This annual review will cover the investing mistakes I made in 2023, a behind-the-scenes look at atmosinvest.com, the winners of the contest of last week, and our 2024 goals.

Introduction

One of the most important things in my job, my investing strategy, or my life, in general, is to take a moment to look back on past mistakes and learn to do better in the future.

This is the feedback loop.

READ: Annual reports, books, letters and fiction

EXERCISE: Running and simple bodyweight strength exercises

WRITE: Short and long-form articles

CONNECT: Engaging and discussing with people interested in investing

REFLECT: Adjusting, changing, having an open mindset

This is my learning loop. Reading and exercising combined generate creativity and inspiration. Writing and the goal of structuring my thoughts help me remember and synthesizing and explaining makes me better understand the topics. Connecting is important to get support from like-minded people and pushback from others who share a different point of view. Finally, taking a moment to reflect on everything that happened is crucial to start the cycle anew.

One of the things I hold most dear is transparency because it creates clarity. That’s why you’ll see me talking about mistakes I made and how this newsletter came about.

This annual review is divided into 2 parts. The first part is my review of investing and my learning process. The second part is on the writing and will give you as a reader a behind-the-scenes look at what is happening with this newsletter.

Last week, I sent an e-mail to everyone with the possibility of winning your “Choose your company, deep dive in 2024”. The result of that contest you’ll find at the end of the article.

Review of 2023 goals

At the beginning of 2023, I didn’t set any specific goals. In September, upon starting to write in public, I had only one goal: write ‘something’ every week. Arriving at the end of the year, I’m glad to say I succeeded. Here are the top 5 most-read articles for 2023:

Inmode deep dive (with downloadable PDF)

Kaspi - Destination analysis (with downloadable PDF)

What stands out? 4 of the 5 most popular articles are about companies, and not about the investing process itself. I wish I could generate one of these every week, but that is simply not possible. There’s a lot of research and writing that goes into these articles.

Because of the lack of goals, the writing topics were a bit all over the place: investment process breakdowns, company analysis, and earnings reviews. We’ll structure this better in 2024.

When looking at the articles that focus on the investment process, especially the threads on X that were popular. Here are the top 5 threads of 2023 with each time their in-depth articles:

ROIC is not just another financial metric, with the full article

The mysteries of the P/E-ratio, with the full article

The flaws of Return On Equity with the full article

Paul Andreola’s investment strategies with the full article

How to hunt for 100-baggers with the full article

Investing: What went well?

Improving the process

By reading several books and partnership letters, I managed to improve my process quite a bit. I’ll talk about this in detail in my next article in January, but essentially, my process is more and more becoming a real process that excludes emotion. Some specific mentions are:

Using expectations investing: In the past, I used a DCF calculation to get to the intrinsic value of a company based on the teachings of Professor Damodaran. I find that it is much easier to do an inverse DCF to figure out ‘what the market is implying with the current price in the market’ and compare this to what we think the fundamentals are doing and will do in the future. I find this much more useful to assess if a company is trading below value or not.

Stop checking the prices of stock tickers: Because I was so busy researching and writing, I noticed I wasn’t checking the prices of my holdings anymore. This helps when it comes to removing emotion from your process. Remember: When the price goes up or down on your screen, it triggers an emotional response.

Always trade when the stock market is closed: This is something I implemented after hearing about it in a YouTube interview with Guy Spier. I managed to respect this rule at all times.

Explicitly write down how I can see an investment going 100x or 10x: At first when I did this, I found it silly because sometimes it was obvious that the company could not possibly gain 100x in market cap. However, after doing it for several company write-ups, I find it useful to explicitly think about how they can achieve it and conclude if it is impossible, plausible, or possible.

Investment returns

Up until now, I haven’t disclosed all my holdings. I decided to disclose this gradually the more I wrote. I also do not care much about a YTD performance, as I consider myself a long-term investor (5+ years at the minimum) and as Warren Buffett says: It takes at least 3 years for the value of a company to reveal itself, so we shouldn’t be judged yearly. Here are the results of the performance of the articles I have written in 2023. I mention again that I write to learn and to entertain. Nothing should be considered investment advice. I’ve added the table below for informational purposes.

