10 key questions to discover the most profitable yet overlooked companies

Uncover 9 cash-rich companies inside

In a previous article, I laid out a ranking system we’re developing.

As a reminder of how the system works:

Measure the Quality of the company

What is the price implying about the Value?

Asign a Quality/Value ratio to the investment

Compare this with other opportunities in the market

Quality is measured by asking one single question.

➡️How S.P.E.C.I.A.L. is the company?

Here’s a quick example for Amazon:

We already covered the S for Sales Strength. Remember the result from last time:

Let’s dive deeper into the checklist and unlock the P for Profitability.

The goal is to develop a checklist of 10 questions. Each question scores 1 point. A company with a 10/10 is an extremely profitable company with high-quality earnings.

We’ll use the following companies to illustrate the checklist:

INMODE (Ticker: INMD)

AMAZON (Ticker: AMZN)

CARVANA (Ticker: CVNA)

DINO POLSKA (Ticker: DNP)

And run some screeners to find some very profitable yet overlooked companies, by focusing mostly on the smaller cap space.

If you prefer a quick summary and just want to look at the companies we found, you can also check out this X-thread:

Profitability

That profits are important for any company is not under debate. Especially companies that can retain profits and then keep reinvesting them with higher returns are the holy grail for any investor. It makes capital allocation simple.

What does history tell us about the performance of stocks of companies with high net earnings?

James O’Shaughnessy can help us with his book: “What Works on Wall Street” where he backtested different investing strategies.

Wait for the wisest of all counselors, time. - Pericles

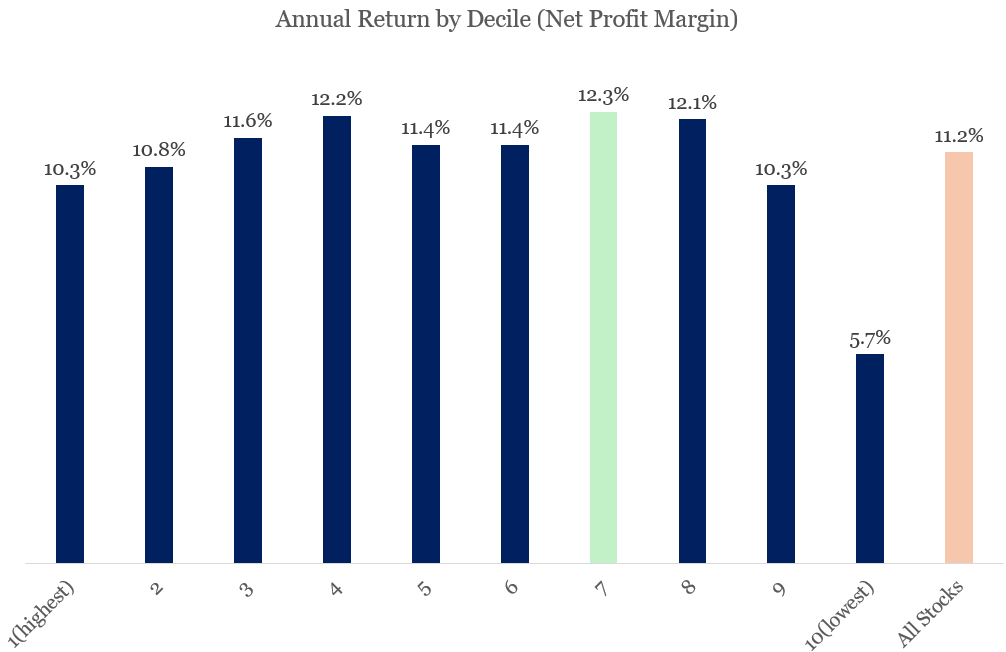

For each strategy, he performs a decile analysis. He takes data from all the stocks from 1964 until 2009. Then he ranks them from highest net profit margin (decile 1) to lowest (decile 10) and looks at the annual performance over that period.

Here are the results:

Conclusions:

The highest returns are not in the highest profit decile (1)

The highest returns are in decile 7, followed by 4 and 8. This means a high net profit margin itself is not enough

Avoid companies with very low net profit margins (decile 10)

Finally, when just backtesting the return of all the stocks without looking specifically at profit margins or another factor, there is only a slight outperformance (about 1%, although 1% over multiple decades starts to add up).

The basic lesson here is:

Avoid companies with low net profit margins or who are unprofitable

Profitability in itself is insufficient. You need other factors like capital allocation to find out performance (we’ll cover this in a future article: A for Asset Agility).

