This company came on my radar through some posts on X. And when I looked at how the price of the stock evolved I figured it was a prime candidate to try to look back and ask yourselves the question:

Could we have foreseen the rise of Epsilon Net?

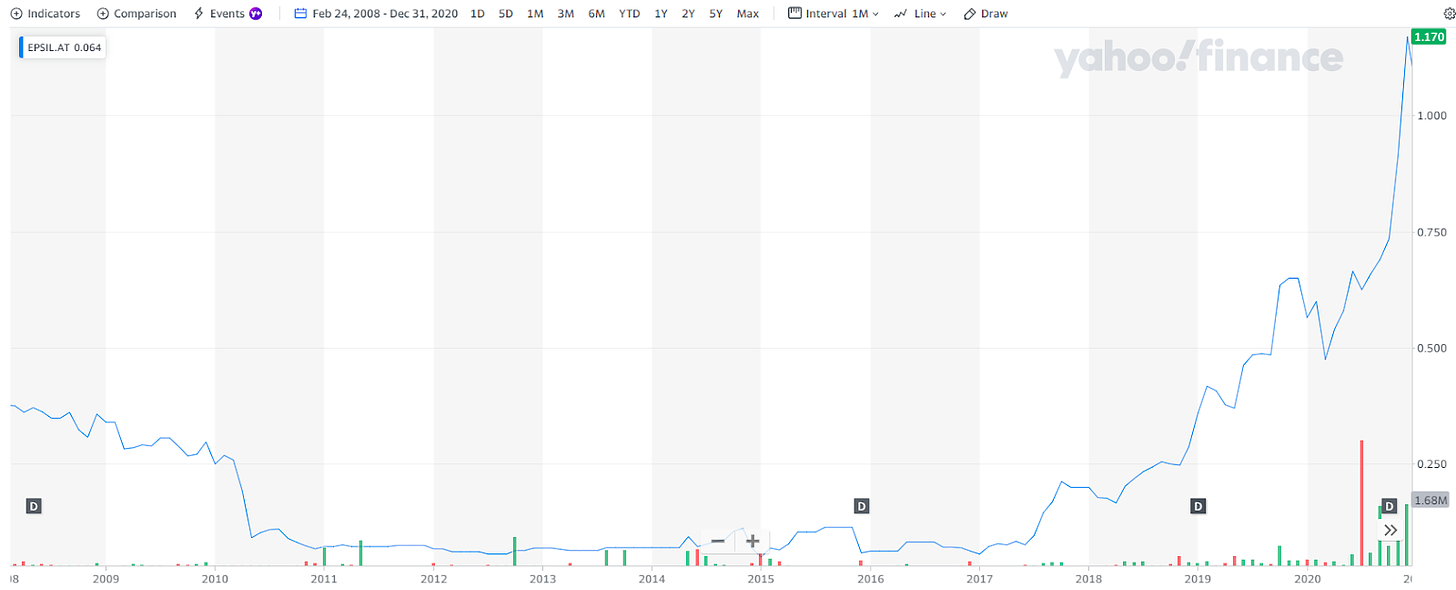

Here’s what the price chart looks like:

From 2008 until the end of 2019, it gained 50%. That’s 50% over 11 years: A no man's land

In 2020 it doubled

From the end of 2020, it went parabolic, from 1 euro per share to currently 9 euros

We’re going to take a look at the data, transport ourselves back to the end of 2020, and then just like Marty Mcfly, go back to the future, to see what we think the company will do.

Every 100-bagger was a 10-bagger once. The goal is to learn from the past, to improve our process for the future, and along the way, to check if the company still looks attractive.

A quick photo of Epsilon Net

Country: Greece

Sector: Business Software Development

Market Cap: 634M EUR

Revenue: 86M EUR

CROIC: 43%

Gross margin: 62%

EBIT yield: 3.7%

EBIT 5-Y CAGR: 82%

That last number is not a mistake. They have grown their earnings in a massive way over the past 5 years, and the price in the market has followed.

You can buy the stock on:

Athens Stock Exchange: Ticker EPSIL.AT

Stuttgart Stock Exchange: Ticker 2OE

Dusseldorf Stock Exchange: Ticker 2OE

The Athens stock exchange is the most liquid (but not super liquid).

Within Europe, the broker Flatex Degiro allows you to buy it. It might be more difficult outside of Europe. (not available at Interactive Brokers)

If you’re from the US, and you know which broker allows you to buy this company, let me know, and I’ll update the article.

Back to the past

Epsilon Net was founded in 1999 and has been publicly traded on the Athens stock exchange since 2008. Here’s what happened in the market until 2020:

When looking at the share price, the company went public at a price of about 0.4 Euros, and then continued dropping until at the end of 2010, it reached a price level below 0.1 Euro, and stayed there for multiple years. Then, between 2017 and 2018, prices increase and by the end of 2020, trading has significantly picked up in volume.

We are going to zoom in on those 5 years until the end of 2020.

How did they make money?

When you think of Epsilon, think of a company like Intuit (INTU), or Fortnox (FNOX).

