This week, Inmode released its Q4 and yearly financial results. It also received notice of a class action lawsuit in the works.

Let’s dig in.

You can download Inmode Deep Dive in PDF by using the button below:

If you remember our latest discussion, the market expected return when the stock was down to 20 USD we considered to be a no-growth scenario. We’ll come back to this.

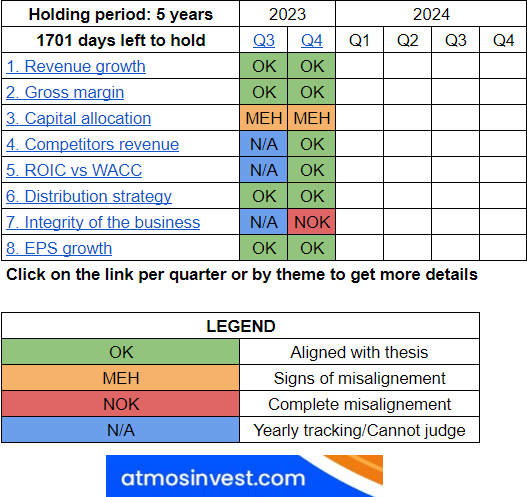

Let’s go through our 8-step thesis tracker. We track the following variables:

Indeed, 1701 days left to hold on. And it is getting harder and harder.

1️⃣Revenue growth and competition

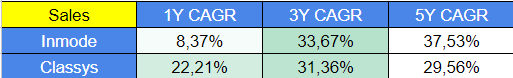

Inmode has been growing rapidly over the past years. They saw a good first half of 2023 and then sales started slowing down in the second half. Overall, they managed to increase sales by 8% year over year.

For the first time, since Inmode has been a public company, they had to revise their guidance downward during the year.

Overall, we do not like to see a sales slowdown, but the question is, is this true for the entire market?

Let’s take a look at Inmode’s competitors:

The downturn in the market is widespread. Inmode explains that the reason for this is the current macroeconomic situation. Here’s an overview:

Inmode sells platforms for premium aesthetic treatments, costing about 2,500 to 6,000 USD per treatment. People might postpone or hold back on these treatments. One data point that confirms this is the slower growth rate in consumables.

80% of platform sales are financed through lease agreements. The increase in interest rates has led to the lease companies being much more stringent. It takes more time to obtain a lease.

Although they see a downturn in the market, they are not planning on spending less on marketing and sales or R&D. They see it as a necessity to wade through the current market and prepare for an uptick.

Their guidance for 2024 is a sales number of about 503 million USD which means a 2% growth in sales. I read that management is being conservative, as they want to avoid another revision of guidance in 2024, but, this could be a problem.

Our main thesis is based on the fact that Inmode can do better than a no-growth scenario. A 2% growth in sales is not enough to beat market expectations.

Conclusion: The thesis holds for now. Inmode is still growing. But 2024 will be a crucial year. PASS ✅

2️⃣Gross margin

A decrease in gross margins might signal that Inmode is forced to lower its prices due to higher competition.

Gross margins remain stable at 84%.

Although, not a lot of information is known about how such high margins are possible in the first place (we must remain skeptical). The gross margin is the biggest difference between Inmode and its competitors.

If anyone has more information or details on how they achieve this, please let me know.

But there is a caveat.

A class action lawsuit was filed on the 14th of February 2024.

Here’s a summary:

The class period: Any investor who has bought stock between the 4th of June 2021 and the 12th of October 2023

Complaint: Inmode made materially false and misleading statements and omissions concerning two topics:

the price at which InMode sells its devices, which reflects the demand for those products

InMode’s compliance with U.S. Food and Drug Administration (“FDA”) regulations, including the FDA’s prohibition on off-label marketing of devices and the FDA’s requirements for the reporting of injuries

Here’s a bit more detail:

On February 17, 2023, an investigative publication reported that InMode had threatened some customers with legal action over complaints made regarding the Company’s devices and sales tactics, with customers stating that the Company offered to replace defective products if they signed confidentiality agreements. On this news, InMode’s stock price fell $1.21, or 3.3%, to close at $35.81 per share on February 21, 2023, thereby injuring investors.

