Is Adyen still a Buy?

This article is structured in the following way:

Introduction to Adyen and the Payment Processing Industry

Adyen’s past performance

A full overview of the Adyen Investor Day

Adyen’s destination analysis and DNA

Conclusion

Further reading

Who is Adyen?

A short history of Adyen

Adyen, a term signifying a fresh start in Surinamese, was established in 2006 by a group of Dutch entrepreneurs led by Pieter van der Does and Arnout Schuijff. The name "Adyen" was chosen because this same group had previously founded Bibit, a payment company. Following the sale of Bibit to the Royal Bank of Scotland (RBS), the founders decided to embark on a new venture in the payments industry.

After self-funding the company for nearly five years, Adyen's founders secured their initial venture capital round in 2011. They only raised 250 million dollars (versus 6.5 billion for stripe). Remarkably, Adyen achieved profitability in the same year, alleviating any financial pressure and presenting an opportune moment to raise capital. During the global expansion frenzy of internet companies in the last decade and a half, Adyen positioned itself as a provider of essential payment tools for these companies.

Even during the IPO, Adyen IPO’d to gain more visibility in the market. It did not need to raise additional capital.

Adyen is more than a simple payment processor as illustrated by the below diagram.

To keep it simple, it processes a certain volume of payments (TPV) and based on a fee structure, earn a gross profit or net revenue on the volume. More detail will be given in the next paragraphs.

How does Adyen make money?

When you buy something in a retail store, you can choose to pay:

Cash

Credit Card

Debit Card

Software (your phone)

When you buy something online, you have the same options, but the software can be Paypal, Apple Pay, etc. There is an enormous amount of payment methods in each country and all over the world.

In other words, there are several different options for you as a customer to choose and the only occasion where may actually see the Adyen logo is if you pay in a store that uses an Adyen terminal or device. 90% of the time, you as a customer will never be in contact with Adyen. Adyen runs in the background if the merchant uses them as a processor.

If I buy a pair of Nike sneakers on the online Nike store, I will get the following possible payment options:

Depending on the method I use, several companies get a cut.

If you choose a credit card or debit card -> The bank and the card get a cut

If you choose Paypal and use your PayPal balance and not a card -> Paypal gets a cut (however, you need to fund your wallet first)

If you use Google Pay, it will use what you stored inside Google Pay as credentials. If in Google Pay, you use a credit card like Visa, then the bank gets a cut and Visa gets a cut. Google Pay does not have fees. It’s just a way that Google makes it more seamless for you to pay.

And finally, if I would use SOFORT -> this is a classic wire transfer from my own bank environment. If I use a debit card from my bank, my bank gets a cut, but Visa does not. Sofort/Klarna get a cut.

Adyen makes it so that these payment methods are integrated into the front end and then handles the back end as a merchant payment processor and acquiring bank.

Businesses like Adyen, Stripe, and Braintree work on behalf of the merchant, to process all the payments. As a customer, excluding the aforementioned point of sale in a brick-and-mortar store, you should never be in direct contact with these businesses.

In general, taking the example of buying a pair of shoes on the Nike online store with a Visa credit card, the distribution is as follows.

You pay 100 dollars but Nike gets only 98 dollars

The remaining 2 dollars are divided between the different companies:

1.5 goes to your bank that issued the card

0.3 goes to Visa because it allows them to use their network and infrastructure

0.2 goes to the payment processor, in this case, Adyen

What makes Adyen unique?

Adyen’s motto is to make complexity simple. Adyen provides complex solutions for large merchants. You want one processor to handle:

Multiple countries and currencies

Multiple payment methods

Online and off-line

then Adyen is your man to solve that problem.

It has a very specific strategic positioning. Their business is divided into 3 pillars:

Digital: These are large pure e-commerce merchants

Unified commerce: These are large merchants who have an online and off-line offering

Platforms: These are platforms like eBay which themselves have small businesses as customers. Adyen does not target small businesses directly. They have an indirect offering through their platform pillar.

This means that Adyen has thousands of customers while Stripe has millions.

They cater their value proposition to avoid commoditization and competition on price. They continue to add different financial solutions (they have acquired a US banking license) in order to provide more value to their customers.