They provide software and software solutions for businesses.

The difference is that Intuit is a global player, while Fortnox only operates in Sweden, and Epsilon at the moment is focused on Greece.

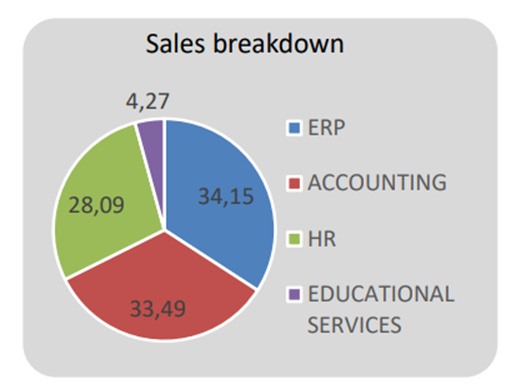

Here is Epsilon’s sales breakdown at the end of 2020 in percentage per segment:

At that time, sales were almost evenly divided:

A third from their accounting software

A third from their HR and Payroll

And a third from ERP (Entreprise Resources Planning) solutions

As you can guess, these are sticky products. Once businesses integrate this software into their operations, and if they continue to grow, they are unlikely to change.

There is a saying:

Changing a company’s ERP software is like going to a dentist without anesthesia.

The accounting software is used by accounting offices or by businesses with their own accounting department.

There were 2 big milestones up until 2020:

The introduction of their Pylon Software Platform. Additional solutions for businesses were developed on top of this platform up until a full ERP release in 2018.

The second milestone is the release of Epsilon Smart which is aimed to profit from an increased digitization of business operations within Greece like the ability for electronic invoicing.

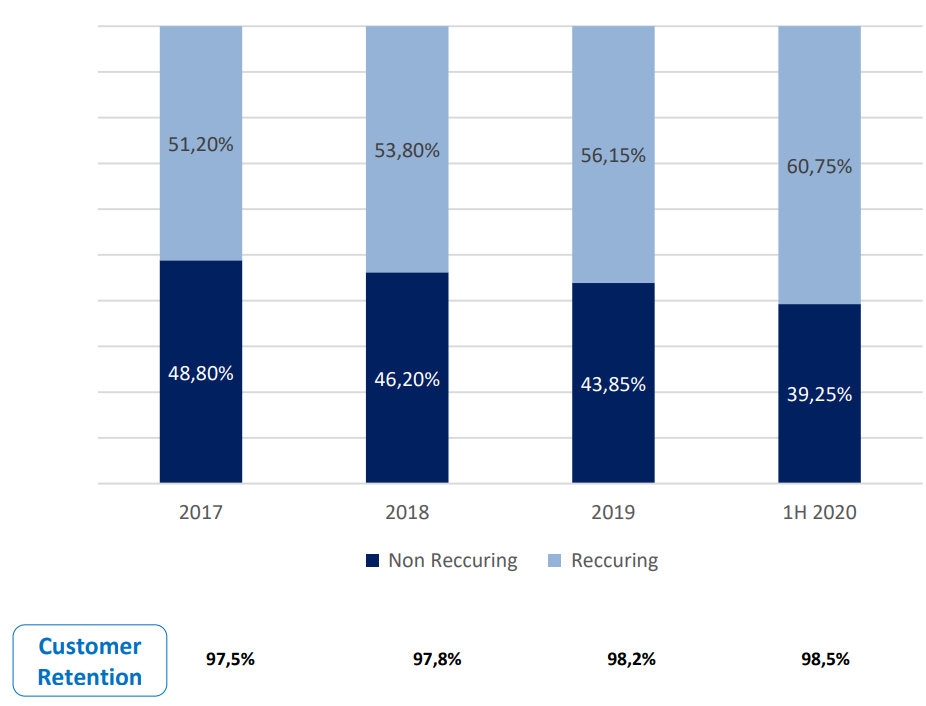

At that time sales were based on a combination of one-time sales and recurring license fees. Here’s an overview of what the ratio looked like:

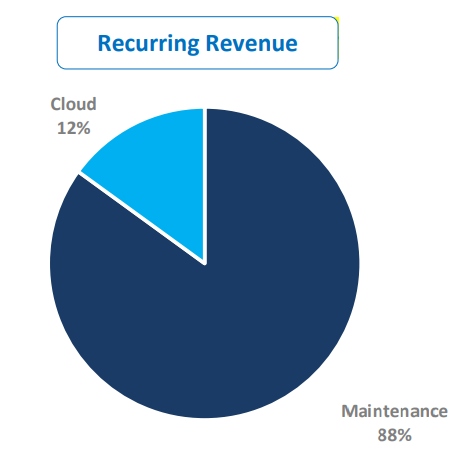

One important detail is the nature of the software used and the portion in the cloud.

Of the 60% of revenue that is recurring, only 12% was related to cloud software solutions.

