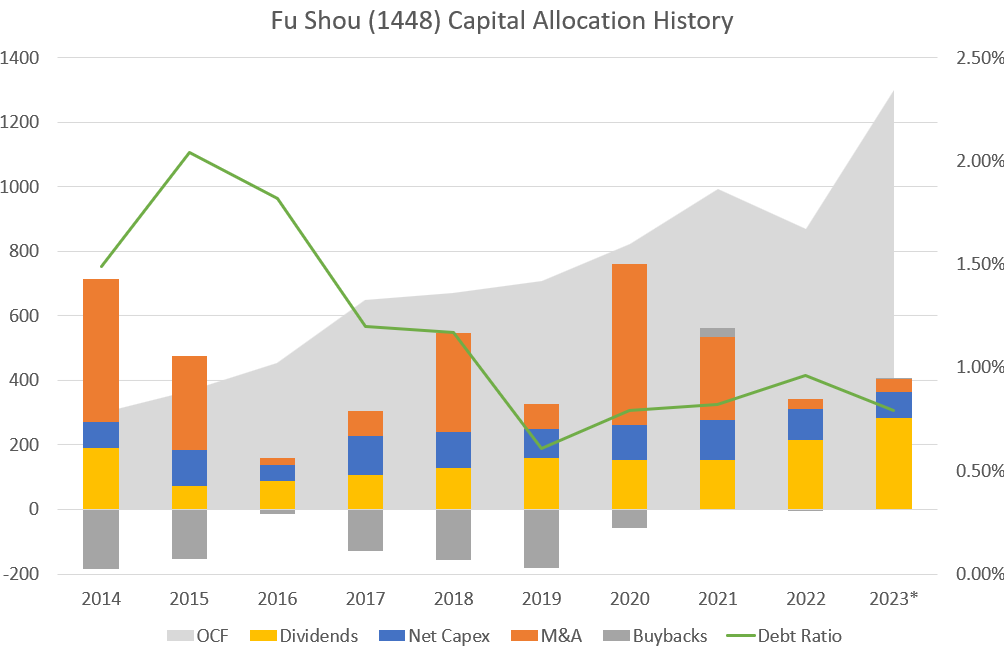

Here’s the company’s capital allocation strategy displayed in one single picture:

Numbers for 2023 are trailing numbers.

Operational cash flow has been steadily increasing over the past decade. It might be somewhat lower depending on the second half of 2023 results (which will be published in April 2024), but it should be the highest in their history.

We can see that they have been active in M&A, but it has slowed down in 2022 and 2023. If they want to keep up the growth pace, they will have to keep acquiring other service providers and continue to execute a roll-up strategy in the years to come. See the previous maps to get an idea about the speed of expansion.

This is a dividend-paying company as mentioned in the annual report, to reward the shareholders for their continued confidence in the company. I would like to see more buybacks, especially since the stock is trading cheaper at the moment. In their latest presentation, they mention that their goal is to be able to increase dividend payments in the future.

Up until 2020, the company has done the opposite of buybacks, they have issued shares. They have an employee incentive plan where options or shares can be granted. In 2021, they, for the first time, did a buyback. Over the last 2 years, no shares or options have been granted to the employees.

Finally, the debt ratio was already low and sits below 1%. They have about 2.2 billion Yuan in cash and cash equivalents. This is a good place to be, but some might say, a bit too strong of a balance sheet.

One final thing to look at before closing this chapter on capital allocation is the evolution of return on invested capital:

It may be unfair to compare Service Corp International to Fu Shou Yuan as they are not in the same life cycle. Fu Shou could be seen as a relatively young company with a past 20% revenue CAGR. Service Corp is a more mature business, still growing in revenue, but at a 5% CAGR.

Destination analysis

What is the downside risk?

As discussed before, the company has pricing power through the value of the burial plots and the scarcity. But there are scenarios where this pricing power could be taken away:

More and more people choose cremation. (see figure below). This is already happening as the rate of cremation is increasing. A continued rise could lead to reduced demand for burial plots and a subsequent drop in price and gross margins.

Crackdown by the government: In the past, there has been criticism of the prices of the burial plots. The government could step in and regulate the market.

If you combine these numbers with the above numbers of number of deaths, you get a rising cremation rate that is approaching 60% of total deaths.

Both of these scenarios are plausible. However, the prices of burial plots have been high over the last decade, and nothing has happened. This could be a testimony to the fact that the company is working together with the government to provide better death care services. FSU claims having a seat at the table when government sets out to drafts new regulations for the coming 5-years. The reason is that due to fragmentation, the smaller funeral services are not always doing their business by the books. The government hopes through better regulations to weed out the bad actors.

Although the cremation is increasing, it is doing so at a slow rate. Also, people want to uphold certain traditions in Chinese culture. Heritage and burials are one of them. As long as people have the means, they will continue to buy burial plots.

Can the company 10X?

