9 takeaways from the deals of Warren Buffett before his retirement at the age of 38.

Did you know, Warren Buffett announced his retirement at the age of 38?

This was due to personal reasons and the market overheating.

He faced many challenges along the way, it wasn’t always smooth sailing.

Here’s an overview of 9 deals he made from age 11 to 38 and what we can learn from them.

All money amounts are displayed in 2024 dollars to get a better ‘feel’ of the size of accounts.

What happened?

Before diving into the deal, can we appreciate that Buffett managed to hustle his way from the age of 5 to 11 to amass 2,400 dollars?

At 11, he buys 3 shares of Cities Service and eventually takes a small profit.

Idea origin: As Peter Lynch said to buy into what you know, he bought based on his context, although 11 is very young, so this is just speculation.

His first experience in the stock market is a great one: After he sold, the stock continued to rise and 5x’es.

And the company now?

It eventually became Citgo, which is no longer publicly traded. Citgo is valued between 32 and 40 Billion USD and currently undergoing a sale process.

Takeaway 1: Beware of fixating on the price you buy a stock. Selling may be a more costly mistake than buying. But these are early days, take it with a grain of salt.

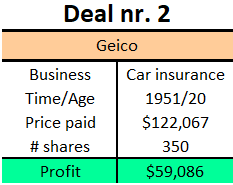

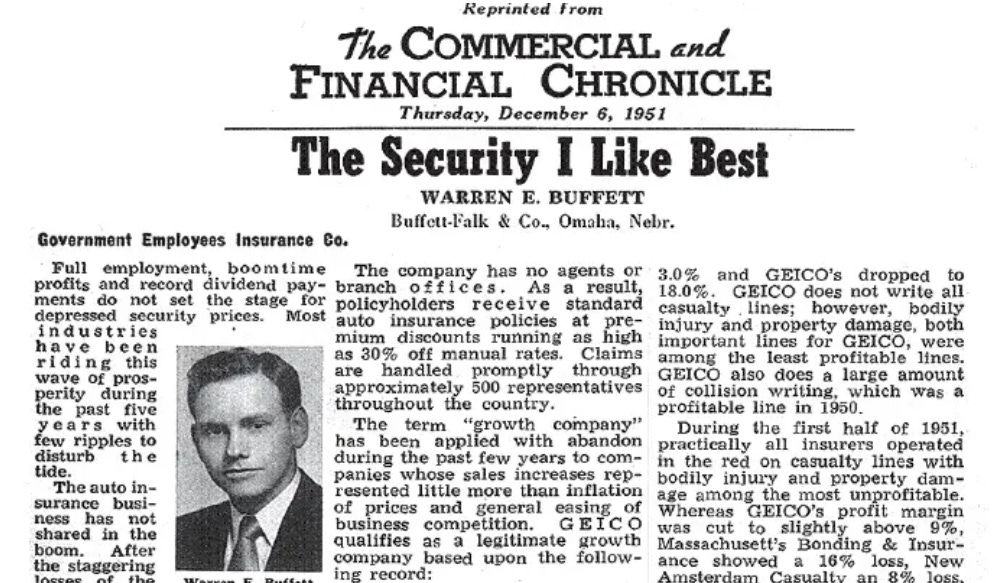

What happened?

First, look at the size of the account at age 20. This reminds me of what Charlie Munger said:

I don't care what you have to do — if it means walking everywhere and not eating anything that wasn't purchased with a coupon, find a way to get your hands on $100,000.”

Idea origin: Buffett noticed that his mentor, Benjamin Graham was the chairman of a small insurance firm.

Lucky enough, the master himself wrote out his pitch in the financial chronicles for all to see. An incredible pitch, a ‘growth’ company, trading at a P/E of 8.

You can download and read the full one-pager here.

His analysis:

Low-cost distribution

good niche within the insurance market

profit margin 5 times that of the competitors

Other experts told Buffett Geico was expensive. But Graham told him:

You are neither right nor wrong because the crowd disagrees with you. Look at the facts.

Did he have conviction: You bet, as he invested 65% of his net worth.

And the company now?

Well, you probably already know the answer as in 1996, Berkshire bought the outstanding stock and Geico became a subsidiary.

Takeaway 2: Buffett went beyond reading the annual reports. He interviewed insurance managers to deeply understand the insurance industry and the business. Scuttlebutting as Philip Fisher would say.