Let’s look at the first four basic questions in our profitability checklist:

1. Is the company generating net earnings?

2. Does the company have stable earnings/share over the last 5 years?

3. Are earnings per share increasing over the last 5 years?

4. Are they steadily increasing over the last 5 years?The first question allows us to avoid unprofitable companies. Then we look at the trend of the earnings per share. Ideally, they are increasing steadily. There can be some volatility to it, but the pattern needs to be towards the upper-right corner of a chart.

For the 4 companies we mentioned at the start of this article, the result is this:

Do you think 5 years is enough?

Now, let’s take it up a notch.

Evolution of margins

Gross profit margins

The gross profits are the revenues minus the costs of goods sold. When we divide the gross profits by the revenues number we get the gross margin.

High gross margins are the equivalent of a soft suspension of a car. When you’re driving, and there are bumps in the road, you’ll hardly feel them. If margins are low, or the suspension is too hard, you’ll feel every bump.

Intuitively you sense that a 1% drop from a 60% gross margin has a lot less impact than a 1% drop for a 10% gross margin.

High gross margins can signal pricing power. It’s a great indicator to measure increased competition where usually, gross margins will start to drop because of a pricing war or increased costs.

We’ll add the following 2 questions to the list:

5. Does the company have gross margins > 40%?

6. Are gross margins stable or increasing over the last 5 years?An increasing gross margin can signal a business becoming stronger.

Let’s screen for some companies with high and stable or increasing gross margins.

If you want to dive deeper into one of these companies, here are some excellent write-ups.

Inpost, a Polish parcel delivery company

Litigation Capital Management (think Burford but smaller and located in Australia)

Or if you like, you can also check out our analysis of Semler Scientific.

Operating margins

When we take the gross profits and subtract:

Operating Expenses (OPEX)

Selling, General and Administrative expenses (SG&A)

Research and development (R&D)

Depreciation expenses

we arrive at the company's operating profits or EBIT

A company can have high gross margins, but if it makes lots of costs related to the above 4 categories, it loses its high gross profit margin advantage.

Let’s add the following 2 questions:

7. Does the company have EBIT margins > 20%?

8. Are operating margins stable or increasing over the last 5 years?Let us add these 2 questions to our screener and see which companies it generates:

Siga and GIG have become a lot stronger. Deterra shows the power of royalties with an EBIT margin that is off the charts.

Here’s one of the best articles on Gaming Innovation Group to check out:

Quality of earnings

Up until now, we’ve only looked at profits or earnings. But we must remember.

Profits are an opinion. Cash is a fact. - Alfred Rappaport

We’ll check if the net income translates into cash and add one additional question to the checklist:

9. Are the Quality of Earnings higher than 80%? (CFO/Net Income)Let’s see what happens with the companies we screened up until now. Will they remain on the screen?

They do. The aforementioned companies all have high-quality earnings.

Would you use a different criteria as opposed to Cash Flow from Operations on Net Income?

Operational leverage

Operational leverage is a powerful force for a company. Imagine the Sales Strength is low because growth has slowed down. The company could still be interesting.

If earnings growth is higher than revenue growth, it means the company is increasing its operational leverage. Due to different reasons, be it scale or other efficiency measures, the company manages to generate more and more profits out of the same revenue.

So our final question becomes:

10. Are earnings per share growing faster than revenue over the last 5 years?Let’s do a final screen, and see if we can find companies that fit that bill.

Autodesk and Bonheur have shown high operational leverage over the last 5 years. Wingstop manages to grow revenue and earnings at the same rate.

If you want to dive deeper into any of these companies, here are some great articles:

Wingstop, a US fast casual restaurant brand

Autodesk, developer of the Autocad software

Bonheur ASA, a French conglomerate

In case you’re wondering, the screener I used is www.unclestock.com, and here are all the criteria:

Summary

We now have 10 questions in a checklist to measure the profitability of a company. Let’s get back to the four companies we mentioned at the start of this article, and see how they hold up.

Amazon and Inmode are highly profitable companies. Amazon is showing operational leverage as profits are of high quality and growing faster than revenue. Inmode has no operational leverage but has very high margins.

Carvana only recently made its first profits in 2023. It has a long way to go to reach the same quality in profitability. Almost a 10-bagger since the start of 2023, it has defied the laws of gravity.

Dino scores a 7. As a proximity retailer, it cannot achieve the high margin levels we’ve added to the checklist. Revenue and earnings per share are increasing at the same rate.

Most companies that make a steadily increasing profit will score at least a 4/10.

I hope you’ve discovered some interesting companies throughout this article.

What would you add, remove, or change to this checklist? Any ideas to add better questions?

Thank you for reading, and as always, may the markets be with you!

Kevin