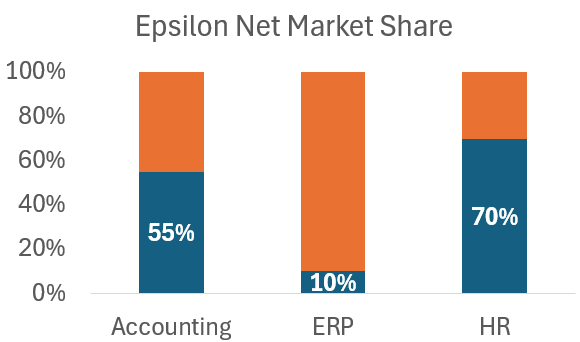

And according to Epsilon, they held the following market share percentage within Greece:

Where especially for the ERP segment, there was one interesting breakdown:

Epsilon Net has been growing sales organically in addition to some business acquisitions.

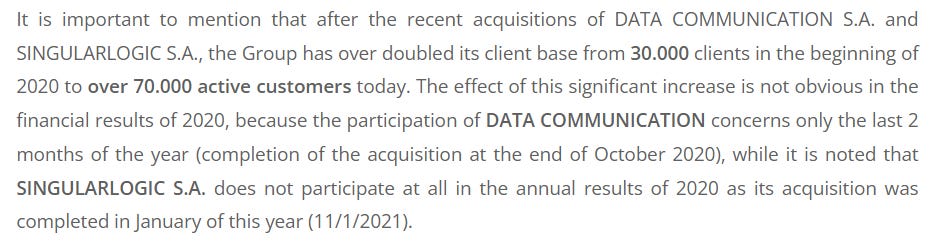

To continue to fuel their growth, in October 2020, they managed to acquire Data Communications which allowed them to strengthen their position in accounting and HR.

Finally, in January 2021, they acquired their main competitor in the ERP software segment, Singular Logic (The biggest IT acquisition in Greece for the last decade).

What’s always interesting is the timing of these acquisitions as the full consolidation method (the International Financial Reporting Standards (IFRS)) is used in the books, but applies only from the moment of the official acquiring data.

This means that:

Data communications acquired on October 1st of 2020, only added to the books for the last 3 months for the full year of 2020

Singular Logic was acquired on January 20th, 2021, and participated for the last 2 months in Q1 of 2021

Summary of Sales Quality:

Sales were based on sticky products

Recurring part of sales was increasing

Sales were increasing organically and through strategic acquisitions

Market share in the different segments except ERP was dominant in Greece

Are they cash profitable?

So the sales quality was great. What about profitability?