The company currently has a market cap of about 10 billion Yuan (1.4 billion USD) with about 2.2 billion Yuan (300 million) in sales. For reference, Service Corporation International (SCI) in the US has a market cap of 10 billion USD with 4 billion USD in sales. It has about 10 times the staff of Fu Shou Yuan.

FSU has increased its revenue over the last decade by about 20% each year through the acquisition of new death care services applying a roll-up strategy. If it can maintain such rates, it will take 15 years for the company to increase its revenues by a factor of 10.

It is plausible that growth will be slower. Still, given that the market is so fragmented, and as the biggest service provider, they only have a market share of about 2-3%, it is not unreasonable to think that the company, given enough time, will continue to grow.

Here’s a look at what the company is working on for the future:

The first is better cremation machines (the other business segment): But as mentioned before, this is marginal in revenue and is not profitable

Pre-need contracts: These are included in the funeral services segment and it is growing. See the number below

Landscape design: Where they design cemeteries and burial sites even for others. But again, this represents only a small part of the business.

Here’s the growth from the pre-need contracts over the past years:

We don’t have any data on the size of pre-need revenue for 2023 yet. Although revenue has been growing, it at the moment still only represents a good 11% of total funeral services revenue.

What is absent from the latest company presentation is their outlook for growth through acquisitions.

Can the company 100X?

Based on the aforementioned discussion this would mean that the company would have a market share of 20% in 2045. It will not get there with the current capital allocation strategy. It would need to be more aggressive in its acquisitions and accelerate the roll-up of smaller death care providers.

Based on the annual reports and presentations, the management will continue to do what they have always done. Try to grow at a steady pace, profiting from the cash flow from the land banks and burial plots, and return a sizable part of that cash to shareholders. FSU will not be a 100-bagger.

Valuation

We’ll use an inverse DCF to get an idea about how the market is currently pricing the company.

Our input parameters are:

A starting free cash flow of 800 million Yuan (it will be higher in 2023)

An EV/FCF multiple of 8 (currently it sits at 7.5 due to the very high H1 2023 results)

A 10% discount rate

In other words, these inputs are conservative when looking at current performance.

Enterprise value is calculated as the market cap + net debt + non-controlling interests

To arrive at the current enterprise value of about 9 billion yuan, the implied growth rate by the market is 3%. You can download the Excel here.

The market assumes a very low growth for the coming 10 years. As a reminder, the past 5-Y FCF growth rate was 15%.

In this model, about 67% of the value comes from the future cash flows and about 33% from the terminal value.

Now, it’s important to be critical of such a simple model.

What would this model have returned had we used it at the end of each year, over the last 5 years? For each year, the same input variables are assumed except for the starting free cash flow, which is the final free cash flow at the end of every year. (to be fair, we should probably adjust the discount rates to reflect the rise in interest rates, but that would increase the past implied growth rates even further which adds nothing to the conclusion)

The implied FCF growth rate by the market in each year would then look like this:

This means that after the facts, knowing that they achieved a 15% FCF growth rate over the past 5 years, the company was priced to perfection right before the start of COVID in 2020.

Here’s an overview of what the upside potential would be for different growth rates:

Because of the high margins on the burial plots, and if they continue to grow through acquisitions as they have done in the past, we expect a growth rate that goes beyond the 3% implied by the market.

Conclusion

Pros

China’s demographics provide an increase in yearly mortality

A competitive position due to its size and profitability due to the burial plots

Strong cash flow and undervalued in the market

Cons

More and more Chinese might choose less expensive burial solutions (cremation) or the government might step in to regulate

Although good ROIC, lack of a solid reinvesting rate (increased cash balance and dividends)

Stock issuance in the past, might be reintroduced in the coming years

Here’s our 100-bagger checklist with summary:

The future will depend on its COVID rebound and how fast management will want to expand. Is the revenue and income increase in the first half of 2023 a sign of more to come, or was it a one-off? If tomorrow, they would announce buybacks instead of increasing dividends, that would also go into the right direction.

As discussed in my annual review, I will withhold taking a position for 2 weeks to avoid any commitment bias.

May the markets be with you, always!

Kevin

Let me know what you think…

Further reading

Great article on Fu Shou and his younger twin by

Excellent article on seeking alpha

Several articles on Smartkarma, but you’ll need a subscription

Did you end up buying Fu Shou or passed in the end?

I will link to this article in my "Emerging Market Links + The Week Ahead (February 19, 2024)" post for latter today. Rollup strategies are always hard to execute though or can run into problems like what happened with SCI + in China, there is the risk that the govt will restrict "wasteful spending" on funerals, etc or do the sort of clampdown they did on education in the name of fairness or something... Also, I thought during covid there were cases of people receiving the wrong ashes back etc etc from the govt - so there is a risk if the company gets sloppy and all it takes is one case getting lots of Weibo attention...

But I do think its a very interesting stock!