Current results on 2023 write-ups:

I own all of these except for KSPI and MSS. It’s too early to tell where these companies are going. I’ll go into more detail on TBLD in the section on what went wrong.

The Fall of the Hindenburg

On Maison Solutions (MSS), which plummeted almost 90% since the release of a Hindenburg short report on the 20th of December, I wrote this on the 1st of September:

I wrote the article as an exercise to go through a prospectus of a company before an IPO, and I admit, that some weird things were going on when reading it. The IPO was priced at 4 USD which I considered overpriced.

When it was trading at 5 USD and increasing, reaching PE levels of 180+ I was thinking, who is buying this?

Anyway, the goal here is not to go into depth into the story of Maison Solutions. What I learned from this is the importance of going through the prospectus and annual report. You can discover a lot of possible red flags when doing so. Never buy a company that you don’t understand and always do the work. I am a long-only investor at this time, but this begs the question that if in the future, similar red flags are found in an IPO prospectus, a short position wouldn’t be worthwhile.

Investing: What didn’t go as expected?

Taking action

Except if you are a trader, the goal of a long-term investor is to sit on our ass(es) as the late Charlie Munger would say. So I decided in 2023, that I wanted to take less buy and sell actions and take more hold decisions. I completely failed in that regard, and writing publicly about investing was one of the causes.

Data on actions taken before and in 2023

My goal was to be more in line with 2022. I was pleased with my portfolio. I especially did a lot of buying in 2023. What does data does not reflect is the amount that was bought. You can make 20 buy decisions each time for 0.5% of your portfolio, and in total, it won’t be that much of an impact. The better way to look at it would be the asset turnover of the portfolio. I’ll take this up for 2024.

Commitment bias

Researching and analyzing a company, and taking the effort to share it publicly creates a significant commitment bias. The idea of buying the company after writing about it seems a lot more attractive than anything I experienced in the past. This in part contributed to me buying several of the aforementioned companies.

An investor should be aware of his biases. I wasn’t aware of it until Tinybuild plummeted. After the stock dropped 50% which someone on Twitter immediately pointed out to me:

In hindsight, that person was right. So, I wrote down an after-action review. What did I learn from my investment in Tinybuild?

In summary:

I bet on a turnaround, which is always tricky

I underestimated the cyclicality of the gaming industry (and so did TBLD management as they did not provide for a sufficient cash buffer)

I discovered new important information about the company AFTER I had already invested

But most importantly: I took too much risk in my portfolio position sizing

This last one can be explained in another way: Hubris

Over the last couple of years, I’ve had some good returns on my investment decisions. The trap of reading about superinvestors, and getting good returns, is thinking we’ve got it all figured out, that we fully understand the risk of every bet we take, which might lead to bigger position sizes based on the conviction one has.

This reminds me of the most important character trait in investing (and working in a nuclear power plant = my day job): HUMILITY

I’m not saying I’m glad with what happened, but I’m actively looking for the lessons to learn so that it doesn’t happen again in the future.

Here are the lessons I take from this for my portfolio risk management:

Take about +-12 positions in my portfolio

Each position has a maximum size of +-8% on a cost basis

Positions are built up gradually, starting at a maximum of 2% (a company has to earn its way in)

These are of course highly personal. Maybe you’re running a more or less concentrated portfolio. In the future, I’ll not deviate anymore from these rules.

My upcoming article will go into extensive detail on what my entire investing process looks like.

Lastly, one other mistake that is worth mentioning is to remember what Peter Lynch said:

"It's very hard to go bankrupt when you don't have any debt."

Most of the companies I researched had no debt with high cash positions. But hard does not mean impossible. When the cash pile dries up, how are you going to pay for the employees? For a gaming company, when you have to start cutting projects (and employees) it automatically reduces the value of the future pipeline of upcoming games.