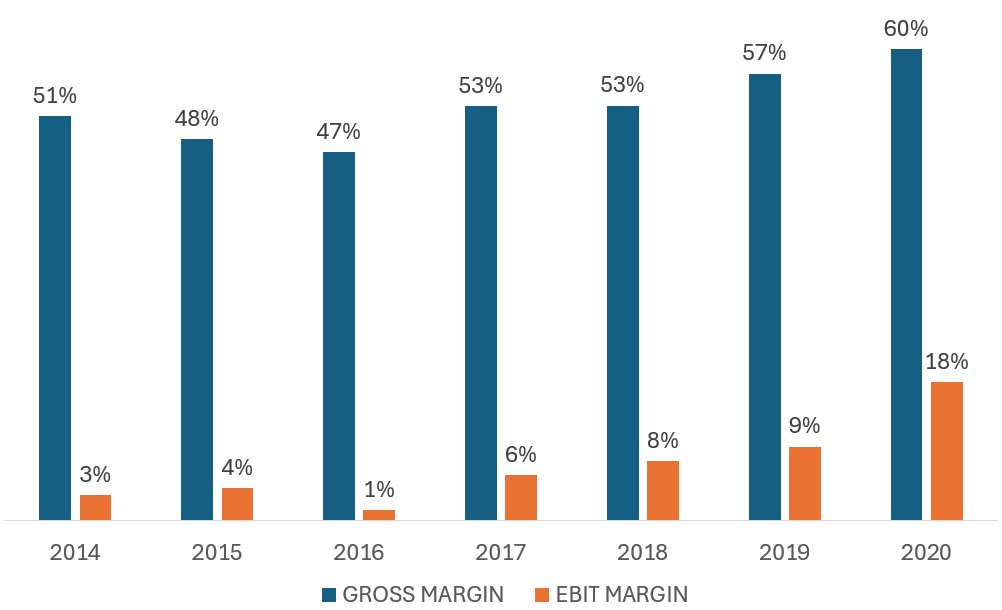

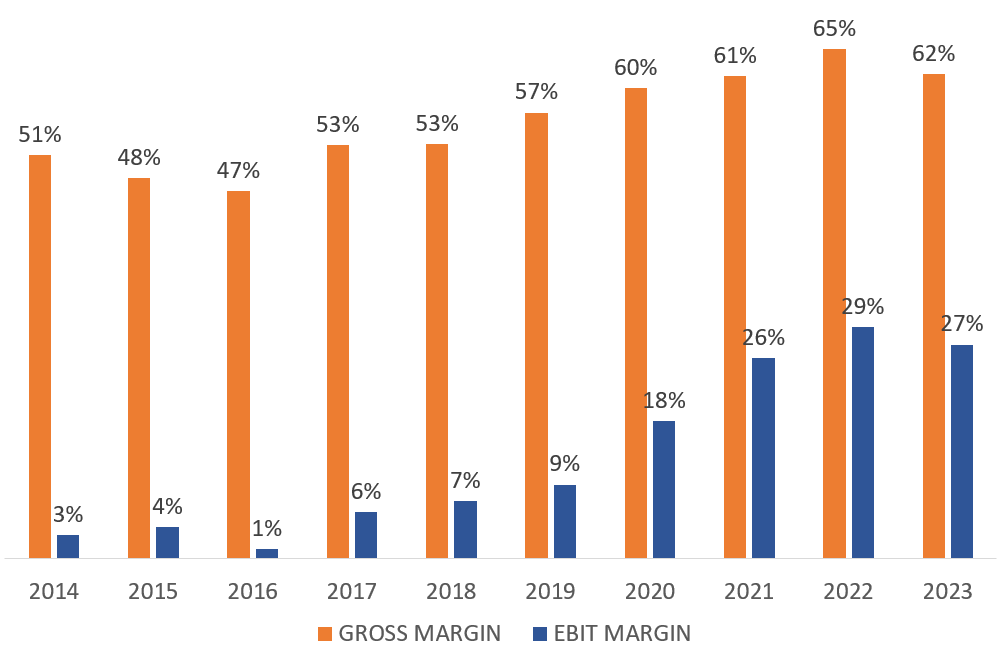

We’ll look at gross margins, EBIT margins, and how profits were converted into cold hard cash.

Gross margins are good, what you would expect from a software company. Intuit at that time had gross margins of 85%, but that’s comparing an elephant to a mouse…

The fact that since 2016 both gross margins and EBIT margins have increased is a very good sign.

A measure of earnings quality is the cash flow from operations divided by the net income. If the ratio is bigger than 1, then you can consider a good quality of earnings. In the case of Epsilon Net, this ratio has always been higher than 1. At the end of 2020, it stood at 1.8.

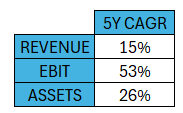

Lastly, we’ll take a look at possible signs of operational leverage. Does operational income increase faster than sales? And how does sales and income growth compare to assets growth?

EBIT is growing a lot faster than sales and assets which signals increasing operational leverage and an asset-light company (which is to be expected).

Summary of earnings quality:

Increasing profits and margins

Profits convert to cash

Operational leverage shows

The company has successfully grown its bottom and top lines, let us take a look at efficiency.

How were they allocating capital?

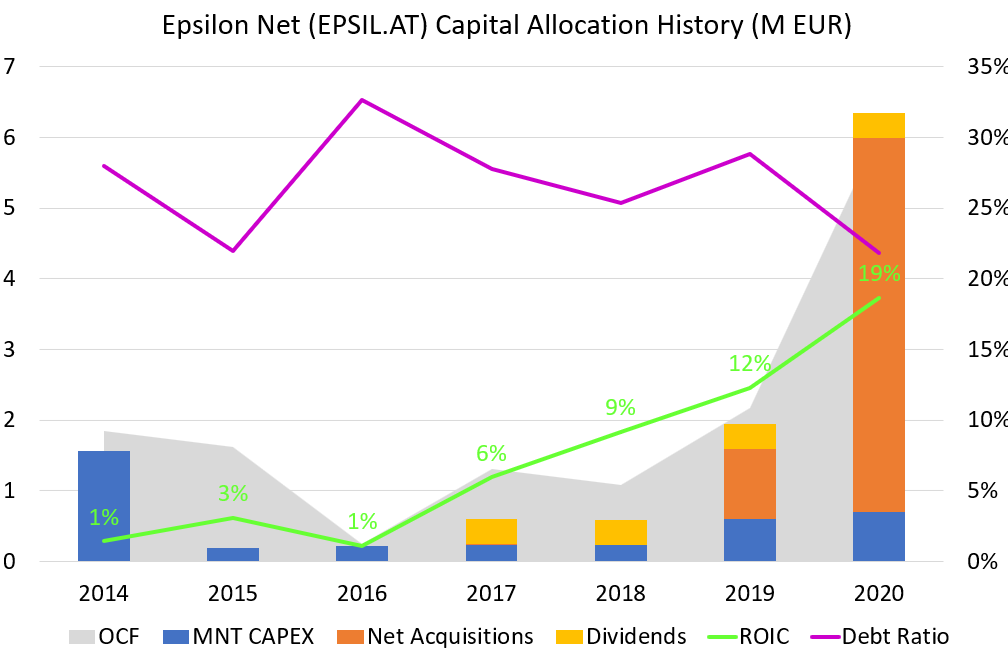

The following graph shows the capital allocation history until 2020:

The debt ratio is more or less stable and acceptable

Since 2016, cash flow is increasing rapidly

As of 2019, acquisitions are made to fuel future growth

Dividends were paid but not in the COVID year

Most importantly: ROIC is increasing and the company as of 2018 is creating value (ROIC > WACC)

A photo at the end of 2020

Up until now, we have seen a small cap company, getting stronger year by year. Sales and profits are increasing.