Adyen has a unique company culture which they describe as the Adyen formula, their 8 company values:

In short, this means:

Benefit all merchants: Their solutions are not one-off highly tailor-made solutions for each merchant. The goal is to be more modular.

“We make good decisions and consider the long-term benefits for our customers, Adyen, and the world at large” -> their focus on the long-term. Quick note: The word long-term appears 52 times in their 2022 annual report

Launch fast and iterate: focus on speed in a market that is rapidly changing. They are able to deploy products in weeks or months, a lot faster than legacy players.

Winning over ego: The final result is what matters

No hiding behind e-mail: avoid misunderstanding

Talk straight: An open and honest approach

Seek different perspectives: To stay sharp

Creating their own path: Taking unconventional routes and being open to fresh ideas

They are very selective in their hiring process in order to protect this culture. 2022 and 2023 were their investing years, to prepare for future growth. But the quality of the persons hired has to come before quantity.

They have grown organically and most of their growth is by expanding revenue from existing customers (not by massively acquiring new customers)

They have never done any M&A and will probably never will

They have a modest share compensation program although cost is rising because they need to stay market conform to others (to avoid losing talent)

They limit the salary of the managers to never go beyond 10x the lowest salary in the company

The payments industry

Here’s the basic overview of how the payments industry works. Again we take the example of buying a pair of shoes at Nike.

Some things to consider:

Issuing banks take the lion’s share because they take the most risk

Mastercard and Visa has a sort of oligopoly because they own the card networks, the railroads

Paypal allows a sort of bypass of the railroad if a customer uses it’s paypal balance

The payment processors like Adyen act between the card issuer the networks and the merchant

If we only look at the industry of the payment processors, it is a very fragmented industry.

The entire market looks like this:

And the market of merchant acquirers and processors is very fragmented

In 2019, Adyen was number 28 on number of transactions. It has probably moved up into the 16-25 group over the last 3 years.

The global payment processing market is forecast to grow at a CAGR of 14% over the coming years, which also explains some of the growth that Adyen has experienced over the years.

The best estimate I have found to estimate Adyen’s market share is here. Adyen’s market share is estimated at about 2.2%.

Ayden's past performance and Investor Day

Past performance

Adyen's past performance has been stellar, growing on a tailwind of increasing digital payments versus cash payments, taking more and more market share in a very fragmented industry with some larger legacy incumbents.

Here’s an overview of growth CAGR on different metrics;

TPV = Total processed Volume that flows through the company

NET REVENUE = Based on Adyen’s tiered pricing model what they actually take from the processed volume

TAKE RATE = NET REV / TPV

EBITDA and Free Cash Flow as reported by the annual reports

You can see it through the colors, a significant slowdown has occurred explaining the hefty reaction of the markets to the H1 2023 results.

EBITDA and FCF have been impacted by Adyen’s investing phase = the hiring of new employees to prepare for the next growth phase.

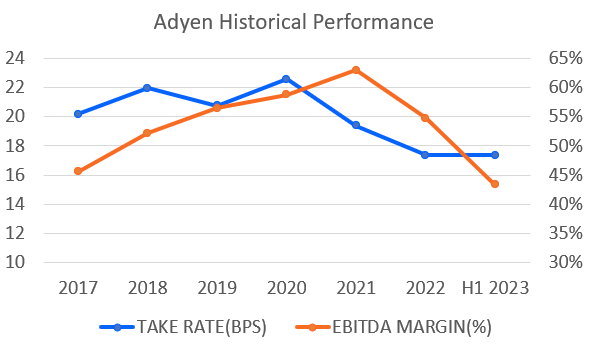

When we look at the evolution of these 2 important parameters:

The current take rate is lower than in the past. If the rake rate continues to decline, it can signal an increase in competition in price. Because this is a tech company, EBITDA margin is heavily influenced by employee salaries and spending. Because of the ramp-up of employee hiring in the last 2 years, I’m not too worried about the current drop. It will need to increase and stabilize in the coming years.

Quick competitor comparison

Here’s a quick overview of Adyen compared to some of its competitors:

Comparing Adyen directly to PayPal is not fair because PayPal offers more than just payment processing. But when we compare specifically Adyen to Stripe, Adyen is a lot leaner.