In other words, maybe a Chapter 11 bankruptcy can be more easily avoided when there is no debt, however, a liquidity crisis will decrease the value of the company.

Later in January, I’ll publish my full after-action review on TBLD.

A quest for focus

After researching Paul Andreola’s investing strategy, I compared it to my own, and it’s clear that my strategy lacks focus. I look at worldwide companies, compounders (DINO Polska), profitable growth companies (Adyen), and turnaround stories (Tinybuild).

The ideas for these investments come from what I read from other investors or letters.

When you’re reading one of my deep-dive destination analyses of a company, you’re seeing what happens at the end of the investing funnel. It occurred to me that you as the reader do not gain any insights into what happened before.

So for 2024, I decided to add some focus to my process. I’ll consciously create a list of companies that make up my investing universe for 2024. (I'll talk about it in more detail in my first article in 2024). Once every 4 weeks, I’ll publish the result of what I call: A to Z quick and dirty. In other words, I’ll go through this investable universe in alphabetical order, and do a quick and dirty analysis. There are 3 possible outcomes of this analysis:

It goes into the NO-bucket. For some reason, I do not consider it an interesting company. I have to justify that reason.

It goes onto the watchlist. The company is interesting, but I’ll need to learn more about it before diving into it deeper. Eventually, the company goes to the NO-bucket or into the deep dive bucket.

it goes directly on the list for a deep dive: I like the company and plan to write a deep dive on it.

I will continue to track the performance of the NO-bucket to assess the opportunity cost down the road. This will help fuel future annual reviews.

Notice that I talk about company and not investment. My best investments have been the companies that I researched and were sitting on my shelf, waiting for the price of the stock to become interesting. I’ll look for quality factors within these companies. If the price in the market is too high, I’ll put it on the shelf.

And what if I had done nothing at all?

This is a short question I’ll ask myself every year. What if I took my portfolio at the start of the year 2023, and hadn’t done a thing?

No buying or selling, adding or trimming. Just sitting on my portfolio and watching it evolve.

Results: I would have been better off. The reason is of course TBLD. If I excluded TBLD from the picture, then I would have been better off than just doing nothing.

The problem with this question is it should be measured on multiple years, and not on 1 year alone. Since I hope to continue writing about my investing adventures for years to come, I hope this paragraph will become more interesting in the coming years.

Connections

Through the investing community online, through X or Substack, I got to know some incredible investors which I’ve learned from through discussions or their writings. Here is a non-exhaustive list. Check them out if you have the chance.

- : Helped me get my X and Substack up and running. Has a couple of great write-ups on underfollowed value picks. A must read in my opinion

- : Paul publishes a company write-up every 2 weeks. The write-ups are extensive and there is some great value in them. For an annual subscription, he only charges about 50 USD which I think is a great deal!

- from Sleep Well Investments: Trung writes about time-tested businesses that allow him and you to sleep well. He has a unique approach, looking at market share evolution, and has a quality thesis tracker to keep up with the different companies.

- from 0 to 1 in the stock market: If you want to go beyond company write-ups and delive into the mind of a knowledge-compounding machine, From 0 to 1 is your place to be. Always insightful.

- Yegor from 100kto1M does something unique. He publicly shows his portfolio and his trajectory to try and build a 1M portfolio starting from 100k. Talk about transparency! There are some great write-ups on companies posted from time to time

- publishes some of the best company analyses out there. I learned a lot from our discussions on Adyen. He has great insights into the company.

- from The Valuing Dutchman is a seasoned investor who has launched his fund mirroring the Buffett partnerships and their fee structure. He has been incredibly generous and provides an incredible amount of wisdom on X and Substack

James from www.firmreturns.com comes highly recommended. He publishes a weekly newsletter of the companies he tracks. You’ll find some deep dives on said companies.

- writes the Hourglass Investing Network newsletter and podcast. I discovered him only recently and he writes excellent deep dives and a newsletter. A must-read.