Our goal with this quick analysis was to verify if the opportunity was present and what we could learn from it to improve our process.

Having a quality company like Epsilon at the end of 2020 is great, but that does not mean it would be a great investment.

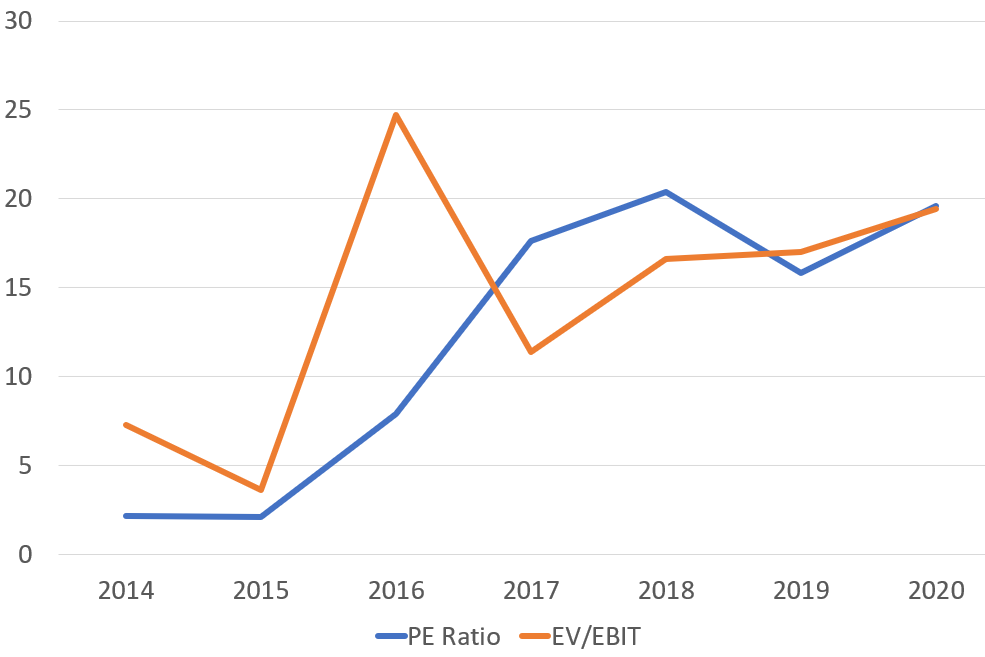

Now if a company is performing like this, the market should take notice, even if it is not super liquid and local. So let’s take a look at what the market was pricing the company:

So the market took notice, and the company re-rated from a low 3 PE to a trailing PE of 20.

Reverse DCF

So if we do a reverse DCF, what was the market implying at that time?

When looking at free cash flow, it was growing fast in the 5 years prior to 2020 with a 5-year CAGR of 50%.

In addition, the government was pushing for more digitization within the country and in particular within the business.

What happened here is that the stars have aligned, a triple whammy occurs

From 2017, the business is generating free cash flow and growing

Digitization: Secular trend + COVID Boost

A major strategic acquisition is done

Now these 3 factors can influence growth. But we have hindsight bias. And I personally never forecast super optimistically. But the question is, what was the market implying?

If we take a base FCF of 3 million (they did more than 5 at the end of 2020) and you model this at a 10% discount rate you get an implied 13% increase in FCF over the next decade.

In other words, a historical 5-Y FCF growth rate of 50% versus an implied 13% future growth rate.

Takeaway: The P/E ratio looked high (although similar companies trade at much higher multiples, we’re taking a discount for it operating only in Greece) but the reverse DCF shows otherwise.

