At the start of the year, I outlined my investment process and how I use a reactor portfolio to be able to hold on to certain positions a little longer.

Since then, I’ve gradually improved my investment strategy and made it simpler.

In this article you’ll find:

My refined investment strategy

A couple of companies on my watchlists

Some insights on position sizing and hurdle rates

A two-fold quality investment strategy

Spaghetti Bolognese

One of my favorite dishes is spaghetti bolognese with hot sauce added to it. I like the spicy kick. What does this have to do with investing?

Let me explain.

In the Western world, spaghetti is a dish that has won. You can find it in most restaurants. Out of all the dishes possible in the world, there’s a good chance a spaghetti bolognese has made it to the menu.

Here’s a short quote from the master:

In 2009, during the peak of The Great Recession, Warren Buffett was driving through downtown Omaha, Neb., with a CEO friend, who took note of their bleak surroundings: Empty streets, shuttered shops, a future with seemingly little hope.

“Warren, how are we ever going to pull out of this?”, the friend asked. “This country is never going to be the same.”

Buffett paused, then posed a question.

“Do you know what the best-selling candy bar was in 1962?”

When the friend said he wasn’t sure, Buffett told him it was Snickers. Then, he told him what the best-selling candy bar was now: Snickers.

Buffett searches for inevitables. Things that will remain the same for decades.

Spaghetti is inevitable. Pasta sits on the menu now, and will in the coming decades.

These ‘spaghetti’ companies are those high-quality companies that have won and will keep on winning. The ones that have incredible past fundamental metrics, big MOATS, and almost always trade at a premium.

You want to fish for those big fat fish.

The way to catch them is to put them on a watchlist and wait for some sort of pullback or short-term downturn.

I have 2 companies in my portfolio that I consider “spaghetti companies”: Dino Polska and Adyen. I bought both on pullbacks in 2023. You can check out the write-ups through the links.

This, “buy on a pullback quality approach”, is the closest you can probably get to a true buy-and-hold strategy. As we consider these companies to keep on winning for the next decade(s), you can keep buying on pullbacks, and let them compound their earnings.

There are 2 problems with this strategy:

First, because they look optically expensive, you might never get in, and miss on the opportunity.

Second, if you are too eager to get in, and have so much confidence in the quality of these companies, you might forget about price. Your end result might be mediocre.

Price always matters!

If you want to dig deeper into this strategy, publications like Compounding Quality or Sleepwell Investments are masters at this, and I highly recommend them.

The Hot Sauce

The most important thing in investing (and maybe in life) was inscribed onto the ancient temple of Appolo in Delphi Greece more than 2000 years ago.

“gnōthi sauton” or Know thyself

The spaghetti strategy in itself doesn’t work for me and here’s why:

Not a lot has happened during the last 3 earnings calls for Dino Polska. It’s a bit like watching paint dry. Dino just keeps doing what it has always done. It’s pretty boring, in a good way.

Adyen has been a lot more volatile. But again, when looking at their latest business update, they continue to use their land and expand strategy, reeking in more volume, and generating more net revenue for the business. Business as usual.

This is great. These companies are of very high quality and keep on performing. The time needed for upkeep and to follow these companies is limited.

It’s a great investment strategy.

But, after a while, I have this itch you see. The itch to do something. To find something exciting.

I scratch this itch by hunting for quality microcaps, the hot sauce on my spaghetti.

If you think hot sauce can’t be that exciting, then look at this short clip of the Shaq trying “da bomb”, while eating hot wings.

Respect to Kansas!

These microcap companies are not big fish, these are small goldfishes. They may have won a little, but they are still growing and building their companies. They are more fragile. And don’t go looking for big MOATS. They may have started to dig a ditch around their villa. But the castle and MOAT are still far out into the future.

Fewer fishermen are fishing here.

Institutions cannot venture into this domain. These are not your popular companies that are always discussed in the media or even on X.

And the best thing for me: Scratching that itch through microcaps allows me to leave those bigger quality compounders alone. Both strategies complement each other.

So these are the companies I look for:

The spaghetti: High-quality companies that have won, I think will keep on winning but the price is at a premium

The hot sauce: High-quality microcaps that are in the process of winning, are more fragile, but can be severely mispriced in the market

What does your investment strategy look like?

How to implement the spaghetti strategy?

For the first category, I have a buy-the-dip list. These are companies that I’ve studied, I would love to own, but are too expensive at this time. I watch them, ready to jump in if an opportunity presents itself.

