The valuation of a fine dining restaurant - Hof Van Cleve

I have many interests in my life, one is investing and valuing companies. The other is: eating.

I’ll eat just about anything. From a juicy burger to a 7-course gourmet meal, I will devour it all.

So when the news broke in February of this year that the chef-owner (Peter Goossens) of the number one restaurant in Belgium would sell his restaurant, it was the perfect moment to combine my interests.

The owner is selling his restaurant to his sous chef, but there was a lot of speculation ongoing concerning the value of the business. During the summer, I followed Professor Damodaran’s online course on valuation by watching all his free YouTube videos. One of his courses covers how to value a private restaurant.

Professor Damodaran believes that valuing companies is more than just art and science, it’s a craft, which should be practiced often. Who am I to argue with the Dean of Valuation? Let’s do a valuation estimate of this very successful privately held restaurant.

Don’t worry, we’re not straying away from the public markets. I’m already working on a destination analysis of a company which will be published next week.

Hof Van Cleve

Hof Van Cleve is a 3-star Michelin restaurant and has been the number-one restaurant in Belgium for years. Peter Goossens is a celebrity chef, who starred in numerous TV shows while at the same time, running his restaurant.

This isn’t just any restaurant as proven by the accolades below:

They even consistently ranked in the San Pellegrino’s World's Best restaurants for the last 15 years.

Here’s an overview of their past ranking:

They started strong, dipping into the top 20 and lately getting back up into the first part of the top 50.

They will serve dishes like:

Tuna Two way: rolled and seared

Diced razor clam served with gray shrimp risotto and a basil broth.

It looks fantastic. It’ll probably taste divine, and one full-course menu will set you back 450 euros (480 USD). If you add the wine selection, you’ll arrive at 610 euros (660 USD).

The restaurant was started in 1992, and then gradually earned its Michelin Stars:

1994: First star

1998: Second star

2005: Third star

Here’s a look at how prices of the menu (without drinks!) increased thanks to the success of the restaurant. I adapted the prices for inflation to get a sense of the real price increase.

You’ll eat great food in a marvelous-looking farmhouse located in Kruisem, Belgium. They even have a Helipad!

Enough drooling on the food and marveling at what an experience this would be, what do we know about the actual business transaction?

The chef-owner and his wife both work at the restaurant, but based on financial statements do not have any salaries. They are paid in dividends.

The transaction will include the sale of the business and its brand (employees, kitchen, furniture) and one of the most beautiful wine cellars in Belgium worth 1.3 million if you believe certain newspapers.

The transaction will not include the real estate. A lease agreement will be signed between both parties

It will be constructed as an earn-out. The final price paid will be related to future performance. The chef-owner will stay on board until the end of the year 2023. The goal is to create a win-win, if reservations keep coming and revenue keeps flowing, then the final agreed-on price will be higher.

To value this business, we will use Professor Damodaran’s teachings.

We need to:

Prepare the financial data for a discounted cash flow (DCF) calculation

Find the cost of capital to use to discount the cash flows

Adjust the data based on what we know about the transaction and private equity corrections

Let’s go!

Step 1: Prepare the financial data

Although it is a private company, financial statements are available publicly in Belgium (this is always interesting if you want to invest in private businesses).

There is only one problem. The financial statement only provides the profit and loss statement and the balance sheet. There is no cash flow statement.

Our goal is to find the historical free cash flows to the firm. Here’s the formula we’ll use:

Capex and Change in non-cash working capital need to be derived from the financial data due to the lack of a cash flow statement.

CAPEX = Current PP&E - Prio PP&E + Depreciation

NON-CASH WORKING CAPITAL = Current Assets - Cash - Current Liabilities

CHANGE IN WC = Current WC - Prior WC

Let us first take a look at the profit and loss statement:

Hof Van Cleve is a very profitable business. Gross margin has exploded in 2022 doubling what was made in 2021. COVID is now behind them although even during 2020, the COVID year, it still made a profit. Wages are the biggest cost, during normal operation (2019 and 2022) about 1 million euros. Normally the tax is calculated on the taxable income, but we already prepared it to come up with the free cash flow.

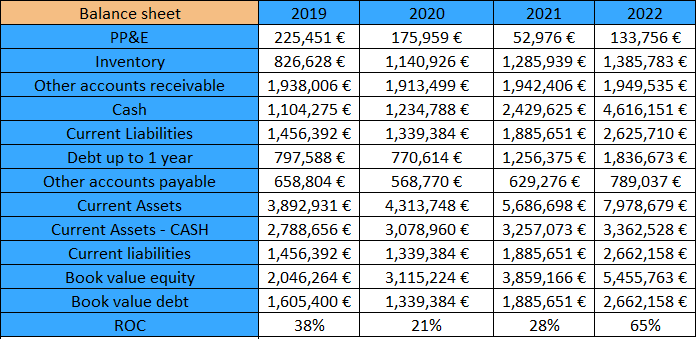

Let’s take a look at the balance sheet:

The balance sheet shows a pretty low value for PP&E and a very strong cash position. We did not mention long-term debt because there is none. The value of the inventory is probably dominated by the value of the wine cellar.

The return on capital (ROC) is high. Based on industry data, a ROC for a restaurant > 25% is considered extremely good.