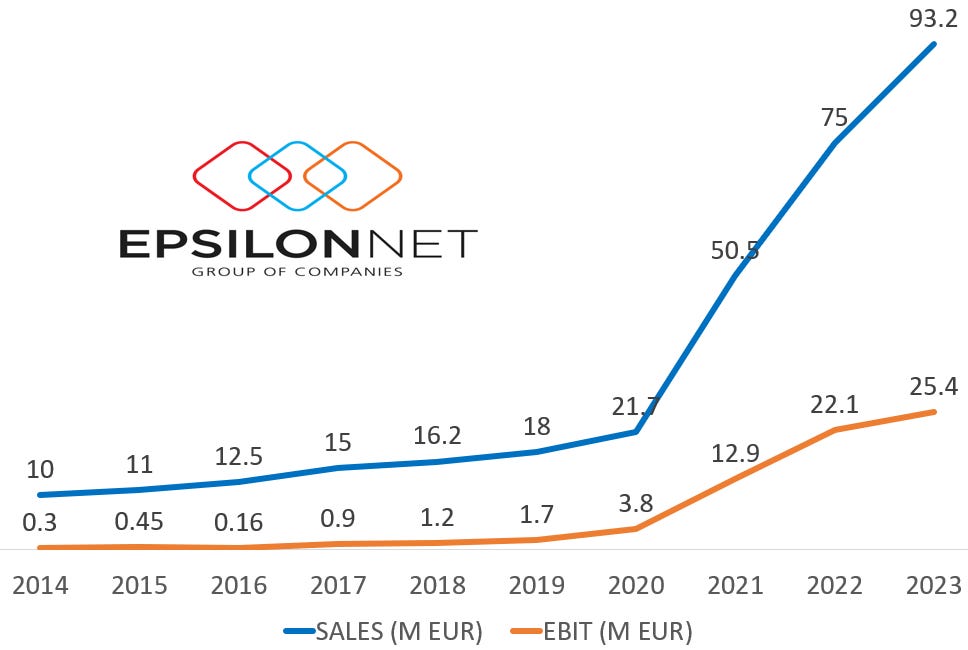

What happened in the following years?

They continued their growth rate at a 46% CAGR in FCF growth and blew everything out of the water.

FCF has risen from 5 million at the end of 2020 to 25 million at the end of 2023. This growth was fueled by the aforementioned triple whammy and the Singular Logic acquisition which made them much stronger in the ERP segment.

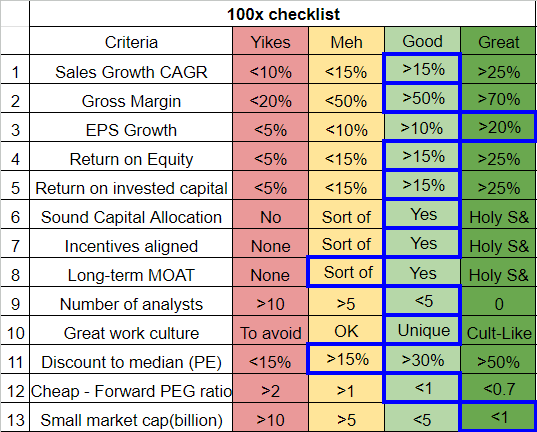

100-bagger checklist

What would the 100-bagger checklist have looked like?

This is how I would have assessed the company in 2020. The quantitative numbers I cannot dispute, but for the qualitative:

Capital allocation seemed solid, and because ROIC was increasing it started to pay off

Long-term MOAT would have been too early to tell. For such a small company, you can even ask yourself if you can talk about a MOAT. But because of the stickiness of the product, it would have been ‘sort of’

Incentives aligned: The CEO owns 65% of the company

Great work culture: They have received multiple awards in the past as the best place to work, so it is better than just OK

Lessons learned?

So what did we learn from this little exercise? Could we have detected the opportunity? Would we have acted upon it?

This company was getting stronger. And it did not happen overnight, it took them 5 years:

Do not only screen on absolute numbers (for example Gross Margins > 40%) but also look for increasing gross margins (or other criteria)

In 2020, the stock was listed on the main Athens Stock Exchange. Before it was listed on the alternative market. I’m unsure if the company data was available in a lot of screeners in the world

Screeners are not sufficient. Follow other ‘local’ investors who hunt for small caps to get new ideas. Add it to the idea funnel. This especially resonates with me after reading one of the latest post by Sebastian

Context matters. There is hindsight bias, but at the end of 2020, the acceleration in digital transformation due to COVID was visible AND information on the push from the Greek government to accelerate digitization was available.

Always look for secular trends or context around the company

Acquisitions are consolidated only on the date they are legally finalized

Take this into account when looking at companies that acquire other companies. In other words, the prospects were a lot brighter than what the past data showed. This information was clearly stated in the annual report:

The P/E is not the best tool to give you an idea about the value

It is best to look at cash and see what the price in the market is implying about future growth

The company had a market cap of 21 Million Euros at the end of 2020

Be market cap agnostic. A quality company can be found independent of market cap

Conclusion

Doing this sort of exercise was insightful, but we must be aware of hindsight bias.

If I’m honest, I found Epsilon Net through X last year. If I could transport myself back to 2020, except if someone had told me about the company, I do not think I would have heard of it. I have run multiple worldwide screeners in the past years, looking for quality companies. Epsilon never appeared on my screen. I suspect this is because they were trading on the alternative market and their data was not included in most screeners.

Were you an early investor? If so, you can reach out to discuss how and why you invested.

Now let us go back to the future. This will be a first look at how I think the future will unfold for Epsilon. I plan to do a deep dive later on in the year.

Back to the future

We’ve seen that if you looked at the company at the end of 2020, it was a quality company getting stronger. But what does the future hold for Epsilon Net?

Performance until now

Growth

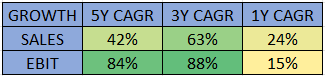

After its massive growth in sales and earnings over the last 3 years, growth has slowed down in 2023:

Or if we represent it into growth CAGR’s:

This can be related to having captured all the low-hanging fruit and maybe an increased amount of competition within Greece (from companies like Entersoft). Although the stars have aligned 2020, it seems the effect of the triple whammy is wearing off.

Profitability

Gross margins have increased slightly but are stable at about 62%. However, EBIT margins have increased significantly and hover around 27%.