Adyen’s Investor Day

Adyen managed to reassure the market and finally give it what the general market wanted: More short-term guidance. I personally appreciated that in the past, they were going against the grain, doing things differently, even on the calls and half-yearly (and not quarterly) updates. In the future, they will, as most of the public companies, do quarterly updates.

Let’s go through the most important topics of Investor Day:

Guidance

Here’s how the guidance has changed over the years:

Since the IPO, long-term guidance was to achieve net revenue growth in the mid-teens to low thirties and an EBITDA margin of 55% Then COVID came, the business was boosted, 5-year growth of digital payments was compressed into 2 years, and they changed their long-term outlook towards 65% EBITDA margin.

On August 16th, 2023, the stock dropped 50% based on their H1 results. Now the stock has increased again by 30%. Over this time span, it is still the exact same company. The value of the company has not changed in a span of 4 months.

Since Investor Day, the market seems reassured by the recent feedback from Adyen’s management.

This is the first time in Adyen’s history that it has provided short-term (3-year) guidance. And apparently, it has worked. Especially since when compared to other players in the payments industry, Adyen’s growth (although it has slowed down) hasn’t slowed down as much as the others.

They do emphasize in their annual reports that these long-term goals in the past, are not specific goals that they pilot on. They estimate that based on implementing their strategy and executing their business, these are the results that will eventually result in these numbers.

When asked if the previous long-term guidance was still valid, Adyen replied more prudently: They claim that long-term EBITDA margin should increase beyond 50% thanks to their single stack and operational leverage.

In the past, it seemed that Adyen was immune to market sentiment, they published half-year results and continued to execute, with a unique company culture to drive it forward. Has Adyen now swayed towards the whims of the market in providing short-term guidance and a specific investor day before the next half-year results?

I think so. Although Adyen does not issue a lot of new stock, its CEO is still a large shareholder, and shares are offered as an incentive package (although a more modest magnitude compared to its US counterparts) so if the share price suddenly drops 50%, I do not think they are immune to this.

Trends

Adyen sees 6 trends moving forward.

The world hasn’t been fully digitized yet, there is a long runway ahead of them

Commerce continues to globalize and new payment methods are developed into the market every year

The shift from cash to cashless continues

Regulation (for example GDPR) has become more complex, which they like

More and more SMEs are using vertical SAAS platforms which Adyen wants to grow with

Macro environment leads to cost reduction: In the past, Adyen was focused on driving more revenue and increasing authorization rates for their customers. Now that merchants are also looking to drive down costs, Adyen is actively helping them do both. Increase revenue and find ways to decrease costs.

Customer Satisfaction

Net promoter scores have increased year by year:

We would need to have the NPS scores for the industry or competitors to get an idea about the relative scoring. Here’s an idea about what a good NPS score is:

The only thing we can induce is that customer satisfaction is improving. We cannot say anything about the absolute value of the NPS score. We would have to see the NPS scores in the industry.

Sales Team

They have significantly expanded their sales teams from 799 end of 2021 to 1255 in September of this year. This should fuel growth in the future with a specific focus on the USA. Sales cycle times can span from months to years.

Growth drivers

Growth for Adyen has always been mainly with existing customers. They call this the land and expand strategy. Once they land a deal, a merchant will let Adyen process a small part of their volume to then expand when trust increases. In the slide below, they explain how they show where growth comes from:

2 main growth drivers are market growth and increase in processed volume for existing customers

There is an offset by the tiered pricing model (the larger the merchant and volume, the lower the pricing)

Growth from new wins is small, but as explained above, should increase in the followings years

What is tiered pricing?

The fees per transaction depend on the total volume processed in the month. During the month, you are charged at the lowest tier. At the end of the month, it can be higher. Transactions at the end of the month: commission fees can be charged in the following month.

Increase the value proposition

There are several initiatives that were mentioned during the presentation in order to increase their value proposition in order to avoid competing on price:

Optimize solution with machine learning towards revenue AND cost

Share data with issuers to further increase authorization rates and avoid false positives

Add and embed other financial services: Buy Now Pay Later

Reduce cost for the merchant by looking at the whole pie (lowering interchange fee with the issuing bank through data exchange)

Use biometrics instead of text messages to make authentication less frictional for the customer

Real time payments and issuing of cards thanks to their banking license

Runway remaining

On all three value pillars, digital, unified commerce and platforms, Adyen see signifcant growth potential. As a reminder, platforms revenue (ex Ebay) grew more than 100%.