Tools of the trade

This paragraph looks at what tools I use in my investment process. There are no affiliate links or anything related to these. I just mention them as I find them useful.

Simply Wall Street: Provides an app to quickly get a general idea about a company. It has a great graphical UI and 5 years' worth of data. What I like is the ownership distribution of a company. Not a lot of tools have that capability. Here’s an example for Dino Polska:

I have the premium plan which is 120 USD per year

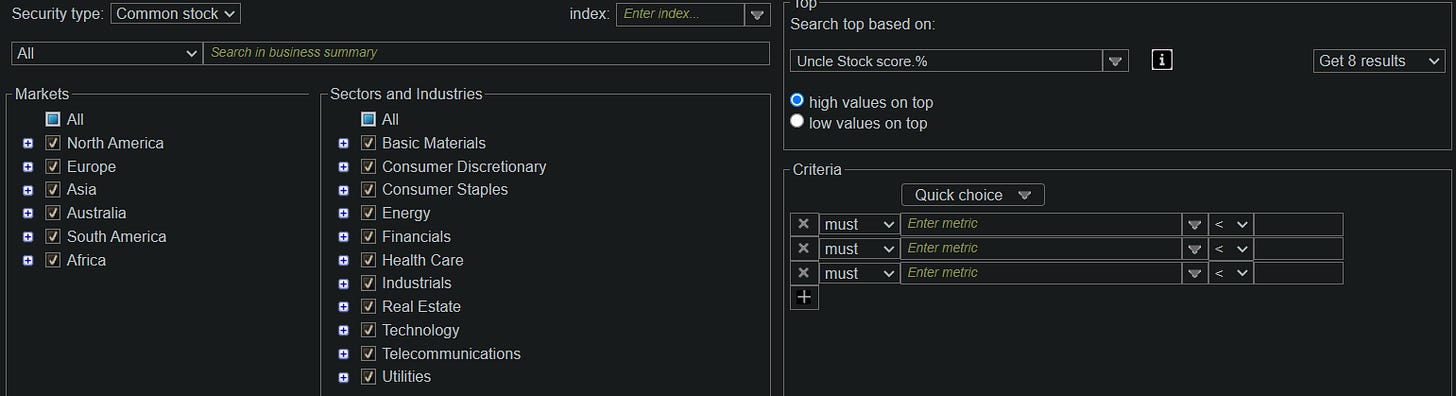

Unclestock.com is simply the most powerful stock screener that I have come across. There is a learning curve, but the possibilities and criteria you can use are immense. I use uncle stock to create a list of my investible universe for 2024

I have the bronze plan which is about 120 USD per year

Seeking Alpha: I use the articles on seeking alpha to try and find the opposite view. What am I missing? Especially the comment section has a lot of value. I also sometimes read their earnings transcripts. The drawback is that you won’t easily find written articles on smaller companies in less covered markets. If I remember correctly you can get a discount on their premium plan in your first year.

I have the premium plan which is about 239 USD per year

Yahoo Finance is my go-to place for a first look at a stock. It has fundamental data going back 4 years and it’s free.

Journalytic.com is a journaling tool specifically developed for investors. What attracts me to it is it is built to reflect on your decision-making ability and it automatically calculates the opportunity costs of the companies you decided to NOT buy. I need to take more time to use it more. I hope to get more into it in 2024. It’s in BETA and free at the moment.

Are there other or better tools out there? Send me an e-mail or comment below!

On writing: behind the scenes

Introduction

I do not have a goal for a certain number of followers or subscribers. I just focus on the work, the act of researching and writing. If you struggle with writing consistently, I highly recommend reading The War of Art by Steven Pressfield. I assure you, it’s supposed to be hard!

What I love is the conversations and connections I make with like-minded people. So please, if you have an idea to share, send me a message. I read everything.

What did I read this year?