These have been my best investment in the past. When all the work has been done beforehand, it becomes a waiting game.

Here is one company I would love to own: Medpace (Ticker: MEDP)

I normally avoid biotech as it can be speculative and is way out of my circle of competence. However, Medpace is a company that assists biotech companies in performing their clinical trials. Especially smaller biotech companies do not have the expertise or resources to go through these clinical trials by themselves. The CEO owns about 25% of the company and has shown a real hustle mentality in the past which I like.

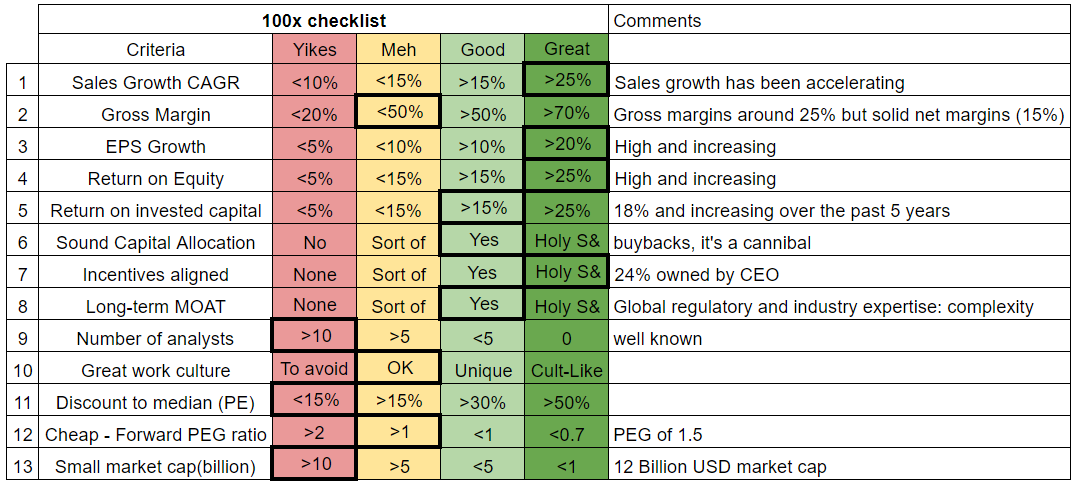

Let’s quickly take it through our 100-bagger checklist.

In other words, it’s a great company, but too expensive for my taste. I’m waiting for a pullback to get in.

Another high-quality company I’m looking into now, is Kinsale Capital, an insurance company. This one is not on my buy-the-dip list as I first need to expand my knowledge of the insurance industry.

So the basic idea is:

Do the work

Be mindful of the price

If too expensive -> lie in wait and jump when the price is right

How to implement the hot sauce strategy?

When you find a quality microcap, you’ll generally notice that the 100-bagger checklist used in the previous example will look completely different:

You probably won’t find a MOAT

Very few analysts are following the company

It might look expensive or really cheap (P/E is unreliable)

Data like Return on Equity or Return on Invested Capital might not look that good

In addition, shares could be limited and very illiquid.

The main thing I look for are changes within an already solid company that might propel it upwards based on business fundamentals in the future. Companies that do not screen well when using popular software tools.

Those that are overlooked by the market.

The implementation is therefore different from the previous high-quality compounders

You’re looking for news that the market has not yet fully recognized

You’re not focusing on the long-term future, you’re looking at the next 3-5 years and how earnings might evolve based on this news

The quality of management is always important but even more important when the companies are so small (a bad decision could ruin the company)

These are not necessarily buy-and-hold companies. If you put these in a coffee-can portfolio, you’ll probably go broke.

Once you’ve done the work and built a position, you need to track everything that is happening with these companies as closely as possible. As we mentioned before, this is the hot sauce, volatile and explosive stuff.

Do not let these companies out of your sight.

For the second category, I have a list of companies that look interesting, but which require more work to build conviction. Here are some examples with a short elevator pitch and the links to the full articles written by some excellent microcap investors.

Innovation Food Holdings (Ticker: IVFH)

Elevator Pitch: A business undergoing a transformation. IVFH has a B2B and B2C business. The B2B business is a lot better than the B2C one. Since March 2023, the entire management team has changed and they are focusing on developing the B2B side. They divest parts of the B2C business to fuel the growth of the B2B business. Note: The stock has already tripled over the last year.