Digital runway curent shares of wallet:

Unified commerce current shares of wallet:

Platforms current shares of Wallet and platforms potential:

Q&A

Often, the Q&A is the most interesting part of any earnings call. Here are some of the highlights from that Q&A:

The slowdown in hiring at the end of 2023 and in 2024 is intentional. They believe they are reaching the capacity needed to fuel the next phase of growth for the company

They reiterate several times their single tech stack, value proposition and the refusal to compete on price

Using their pristine balance sheet in the future to further facilitate development of financial products

They haven’t confirmed their long-term goal of 65% EBITDA and only mention the EBITDA margin should increase

One of the reason stated for the slowdown in hiring is they have seen an increase in efficiency in the organisation because of the use of decentralized teams and automation to avoid simple ‘jobs’

They want to hire the smartest people at a salary conform with the market

Conclusion for the Investor Day:

Adyen gave the market what it wanted. It was a very detailed sell to explain their unique value proposition and the future potential in the market.

As Adyen repeatedly mentioned: We are just getting started.

Capital allocation

This paragraph will be short.

Adyen spends no more than 5% on CAPEX to maintain their single tech stack. It has a strong balance sheet but will not pay dividends or do any buybacks in the future. Instead, it will continue to grow their cash pile because it facilitates negotiations around regulations, licences and the possibility of offering new financial products in the future.

Adyen’s MOAT

Does Adyen have a MOAT?

Consumer advantages

Switching costs: Once a customer is locked in, the bigger the customer, the higher the switching cost. We know that bigger merchants use multiple payment processors, so I consider this advantage as existent but maybe not that significant.

Network effects: If Adyen provides a payment solution to Nike, as Nike grows to more and more countries and more and more currencies, Adyen will implement these seamlessly into their solution. But the product does not become better because there is growth. However, if a customer of Nike buys shoes, it will be identified on the Adyen network as a trusted customer. If that same person now buys another product with a merchant that also uses the Adyen processing network, that person is trusted and authorization will be seamless. In other words, there is some sort of network effect because when the number of customers on the network increases, the product becomes better for the customer (assuming the same person buys at different companies). In other words, the network effect is not super strong, but there is something there.

Production advantages

Complexity: This is the bread and butter of Adyen, to turn complexity into simplicity for their merchants. This is where they have a competitive advantage, and the Adyen formula, the single tech stack, and everything they do is to keep this advantage for as long as possible.

Intangible assets: Bank licenses. Adyen compared to Stripe, also offers the service of an acquiring bank. In order to do so, licenses need to be obtained in each country. This takes time and can help protect their MOAT as a business. Adyen has obtained a banking license in the US 2 years ago. This in theory allows them to for example issue cards and provide bank accounts. They are still in the early stages of deploying this kind of service to their customers.

Cost advantage: Adyen does have the typical cost advantage in the software industry. If Nike grows 10 times, and it does this by growing in the same country, and it does not add any additional payment options to its offering, then Adyen will generate more revenue, but its cost will stay the same. On the other hand, when compared to Stripe, the cost has OPEX costs that are much lower. In other words, they seem to function as a mean lean machine and are proud of it. However, we will need to see if costs stabilize in the future while net revenue grows.

Distribution: Adyen has some advantages because it has built out a global distribution network. This is not distribution in the classical sense of a retailer, but the technological and regulatory capabilities to provide solutions for their customers in numerous countries

Conclusion

Adyen does seem to have a MOAT, but it will need to prove it is a real MOAT (sustainable competitive advantage) versus a temporary one.

Market expectations

Inverse DCF

How is the market pricing Adyen after the Investor Day?

Using an inverse DCF model, and looking at past FCF growth what is the market expecting based on the current pricing in the market?

Here are the possible combinations for the terminal value and FCF growth based on the current price as of November 10th, 2023 if we consider a 10% discount rate:

Historical FCF growth has been about 25% with a significant slowdown in the last 2 investing years. The current price to FCF multiple is 50. The price to FCF multiple of 10 is the commodity multiple in the scenario that Adyen is no longer generating an ROIC higher than the cost of capital.