INTERMEZZO: In 1951 both Graham and Buffett’s father advised him not to invest in the stock market as prices were too high. What did he do? He had a 76% return at the end of the year…

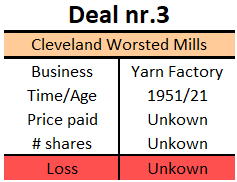

What happened?

First, what is Worsted? A high-quality woolen yarn. Here’s a picture of what the factory looked like:

These are the days of bargain hunting. Cleveland Worsted Mills had a share price of less than half of its net current asset value. In addition, a high proportion of its earnings was paid in dividends. It seemed like an attractive bet.

But it went wrong. Fierce competition from other textile plants and the rise of synthetic fibers resulted in the business suffering large losses, and having to cut its dividend.

Buffett took a loss, but the overall impact on 1951 performance was meager.

And the company now?

In 1956, after a bitter strike over union recognition, the plants were shut down.

Takeaway 3: Every investor makes mistakes. If you can be right 55% of the time, over many years, you’ll do just fine.

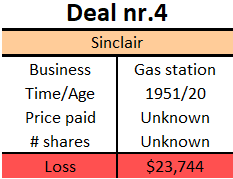

What happened?

Back to the roots, Buffett buys a gas station.

There was only 1 problem, it was located opposite a Texaco station, that outsold them. Buffett even served customers on the weekends. By working and observing, boots on the ground, he learned many lessons on competitive advantages and customer loyalty.

And the company now?

Sinclair Oil Corporation is alive and kicking. It trades under the ticker: DINO on the NYSE.

Takeaway 4: Never neglect qualitative factors like understanding competitive positioning.

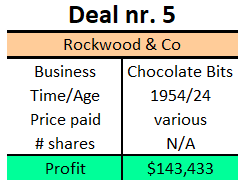

What happened?

Working for Graham, his main job was to plow through data on hundreds of companies in a windowless room.

Idea origin: The directors of Rockwood, a Chocolate bits maker, failing to make a profit, asked Graham-Newman Corporation to buy the company.

Another investor, Jay Pritzker, recognized an arbitrage opportunity. Shares could be bought at 34 USD per share and cocoa beans were priced at 36 USD per share. A liquidation of the inventory provided a 2-dollar per share profit.

But Buffett was smarter, instead of playing the arbitrage game, he bought 222 shares and held on to them which increased the number of beans per share you owned as others were selling. He made a nice profit.

And the company now?

Rockwood & Company sold the factory to the Sweets Company of America in 1957, who used it to produce Tootsie Rolls until it closed in 1967.

Takeaway 5: Dive deep to understand a company’s actions and their impact on future value. Do not forget the balance sheet.

Intermezzo: In 1956, Graham retired, and Buffett had amassed 1.6M USD through his investing. He wanted a sound base from which to think and make investment decisions about American companies so went to Omaha. Here the Buffett partnership was created.

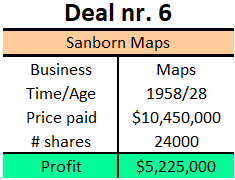

What happened?