Then, on October 12, 2023, InMode lowered its full-year revenue guidance due to higher interest rates, tighter leasing approval standards, and bottlenecks in loan processing. Additionally, that same day, another investigative publication revealed that InMode had routinely and significantly discounted the prices of its devices. On this news, InMode’s stock price fell $7.24, or 25.9%, to close at $20.75 per share on October 13, 2023, thereby injuring investors further.

The aforementioned investigative reports were published by The Capital Forum.

There are in total 7 reports mentioned on their website starting on December 9, 2022. Here’s an overview. You can access the information through our thesis tracker.

If Inmode heavily discounted its devices, then this should be visible in a reduced gross margin. But if we disregard gross margin and only look at what matters in the end: the cash generation, then the business is still very profitable (even if margins are incorrectly stated in the income statement).

A lot of the information is not publicly available. We’ll have to see if we can gain access.

Here’s my current interpretation of these reports:

Any report of this nature (true or not) is damaging to the image of a company. So we should not disregard it.

Other companies in the medical sector have received similar reports (it’s not just Inmode)

There are no reports on Cutera

Why aren’t there any reports available before 2023?

Because nothing was going on of the sort?

Because of the market downturn: Is Inmode becoming more and more aggressive which has led to these reports coming out?

Once more information is available, what we can do is:

Assign a value in cash to the lawsuit to see what the damage would be if it holds

Verify if Inmode will set aside certain provisions relating to the lawsuit

Assign a probability to a win/loss of the lawsuit

Conclusion: The thesis holds for now, but we must remain skeptical. Gross margins are stable. It is impossible to judge the claims in the lawsuit with the current information. PASS ✅

If you have any additional information, please reach out!

3️⃣Capital Allocation

Now it gets more interesting (well the lawsuit is interesting too)

If you’ve been following the story, the CEO made a rather bold statement regarding buybacks 👇

Well, we thought about buyback. We thought about buyback for a long time. But I have to say two things. One, our previous experience with buyback, actually we did buyback for $100 million, did not help, did not help at all. And the stock did not react to that.

Usually we believe that buyback is something that will help few days and the market will forget that. And therefore we're better off keeping the money and looking for M&A opportunity, business development opportunity, things that we can do with the money better than just spending on buying stock.

Followed by a letter from shareholders asking for an immediate start for a buyback program! (you can click the post 👇)

So what does this all mean?

Nothing has changed.

The management team is holding its stance on the buybacks. They mention that they are exploring one M&A opportunity in the aesthetics market. It’s not a medical ‘laser’ company but it could complement Inmode’s business. They are not using a bank and are exploring this opportunity on their own. We’ll have to wait for the next quarterly call.

They are very picky about M&A. They have repeatedly mentioned in the past that prices were too high. I consider this a good thing.

Better no M&A than bad M&A.

However, the fact of doing this on their own might be bothersome as they haven’t shown any significant experience in the past on the M&A front.

The medical aesthetics market is a very competitive industry. There are examples of companies in the past, who felt forced to act and use their cash reserves until the market trended down, and the company had no reserves left. There’s nothing wrong as Charlie Munger would say, to sit on your ass and wait.

I think there is a middle ground to be found. If they are convinced that growth can pick up again once the macro and interest rates start to change, then from a capital allocation point of view, a modest buyback could be a good thing.

What I read, is that they are conservative. I just hope that when the time comes, and an opportunity presents itself, they will be greedy when others are fearful.

Conclusion: Capital allocation remains MEH. 🫤

4️⃣Economic Spread: ROIC VS WACC

If growth is slowing, and margins may be under pressure, is the company still efficient?