Based on this, and looking at guidance on net revenue growth and future EBITDA margins it seems as if Adyen is now priced to perfection.

In the long term, multiple compression seems plausible.

Market beats

Here’s the current historical analyst forecasting for Adyen:

There are no sell ratings, most analysts are on HOLD.

Adyen’s destination analysis

Where is the payment industry headed?

The industry is complex, fragmented to a certain degree, and changing every year. Overall, it is expected that the number of digital payment transactions will continue to grow versus cash payments. The market will continue to grow, and a tailwind is still present, but not as strong as the last few years.

Covid acted as a short-term catalyst for digital payments, and this was observed in the rapid growth of Adyen and some of its competitors (and the entire industry as a whole). That growth will continue but at a slower rate.

Technology will continue to be embraced and change is expected to happen year after year. This is not an industry to invest in if you follow Buffet’s principle of looking into the future to see if a snicker bar will still be the top-selling candy bar in 30 years. It is not a stable industry.

If you look at the history of the card networks, and the big players like Visa and Mastercard, a sort of consolidation has taken place, with an oligopoly, especially in the US.

Will the situation over the next 2 decades be similar in the payment processing space?

Probably not.

I expect players like Adyen and Stripe to continue growing, taking market share from incumbents and surfing on the wave of a growing market. But their end state will not be that of a Visa or MasterCard.

You need to look at the customer side:

Adyen thrives on complexity. It delivers ROI to big customers who are selling their services or products all around the world. A small SME in a single country does not need Adyen. It may use Stripe. Adyen is doing the right thing, focusing on the platforms, and not on the SMEs directly. Deciding to compete directly would mean competing on price, which is always a race to the bottom unless you're a Costco, where disruption may not be possible anymore because the low frontier has been reached.

Adyen needs to stay focused on what it already has, growing alongside its existing big customers by adding additional solutions to them and at the same time, keep adding new large customers to the mix.

Remember that their business at the moment is mostly from Europe and the USA. There is a whole world to grow into, and this is where Adyen excels, complexity, different countries, currencies, and regulations…

Is Adyen a potential 100-bagger?

Let’s first look at TPV. Is it even possible for Adyen, in the next decade, to increase their TPV by 100-fold?

Let us compare Adyen to Visa. Adyen processed 816 billion dollars in 2022. Visa processed more than 10 times more at 11.6 trillion dollars.

This means Adyen would be the size of 10 current Visa’s towards 2033. Even beyond 2033, that does not seem possible, even with an increased profit margin if we look at EBITDA.

Adyen is not a potential 100-bagger.

Is Adyen a potential 10-bagger?

Based on TPV, this would mean processing 8 trillion dollars in 2033, or roughly being the size of a Visa now. That doesn’t seem impossible but it doesn’t seem plausible. It would mean Adyen to keep on growing a lot faster than the market.

What does seem feasible then?

Conclusion on the potential upside: On the basis of TPV, I see a potential upside of 5x in the next decade. This could be a little bit more if margins improve. What happens beyond that first decade, I dare not assign a number to it.

The downside risk

We should have started with this, but as explained before, this is the danger of a destination analysis, by definition it is pretty positive, and one should always first look at the downside.

Will the part of the cash payment level off or even start to increase again?

No, that risk has sailed. The market will remain in a slower but growing tailwind of more and more digital payments.

Will Adyen receive more and more competition, and as a result slower growth and margin reduction?

This is probably the most obvious risk. But I do believe Adyen has a MOAT, and as long as it focuses on its strategic positioning, it will be able to defend that MOAT for the years to come. In fact, I believe it has a wide MOAT with its current client base, if it ventures towards ‘simpler’ payment solutions into the realm of a stripe, then its MOAT decreases significantly.

When looking at Adyen’s balance sheet, it is a fortress. Very little debt. Lots of cash. This company will not go bankrupt in the near future.

As a company, I feel the downside risk is limited on one condition: if you hold for the long term. This seems to be a very unique and high-performing company with years of runway left in front of them. But as an investor, things may be different. What is the downside risk of the current investment?

Adyen now trades at a PE of 52. These are large numbers.

In the short term, it’s impossible to see what is coming, and there might be significant downside risk looking at how violently the market reacts to news with the most recent swings in prices.

