After reading Philip Fisher’s book on Common Stocks and Uncommon Profits, he inverts and lists what you should avoid when investing in the stock market.

Here are my 7 picks on things you should avoid when investing in the stock market.

1️⃣Don’t buy if you don’t know why

Knowing your why and understanding the company will help manage your temperament.

Have you ever bought a company and seen it drop 50% one week later? It’ll be difficult to hold on if you don’t have a why.

There is a risk when copying another investor’s position. You can easily copy what he does, but you’ll need to do the work to copy why he does it.

Understanding a company, and writing down an investment thesis is essential to define your selling rules.

“The price has tripled, I’m taking a profit, or I just lost 30%, and I’m cutting my losses”, are no valid reasons to sell.

If you do not know why you buy, then you won’t know when to sell (or add).

So what can we do?

Start with why: Write down your investment thesis

How: Stick to your investment process

What: Buy/sell the stock

2️⃣Don’t confuse pricing and valuation

This is the most important lesson I learned after following Professor Damodaran’s valuation course. (it’s free on Youtube)

Any ratio related to price, for example:

P/E

EV/EBIT

P/FCF

Is related to the pricing of the stock in the market. The price current investors are willing to pay has nothing to do with intrinsic value.

A low P/E could be cheap or expensive. You can’t know by just looking at the ratio.

The intrinsic value of the company is the sum of current and future cash flows. That’s it.

So what can we do?

Estimate intrinsic value

Use a DCF or inverse DCF

Apply a margin of safety

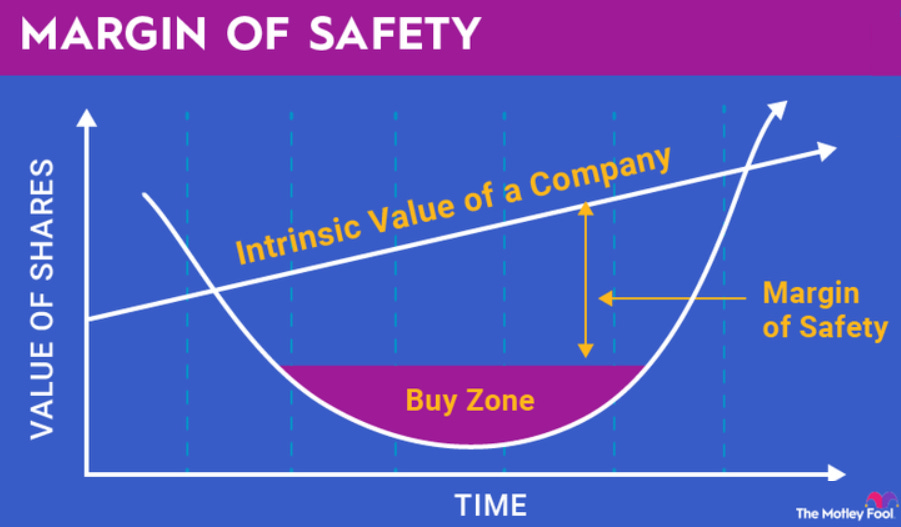

3️⃣Don’t buy without a sufficient margin of safety

Although it is related to step 2, I feel it’s important to emphasize.

Sometimes I see reports of financial professionals claiming that a stock is undervalued by 21%. “We consider it a buy.”

But what if they are wrong in their model?

Most of us know the concept of margin of safety, but the important word here is sufficient.

Remember that a bigger margin of safety is a double whammy:

If you’re wrong, you have more protection on the downside

If you’re right, you have more upside potential

So what can we do?

Define your level of return, your hurdle rate

Define your minimum margin of safety (I use 50%)

The higher both, the more you can say no

4️⃣Don’t quibble over eights and quarters

It’s important to fix a price you are willing to pay for a stock, just like if you’re going to bid to buy a house, you better go with a predetermined price in mind to avoid overspending.

But there’s a risk.

Quibbling and falling over a minor price difference can be a costly affair. If you are a long-term investor, the longer you hold, the less the initial price matters.

Although Warren Buffet was known for sticking to a specific price he wanted to pay, even he considered it a mistake. He bought Berkshire Hathaway, a monumentally stupid decision, quibbling over eights and quarters! (it wasn’t a great company when he bought it)

So what can we do?