Here’s what we posted in the past on ROIC comparing Inmode to Cutera (click the image):

Now the current overview when we look at the economic spread:

Although the spread has decreased, it remains high, much higher than those of the competitors. Inmode keeps adding value. But beware, the reinvestment rate sits at 12%, so it’s not very high but the combination of a high spread with the reinvestment rate is positive.

Conclusion: The company keeps on earning above-average returns. PASS ✅

5️⃣Distribution and integrity

On distribution, nothing has changed. They have developed additional sales reps in 2 countries to avoid a 3rd party distributor. Now that we have the year-end numbers, here’s what distribution has looked like over the past 3 years:

Conclusion: Distribution strategy stable. PASS ✅

We already discussed the integrity of the business when looking at the lawsuits.

If we pile up the different reports, the KPI we track looks like this:

As we mentioned before, whether the lawsuits and reports are true or not, the image of the company is tainted. We therefore consider the integrity in misalignement with our thesis.

Conclusion: Integrity: NOK ⛔

6️⃣EPS growth

Inmode remains a very profitable company. Even despite a revenue slowdown, EPS increased by almost 22%. Not much to add to that.

Conclusion: Solid EPS growth PASS ✅

Here’s the current overview of the tracker: You can look at more detailed information here.

7️⃣New kid on the block

I missed this company when I first wrote the deep dive on Inmode.

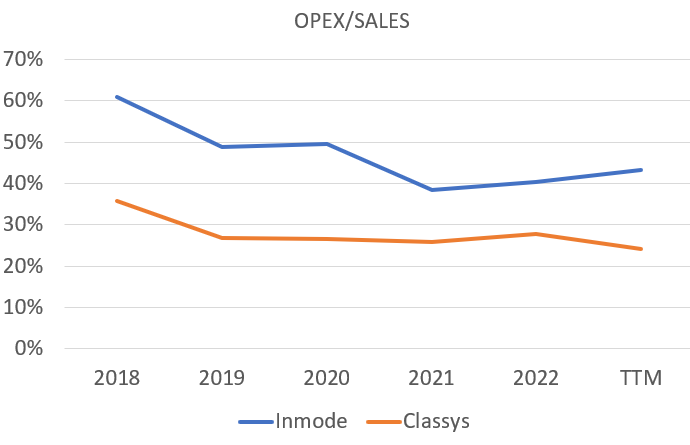

Classys, a Korean company, is a direct competitor for Inmode, but at this time, mostly sells directly in Korea.

Their numbers are impressive.

They have high margins in the 70% and are growing sales (even in 2023). It seems that the market is not seeing a slowdown in Asia.

But what differentiates them from Inmode is their cost structure:

Is this an immediate problem for Inmode?

In the short term, Classys is not a problem for Inmode, as they are not directly competing with their business in the same markets. Classys plans to enter the US in 2026. Geographical distribution and expansion are not that easy, so we’ll have to see how Classys executes. The risk is that if Classys manages to get a foothold in the markets where Inmode is selling, they might undercut Inmode’s price.

Summary

2024 will be the true test.

Will the market return to its former glory?

Will Inmode reap the benefits from their continued sales and marketing investments?

What will the impact of the lawsuit be, and how will Inmode react?

Our thesis still holds besides one misalignment on the integrity front. I’m not going to sell only because of this. But if additional criteria start to blink in red, then it might be time to move on.

These are not positive developments for the company. It’s important to avoid confirmation bias and keep looking at the case from the opposite view.

Thanks again for reading, and as always,

May the market be with you!

Kevin

Their CFO said in the earnings call they are starting to use their BS to take some risk from their customers on themselves.

This basically equals to lowering prices without saying it. (not relevant to the lawsuit)

We'll probably see the impact in their BS later this year in bad allowances or credit losses.

but their margins definetly took a hit and with the growth in R&D & sells we will see lower margins this year.

You say it's still growing, but they are guiding to no growth this year...