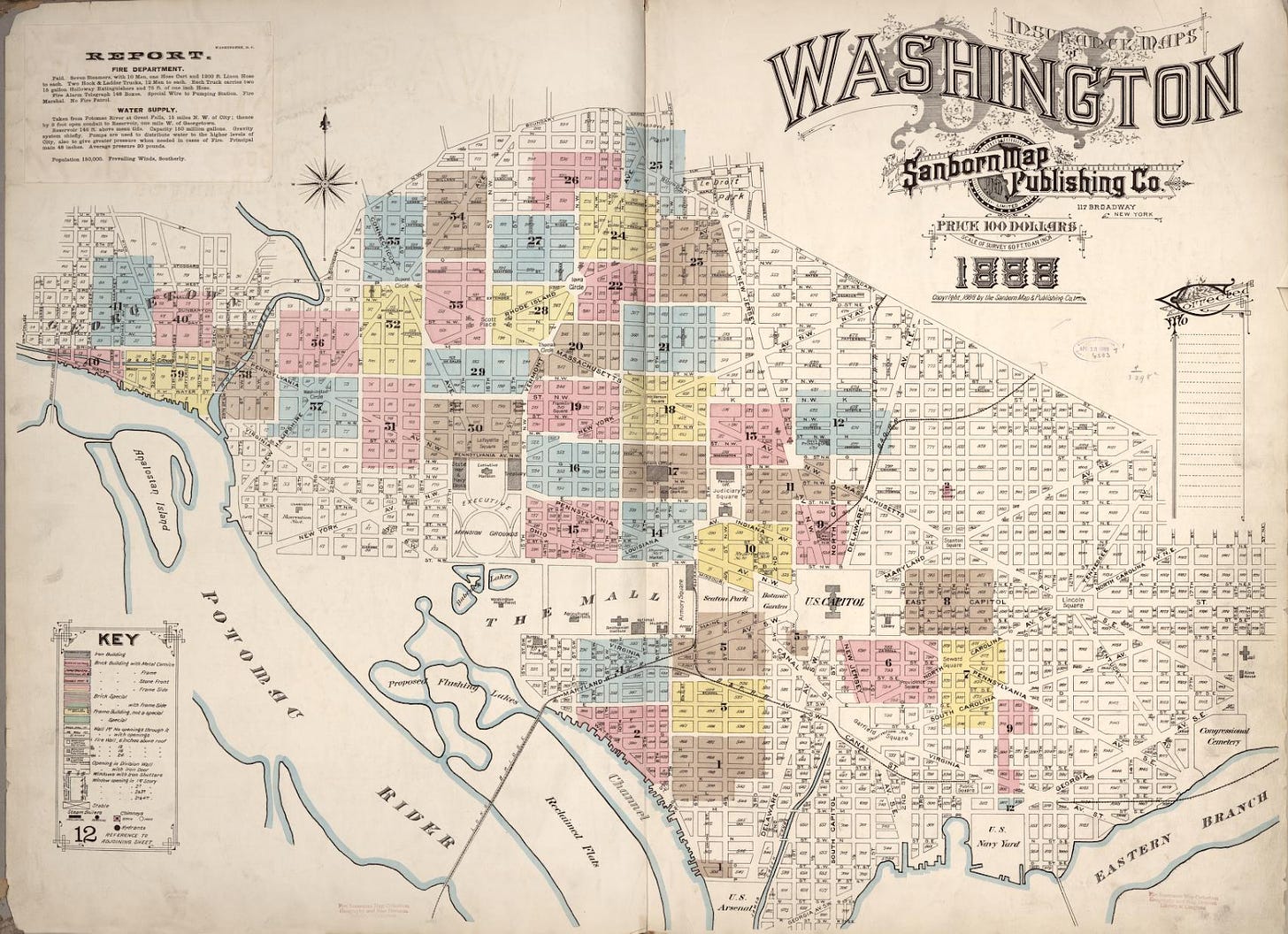

Sanborn was a company that sold detailed maps showing power lines, water mains and buildings to insurance companies.

The merger of insurance companies let to less maps being bought. Profits came under pressure.

On top of the map business, the company had an investment portfolio. The market cap was 4.7M and the portfolio amounted to 7M.

Buffett recognized the value but needed control to unlock it. He bought shares and encouraged his friends to do so.

In the end, Buffett had put 35% of his partnership into the investment. In 1960, once he had control, the board agreed to use the portfolio to buy out shareholders.

And the company now?

Sanborn held a monopoly over fire insurance maps for the majority of the 20th century, but the business declined as US insurance companies stopped using maps for underwriting in the 1960s. The last Sanborn fire maps were published on microfilm in 1977, but old Sanborn maps remain useful for historical research into urban geography. The license for the maps was acquired by land data company Environmental Data Resources (EDR), and EDR was acquired in 2019 by real estate services company LightBox.

Takeaway 6: Always buy the shares with a decent margin of safety. But unlocking the value would be difficult for us retail investors alone. You need critical mass.

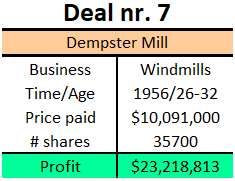

What happened?

A small, family-owned business located in Beatrice, Nebraska. It supplied windmills and irrigation systems. It was the most important employer in the city.

Buffett began buying shares at 16-18 USD per share while the NCAV was 50 USD per share. Why was it trading like this?