Here’s the free cash flow generated by the business over the past years:

Capex is limited and mainly related to remodeling the restaurant. We can see the impact of COVID on the free cash flow in 2020 and 2021. But then the numbers took off in 2022, the revival of the restaurant.

Step 2: Defining the cost of capital

When valuing a public company, the models assume that the investors only have to worry about the risk that cannot be diversified (market, geopolitical risk, etc.). We represent this market risk by betas that are defined by past price information. This assumption does not hold when an individual buys a restaurant. He exposes himself to more than just the market risk. He takes on the full risk of the restaurant business.

Therefore we’ll use total beta’s that include the firm-specific risk. When looking at the industry data, a sample of high-class restaurants that are public businesses does not exist.

There are several other possibilities to choose from

In the apparel industry, we can find businesses like DIOR. These are businesses that sell high-end goods. Also, the debt versus equity ratio seems more in line with this specific restaurant. The total levered beta becomes 4.36.

Now that we have chosen a beta, it is possible to define the cost of equity. In the table below, the other data is shown that is needed for the calculation.

The cost of equity = Risk-Free Rate + Total Beta x Equity Risk Premium = 28.1%.

Hof Van Cleve does not have any long-term debt. However, treating the lease as a financial expense allows us to estimate the cost of debt.

The debt rate will be determined by how well the interest expenses are covered by the operating income. The data used to determine the rate can be found here.

Now that we have the cost of equity and debt, the cost of capital becomes:

Cost of equity x Equity / Assets + Cost of debt X Debt / Assets = 24.75%

Step 3: Adjust the financial data

For the final valuation, several assumptions will be made to estimate the future operating income.

The building is not included in the acquisition. An operating lease agreement will be negotiated. On the internet I’ve seen similar buildings and sizes go for 3500 euros/month. But since this building is unique, it has a helipad, let us make it 5000 per month on a typical 9-year lease. It will be booked as a financial expense. The assets of the lease agreement and the debt will be added to the balance sheet. We’ll need to find the present value of the future lease expenses by using the cost of debt.

If the owner and his wife (who is the hostess) no longer work at the restaurant, then the new owner becomes the head chef, and he will have to recruit 2 people which will increase the wages. The average wage in the financial statement is about 50k. So let us increase the wages by 100k every year.

The home run from a revenue point of view in 2022 was even before announcing the sale of the business. Maybe 2023 will be even better due to a FOMO effect. Factors that could contribute to revenue increase in 2022 are the increase in pricing due to inflation (they increased their fixed menu price by 40% compared to 2020), and the rebound after COVID where we presume that more tables were booked during the year (according to our information, the number of tables at the restaurant is fixed and there was no change in working hours). But there is still the impact of the current celebrity chef. Usually, when a 3-star chef leaves his restaurant, the restaurant loses its Michelin stars. It is unclear if this will happen because the future owner is a long-time employee. We would calculate the impact of just the celebrity chef leaving as a 20% reduction in gross profit. The loss of the Michelin stars will have an even bigger impact. Therefore, we assume a 20% reduction in 2022 gross profits in our future estimates.

Future depreciation was lower in 2023, but we’ll assume 100k each year for the coming years (ignoring the additional depreciation of the new lease asset)

When valuing a private company, we apply a discount due to the illiquidity of the transaction

These assumptions will change the estimated operating income in the following way:

The value of the operating assets is determined as:

Firm Value = Expected Income(1- tax rate)(1-RIR)/(Cost of capital - g)

We know all the parameters needed for the Reinvestment Rate (RIR) and the terminal growth rate g.

Based on the past return on capital we estimate the return on capital to be 30%. The terminal growth rate is set at 3%. This gives us an RIR of 10%.

Finally, the equity value is obtained by adding the cash and subtracting the lease debt.

(note: the lease debt is calculated based on yearly commitments of 60,000 euros at the pre-tax cost of debt).

Almost 10 million euros. I was surprised by the number, but when you look at the business, it is throwing off a lot of free cash each year and it has a high cash balance at the moment. This isn’t only a high-quality restaurant, it is a high-quality business.

The previous valuation was done at the end of July of this year. Since this week, new information has come up:

The main issue with a business transaction such as this: Is the value of the fame of the chef transferable in the deal? According to this latest newspaper article, it appears it is not.

The future owner has now declared that prices of menus will come down significantly, which will hurt margins and I assume will force him to reduce costs not necessarily to maintain past margins, but some margin. The initial discount we applied based on the loss of fame was 20% on profits. We now know that future prices will be cut by 50%. This will impact future returns and future returns on capital.

Based on this new information, we’ll increase the adjusted correction on operating income from 20% to 40%. The return on capital will be left alone as it already includes a 50% discount on current levels.

This will lead to the following valuation:

Conclusion

I’ve made several assumptions in this valuation. Especially in a private equity transaction, the situation will be more complex. We have no information on what will be negotiated. My goal was to give a general idea of what the restaurant would be worth.

Anyway, I hope you enjoyed this valuation of a business I admire. I know I did.

If you can get your hands on the financial information of a private business, you can apply the same process to get to a valuation. But next week, we’ll dig back into the destination analysis of a public company.

As always, may the markets be with you,

Kevin

P.S. Now that this article has come to an end, I will prepare dinner. A ready-to-eat, vacuum-sealed fish dish prepared by the fine dining chef himself (the recipe at least) which sets me back 10 euros. Bon appetit!