Check out this excellent analysis by

Intelligent Monitoring Group Limited (Ticker: IMB.AX)

Elevator Pitch: A small-cap Australian home and business security provider that sells services and products. The company has made multiple past acquisitions which are currently not reflected in their financial statements. (remember my previous article on Epsilon Net where a similar thing happened)

Check out this incredible write-up by

Gaming Innovation Group (Ticker: GIG)

Elevator Pitch: Similar to Innovation Food Holdings, GIG has a good (Media, affiliate marketing) and bad business segment (Platform, backbone IT system for iGaming operators). The quality of the good business segment is not recognized by the market at this time. Management has initiated the launch of a spin-off or split of the 2 segments probably in Q4 of 2024. Once the spin-off is completed the market could rerate the media business. A new focus can be given to the platform business to grow it further.

You can dive deeper here written by

These are all small companies where changes are happening and where the market has not fully appreciated the impact of these changes on their business performance.

Position sizing and hurdle rate

Position sizing

After my past mistake on a small gaming company named Tinybuild, where I focused too much on upside potential instead of doing more due diligence on the downside risk (for Tinybuild the lack of liquidity) I’ve decided to size my position based on downside risk.

The base idea is to have about 11 companies in a portfolio with a 9% position each. Each position is built up in 3 steps: 3%-6%-9%.

There is one exception: I will allow myself to go beyond 9% on a cost basis IF the downside risk is extremely low.

Future additions or trimming is based on the cost basis not on a current portfolio size.

Imagine a 100k portfolio, and you buy a starter position for 3k into Adyen. If Adyen doubles in a year and all the rest stays the same, you now have a 6% position. You can still consider Adyen only having a weight of 3% and could add on a pullback.

The idea is to reward your winners instead of the losers and to average up when possible.

Investing is a continuous process. If I add 10k of cash to the portfolio, then Adyen will now have a 2% weight based on cost.

Hurdle Rate

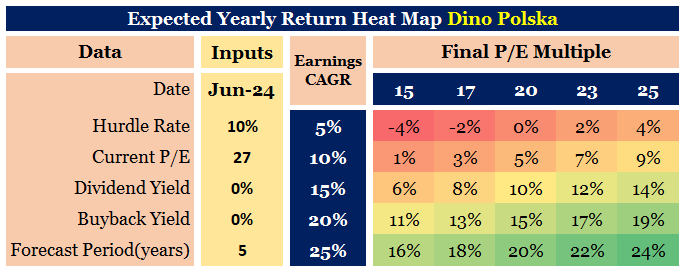

In the past, I used a lower hurdle rate for a company like Dino Polska when compared to a company like Connexion Mobility. I figured Connexion is a lot more fragile, so I increased my hurdle rate to 15%.

But after reading Buffett's book on reading financial statements, I’ve decided to use a fixed hurdle rate of 15% for any investment. This makes it a lot easier to ensure that I am more picky about the companies I choose and to compare companies.

Imagine you find a high-quality compounder that could deliver 15% and a microcap that could also deliver 15%, why would you choose the microcap?

I’ve also added the following questions to my checklist:

Do I have a 90% degree of confidence, earnings will be higher in the next 5 years?

Do I see a plausible path of earnings per share growing at 15% each year over the next 5 years?

Can the company grow through a recession yes or no?

In other words, the goal is to find investments that can double over 5 years with a solid base of free cash flow generation.

I’ll add to this a heat map based on the earnings growth model and a reverse DCF. The goal of the heat map is to ask the question:

Do I think the growth needed to return 15% yearly is realistic based on the current price and business fundamentals?

You can download our Excel template heat maps in the tools section.

Summary

I feel like my investing strategy is getting stronger and more attuned to who I am.

You must find the strategy that best suits your own personality. Once process and temperament are aligned, money can be made in the markets.

I look for:

Spaghetti: High-quality compounders

Hot sauce: Mispriced quality microcaps

I will build my positions slowly, and use a 15% hurdle rate while always focusing first on the downside risk. The smaller the downside risk, the bigger the position.

What does your investment strategy look like? Do you own Medpace, Kinsale, or one of the 3 microcaps mentioned?

I hope this article can help you find your own strategy.

Phil Fisher continuously changed his strategy over the course of 4 decades, so this will always be a work in progress.

I wish you a great week-end and as always,

May the markets be with you!

Kevin

Like how you think with the use of these frameworks but honestly believe that Dino Polska’s last few quarters were just trash. The number of new store openings…

Have you read Chris Mayer's book 100 baggers? He has some solid compounders in his portfolio. Patience is the hardest part of buying these stocks. You have to be patient with the price you pay, and patient in letting the stocks grow over years and years.