In the long term, multiple compression seems logical. The only engine you have if you choose to invest in Adyen is FCF growth and time.

Conclusion: Taking into account the upside potential and downside risk, looking at future multiple compression this leaves us with a 3 to 4 times upside.

What is the DNA of the company?

I like to find businesses that have some sort of optionality. This means that there is a low chance but a high upside possibility because of the way the business is run. Are they experimenting with other business models? Is there a chance they will develop something really special that will lengthen their growth runway in the future?

Although the culture of Adyen leads to putting a solution out there, getting feedback, iterating, and going forward, there may be some optionality to the business but not a significant one. Amazon was experimenting with different things. An online retailer developing a cloud-based business, you couldn’t have guessed this to happen but you did know that this failing fast and experimentation was ingrained into the DNA of the company. (well if you looked at it like Nick Sleep did, at the time, most of the market didn’t understand the company in this way).

Adyen is innovative in the way that it implements and embeds new financial solutions in its offering based on a payment world that is becoming more and more complex. Getting their banking license and all development that is currently made in providing additional services is done to protect their value proposition. Rightly so, they want to avoid at all costs becoming a commodity. They listen to their customer, create a feedback loop, and try to stay ahead of competitors by being a first mover in new solutions.

Based on what I learned during Investor Day after reading more about the company, it seems they lean more towards a combination of high level of customer experience and operational excellence instead of being truly disruptive.

I don’t see a culture of innovation in the more classical definition. Trying to build disruptive products and finding product market fit, experimenting, and failing fast.

Conclusion

Pros

Adyen is a high-quality company with a long runway ahead of it. It will continue to gain market share in a growing fragmented market. Its focus remains on the larger merchants be it, purely digital, unified commerce (brick and mortar), or platforms. Their strategic positioning is perfect.

Acquiring banking licenses, and embedding new offerings in their value proposition will help increase net revenue and avoid becoming a commodity offering.

Adyen grows organically and avoids acquisitions to protect its unique culture and Adyen Formula. They develop a single tech stack, which allows them to be more nimble than legacy players.

Cons

Although their new product offerings will have an impact on the growth of net revenue, I’m less convinced of their operational leverage to continue to increase EBITDA in the future. They are leaner than competitors, but based on the past, it remains to be seen if revenue will continue to grow faster than the costs. The fact that they no longer validate the long-term goal of 65% EBITDA may confirm this. A follow-up is needed in the future.

Adyen claims to innovate, but not in the classical way. Although in some way it is disrupting the legacy players, it is also surfing on a tailwind in the market. Adyen remains a middle-man, by wanting to be neutral, aligning their interests with their customers, and embedding a variety of payment methods and other financial offerings, they are able to produce value and avoid commoditization. However, their company DNA does not show a culture of failing fast and experimentation. This reduces the probability of further upside optionality.

Conclusion: There is a lot to like about Adyen, but the price in the market is hefty. I bought a small position in Adyen after the dip, but refrain at the moment from adding to it as it is priced to perfection. The downside is limited but, I need more proof of further upside in order to justify the current price in the market.

I currently consider it a great business at a fair price. Further proof must be revealed to see if this is a wonderful business.

Further reading

I feel I’ve only scratched the surface while researching this industry. In my research, I’ve come across talented analysts. Here you can find some of them in order to do further research into Adyen.

Adyen Deep Dive by the Wolf of Harcourt Street

Bear case and blind spots by From Growth to Value

Colossus business breakdown of Adyen

The Navy Seal of Payments by MBI Deep Dives

Adyen Investor Day slide deck

Adyen, payments, and profitability by Jareau

May the markets be with you, always

Kevin

Oh wow another excellent write-up (I am catching up :-). As an incorrigible value investor, I couldn't resist loading up the truck at 600s beacuse the trade-off seemed skewed too much to the upside at that point. However, I like Adyen now much less at ~ 1200s than I did in 600s, a gut feeling that your superb analysis provides some good foundation for. Holding something that's priced to perfection is not my investment style, but then again selling a company with a fortress balance sheet, a long runway of double-digit growth, 50%+ EBITDA margins and so on just somehow feels wrong, too. So I am torn. I think I'll go against my Ben Grahamesque instincts for now and hold on, and let it be a lesson, just don't know which one yet!