Capital Allocation

A quick look at the full picture up until the latest numbers released yesterday:

Epsilon Net is firing on all cylinders

They have gone on an acquisition spree to grow the future business

Debt has been reduced to a minimum

A bigger dividend has been paid

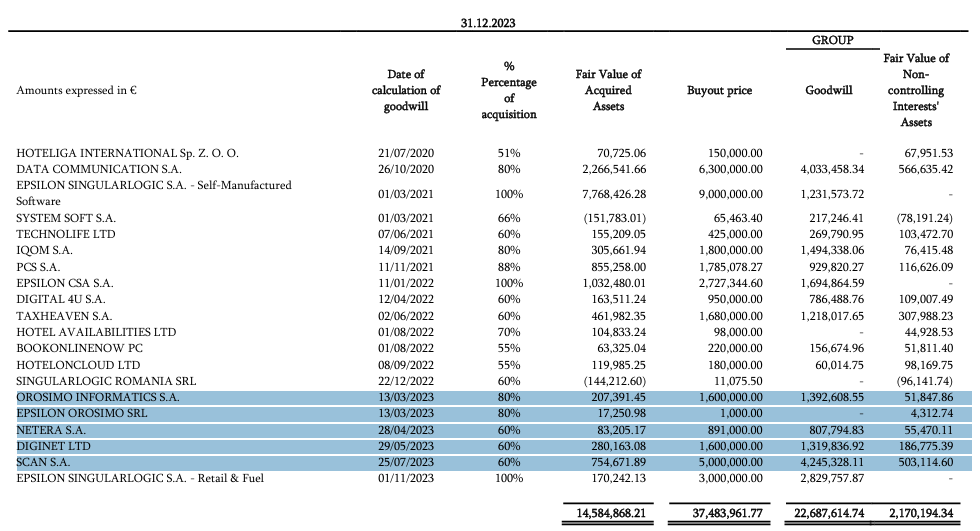

Epsilon has acquired:

Orosimo Informatics specializes in the implementation of complex IT projects and installation of ERP, CRM, and Supply Chain Management in medium & large enterprises with an emphasis on activities in the industry, logistics, transport in Greece & abroad, and in the development of special software solutions & systems that meet the specific needs of its customers. (EPR segment)

Netera is exclusively active in the development and provision of specialized IT solutions for businesses in the hotel sector.

Diginet is active in the development, distribution, and technical support of modern tax and cash systems and specialized technology products and solutions (Epsilon Smart)

Scan is an important partner of the EPSILON NET Group, having the responsibility for the selection, supply & distribution of access control systems, time and attendance systems, and generally integrated solutions with payroll systems & HRMS. (HR Segment)

For a total of 9 million euros.

The remaining 15 million is NOT the acquisition of new businesses. It is the final purchase of 35% of Epsilon HR (4M) and 40% of Singular Logic (11.8M).

Here you can see the percentage of the acquisition and the dates of calculation.

Market Trends

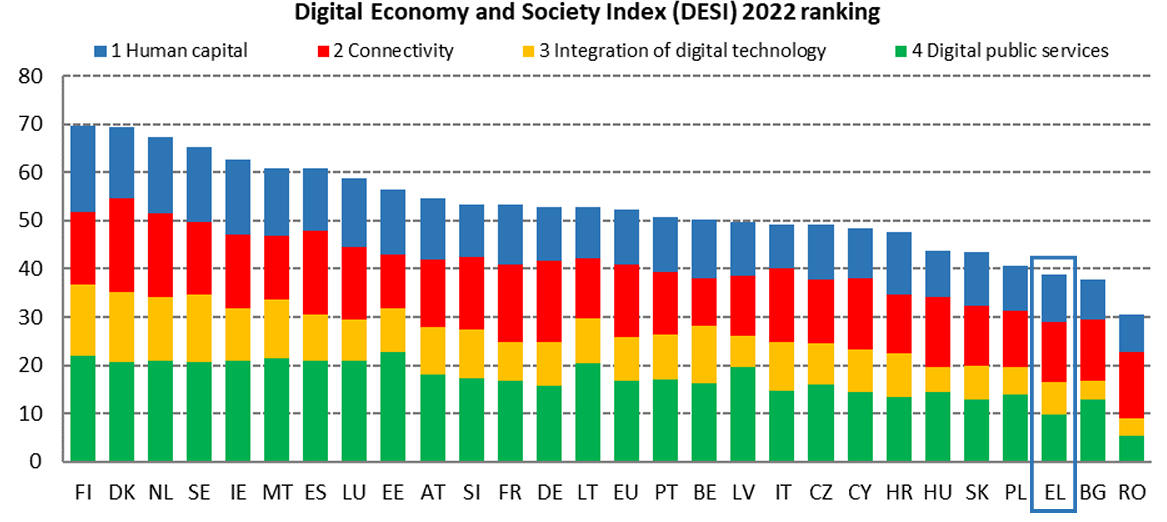

The trend in Greece towards digitization is still valid.