100-baggers by Christopher Mayer (2nd time)

Nomad Partnership letters (second time)

Thinking in Bets by Annie Duke

What Works on Wall Street by James P. O'Shaughnessy

Richer Wiser Happier by Richard Green

Global Outperformers by Dede Eyesan

The Deals by Warren Buffet by Glen Arnold

That’s it. However, I went through a lot more annual reports than I ever had in the past.

These are the books that I plan to read in 2024:

Common Stocks and Uncommon Profits by Philip A. Fisher

Alibaba, The House Jack Ma Built by Duncan Clark

Competition Demystified by Bruce Greenwald

Expectations Investing by Michael Mauboussin

The Making of a Multi-bagger by Alta Fox Capital

Margin of Safety by Seth Klarman

The Nomad Partnership Letters (3rd time)

Just as looking through financial data, let’s look at some other data to review how the writing went.

The data

Words Published

I started writing online on the 1st of September 2023, and my goal was simple: publish ‘something’ every week. This gradually morphed into 1 article every week accompanied by 1 thread on X at the same time (this was not planned, but I love writing threads).

Here’s the data for my articles by number of words published since September 2023

I published 16 articles through substack with in total of about 67500 words written. That’s about a 250-page book.

In addition to being pretty active on X, I wrote 1 thread every week. Writing threads is my favorite part of writing. The goal is to get to the essentials of an article, keep the thread flowing, and make it entertaining for you. If I had the time, I would write more threads.

Time spent

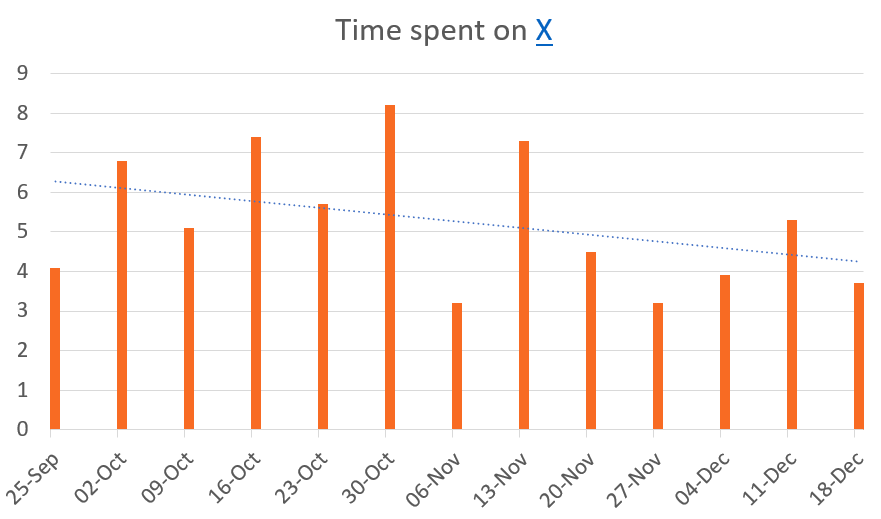

Since I started this newsletter, I started tracking the time I spent on what I did. I use an app called toggl.com which helps me easily track time. This app is free and allows you to create reports and different statistics to gain insights into the way you spend your time.

Here’s some data to get you an idea of how much time this all takes.

First, we have the number of hours spent each month:

I’m now hovering at around 70 hours per month or roughly 18 hours each week on average.

This is probably a conservative amount of time spent as it could be that I sometimes forgot to clock an hour and some time was used before the 1st of September of 2023.

Toggl allows you to assign each hour you spend on a specific project. Let’s take a look at the 5 deep dives on companies I have written and how much time it took:

I’ve tried to split the time in what I call researching and writing. I wasn’t aware of this up until now, but the actual writing takes about 11 hours on average. Bear in mind that this happens in bits and pieces over the course of several weeks. The research is a combination of reading annual reports, and articles and listening to podcasts and earnings calls.

I already went through Dino’s annual reports in 2022 and was following the company. If I would never have heard about the company, the write-up would have taken a lot more time. Same thing for Inmode, I was a shareholder and went through their annual reports in the summer of 2020 when the stock was heavily beaten down. Again, if I had to start from scratch, it would have taken a lot more time.