Fluctuating profit and loss history

Bad industry

Lots of debt

Mid-1961, the Buffett Partnership became the majority shareholder with a 70% equity stake.

As chairman, Buffett asked to reduce inventory and create a cash buffer. But management did nothing. In 1962, it was months away from bankruptcy. This would amount to a loss of 21% of the Partnership!

Charlie Munger knew a tough-minded manager who could help: Harry Bottle.

Harry Bottle cleaned ship:

He fired staff

Sorted through the inventory

Revamped the marketing

Divested surplus equipment

Liabilities were eventually reduced by a factor of 10.

In the end, the town of Beatrice raised 3M USD to buy the operating assets (they did not want the company to be sold to another outsider). This left the cash and investments.

And the company now?

After Buffett sold the company, years later, in 1985 the company became privately owned with its purchase by Don Clark. In 2008 Wallace and Felicia Davis purchased the company; however, it was closed in 2011.

Intermezzo: A shift occurred in Buffett’s investment strategy in the early 60s under the influence of Charlie Munger and Philip Fisher. The shift went from the emphasis on value to the emphasis on durable quality. Another reason was because of the increasing size of the assets, the smaller companies, which

Takeaway 7: Good managers can work wonders. Turnaround stories are always a risky bet. In any investment, always look for great management.

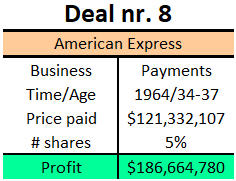

What happened?

In 1963, the share price of American Express dropped 50% because of the salad oil scandal.

American Express was the world leader in traveler’s checks (60% of the market) and credit cards.

So what did Buffett do?

He scuttlebutted: He went to restaurants, banks, and travel agencies. Everyone was still using their checks and credit cards. He talked to competitors and they said they still consider AE a serious competitor.

American Express had pricing power, customer loyalty, and a cash float as people paid for the cheques upfront.

From 1964 to 1966, Buffett kept adding to his position to arrive at 5% of all outstanding shares.

And the company now?

American Express is still around and well known. Buffett took a large position in 1991 and has held on to it since.

Takeaway 8 Think. Be on the lookout for negative news. When a stock price drops because of it, is it affecting the long-term value or not?

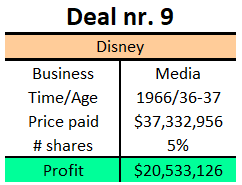

What happened?

The market was pricing Disney at a PE of less than 10 because it considered it didn’t have anything in its future pipeline.

Buffett went to the cinema and observed. Everybody loves Mary Poppins, and with the large back catalog, he figured people would keep paying to see Disney movies. There is a recurring element to it as children are born and grow up, they can again discover Snow White for the first time.

Buffet and Munger visited Disneyland and walked around, trying to value the business. Walt Disney showed Buffet a ride: The Pirates of The Carribean which cost 17M USD. Warren Buffet said:

Imagine my excitement - a company selling at only 5 times rides!

Buffet was now putting a lot more weight on the value of the intangibles as opposed to what was booked on the balance sheet.

Although he made a nice profit selling his stake for 6M, if he had held it, it would be worth 8 Billion right now.

And the company now?

No reason to dig deep. Disney went on the rise, although it has been facing harder weather lately.

Takeaway 9: Mr. Market can be a Dumbo

Retirement

Of course, Buffett made many more deals, but this gives us a short glimpse of how he evolved as an investor.

At the end of 1969, the market got overheated. Buffett got frustrated as he could not find the companies he used to and for personal reasons, as his focus on investing had taken a toll on his private life. At the age of 38, he sent a letter to his partners to announce his retirement.

But we already know how this panned out. As Glen Arnold wrote it best: It was not in his make-up to set aside his sense of stewardship and paternalism.

I hope you enjoyed going through history. This article was based on the book: The Deals of Warren Buffet: The first 100M.

I highly recommend it.

Here’s a recap of the 9 takeaways:

Do not sell too soon

Scuttlebutt: Do the groundwork

You will make mistakes, just be more right than wrong

Do not neglect quality factors like competitive advantages

Dive deep to understand the company’s future value

Always buy with a margin of safety

Great management can do wonders

Be on the lookout for negative news, there may be gems in there

Mr. Market can be a Dumbo

As always, may the markets be with you!

Kevin