Use limit orders

Hold on for as long as you can

If holding for the long term, buy it close to your price

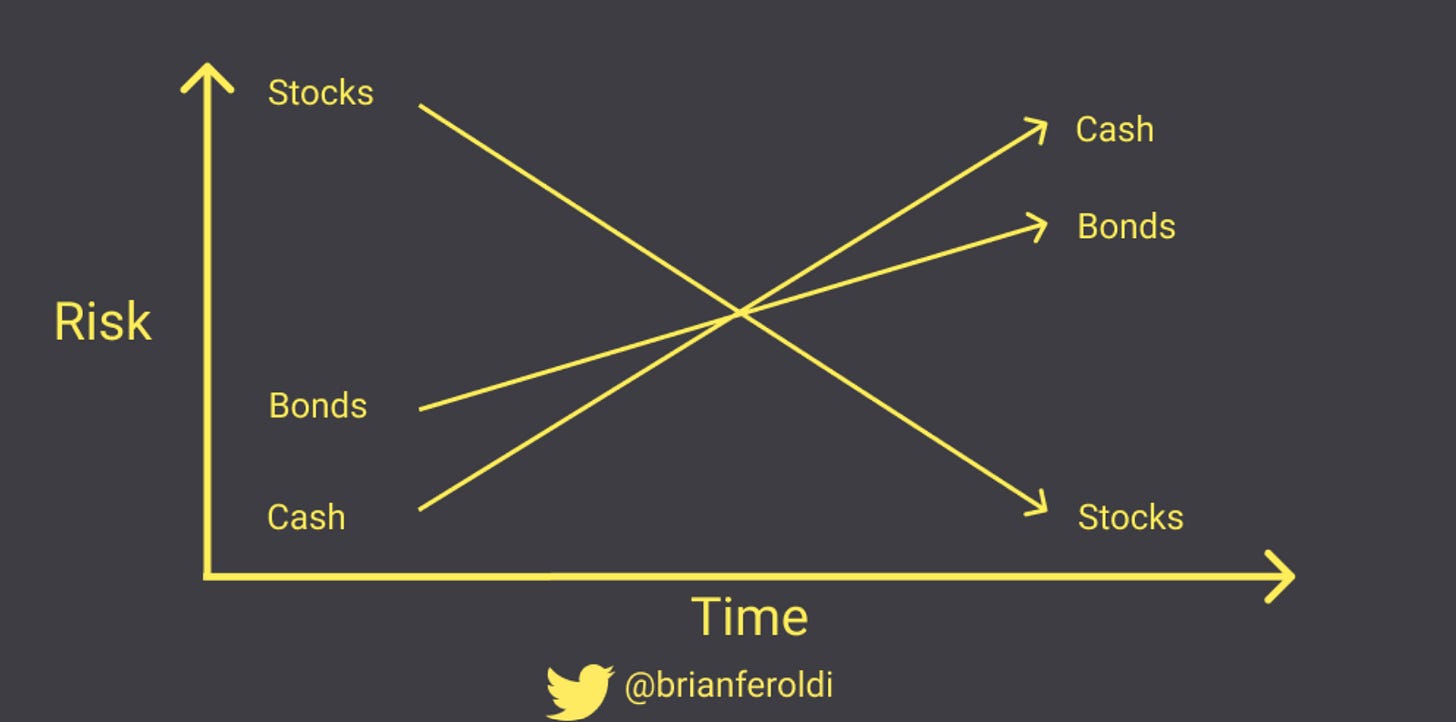

5️⃣Don’t be impatient, time is your ally

In investing, patience is the most important skill of all. There are two things to consider:

First, nobody forces you to do anything, you have time. When you look at those price movements, the stock market always calls to action. But the value of a company can take years to reveal itself.

Second, time is your ally towards great returns. Compounding returns speed up at the end of the curve.

Intermezzo: Philip Fisher implemented a 3-year rule. When he took a position, he gave the company 3 years to reveal its value. If the stock after 3 years went nowhere or went down and nothing had changed to his thesis or what he knew of the company, he would sell.

Would you apply this rule?

To emphasize this point even more, here’s an excerpt from The Psychology of Money by Morgan Housel:

So what can we do?

It takes time for a company to grow

You have time before buying anything

Read Morgan Housel’s books, they are fantastic

6️⃣Don’t be too eager to act

Can you feel that?

It usually starts in your stomach, then your heart starts pumping faster and excitement flows upwards to your brain, setting the mouse hand in motion, to buy…

“I've always said, the key organ here isn't the brain, it's the stomach. When things start to decline – there are bad headlines in the papers and on television – will you have the stomach for the market volatility and the broad-based pessimism that tends to come with it?” - Peter Lynch

Investing in the stock market should be devoid of emotion. So be a Jedi and not a Sith, do as Yoda says:

When you feel eager to buy a stock, why is this?

Is it because you're doing your due diligence, and the price is going up (but you haven’t finished yet)?

Is it because others already made a fancy profit, and it’s time to jump in?

Controlling your emotions is key in the stock market, and eagerness can be misleading. Only act when the work is done, do it without emotion. Automate if you can. Trade when the stock market is closed.

So what can we do?

Be an investing Jedi

If you feel eager, put the idea away for a week

Develop a process to protect yourself (here’s mine)

7️⃣Don’t take shortcuts, do the work

Succeeding in the market is a combination of luck and skill. You can increase your skill level and increase your surface area to capture luck by doing the work. Those I’ve met who do well in the markets over longer periods take no shortcuts. They are obsessed, and love what they do.

If you’ve made a killing, and didn’t do the work? Congratulations!

But better stay humble. There is more work to be done.

At least, that is what I understand from this message from Morgan Housel:

So what can we do?

Work

Keep learning

Be humble, but build conviction

Conclusion

Do you agree with these 7 picks? Which one would you remove or add?

Let me know!

As always, may the market be with you

Kevin

Nice

Love your articles! Thank you!