The Atmosinvest community

How has this work resonated with you? Here is an overview of how the number of readers that have joined this newsletter has evolved:

I started this newsletter without telling anyone. In other words, everybody who decided to join I previously had no connection to. I did this on purpose to see if it is possible to get people interested in my writing who are not acquainted with me. Some will say that 450 people who joined a newsletter is low. I can only say:

It is an honor for me. I did not expect this when I started. So thank you for being here!

Let’s take a look at what happened on X:

There are about 1200 people following Atmosinvest right now on X, which to me again feels like a great honor. Now let’s get real, there are several bots in this number. I have no idea what it looked like when X was still Twitter, but we should be careful with the absolute number.

I do think I was lucky, as I was jump-started when Chris Mayer in September shared my post on 100-baggers with his 50k followers. You can see the first sharp increase in the graph.

From then it’s about connecting with people with the same interests, who are covering similar companies. This part for me has been the most rewarding since starting to write online. Meeting with like-minded people or even better, people who push back on your ideas is the best. If you consider going onto a platform like X, I think the best way is to be genuine. How would you talk to someone you meet somewhere in real life?

I have reduced my activity on X due to time constraints. Here’s an overview of my X usage over time:

Is use an app on my phone called App Usage. There’s a free version but you’ll have to copy the data monthly as it will not store historical data.

I’m glad I was able to slow down on the social media activity. 4 hours is about perfect in a week. More than that is too much for me. I know that professionals will say that volume is important and that you should tweet every day, but my goal is not to build a business. I write about my mistakes and successes online to learn faster. It is up to others to decide if my learnings can bring them value.

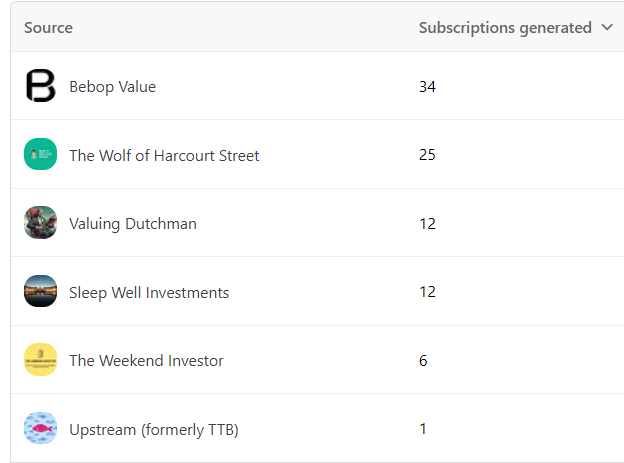

So how does the newsletter get noticed? Where does everyone come from?

Here’s the data:

So in summary:

Most discovery goes through the substack network: 40%

Then there is discovery through X.com: 30%

Direct are those who join through me by going directly to the URL: 15%

And finally, discovery through Google’s search engine: 5%

That leaves 10% from various sources

The results are not surprising as I am most active on X.com and substack which provide network effects.

Substack allows for a writer to recommend other writers. So a big thank you to those who recommend me. About 20% of you have used these kind of recommendations.

When you visit this substack, you’ll automatically see the newsletters I recommend.

And finally, maybe as the most interesting data point to me, where is everybody coming from in the world?

“Read across 24 US States and 60 countries.”

Consider my mind blown! Again, thank you!

Conclusion

So what to make of all this data?

In honesty, I think the data just tells me to keep writing as in 2023. It’s difficult to draw any other conclusions. If you have any feedback on this data for me or if you would like something to change to this newsletter, do not hesitate to send me an e-mail or comment:

What didn’t go as expected?

Effort and time spent do not correlate with external results like followers. You just need to accept it.

I like to write articles that are skimmable (bullet points, bold, etc.) as this is how I read myself. If the headline is interesting, I open the article. Then I skim. If by skimming, the article is interesting, then I will read it in detail. But the problem is that this takes more time. I could write an article much faster by just letting the text flow.