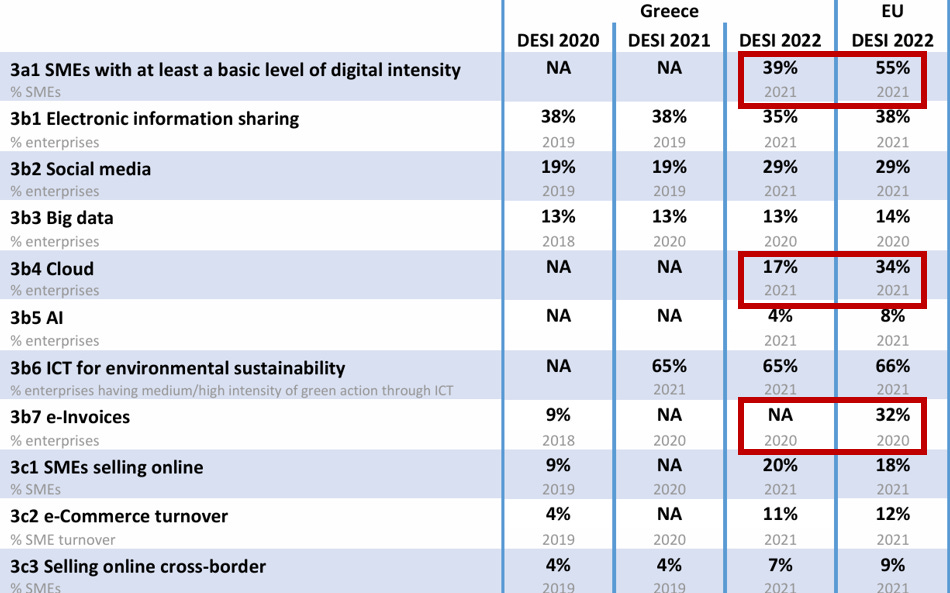

As a reminder, in 2022, Greece ranked 25th of the 27 countries when looking at the DESI scale.

DESI is the Digital Economy and Society Index and measures:

Human Capital relates to % of people with digital skills and ICT experts in the population

Connectivity is the amount of high-speed broadband and 5G coverage

Integration of digital technology

This is an interesting one as it relates directly to Epsilon Net’s business. I’ve highlighted 3 things in particular:

The general digitization level of SMEs is at 39% versus 55% in the EU

Software by cloud usage in companies at 17% versus 34% in the EU

e-Invoices which was practically nonexistent in 2020

Digital public services relating to digital government services

Since this report dates from 2022, steps were taken thanks to Epsilon and other companies in 2023.

The government has decided in the past that e-invoicing is mandatory for certain businesses (for example agricultural sector is not included) which provides a tailwind for Epsilon Smart.

What is the market pricing for?

Let’s take a look at a reverse DCF.

Basic assumptions:

Discount rate: 10%

Base FCF: 24 million (= 2023)

To obtain the current enterprise value, over the next 10 years, to obtain a 10% return, FCF should increase with the:

First 5 years: 19% each year

Last 5 years 10% each year

Based on Epsilon strengthening its business model through the cloud, making more acquisitions, looking for opportunities abroad, and its dominant position in certain markets in Greece, these growth rates seem reasonable.

I’ll need to dig some more during the deep dive, but from a first look, the price seems fair.

Incentive structure

The CEO owns about 65% of the company and this has not changed.

Conclusion

Epsilon is on a path for growth and will continue to grow.

They will continue to benefit from the overall digitization related to e-invoicing with Epsilon Smart

They have an exclusive agreement with the second largest bank in Greece: The Greek National Bank to develop embedded banking products. There was a press release

More and more businesses will go towards the cloud which will strengthen Epsilon Net’s business model. (64% of sales based on their last corporate presentation in October was recurring)

Their business is sticky as mentioned at the beginning of the article

They are the market leader in accounting and payroll (according to their data, they claim a 75% market share for both segments)

They want to expand through more acquisition and try to find opportunities abroad (Romania, Bulgaria I believe)

Their exclusive agreement with the national bank has resulted in a first launch: Epsilon All in One

Adopting EPSILON ALL in ONE the end user can invoice, receive payments, and issue receipts using a single device, in 3 simple steps.

Businesses can sign up for free at the moment (instead of a 99 euro cost). But it’s unclear at the moment what the business model looks like. Their goal with the bank is to develop embedded payments. This allows the business to have instant data on sales and data on the customers directly within the Epsilon platform.

Add to that a strong balance sheet and solid capital allocation to conclude that Epsilon is a quality company.

Disclosure: I have no position in Epsilon Net at this time and will continue researching the company and will release a deep dive shortly with a MOAT and competitive analysis.

I hope you enjoyed the article. Happy hunting. And as always,

may the markets be with you!

Kevin

Further reading

An excellent article on Epsilon Net by Picolinie Capital:

Some insight into one of their competitors: Entersoft

Another excellent article on Epsilon Net:

In the US, one can buy it through Fidelity (EPSIL:GR).

I think the game changer for Epsilon was the introduction of their e-invoicing solution epsilon smart where they became very fast the leading company and where they have now very good upselling possibilities and high margin