On X, sometimes weird things happen when posting. Here’s what I experienced over the last 4 months:

When you tag, sometimes people are not notified

I posted a thread and it got double posted -> I had to remove one of them as if you don’t it will impact discoverability

I posted a thread, and it posted a thread and all separate posts of the thread (no idea why)

Concerning writing on X, I tried a couple of long-form posts, but I prefer threads. So I’m sticking with those

The cost of writing

What does it cost in dollars to publish online?

Substack is free, as long as you do not go paid (substack takes 10% I think)

I have X Blue (8 USD/month), and the main reason was to be able to correct a post after I had written it. I used this several times to correct spelling errors or other mistakes in my posts.

I used Tweethunter in the past. The main reason is that I have a day job, and all my articles or threads need to be scheduled in advance. You cannot schedule anything natively on X (which seems like something they should be able to implement?). Tweethunter is a great tool if you want to grow your X following, but it costs 50 USD per month. And although it’s a fantastic tool, in the end, I only used it to schedule. For scheduling purposes only, there a less expensive tools out there.

I use Grammarly free edition as I am not a native English speaker.

Choose your company, deep dive

Last week, I sent you an e-mail to propose a company name that I would write a deep dive on in 2023.

Several of you have replied and I added these to the wheel of names. Some of you replied with 1 company, others with up to 4 companies, so to make it fair, those that only provided one company were added 4 times to the wheel.

Here’s the video with the results:

The deep dive for the winner will be published in February. But as a thank you; I’ve decided to do 1 write-up for each one of you who entered the contest. For those who proposed several names, I’ll get in touch to choose one of them.

Conclusion: My Goals for 2024

From an investing point of view, I’d like to learn to turn over more rocks in a given year. I didn’t track in detail the number of companies I looked at in 2023, but I have a feeling I need to develop the skill set to go quicker.

If anyone has any pointers or would like to share their process, hit me up!

Here’s the process I mentioned at the start of this annual review:

This cycle is intrinsically based. I think that’s important. It means you can keep doing it, without having to rely on external input or validation. I hope this will allow me to keep writing online for years to come.

From a writing and publishing standpoint, I contemplated reducing the weekly schedule as it is sometimes extremely difficult because of my day job and life, in general, to get something out there. But I figure if I would reduce the frequency and allow myself more time, I’m not sure I’ll be more productive. There is a risk of procrastination kicking in. So I decided to stick with the weekly schedule but mix it up a little.

So my goals become

1 article on substack every week

1 thread on X every week

30 minutes of reflection on what I have learned that week

Lastly, I hope to make new connections with all of you in 2024. This cannot be planned, but the discussions I have had with some of you on various investing topics were incredible.

Thank you!

Putting all that was written above together we get a schedule for 2024 that looks like this:

Only the first 8 weeks are shown, but almost the entire year is planned in advance

You as a reader will get, every week, alternating every 4 weeks an article on:

Process: How to improve the process of investing

A to Z: quick and dirty of several companies

Update: What’s happening with companies in the portfolio and on the watchlist

Deep Dive: A company destination analysis

This will add a lot more structure to what you’ll be able to read. I’ll add a semi-annual review in the middle of the year as it will allow me to shorten the annual review somewhat at the end of the year.

Any feedback on this schedule would be greatly appreciated! If you like this, and you think someone else will, please consider sharing.

I hope this annual review has brought some value to you. I have to admit it felt uncomfortable writing it as there are a lot of I’s in this article. I wish you a happy new year, good health, and lots of love from your family and friends.

As always, may the markets be with you in 2024!

Kevin

Happy to have been able to sneak in with these other great authors at the end of your 2023, Kevin! Looking forward to what you do with 2024.

Thank you for an interesting read. I hope 2024 will be a great year for you and I will continue to be looking forward to your articles.

I wish you happy holidays here from Sweden!